One of the hundreds of Continental Wealth Management victims stuck in a useless and expensive SEB Life International bond, and ruined by crippling investment losses, has made a detailed complaint to SEB.

One of the hundreds of Continental Wealth Management victims stuck in a useless and expensive SEB Life International bond, and ruined by crippling investment losses, has made a detailed complaint to SEB.

Some idiot from SEB called Orla Golden has replied – and the response is astonishing. Below are my answers to this ridiculous rebuttal. The complaint will now be referred to the Central Bank of Ireland – asking that SEB Life should be suspended. I will also copy this in to the Financial Services Ombudsman.

Let us see whether the regulator and ombudsman in Ireland will turn out to be as useless as the regulator in Gibraltar, or will actually have some teeth. If the authorities in Ireland are any good, hopefully they will hold Conor McCarthy and Peder Nateus fully responsible for facilitating this deplorable scam.

LETTER FROM ORLA GOLDEN TO THE CWM/SEB VICTIM IN RESPONSE TO HIS COMPLAINT (WITH MY COMMENTS IN BOLD):

We are writing to you in response to your recently submitted complaint in respect of your insurance policy with SEB Life International Assurance Company DAC that you placed through your appointed independent financial advisor, Inter-Alliance WorldNet Insurance Agents and Advisors Ltd.

The victims did not place any orders or instructions through Inter-Alliance. SEB is being not only disingenuous but dishonest here. The advisor in question was Continental Wealth Trust SL, trading as Continental Wealth Management SL (CWM) in Alicante Province, Spain. CWM was a firm full of unqualified so-called “advisers” with a track record of scamming, cold-calling and flogging dodgy products to unsuspecting victims. The victims appointed CWM as their advisers, and all the dealing instructions for the toxic structured notes came from CWM and not Inter-Alliance.

SEB Life is a designated activity company which is registered under company number 218391 with the Irish Companies Registration Office and is authorised as a life insurance undertaking by the Central Bank of Ireland under number C771.

So, let’s see just how good a regulator the Central Bank of Ireland really is. We must all hope it is not as hopeless, limp and corrupt as some of the other regulators.

SEB Life is permitted to distribute life insurance policies in Europe (EU) by way of a freedom of services passport issued by the Central Bank of Ireland under the Solvency II Directive 2009/138/EC as adopted into Irish law by the European Communities (Insurance and Reinsurance) Regulations 2015 (the “Solvency II Irish Regulations”). That may be true, but these weren’t true life insurance policies: they were bogus policies designed to act as “wrappers” for dodgy, rubbish investments and to facilitate financial crime in multiple European jurisdictions – most notably Spain where such insurance/investment products have been outlawed by the Spanish Supreme Court.

SEB Life is permitted to distribute life insurance policies in Europe (EU) by way of a freedom of services passport issued by the Central Bank of Ireland under the Solvency II Directive 2009/138/EC as adopted into Irish law by the European Communities (Insurance and Reinsurance) Regulations 2015 (the “Solvency II Irish Regulations”). That may be true, but these weren’t true life insurance policies: they were bogus policies designed to act as “wrappers” for dodgy, rubbish investments and to facilitate financial crime in multiple European jurisdictions – most notably Spain where such insurance/investment products have been outlawed by the Spanish Supreme Court.

In January 2015, Inter-Alliance novated its business to Trafalgar International GmbH who became your financial advisor.

Not true. Trafalgar International did not become the financial adviser. Few, if any, of the victims had ever heard of Trafalgar until CWM collapsed in September 2017.

Trafalgar is an independent financial advisor located in Germany

No it isn’t – it is located in Cyprus. Orla Golden clearly has never done Geography.

and is authorised and entered into the register of insurance intermediaries maintained by the Chamber of Industry and Commerce (DIHK). Trafalgar is authorised to mediate insurance policies in various EU territories including UK, Spain, Malta and France. Yes, Trafalgar was. But CWM wasn’t.

SEB Life has terms of business with Trafalgar, and previously had terms of business with Inter-Alliance which was authorised by the Insurance Companies Control Service in Cyprus to mediate insurance policies in the EU; before it transferred to Trafalgar. Continental Wealth Management (CWM) was a sub agent of Inter-Alliance

Really? Sub agents are illegal in Spain

and then continued to be a sub-agent of Trafalgar.

