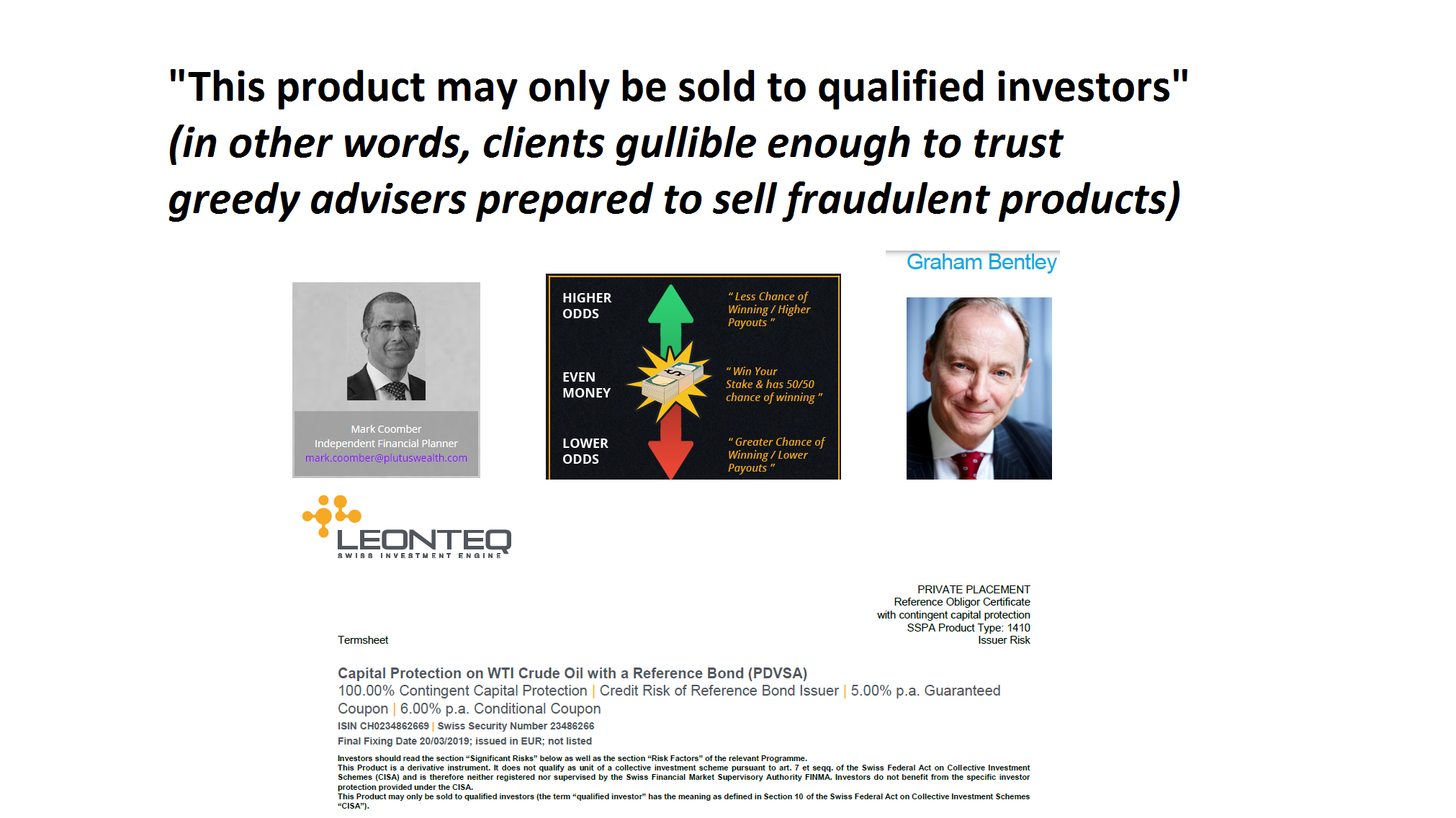

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that structured notes are FOR PROFESSIONAL INVESTORS ONLY (and not for retail investors).

Nitwit or Dragonfly? Gambling or Investing? Are investment losses as a result of a bad adviser or a bad investment? Or both? The real question is: how does the consumer tell the difference? A favourite episode of Fawlty Towers involved Basil’s ill-fated bet on a racehorse called Dragonfly. Confusion sets in – fuelled by the easily-confused Manuel – and “Dragonfly” gets muddled up with “Nitwit”. And that is how clients get confused just as easily: by advisers who spout the usual rubbish: capital protected; guaranteed returns; blue-chip investments; solid providers etc. They just leave out the three most important things: the fat commissions paid to the adviser; the high-risk nature of the “investment” and the fact that structured notes are FOR PROFESSIONAL INVESTORS ONLY (and not for retail investors).

