Most victims of pension and investment scams bitterly regret not having asked more questions with regards to their financial planning. The problem is that they wouldn’t have known what questions to ask, and they probably wouldn’t have understood the answers even if they had. Pension Life offer you 10 essential questions to ask an IFA so you can ensure you are not the next victim.

All existing victims wish they had asked questions, obtained assurances, checked advisers’ qualifications and regulation. But, of course, it is now too late for the victims who have lost part or all of their life savings.

These victims all agree that it is important to prevent future victims. This is why we have come up with these 10 essential questions to ask an IFA, when considering financial planning and the transfer of your pension:

1 – How is the adviser and/or his firm licensed to provide advice to you in the jurisdiction where you – the client – live? Don’t be fobbed off with the answer that the adviser has an insurance license – that isn’t enough. The adviser needs an investment license. Also, don’t be fobbed off if the adviser says the firm is licensed in another jurisdiction – it needs to be licensed for where you, the client, live.

2 – If you are transferring a DB (defined benefit) or FS (final salary) scheme, you must get FCA regulated, qualified, independent advice on the merits of the transfer. Remember, the advice might be that you are better off leaving your pension where it is.

3 – Make sure the transfer recommendation (from a DB or FS scheme) is correct. Get a second opinion. You only get to do this once – and if the wrong road is chosen, it is very difficult (if not impossible) to correct it.

Check that the transfer advice report makes it clear that you, the client, are being advised on the transfer and that the advice is about what you should do – not what you could do.

4 – Don’t let the adviser put you into an insurance bond. Examples of these are Old Mutual International, SEB, Generali, Friends Provident, RL360, Hansard, Investors Trust. An insurance bond is a wrapper. A QROPS is a wrapper. You don’t need two wrappers. That’s like Superman wearing two pairs of pants over his tights.

The only purpose an insurance bond serves is to pay the IFA 8% commission. Plus, the insurance bond will tie you in for between five and ten years, and you neither need nor want to do that with a pension.

Insurance companies will take business from any old unlicensed, unqualified scammers. They don’t care. The quarterly charges are called “management charges” but that is very misleading because they don’t do any actual managing. Once the value of your fund starts to diminish because of the high charges and the toxic, illiquid, high-risk investments, the insurance company will keep taking its fees – sometimes until the whole fund is extinguished and worthless.

5 – What qualifications does the adviser have?

You wouldn’t take medical advice from an unqualified person posing as a doctor; legal advice from an unqualified person posing as a solicitor or accountancy advice from a person posing as an accountant. So why take financial adviser from someone with no qualifications?

It is a sad fact that in many jurisdictions, so-called advisers spring up with no qualifications and even no Financial Panning experience. Sometimes, they had been selling mortgages, second-hand cars or ice cream the previous week to selling pensions.

Pension Life covered the question of qualifications in a recent blog by Kim:

Using advice from Chartered Global about financial qualifications, you can discover that:

Level 3 Financial Adviser Qualifications

The most basic or entrance tier is the certificate level which is classed as a level 3 qualification within the UK framework, equivalent to A levels. Level 3 qualifications include:

- CertCII: Certificate in Financial Planning issued by the Chartered Insurance Institute

- CertPFS: Certificate in Financial Planning issued by the Personal Finance Society

- CeFA: Certificate in Financial Advice issued by the Institute of Financial Services

- Cert IM: Certificate in Investment Management issued by the Chartered Institute for Securities & Investment

Level 3 qualifications are sometimes held by adviser office staff and certain mortgage or protection advisers in a bank for example. These certificates require passing a selection of exams over 1-2 years and holders will have a general grounding in financial planning and financial services.

Level 4 Financial Adviser Qualifications

However, since 2012 financial advisers in the UK have been required to hold a minimum of a level 4 qualification to be able to continue to provide independent financial planning advice. The minimum required qualification to provide independent financial planning advice in the UK is now the diploma level, a level 4 professional qualification.

Look for the following letters or designations to identify a level 4 adviser:

- DipCII: Diploma in Financial Planning issued by the CII

- DipPFS: Diploma in Financial Planning issued by the PFS

- DipFA: Diploma in Financial Advice issued by the IFS

- IAD: Investment Advice Diploma issued by the Chartered Institute for Securities & Investment

Building on the certificate knowledge, level 4 advisers will offer a well-rounded understanding of financial planning and products, from general investments, structured products, to basic pension, protection, tax and savings advice.

Level 6 Financial Adviser Qualifications

A full two levels higher are the profession’s top tier of financial advisers; holders of level 6 qualifications equivalent to a bachelor honours degree. Completing a comprehensive suite of professional exams over many years, these top-flight advisers will be designated through one of the following:

- APFS: Advanced Diploma in Financial Planning issued by the CII

- CFPCM: Certified Financial Planner

- Adv DipFA: Advanced Diploma in Financial Advice issued by the IFS

Advisers at this level will have advanced expertise in the main areas of general financial planning.

