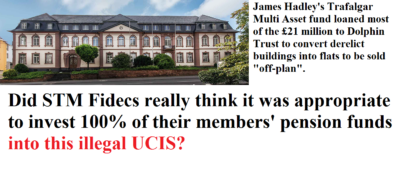

STM Fidecs, the Gibraltar-based trustee firm used for the Trafalgar Multi Asset Scam, is now the subject of large numbers of complaints to the Gibraltar authorities. Hundreds of victims of XXXX XXXX’s unlicensed “advice” transferred safe UK pensions to a Gibraltar STM Fidecs QROPS and then he invested 100% of their funds into his own fund – Trafalgar Multi Asset (now under investigation by the Serious Fraud Office). These victims have now submitted evidence and testimony. These reports and complaints are against both XXXX XXXX and STM Fidecs for their part in this scam.

STM Fidecs are also being reported to the Gibraltar Financial Services Commission for the attention of:

Annette Perales, Head of Financial Crime

and

Zoe Westwood, Head of Enforcement, Legal, Enforcement and Policy

The Serious Fraud Office has been investigating this scam – in which STM Fidecs played an integral and crucial part – for some months. XXXX XXXX and one of the STM Fidecs directors have been arrested. XXXX’s office was searched and no doubt STM Fidecs’ offices were also searched. Obviously, the victims all want those responsible for this scam to serve maximum prison sentences.

The STM Fidecs website makes the following grand-sounding claim:

“The backbone of STM is its staff. We have people who have worked for us for 20 years who are the heart and soul of our business. If we didn’t have outstanding staff, we wouldn’t be able to do what we do.”

The only thing “outstanding” would be an immediate admission of their guilt and negligence, as well as an undertaking by STM Fidecs to compensate their victims for the £ millions of losses they are facing due to STM Fidecs’ complicity with this scam. Let’s examine some of these staff and see how much backbone they really have.

ACA ACII AIRM

Role: Chief Executive Officer

Alan Kentish, CEO, claims to be a qualified chartered accountant specialising in the financial services industry. So you would have thought he would have known not to accept business from an unlicensed firm – XXXX XXXX’s Global Partners Limited (now Tourbillon). He ought to have known that UK residents should not be transferred to a QROPS at all. He would have known that members’ funds should not be 100% invested in one UCIS fund (illegal to be promoted to UK residents). And he should have recognised that it is a clear conflict of interest for members to be invested in a fund for which their adviser was also the investment manager.

What has Alan Kentish done to put this right? How much compensation has he offered to the hundreds of distressed investors? Has he engaged with the victims and assured them that STM Fidecs acknowledges their responsibility, liability and culpability? No – Alan Kentish has done nothing except pull up the drawbridge-like a spineless coward.

“David Easton, Head of Pensions for STM Group PLC joined STM in October 2014 as Managing Director of the Gibraltar pensions business and is also a board member of the pensions businesses in Malta and the UK. Since 1990 David has worked in the financial services arena specialising in pensions administration. David is responsible for driving the expansion of STM Group’s international pensions division as well as personal and occupational pension schemes in Gibraltar and personal pensions in the UK.”

So, responsible for driving the expansion of STM’s pension business into an investment scam run by a known serial scammer? Well done David. Your “primary focus” was very clear: put UK residents into a QROPS and then allow all of them to be 100% invested into an illegal UCIS. And to what extent has he engaged with the hundreds of distressed victims of this scam? Zero. Another spineless coward who refuses to speak to these people. He will neither explain nor apologise.

Other members of this spineless team include Therese Neish – Chief Finance Officer, Liz Plummer – Company Secretary, Ian Farr – Group Head of Distribution, Linda Martin – Technical Services Manager. There are of course many more – none of whom has shown the slightest concern for the plight of the victims who have lost £21 million worth of pensions between them.

Backbone? Heart? Soul? Absolute rubbish!

A former employee of STM Fidecs sent me the following statement:

“We were told not to go to the Pension Life website so as not to give her any traffic and SEO rankings. I believed them. More fool me. This is why I am now checking it out and am amazed at what’s on there.

I was asked to dig the dirt on Angela Brooks and I did, believing STM had not been aware of the Trafalgar stuff but had instead been duped. It’s more than apparent now that they fully knew what they were doing. They have sent Angela lawyers letters insisting she cease from mentioning them on her website or will take legal action against her.

Shot in the dark because everything she says is true so they can’t gag her.

Glynis Broadfoot (a victim of Holborn Assets and Gower Pensions) who also used to work for STM Fidecs, was marched out. We had no anti-bullying policy in place at the time and Glynis was being bullied. They marched her out on trumped up charges.

If I had known this at the time I would have objected. Glynis won’t speak though. They must have frightened her to death.