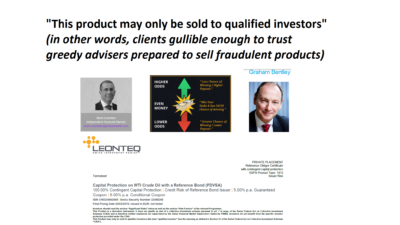

Equally befuddled – but much less funny – this past few days, has been a bunch of nitwits posing as financial experts on Linkedin. Almost as barmy as Basil and Manuel, these comedians don’t know the difference between investing and gambling. Graham Bentley of a firm called gbi2 has been suggesting that structured notes should be revisited as viable “investments” for valued clients.

Bentley has suggested that structured products are an option that advisers could consider including in their portfolio of investment solutions. If he is talking about outright scammers, then – of course – he is right. Structured products pay juicy commissions of up to 8%, so naturally they are a favoured product for these criminals to sell. Plus, if the clients themselves have so much money they are desperate to get rid of as much of it as possible, as quickly as possible, then structured products are ideal.

But Bentley is missing the point entirely. Structured products have, for years, been sold enthusiastically and aggressively by the usual suspects: Leonteq, Nomura, Commerzbank, Royal Bank of Canada and BNP Paribas; bought by scammers such as Continental Wealth Management for the juicy commissions; harboured by crooked life offices such as Old Mutual International. And the result has been huge losses for hundreds of victims. In some cases, total destruction of a victim’s life savings.

Most advisers who sell these toxic products are too thick to understand how they work – and indeed anything beyond the amount of commission they earn out of flogging them is way too tricky to get their simple minds around. And why should they even bother? They just sell them, collect their 8% and then move on to the next victim. What’s to understand? They know that life offices love them – and indeed Old Mutual International bought £94 million worth of the fraudulent Leonteq ones alone. It is a delightful circle for all concerned: the scammers get rich, the bent life offices get fat and the structured product providers do very nicely thank you. And not a single one of them gives a second thought for the victims.

One cheerful idiot on the Linkedin thread has enthusiastically supported Bentley’s idiotic view:

“Continue to use structured products (as part of portfolios) both personally and for clients with great success. Most of the negative comments I read about them are born out of ignorance and sheer laziness of some advisers who cannot be bothered to either learn the topic matter or undertake the relevant due diligence.”

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

And this guy is chartered! As a member of the CISI he should know better than to spout such rubbish – and I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products. If he is stupid enough to use them for his own gambling fun, good luck to him. But he has no right to inflict them on retail clients.

One of the fraudulent structured notes sold by Leonteq (for 8% commissions to the scammers) was:

Capital Protection on WTI Crude Oil with a Reference Bond (PDVSA)

100.00% Contingent Capital Protection | Credit Risk of Reference Bond Issuer | 5.00% p.a. Guaranteed

Coupon | 6.00% p.a. Conditional Coupon

ISIN CH0234862669 | Swiss Security Number 23486266

Final Fixing Date 20/03/2019

The term sheet did, to be fair, give a clear warning:

The term sheet did, to be fair, give a clear warning:

“Given the complexity of the terms and conditions of this Product an investment is suitable only for experienced Investors who understand and are in a position to evaluate the risks associated with it.”

Sadly, we have to wait until March 2019 to find out how many victims have lost their shirts on this particular lame horse.

And this is the problem: most advisers don’t understand structured products themselves – all they understand (and care about) is the fat commission. They certainly don’t care that the products are fraudulent. But, more importantly, none of these rogue advisers’ clients are experienced investors. If they were, they wouldn’t be paying a greedy and irresponsible financial adviser to risk their hard-earned life savings for them.

STRUCTURED NOTES ARE GAMBLING – NOT INVESTING!

So my message to Coomber and Bentley is this: read Leonteq’s term sheet:

“Products involve a high degree of risk, including the potential risk of expiring worthless. Potential Investors should be prepared in certain circumstances to sustain a total loss of the capital invested to purchase this Product.” And then try to decide which horse is going to win: Dragonfly or Nitwit.

The author is, of course, wrong and her comments are not based upon facts. She clearly has no understanding of the UK structured product industry and the UK regulated advice profession.

Are you sure?

UK advisers cannot be paid commission on Structured Products under RDR rules. So your article is incorrect. For something so fundamental I wonder what else is incorrect in your article!!

There’s a UK regulated financial adviser Facebook page that Angie has posted this rubbish on. And she’s presently getting a good dressing-down from the UK adviser community there who are pointing out her extra-ordinary lack of knowledge of this topic.

I wouldn’t be surprised of Pension-Life.com itself turned out to be a scam since the website content ticks many of the same boxes as a typical scammer’s one.