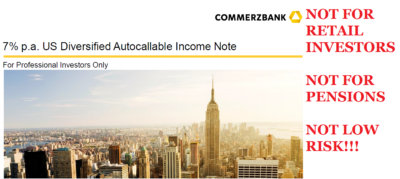

6 – Is the adviser planning on investing your life savings in professional-investor-only structured notes?

Structured notes are complex, risky, expensive derivatives which are only suitable for sophisticated investors who understand them. Few advisers/brokers understand them – but love them because of the very high commissions they pay. They also love them because once they have purchased them, there is no management to do – only stand back and watch them plummet in value.

Examples of structured note providers are Leonteq (currently being sued by Old Mutual International for fraud), Commerzbank, Royal Bank of Canada and Nomura. There are, of course, many more out there.

However, if your adviser/broker says he wants to invest part of your life savings in structured notes – ignore any old baloney about “capital protection” – and RUN LIKE HELL!

7 – Why are the firm’s own in-house funds used? An adviser can’t be independent if he is recommending his own firm’s own funds.

The way that financial advice is supposed to work is the adviser does a thorough, detailed fact find to analyse the client’s individual circumstances and risk profile. Then the adviser can go out into the market and find the most suitable and cost-effective investment products.

There is a huge choice and many good low-cost investment platforms. But some firms set up their “own” funds – which are merely somebody else’s fund which has been “white labelled” as the firm’s fund. This means there are two layers of charges.

An adviser cannot be independent if he is advising that his own fund should be the investment choice. This recommendation is usually made because of the extra commission which can be earned from an in-house fund, rather than because it is in the client’s best interests.

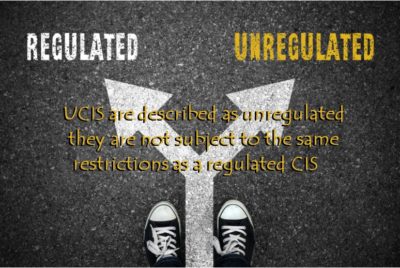

8 – Are UCIS funds going to be used?

Many a poor victim has lived to regret his trust and faith in a silver-tongued adviser’s ability to manage his investments. UCIS funds (Unregulated, collective investment schemes) are inevitably high risk and can have catastrophic results.

Such funds include EEA Life Settlements, LM, Harlequin, Brandeaux Student Accommodation, Premier New Earth Recycling, Dolphin Trust and many more which are sometimes no more than Ponzi schemes. Underlying assets include forestry, “clean” energy, eucalyptus and truffle-tree plantations, chia seeds, fine art, wines and speculative property.

Life savings have been decimated by failed UCIS funds – make sure your adviser/broker understands you don’t want your money to be invested in any of these toxic, high-risk, unregulated funds. You could well be promised high returns, but you have to remember that with high returns comes high risk.

9 – What is the full extent of the charges/fees/commissions on the entire transaction?

So many advisers conceal the full extent of ALL the fees and commissions. Victims only find out about them long after it is way too late. The “drag” on a fund can be catastrophic, even without investment losses.

If you are being advised to go into a QROPS, there will be the set-up and yearly ongoing charge (as well as exit charge); the adviser will charge between 2% and 3% set-up and then 1% (at least) annually; if UCIS funds are used, these can pay up to 25% commission (or even more sometimes); if structured notes are used, these can pay between 6% (for the regular ones) and 8% (for the fraudulent Leonteq ones). Then there is the 8% on the insurance bond. Then there is anything else the adviser can slip in without you noticing.

Victims of poor advice often only notice the dragging effect of all these charges on their fund after a year or so – or more. And by then it is too late, and the fund can never recover.

10 – Why were you graded as a “7” balanced investor – or even higher as an “adventurous” investor (when, clearly, you should have been graded as a low-risk investor)?

Here is the basic problem – the higher an investor’s risk profile is, the riskier the investments can be. This, of course, means that the riskier the investments are, the more commission the adviser can make.

After suffering crippling losses, many victims (retrospectively) look at their statements and documentation and find that they were graded as medium or high risk without their knowledge or consent. The adviser’s excuse is that the client valued growth above all else and that this was reflected in the risk assessment questionnaire.

Often, clients start off as low to medium risk, and then the adviser surreptitiously increases the risk profile. This can have catastrophic consequences for investors – and is what ALL of the known victims report as being the cause of their crippling losses.

The bottom line is that the public needs to be educated and warned about the bad practices offshore. Only by spreading the word about what happened to existing victims, will future victims be prevented.

People who have lost part – or all – of their pensions and life savings, are devastated and destroyed. They are facing potential poverty in retirement. Some will lose their homes, their health and their relationships. Some will take their own lives.