No it did not. SEB is lying. CWM was never a sub agent of Trafalgar

CWM is the responsibility of Trafalgar and SEB Life does not have terms of business with them.

CWM is the responsibility of Trafalgar and SEB Life does not have terms of business with them.

So why did SEB accept dealing instructions from CWM if they had no terms of business with the firm?

SEB Life regularly reviews the authorisation of independent financial advisors with whom they have terms of business,

SEB is failing to get its story straight. CWM was not authorised – ever, for anything. SEB may have had terms of business with both Inter-Alliance and Trafalgar, but CWM was never an authorised agent of either firm.

however, it is the independent advisor’s responsibility to comply with their own regulatory obligations for authorisation

And nothing to do with SEB? So, why did SEB accept dealing instructions from CWM?

and their regulatory authorities have oversight responsibilities.

Like the Central Bank of Ireland has oversight responsibilities over SEB? Let’s see how seriously it takes those responsibilities.

Trafalgar, as the appointed independent financial advisor is your agent.

No it isn’t, and wasn’t. Trafalgar was not an IFA firm, it was a network.

Any policy related intermediary commission was paid directly to Trafalgar (formerly Inter-Alliance), with whom SEB Life has terms of business.

So why was SEB paying intermediary commission at all to CWM which was not regulated at all for anything – not pet insurance, not bicycle insurance, nothing. It matters not to whom the commission was paid, the products were sold by an unregulated firm (CWM) and SEB should never have accepted the business – let alone ever paid commission (irrespective of to whom this commission was paid).

As your agent, Trafalgar must handle your complaint in accordance with their agent and regulatory responsibilities.

Trafalgar was never the victims’ agent.

In addition, the pre-sales advising process occurs between you as the policyholder and your appointed agent.

Trafalgar was never the appointed agent. Trafalgar did not provide the advice; Trafalgar did not place the dealing instructions; Trafalgar did not meet the clients.

This process identifies the customer’s needs, based on the information provided by the policyholder(s)

How would SEB know? Did they ever check the fact finds or make any attempt to ascertain the victims’ attitude to risk? No, of course they didn’t

and recommends the insurance product which best suits the customer’s objectives and needs.

This is a ludicrous comment to make. Not one single victim needed a bogus life assurance product – they were all, 100% mis-sold purely for the fat commissions paid by SEB.

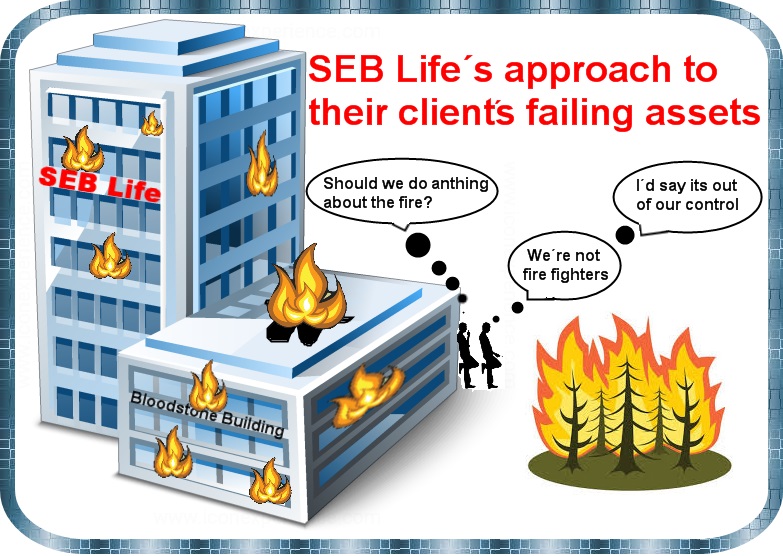

SEB Life is not party to this pre-sales advising process and the discussions that occur between a policyholder and their appointed independent financial adviser as to their risk profile and the assets that will fulfill the investment needs and objectives.