I’m surprised you think this is “rubbish”. I would have thought you would have wanted to be informed about the very industry you work in. There is no dressing down as you call it – only a few other nitwits who are equally determined to remain ignorant of the facts. Being insulting about Pension Life and me personally does nothing to change the facts: that structured notes have been sold for years to retail investors and this has caused massive losses. You can argue all day long, and call me all the names you want, but the facts won’t change.

Angie

To correct your misunderstanding please note that a Structured Note / SCARP (Structured Capital At Risk Product) is a RETAIL investment product as defined by the UK’s Financial Conduct Authority. Please see the list of all types of Retail Investment Products here:

https://www.handbook.fca.org.uk/handbook/glossary/G2763.html

And data on the success, or otherwise, of structured products here:

https://www.ukspassociation.co.uk/performance/

Yes, a minority may have failed; some investments do….that’s the nature of the game. And even some fraudsters have ‘scammed’ some investors. But don’t tar all structured products with the same brush.

Nor make wild unsubstantiated claims about myself or the firm I work within in the UK. I would suggest you take-down the offending parts of your column.

Angie, setting aside the subject of suitability, and instead within this sub-comment concentrating on structured notes as a whole, you talk of “massive losses” that some have incurred as if all structured notes are toxic and all cause heavy losses*. But fail to also mention some of the massive gains investors have made.

* that maybe not what you meant but that’s how it reads. [ Shoot the proof-reader! ]

1. Yes, I am based upon your comments above. There are so many errors in there – Just look at the comments on your Facebook blog from other UK-authorised advisers who are also correcting you.

2. Additionally, and I quote: “I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products.” – Could you please provide evidence supporting this?

3. Likewise, please confirm how much of the Leonteq structured product I “sold”.

4. Ditto, how much commission I have been paid in the last 6 years (especially from the suppliers of this type of “toxic” “high commission” paying investment product).

5. Please also supply details of your formal qualifications and evidence of CPD specifically in the field of structured products, and in particular those available within the UK marketplace.

6. Also please summarise for the reading audience the salient points arising from the implementation of the UK’s Retail Distribution Review at the end of 2012. And specifically around the area of private clients paying for regulated advice by way of a commission payment facilitated by the structured product provider.

7. Whilst on the commission topic, please also clarify for the reader whether (on-line) brokerages / fund supermarkets – who provide investors with no advice – receive a commission from the product-provider.

8. And, lastly, in percentage terms, please confirm (again with reference to the UK market place over the last 10 years): what proportion of retail structured products (both deposit-based and SCARP-type) have:

a) returned positively

b) have not generated a positive return but have returned all of the invested capital

c) have returned only a proportion of the original capital

d) have returned nil

e) were fraudulent scams (and by “scam” I mean criminal, and not your own definition per your YouTube clip)

ps. Do pop-in for a coffee next time you’re in London. You might find it enlightening.

Wow! Lots of questions. But the answer to the last one is “yes please” (no milk, no sugar).

Still waiting for your answers to my list of questions.

Just replied by email. Shall I post my reply as a blog so it is nice and transparent? Or do you want to do this privately? Your call.

Your emailed reply has failed to address the 8 points raised above.

Instead your email bands around commentary about ‘dodgy’ overseas advisers and the types of commission-laden products they sell. For the record, I am not one of these and neither do I “sell” those types of products which are note available here in the UK; this despite your unsubstantiated claims to the contrary.

Your comments about myself and Plutus are, to put it bluntly, lies. Lies I request you withdraw. Or provide robust evidence to the contrary……and don’t bleat-on again about overseas fraudulent products and snake oil salesmen operating out of the Costa del Con. Both of which are totally unconnected with myself, UK regulated advisory firms and the UK structured product market for RETAIL investors.

Get your facts straight, woman!

There are no lies. You have admitted selling structured notes. You have omitted to explain what the difference is between the ones you sell and the ones the offshore scammers sell. The latter may be unconnected to you, but don’t you think you have a professional duty to make it clear how and why there is a difference? I have never seen a structured note term sheet which says “for retail investors” – I have only ever seen ones which say “for professional investors only – not for retail investors”. I am sure the thousands of victims who have lost their life savings to structured notes would be very interested to learn the difference. But until you step up to the plate and clarify this matter, you are still in danger of helping the scammers sell their toxic wares to more victims with your irresponsible endorsement of the use of structured products.

1. Yes, I am based upon your comments above. There are so many errors in there – Just look at the comments on your Facebook blog from other UK-authorised advisers who are also correcting you.

2. Additionally, and I quote: “I feel deeply sorry for any clients of Plutus Wealth Management as they are clearly in danger of being sold these toxic products. In fact, I would go further and suggest the public should be warned about the dangers of using this firm, as Coomber clearly has every intention of flogging his victims these high-risk products.” – Could you please provide evidence supporting this?

