Katar Investments say they give UK and overseas investment advice in a simple way. However, the types of investment opportunities they are offering are, unfortunately, once again, making my red beacon flash. So, with Déjà vu, let me tell you why. Please make sure you are comfy, this might take a while!

Firstly, I had a quick look into their team. In my opinion, you would hope that some of the people advertising about giving you advice on investments would hold some sort of financial qualification. However, out of the five team members listed only one mentions a background in finance, the others only list sales experience.

I had a quick check on the registers to see if the one team member who states she has 10 years´ experience in the financial sector, holds any qualifications with the CII, CISI etc. – she did not appear to have any registered financial qualifications.

Now, forgive me if I am slightly biased and ever so critical when it comes to firms giving investment advice, but I would hope that any firm giving me advice on what to invest in, would have a team of fully qualified financial advisers. Not just sales experts. Or am I just being fussy?

Katar Investments state:

“Whether you are looking for a steady income investment, a property investment with high capital growth and a quick turn around of your capital or an opportunity in the latest emerging market, we have something to offer you.

We are highly committed to our investors and are focussed (their spelling mistake – not mine) on delivering a level of customer service which is above and beyond. So rest assured our agents will strive to provide you a class A service when you Invest with Katar Investments.”

I feel that the salespeople who work for Katar Investments may well be driven solely by earning high commissions when it comes to offering class A services. But, again, maybe I am biased! Let’s move on to what investments they offer.

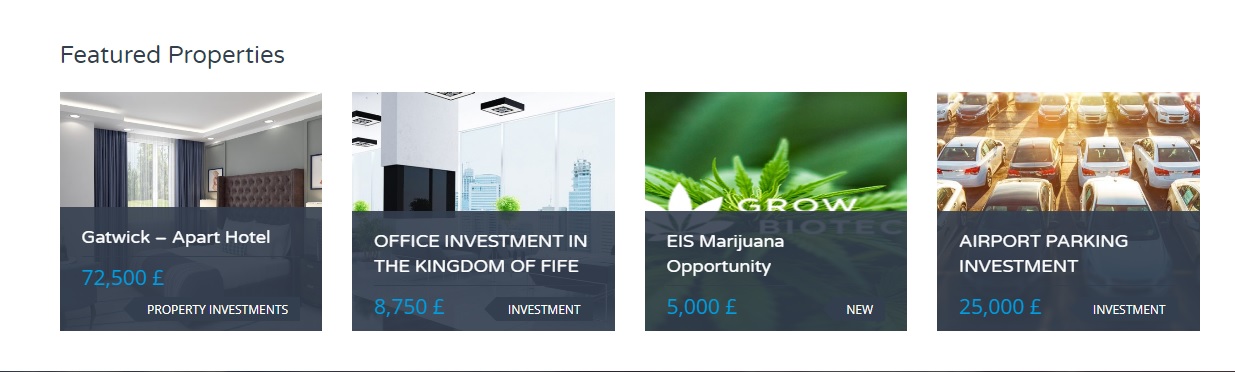

Gatwick – Apart Hotel – This is a serviced apartment/Hotel investment with a minimum investment of 72,500 GBP. The figure states “from”, so I assume you can throw a bit more in for good measure. The promised outcomes:

- 12 Months rental paid in advance

Rental protected by Insurance

Rental protected by Insurance- 5 Years Rental 8%

- 2% profit paid on exchange deposit during refurbishment

- 7 days free stay subject to 1 months notice

- Buy back at 110% after 10 years

- 40% Finance on units over £140,000

- Luxury furniture pack included with every purchase

- Completion date: March 2019

This is a fixed term investment of 10 years and it has not been built yet (check the completion date). To me, an investment like this would ring alarm bells, as you are purchasing property that has yet to be completed. All sorts of hiccups could occur before the investment was up and running. An illiquid, high-risk investment, only for those who can afford a potential loss on the funds used.

Office investment in the Kingdon of Fife – Another illiquid and fixed-term investment, although slightly lower in price than the Gatwick offer.

- Structured exit plan at 10 and 15 years

This means your money is trapped for an awfully long time. If the market sways, you could be set for a loss and often with fixed-term structured investments there are fees and charges. Investments like this can, if they go wrong, result in you, the investor, falling into negative equity.

Property investments like these, ring similar to that of the Dolphin Trust´s German property investments – high-risk, unregulated, non-standard “assets”. An awful lot of pension money has been loaned to this company – many DB pensions earned by British Steelworkers were invested here. Introducers saw commissions of up to 25% and in the case of British Steelworkers, Celtic Wealth – who are now in liquidation- were the introducers. The victims do not know where their pension funds are or if they will get any return. Dolphin Trust are still selling their assets, despite the lack of funds being released to mature investors.