Correct. But SEB ought to have noticed, over a period of several consecutive years, the inexorable losses from the toxic structured notes which repeatedly failed – and the dealing instructions for which (submitted by CWM and accepted by SEB) bore forged client signatures. SEB may not have been party to the pre-scamming advice con, but they should certainly have taken action when the results of this clear fraud started to become obvious.

SEB Life does not offer any investment advice, and this is clearly stated in the declaration section of the application form that we ensure is signed by the customer.

And damn good job too. Most victims would probably trust a convicted thief rather than SEB. The declaration section of the application form may make it clear that SEB does not offer investment advice, but the annual statements also make it clear that SEB can do maths. And that basic maths demonstrated that hundreds of policyholders’ funds were being routinely destroyed.

Our literature states that the amounts invested in the Units of the Fund in the contract are not guaranteed but are subject to fluctuations in value depending, in particular, on the performance of financial markets.

There is fluctuation, and then there is total destruction. Fluctuation goes up and down. Destruction just goes down. Did not a single half-wit at SEB notice the difference over a period of seven years?

The return on investment is not in SEB Life’s control and past performance is not an indicator of the future performance of any asset.

So, if Bloodstone Building in Dublin caught fire, would the blind, deaf and dumb idiots at SEB just sit there, shrug their shoulders and say “a fire in the building is not within our control – we aren’t firefighters. And we won’t even bother using the fire extinguishers or calling the fire brigade. We’ll just sit here and watch the building get destroyed and burn to death ourselves?”

SEB also request that a one-page “Statement of Understanding” is signed by a policyholder where an investment request is received in relation to a non-standard asset.

Really? Who told Orla Golden that? The Statement of Understanding Fairy? This simply is not true.

This is to confirm that the policyholder has read and understood the potential financial, market and liquidity risks associated with the asset before proceeding.

This is to confirm that the policyholder has read and understood the potential financial, market and liquidity risks associated with the asset before proceeding.

None of the victims understood the assets which SEB was permitting the scammers at CWM to churn; none of the victims realised or understood what structured notes; none of the victims knew that structured notes were for professional investors only and not for retail investors; none of the victims knew that they stood to lose part or all of their investment (as most did); none of the victims realised that SEB would just sit there and let the repeated losses keep happening as the unlicensed, unqualified scammers at CWM kept scamming away for seven years.

Policyholders are able to request that their policy be linked to assets that are within the company’s permissible asset list. The investments have been executed by SEB Life on the basis of written instructions submitted to SEB Life that were signed by you as the policyholder

No they weren’t – the signatures were forged

or your appointed investment advisor.

Meaning the unqualified, unlicensed scammers at CWM who did not have an investment license – let alone an insurance license.

SEB Life relief upon and implemented those instructions in good faith and in accordance with the terms and conditions of the policy.

There was nothing good about SEB’s “faith”. This particular victim – whose complaint has not been upheld by SEB – suffered the following losses between 2009 and 2015:

12 toxic, professional-investor-only structured notes from Nomura, RBC, Commerzbank, Leonteq and BNP Paribas:

Lost a total of 271,539 EUR

Investment in the Quadris Teak UCIS fund:

Lost 100,000 GBP

TOTAL LOSS IN SIX YEARS: 371,539 EUR

Didn’t SEB notice? Didn’t SEB care? Didn’t SEB do anything for seven years?

The answer, of course, is a resounding no. The lazy, callous, greedy, negligent did nothing except sit there and watch this victim’s life savings be destroyed by the scammers.

With regard to your allegations of regulatory breaches and fraud committed on your policy, SEB Life is unable to comment on such allegations and these must be discussed with your appointed financial advisor Trafalgar directly.

I have no doubt that SEB’s lawyers will have advised them to keep their mouths shut on this one and to try to deflect the blame onto Trafalgar. This is one of the things I hate about lawyers – even when they know their dirty clients are guilty they will still defend them to the hilt. As long as they keep billing, the lawyers won’t care how many lives their negligent and culpable clients ruin.