3. Likewise, please confirm how much of the Leonteq structured product I “sold”.

4. Ditto, how much commission I have been paid in the last 6 years (especially from the suppliers of this type of “toxic” “high commission” paying investment product).

5. Please also supply details of your formal qualifications and evidence of CPD specifically in the field of structured products, and in particular those available within the UK marketplace.

6. Also please summarise for the reading audience the salient points arising from the implementation of the UK’s Retail Distribution Review at the end of 2012. And specifically around the area of private clients paying for regulated advice by way of a commission payment facilitated by the structured product provider.

7. Whilst on the commission topic, please also clarify for the reader whether (on-line) brokerages / fund supermarkets – who provide investors with no advice – receive a commission from the product-provider.

8. And, lastly, in percentage terms, please confirm (again with reference to the UK market place over the last 10 years): what proportion of retail structured products (both deposit-based and SCARP-type) have:

a) returned positively

b) have not generated a positive return but have returned all of the invested capital

c) have returned only a proportion of the original capital

d) have returned nil

e) were fraudulent scams (and by “scam” I mean criminal, and not your own definition per your YouTube clip)

ps. Do pop-in for a coffee next time you’re in London. You might find it enlightening.

I’ve used structured notes with large developed markets (such as the FTSE100 or S&P500) successfully in client portfolios for years.

I agree there’s some simply horrendous notes that get made – single stocks, uncorrelated assets like metals etc – and these should be rightly panned.

But to write off a whole section of the industry because some crooks use them as weapons of mass destruction seems a little harsh.

Should we ban all knives because some people used them to murder their fellow man rather than to peel potatoes?

Try sending your ten-year-old son to a shop to buy a knife. If the shopkeeper sells him one, he is committing an offense. I think most readers are missing the point – the offshore scammers will love all this stuff about how wonderful structured notes are by UK advisers. And more victims will get ruined – while the scammers get rich. It is deeply irresponsible to advocate the sale of a product which is so easily misused – just as it would be irresponsible to advocate the sale of knives to children.

But, Angie, what you’re essentially saying is that I shouldn’t advocate that knives are useful for chopping food, in case a ten year old reads it.

That knives are useful tools is a totally harmless statement of objective fact. So is stating that structured products are, in certain market conditions and at certain times, worth considering. Just like unit trusts (also used by scammers) or fixed interest investments (also used by scammers) or insurance bonds (also used by scammers) or SIPPs (you get the point).

I think these comments are being censored/manipulated. Could pension-Life.com itself be a scam? Someone seems to think so: https://pension-life.pissedconsumer.com/angela-brooks-201808101326390.html

I don’t drink beer, and even if I did I certainly wouldn’t slosh it. This story is entirely fabricated – probably by one of the scammers. I wonder how much the “respectable” lawyer charged?

TheTruthIsOutThere.

Is it? You mean it is not with you and pissedconsumer?

Didn’t think so.

As a victim of the CWM scam and the “not our fault” responses from trustees, life companies, “financial advisers” and CWM employees (including COO, CEO etc), it was suggested to me that I contact Angela Brooks at Pension Life. The story of “pissedconsumer” is very different to my experiences. I have been to the Pension Life office a few times. I have spoken to Angela face to face. I joined PL and continue as a member. Yes, I paid my fees. I’m aware that nothing in this world is free and PL have operating costs and fees to pay.

I know that Angela works very hard on behalf of victims of many scams in addition to those of us that have suffered because of the CWM scam.

Frankly, I find that I cannot now bring myself to trust any words of so called financial advisers. The so called “industry” needs a thorough clean out to get rid of scammers but all we hear from those that are a part of this setup is a lot of whinging and whining about criticism of their failure to clean house! No concern for the victims or ideas to put the situation right! Even some of the perpetrators and facilitators of scams have used the internet to broadcast mistruths; give their companies good reviews and to try to mislead their victims. They have no conscience and no shame.

John R

PS. Please give me your phone number Mr Coomber.

Angie

Please provide a telephone number for Mr Coomber. He suggested that I call him after obtaining the telephone number from you.

I can’t explain why he doesn’t wish to provide it himself.

John R.

There is clearly something going wrong outside of the UK and clearly proper regulation in the UK.

For those of us that are struggling to follow this, what is the difference between a UK structured note and the ones sold outside the UK? I am not referring to Retail or Institution but the difference in the construction of the product.

Why don’t the advisers that sell to non-UK investors use the same structured notes as the one recommended (as opposed to sold, as I can feel there is a difference) to UK investors?

That might take some of the heat out of this. However, to my mind, all advisers are going to be seen as distrustful if one group routinely sells bad products that fail consumers. To that end, I think the UK advisers do need to get involved to limit the damage this is doing to the industry or profession.