Outstanding staff? I think not. The only thing the STM Fidecs staff excel at is bullying. And bullies are, of course, the biggest cowards of all.

The Trafalgar Multi Asset Fund liquidators say this is the most obvious scam they have ever seen. Purely designed through ‘layering’ to misappropriate funds, the liquidators are just glad the administrators pulled the plug at £21m and not later. At the height of the success of this scam, STM Fidecs was accepting more than £1 million a month from UK residents (none of whom should have transferred into a QROPS at all) and allowing it all to be invested in XXXX XXXX’s illegal UCIS.

Apparently, Dolphin Trust (the German fund which borrows money to refurbish derelict government and listed buildings) has “cooperated” and the liquidators have found some other assets as well, although getting them may prove tricky since they will have been vigorously hidden. Dolphin Trust is typically found alongside car parking spaces, store pods, eucalyptus plantations, truffle trees and other toxic crap peddled by the scammers.

The liquidators reckon the victims might get 50% back less costs, so after the liquidators’ costs that would be nearer 30% net. But STM Fidecs know all this, but have deliberately hidden it from the victims.

It is human to err, and STM Fidecs is staffed by humans (albeit spineless ones). But what is not forgivable is to fail to come to the table and assure the victims they will be compensated for their losses and profound distress. STM Group has been bragging that it has plenty of money and will be buying up other trust companies to make their business bigger and more profitable.

STM Fidecs’ victims feel they shouldn’t be in the pension trustee business at all since they are clearly incompetent, dishonest and dishonorable. This belief is clearly correct since STM Fidecs also accepted transfers from Continental Wealth Management (unlicensed “chiringuitos”) and then allowed the victims’ pensions to be 100% invested in high-risk, professional-investor-only structured notes. As a result, the STM members are facing heavy losses.

The Gibraltar authorities must now show how “highly regulated and transparent” Gibraltar is. As things stand, the evidence is that Gibraltar is full of thieves, scammers and scoundrels. The chiringuitos love being there because the regulation is widely accepted as being as spineless as the staff and directors at STM Fidecs.

**********************************

As always, Pension Life would like to remind you that if you are planning to transfer any pension funds, make sure that you are transferring into a legitimate scheme. To find out how to avoid being scammed, please see our blog:

I have put all my pensions in this company who put it in trafalgar £120,000 and now I here it is a scam is this ture.. I have phoned STM and was told Trafalgar had gone into Liquidation.

my husband has put all his pension into this group, he did it because he assured that if anything happened to him, i would get 100% of his pension and i would not have to worry! we are not rice and we live on the bread line, at the moment i have no heating and hot water and we don’t have the money to fix it… that tells you how little we have, i am not in a good way and can only do part time work, but now that will have to change and i will have to start full time, i have slipped disc in my neck and more will go but i will have to carry on, because our furture is uncertain! how can they do this to people, don’t better that the scum that rob little old ladies

Enterprise Insurance Failure / Green Planet Investment Failure / Sceptre International Failure / Eco push Failure / Kijani Fund Failure…….. For such a tiny jurisdiction hell of a lot of investment failures seem to be associated with this former colonial UK outpost. Gibraltar does seem to attract a good few scammers for such a small and so called highly regulated jurisdiction.

In 2014 I had a Military Pension, I looked online about how I could transfer this pension into a civil pension scheme. I contacted firm called Portia Finance based in Liverpool who in turn placed me in contact with a representative of theirs. When filling out necessary paperwork I was led to believe that even though I was a UK Resident I was able to transfer to a QROPS. After the necessary paperwork had been completed I was placed with Global Partners (now Tourbillion) as my financial advisors and advised to invest my money £100,000.00 plus into a QROPS scheme called The Calpe Lite with The Sovereign Group in Gibraltar, on receipt of the paperwork I noticed a part saying I intend to move abroad in the next 2years, I informed the rep I had no intention of leaving the UK, to which he replied ” Oh dont worry about that, just sign, its nothing to worry about” I have a witness to this conversation. Consequently my pension was transferred in full from the Army to Sovereign and they invested into Ashburton Fund and Trafalgar Fund, I have just recently found out I should’nt even have this pension as I reside and always will reside in UK, I asked Sovereign about this and they just said talk to my Financial Advisor, so now Im worried I may be breaking the law on top of having half my funds suspended with Trafalgar, these people should be brought to justice with the stiffest penalties.

I am afraid you were scammed. The Trafalgar fund may or may not ever return any money – we will have to see how the liquidator gets on. There might be a possible claim against Sovereign for accepting business from an unlicensed adviser. Did you have any dealings with Ben Fox or xxxx xxxx (or Tom Biggar)?

like a lot of people I was also duped with my pension is there a site for victims to get feedback as to what is going on with any remaining funds or how much longer this will take or can legal action be taken against stm for there part in this scam