In these circumstances, you may wish to seek independent financial advice

I wonder what sort of “adviser” SEB have in mind? Scammers like CWM?

and/or legal advice regarding your engagements with your appointed financial adviser.

i have a very similar (if not verbatim) response to a written complaint, my question is “if seb are not responsible for any of my losses, why are they all detailed on documents year after year from seb and why were no questions asked?” My second question is, as seb do not offer investment advice, only life insurance, why then am I now an seb client when my original fact find signed by both myself and my financial adviser stated “that as I have no dependents I do not need life insurance”

This is exactly why the Spanish Supreme Court has deemed life bonds used for investments to be illegal and invalid. The nature of insurance is that the insurer takes a risk – which, of course, SEB (and all the other bogus life insurance providers such as RL360, Generali, Friends Provident International etc) avoid doing. SEB is trotting out these nonsensical rebuttals but doesn’t really think them through at all.

Hi Angie

The 371k of losses you include are the exact values I sent you when I registered with PL early this year. You say here that the claim has not been accepted

I know nothing about that having heard nothing from since registration.

Please clarify

Registered

This reads like the ramblings of a conspiracy nut, I fear your judgement in relation to these issues are born more from your misunderstanding of their operations than genuine knowledge.

As far as my understanding goes (of which I am happy to admit has a limit), SEB operate purely on an execution only basis, to claim they “sit and watch” the proverbial fire that is clients’ pensions burn up into dust is purely comical. They are not authorized to make trades they believe are in the best interest of the client, they are only allowed to action the signed instructions sent through by the advisers (hence the use of dealing instructions and statements of understanding, forms that must be independently dated and signed by the underlying client).

If it as you claim and their “dodgy” financial advisers are deliberately putting clients in to terrible products with large backhand commission, then bring on their comeuppance in the courts – something I believe we can both be in agreement with.

However I question the validity of the suggestions as to the use of forged signatures. Most clients I remember from my internship days pre-sign forms and give them to their adviser to fill as they please (something I believe to be the fault of the client). It is easy to cry foul and robbery when one leaves their doors wide open as such!

As you seem to be a fan of metaphors, in these cases the clients are handing their advisers a struck match having let them build a pallet throne doused in petrol, and then complain when they get burned.

On a side note, might I ask why you are still avoiding to acknowledge/refute the claims that you are in cahoots with Devere (a relatively large financial consultancy firm somehow still evading your qualified and registered checks – even after having instances of policy devaluations and absurd commissions being paid to the advisers!)

If the rumor-mill is to be believed that alongside being in the pockets of Devere you are truly charging people for this “service” of chasing the regulators and ombudsmen in the interest of client reparations, I fear that I hold you in lesser regard than these crooked advisers you have such a vendetta against.

Kindest regards,

John Doe

on all my documents Trafalgar were trading as CWM in Spain. The buck stops with Trafalgar but Angie is protecting them. They must have done a deal. I think with other people too. She is leading people on a merry dance in Spain and earning a lot of money out of the victims. There are a lot of people after her now including a few journalists. As JOhn Doe says above she is worse than any of them. Sheep in wolves clothing.

I think you mean wolf in sheep’s clothing (you really are a “silly sausage”!). Hard to take someone seriously if they don’t have the courage to disclose their identity. (Your IP address says you’re in Spain – with Orange). Funnily enough, people do leave unintended clues in what they write (even spelling, grammar and punctuation mistakes) – even if they are trying hard to hide who they are. Why not give me a call? Here’s my number: 0034 674746663. Or pop in and see me – here’s my address: 24 Calle Cuatro Esquinas, Lanjaron, Granada. But then you know that already, don’t you.

These are not Insurance Bonds …. they are ASSURANCE products and completely different in all aspects.

Where does it state that ‘these’ products are illegal and invalid – not true.

As explained – the Life Companies provide a product, which in this case has been abused, to blame them makes as much sense as blaming a car manufacturer for a drunken drivers actions – in both cases the results are horrible, in both cases the manufacturer is not at fault.

Double check your CWM to Inter-Alliance to Trafalgar links – you are mis informed.

AGAIN ….

The funniest thing I have read for ages. They are termed insurance bonds, but they provide assurance such as payment in the event of death. Therein lies the issue as there is no actuarial risk applied to the insurance, and that is why the Spanish don’t accept them, from what I have just read, as there is no real insurance at all. Within a pension, they provide no taxation advantages that they might otherwise do for non-pension trusts and for wealthy investors that can plan where and when they pay tax.

