Humour me – you may consider me to be naive – but I believe that the ills of financial services (especially offshore) can be put right. All it takes is for the ethical stakeholders to outlaw the unethical ones. Yes, it will be a bit like something out of the Old Testament – but I firmly believe it can be done. And, more importantly, it MUST be done.

Humour me – you may consider me to be naive – but I believe that the ills of financial services (especially offshore) can be put right. All it takes is for the ethical stakeholders to outlaw the unethical ones. Yes, it will be a bit like something out of the Old Testament – but I firmly believe it can be done. And, more importantly, it MUST be done.

So many thousands of victims have lost part or all of their life savings already – and these people must be compensated. But, above all, future victims must be prevented.

Here’s my TOP TEN wishes that I want the Magic Financial Services Fairy to grant (as a matter of urgency):

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime.

Governments in the UK and all expat jurisdictions must wake up to scams – both offshore and at home. They must empower/galvanise law-enforcement agencies and give them the resources to tackle financial crime.

Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

Regulators must put together effective regulations – and then ENFORCE them. Regulations on their own are worthless and pointless – the industry must be policed and failure to comply with regulations must be severely sanctioned.

Ceding pension providers must stop handing over thousands of pension transfers to scammers. The Scorpion campaign has had a negligible effect and all leading providers are still at it .

.

Advisory firms must be regulated – and not just for insurance. If all a firm does is sell insurance, that is fine. But if pension and investment advice is given, the firm must be properly regulated.

Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

Advisers must be appropriately qualified. If they don’t have the right qualifications, they must demonstrate that they are studying and aiming to qualify within a reasonable, pre-determined time frame.

Investors with DB scheme transfers must get proper advice – avoiding flimflam which takes no responsibility for the end result of the transfer. QROPS providers must ensure they only accept business from regulated firms.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile.

QROPS providers must also ensure they have understood and verified the members’ risk profiles – and then ensure that any investments made on behalf of those members are in line with their risk profile.

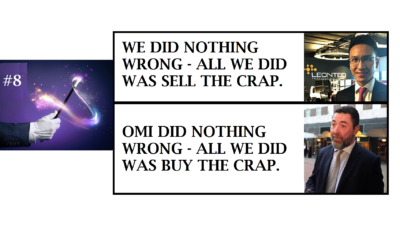

Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

Life offices must stop accepting business from known scammers and unregulated firms – and cease investing victims’ life savings in unsuitable assets – such as structured notes and UCIS funds.

Life offices must pay redress to their victims for investment losses caused by negligence and fraud.

There must be a quality assurance system to which all offshore advisers, life offices, trustees and fund managers subscribe and adhere.

100% agree with this. Sooner than later before more lives are destroyed.

100% agree with this and it will probably happen when Nelson gets his eye back!

The second sentence “All it takes is for the ethical stakeholders to outlaw the unethical ones” is perhaps the ONLY way the world is going to change.

My QROP trustee in Malta (Integrated Capabilities Malta Ltd – https://integrated-capabilities.com/about-us/ and their administrators Optimus Pension Administration Ltd (OPAL) – https://www.optimus.co.im/services/pensions/qrops – I believed were also conned by those that scammed me and unwittingly hoodwinked into facilitating a pension scam. I always believed they were actually “good eggs” since they did their very best to extract me from the scam – whether they went further and helped the other victims I don’t know.

However it was within their capability to blow the whistle on those orchestrating the scam, https://pension-life.com/not-so-square-mile-and-far-from-lilly-white/ and assist in shutting the bar stewards down. They could have supported my complaints to the CNB and the FCA. They must have had ( & still do I guess) a shed load of evidence behind the scenes I didn’t have that would conclusively prove to the regulators just what Tweedledum & Tweedledee were up to. They could also have worked to “outlaw” other QROPS that are not so cooperative at getting victims out as they had done with me – the likes of STM and Harbour (now sold to STM) to name just two.

There is also a lot of pressure that could be made to bear on local regulators in Malta or IoM (for example), to shut down the bad QROPS and weed out the scammers.

However I don’t think they have the will to apply that pressure and clean up their jurisdiction. Without pressure, regulators tend not to do anything constructive even though they have the legislative power. Local businesses could effectively apply that pressure.

“Good QROPS” – there are those think this is an oxymoron – know what’s going on, but turn a blind eye; walk on the other side of the street whilst bad QROPS facilitate scams on innocent people.

It is a sad state of affairs. There are no good Samaritans in the financial world – lots of sharks plus those that turn a blind eye!