EIS marijuana opportunity – Grow Biotec, there is a lot of press going around at the moment into the medical uses of marijuana and possibilities of a change in legislation in the UK. In many states of America, the use of marijuana for medical use has been decriminalized. As an avid supporter of natural remedies and healing through nature, the use of CBD extracted from the marijuana plant interests me immensely, the idea of investing in this potentially lifesaving product does have a certain draw.

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the Elysian Bio Fuels liberation scam promoted by James Hay. The victims of this scam have been left penniless AND with huge tax bills from HMRC.

But, there is always a but! Since working for Pension Life, any investment opportunity that quotes the word ´bio´ gives me the heebie-jeebies. We have only to look back and remember the Elysian Bio Fuels liberation scam promoted by James Hay. The victims of this scam have been left penniless AND with huge tax bills from HMRC.

Another ´bio´investment disaster was Sustainable Agroenergy (SAE) Plc, investors were told their investments were in biofuel products, that land was owned in Cambodia and planted with Jatropha trees – a tree with highly toxic fruit that could be used to produce biofuel. Unfortunately, the Jatropa trees were not as fruitful as originally thought. The perpetrators, were thankfully convicted of fraud and bribery offenses.

The reasons I doubt this as a good investment are the vague promises and the over promises.

´It is a private offer raising £5 million to develop one of the world’s most valuable portfolios of cannabis-IP assets by 2022.´

What will be the outcome should this £5 million not be made? A possibility of loss of all or part of your investment.

´We are seeking to develop one of the world’s most valuable portfolios of cannabis-IP assets by 2022.´

Meaning this is a fixed-term investment, with potentially no return for at least 4 years, if not longer, AND only if successful.

- Projected high returns: Target return of £50 per £1 invested (not guaranteed)

- EIS Tax relief: up to 50% income tax and capital gains tax relief. Remember tax rules can change and benefits depend on circumstances.

If it sounds too good to be true – it probably is. Plus this figure is not guaranteed and seems to me like it was just plucked out of the sky, nice and high, to lure investors in.

These investments are what we in the industry call illiquid. Once your money is in, then it´s pretty hard to get it out quick AND unless the venture does well there will be no return. With regards to pension investments, these are the very worst, toxic assets to invest in.

Unfortunately, they are often the assets which pay handsome investment introduction commissions to the salesperson, and this is why serial scammers, like Ward, love them. They go in with the ´eco-bio´ sale pitch or the glamorous property ownership – withholding the high-risk, fixed-term rules surrounding the investment.

A pension fund is a retail investment that should be placed in a low to medium-risk asset. Fixed terms, high-risk and illiquid investments should be avoided at all costs.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

The types of investments offered by Katar Investments are high-risk and illiquid, if you have a spare five grand that you can afford to lose, then go for it: have a cheeky punt on Bio Grow. You may be pleasantly surprised and get the target return of £50 per £1 invested (just remember to duck smartly when those pink things with curly tails fly a bit too close!). However, if your money is dear to you and you cannot afford to lose it, please stay away from shiny pink and green investments like this.

When it comes to your precious pension fund it is always best to air on the side of caution and go for the safe bet. It might not pay the highest interest, however, slow and steady wins the race. Meaning you will be able to enjoy your hard earned pennies in your retirement – stress free.

John Rodgers wishes he had said no to the offers of Continental Wealth Management.

it’s a great article until we get to this: “A pension fund is a retail investment that should be placed in a low to medium-risk asset. Fixed terms, high-risk and illiquid investments should be avoided at all costs.” The bit that is contentious is the term “illiquid” coupled with “avoided at all cost”.

There are many, well regulated OEIC’s available from numerous highly respected platforms, available to UK retail clients, that invest your money in respectable, stable assets like office blocks, shopping malls, warehouses and such like and many pension funds invest in these assets. They are “illiquid” only in the sense that IF a large number of redemption’s were requested they would have to sell some of the assets and that takes time – selling a shopping mall not quite like selling your house! This doesn’t happen often, and last occurred in 2016 after the Brexit vote and some OEIC’s had to suspend trading to cope with redemption demand. However, after several months, the funds coped, and resumed trading again. It is often a wise asset to invest a proportion of a person’s pension or ISA in such funds, they can generate a reliable steady inflation proof income.

The big issue with scams is they are promoting UNREGULATED investments into “illiquid” assets. They avoid breaking the law (FSMA 2000) by claiming not to be operating as a “collective” (a regulated activity) but are selling you one or more actual “parking spaces”, “storage pod” or leasing you “serviced offices” etc. and you are supposedly making money from the rent of the actual office or parking space you purchased. i.e. if no one parked in your space(s) you don’t earn any income from it. On the face of it, it doesn’t sound like a bad investment but the issue often arises that they are very badly managed. After all NCP operate very successfully with generating income from parking spaces. However scammers often manage these investments very badly and invest in dodgy private ventures by giving out “unsigned loans” to family and friends – e.g. Trafalgar Multi Asset Fund that collapsed a while back.