Get onto Google and search for Antonio Flores to find the answer to the question of whether there is an issue with the sale of these insurance bonds in Spain. It would seem one life company has been fighting hard not to have the case heard in a Spanish court.

I think the issue, for me at least reading this, is that there ought to have been some alarm bells ringing at these life companies. The allegation about forgery is serious and so should not the life companies be joining in with the action against the advisors? This goes beyond a matter of regulation. I am sure the investors will know if they have or have not signed something!

The internet archive shows up the links with CWM and Inter-Alliance in the past and Trafalgar(who appear to have inherited the problem), and there is nothing in this blog that contradicts anything I have found. Enlighten us then!

Hi Angie, how come CWM’s emails said they were regulated by Trafalgar?

Continental Wealth Trust S.L. is regulated by Trafalgar International GmbH, Authorised and Regulated in Germany by the Deutsche Industrie Handelskammer (IHK) Insurance Broker registration number: 34(d): D-FE9C-BELBQ-24 & Provision of Investment Advice via D-IHK 34(f) license: D-F-125-KXGB-53

on all my documents Trafalgar were trading as CWM in Spain. The buck stops with Trafalgar but Angie is protecting them. They must have done a deal. I think with other people too. She is leading people on a merry dance in Spain and earning a lot of money out of the victims. There are a lot of people after her now including a few journalists. As JOhn Doe says above she is worse than any of them. Sheep in wolves clothing.

So Maya,

It is easy to come on here and make libellous comments from the safety of anonymity. ‘Must have’ and ‘think’ proves that beyond doubt.

Isn’t this case in the courts? Why not let a proper court decide rather than making snide comments?

Put your name to the comments or you are no different from the people you claim to have ripped you off!

Anon ( It is easy isn’t it 🙂 )

In response to Wilson Philips above.

It doesn’t matter whether we call these bonds ‘Insurance Bonds,’ ‘Assurance Bonds,’ ‘Single Premium Investment Bonds,’ ‘Bond Wrappers’ or whatever……IT IS ALL THE SAME THING. They have been available in the UK for several decades and many have given clients good results. They can be tax efficient for the right clients but not all……professional advice should be sought. Whilst they may be a good investment for trustees (trustees of settlements etc.) they should NEVER, NEVER, NEVER be held by pension funds. This rule should apply regardless of whether we are discussing UK or offshore bonds, UK pensions or QROPS. Warning lights should flash when a bond is held in a pension as it is will almost certainly only be there to generate commission and facilitate shameful ‘double dipping.’

People do dire and evil things in the UK. ‘Fast Pensions’ is a shocking example. However, across the board things are much better in the UK than most other countries. At the moment a few UK SIPP providers are wetting themselves because they have allowed UCIS (toxic unregulated crap) to be purchased for clients through their platforms. One or two have gone bust due to the weight of claims and it looks like there will be more to come. The outcome of court cases is awaited. A number of SIPP providers will now simply not allow ‘non-standard’ investments onto their platforms…..good on them.

From the point of view of responsibility, fair practice, simple decency and ensuring a good outcome for clients then what can possibly be the difference between the UK SIPP providers and the offshore life companies? It is simply not good enough to say ‘execution only’ and allow the offshore life companies to facilitate the financial ruin of so many people. They have to take responsibility. They have to look at the suitability of investments and they have to refuse some instructions. They need rules, they need parameters, they need lists of ‘acceptable’ and ‘not acceptable’ investments. They also have to be sure they are not dealing with advisers and introducers with wooden legs and parrots on their shoulders.

Angie is right in what she says about the practices of the offshore life companies. ‘Execution only therefore not guilty’ does not wash. They have a huge responsibility to their clients and sooner or later they will know this. Bit by bit the picture must change and it can’t happen soon enough.

There are issues with SEB all over Europe.

Under SEB own policies (if I recall correctly) they state that they will only allocate up to 5 % into a structure product and yet they have in some cases accepted over a 90 % investment into a structured product.

These investors are low risk, retired pensioners. Why would SEB accept such investments when it is against their own policies, surely they are obligated to inform the investor based on their own policies.

The other thing that SEB seem to do is accept the passporting of funds from unregulated fund managers. In accordance to the laws of Ireland and European countries, anyone passporting investment funds within Europe have to have the correct credentials and certifications to do so within the European country they are operating from.

Many many so called financial advisers do not hold the correct regulated certifications and yet SEB are happy to deal with these financial advisers. It is against the law to accept investments from none regulated and certified financial advisors. I can assure you that SEB have agreements with these financial advisers, on this agreement the financial advisers will have to submit their company certifications and credentials to verify they are legally in a position to market and sell investments in the Eu country they are operating from. I know for fact that SEB do not check the certifications, if they did they would discover that many of these advisers are not legally in a position to market / sell or passport investments.

I doubt SEB have any consideration for the elderly retired people who have lost most of their savings, even though they claim they will protect their clients.

SEB now have a terrible reputation, it’s not surprising that they no longer are in a position to market in most European countries.

Is that what the bank of Ireland really want? Ireland will over time collapse as an investment economy when people realise that there is no protection.

By the way, you might invest in Ireland but in accordance to the Irish regulations, unless you are an Irish resident you have no consumer protection rights, even if you are a European citizen. So much for the Eu laws.

Good luck to everyone

£118,000 of my pension was transferred to Irish life now SEB life, in 2009 via a FSA agent, when I found out about this I was devastated to hear it was a portfolio not a pension, the FSA was not under Governance to conduct pension activity, and, apparently they could not discuss my money placed with them, because it had been placed into a pre existing account not under my name in its first year of trading it lost a total of £18,000, the FSA agent was a Geoffrey Mills registered as a FSA agent, but he was under governance at a different firm based in the UK, he told me that my pension was being placed with hornbuckle and Mitchell a uk based pension firm, since then it has lost over £71,000 and their charges to the account have been nothing far of extortionate and they would not tell me who’s account the name was under, this is a devastating loss to my hard earned pension plus large amounts have been removed by unknown parties, I was told by him that my pension was being placed to Hornbuckle and Mitchell a uk based pension provider, all they could tell me was that 2, 000 of the money had been placed with them, and £118,000 had gone to Irish life now known as SEB life, the FSA agent did not inform me of this, therefore I find the transaction to be fraudulent and to date has lost a total of £71,000 of hard earned pension money, it was clearly placed overseas in Eire Dublin as a drawdown asset asset for the criminals and fraudsters involved in the transfer, apparently he said he worked for European Alliance a firm base in Cyprus, who were not allowed to conduct pension activity in the UK, as was not the FSA agent a certain FSA agent Geoffrey Mills who ceased to be a FSA agent in 2019,also I have ended up paying two lots of fees one to Hornbuckle and Mitchell thie other to SEB life working out at around £1,800 per year had my pension remained in the UK I would not have lost more than 1% per year, this has devastated my life and my pension since an accident in 2014 I can no longer work and lead an impaired life, fraud is based on what people don’t tell you rather than what they do, I did do diligence to see if Mr Geoffrey Mills was a FSA advisor, and if Hornbuckle and Mitchell was a UK pension provider, as indeed they were, after contacting a UK government pension adviser, it seems that the transfer of the £118,000 was explicitly to draw it down over the past 10yrs it now holds just £47.000, apparently just to reaffirm the UK pension provider now know as just Hornbuckle received just £2,000 of the total pension fund of £120.000 and they also take out £300.00 fees for that service I signed up for this believing that my whole pension fund had been transferred to them, as far as I’m concerned SEB life are nothing but fraudsters, when I found out that the majority of my pension had been transferred to them overseas I was devastated, also there was a panorama programme on BBC 1 in June 2010 speaking of these fraudulent activities which sadly I missed, I contacted European Alliance Cyprus, they said that Geoffrey Mills had never worked on their behalf, which rang true because the form he used was an extremely bad photocopy. Due to the nature of the fraud I am now about to contact the serious fraud national crime agency as suggested by the FSA ombudsman. I would be obliged if anyone can help me further, but one thing I believe I need to do quickly is recover any money SEB life hold on my behalf before nothing is left.