However, some scams are often believing they aren’t a collective but in actual fact operate as a collective as far as FSMA 2000 s.235 3(a)&(b) goes (e.g. https://www.fca.org.uk/news/press-releases/fca-wins-case-against-capital-alternatives-limited-and-others ) and there is a compelling argument that Blackmore Global is/was operating as a collective, from evidence that I have, and guess what – when I complained about this to the regulator they didn’t give a sh*t! I don’t know if Blackmore Global is still active or just some dormant Black Hole and by the way, beneficiaries have no idea. Blackmore refuses to publish any audit or publish any details on where the money has gone. This refusal to be transparent in my opinion says a lot about whether it’s black hole-ish or blackmore-ish.

Take out just one word from the phrase at the top of my comment and it reads much better. i.e. had it read “… high-risk illiquid investments should be avoided at all costs.” and I would have been happy. 😉

I find this whole blog misleading out of context and full of holes.

There are an awful lot of “ifs” , “what ifs” and a good number of “other similar investments” not to mention a number of statements that are irrelevant and above all completely wrong, however I do understand everyone is entitled the their opinion (after all everyone has one) even if they are way off message.

Comments like “making my red beacon flash” are inflammatory and attention grabbing but in actual fact have no relation to the reality of the following text.

The overall tone of the article is that is in your experience … your experience is based on pensions…. You also reference a lot of pension investments that have failed or been scams, and you mention unregulated pension scams, I do not see anywhere on Katar Investments website them promoting pension investments so why is that relevant ? further more there have been a large number off regulated investments , funds , pension funds that have fallen foul of regulated scams, I’m sure with your extensive knowledge of pensions you are well aware of these without me listing them however I’m sure you wont disagree that they total hundreds of millions of dollars.

I had a quick check on the registers to see if the one team member who states she has 10 years´ experience in the financial sector, holds any qualifications with the CII, CISI etc. – she did not appear to have any registered financial qualifications.

This statement is incorrect, had you taken the time to contact the person in question I’m sure she would be happy to send you copies of her qualifications, perhaps you should consider replying with an apology, as this is misleading and therefore calls in to doubt your whole blog / opinion if you cannot get the easily checkable facts right why would anyone value your opinion ?

I feel that the salespeople who work for Katar Investments may well be driven solely by earning high commissions when it comes to offering class A services. But, again, maybe I am biased! Let’s move on to what investments they offer.

This is not news , basically the same as IFA’s Katar Investments do receive commissions for sales, however unlike IFA’s they do not charge fee’s, and unlike IFA’s they are not limited on the investments they can offer.

“This is a fixed term investment of 10 years and it has not been built yet (check the completion date). To me, an investment like this would ring alarm bells, as you are purchasing property that has yet to be completed. All sorts of hiccups could occur before the investment was up and running. An illiquid, high-risk investment, only for those who can afford a potential loss on the funds used.”

Correct this is a fixed term investment as are a lot of investments , this is not news ? also this is not off plan it is an existing hotel so the hotel is completed , it is undergoing a refurbishment which is ahead of schedule, there are also site visits available for interested investors , again had you taken time to look into this in detail you might have learned something instead of just looking at the headlines, again you might want to offer an apology as this is misleading and therefore calls in to doubt your whole blog / opinion if you cannot get the easily checkable facts right why would anyone value your opinion ?

Office investment in the Kingdon of Fife – Another illiquid and fixed-term investment, although slightly lower in price than the Gatwick offer.

• Structured exit plan at 10 and 15 years

This means your money is trapped for an awfully long time. If the market sways, you could be set for a loss and often with fixed-term structured investments there are fees and charges. Investments like this can, if they go wrong, result in you, the investor, falling into negative equity.

Again this is not news and you are only pointing out what is clearly stated, bit of a filler this one, comments like “Investments like this can, if they go wrong, result in you, the investor, falling into negative equity” is this really note worthy , it is common sense ?

EIS Marijuana , “heebie-jeebies” really ? you are referencing a Bio fuels scam because it is called “Bio” also you have missed the point totally here , do you understand what EIS means ? lets leave that one right there. You have missed the point and the investment is now fully subscribed closed.

Airport parking Investments, These investments are what we in the industry call illiquid. Once your money is in, then it´s pretty hard to get it out quick AND unless the venture does well there will be no return. With regards to pension investments, these are the very worst, toxic assets to invest in.

OK so nothing new from you here , using the same lines “illiquid” , “unless the venture does well” and “these are the very worst, toxic assets to invest in” again this is your opinion and as said before everyone has one.

A pension fund is a retail investment that should be placed in a low to medium-risk asset. Fixed terms, high-risk and illiquid investments should be

avoided at all costs.

When it comes to your precious pension fund it is always best to air on the side of caution and go for the safe bet. It might not pay the highest interest, however, slow and steady wins the race. Meaning you will be able to enjoy your hard earned pennies in your retirement – stress free.

100% agreed , as before Katar Investments do not promote pension Investments so as before another irrelevant pointless statement in relation to Katar Investments …

So, who do you work for?