My name is Nikki Mitchell. Lets peep behind the scenes at life at Pension Life, fighting pension scams. I’m the newest member of the team. I started in June 2016 – there was a lot to learn in six months. I am PA to Angie, but most importantly I handle a wide variety of tasks.

Angie has been defending people scammed out of their pensions since 2013. My colleague Sue Halfyard’s role is member administration. She completes all the essential documentation that we, HMRC, Dalriada Trustees and the solicitors need. Sue also liaises with HMRC on the unauthorised payment tax appeals and helps Angie prepare for the Tax Tribunals. Elizabeth is our website and blog-writer and is currently on maternity leave.

Our website is not only a place to inform people of the work we do, and how we can help people who have fallen foul of pension scammers, but it also serves as a platform to warn others about scammers, so that hopefully we can stop them losing their life savings.

We are currently dealing with over 30 different schemes:

Ark; Axiom UP; Barret and Dalton; Baxendale Walker; Capita Oak; Confiance; Continental Wealth Management; EEA/Concept Trustees; Elysian Fuels/SIPPS; Evergreen QROPS; Headforte; Henley; Holborn Assets/Gower Pensions; Holbrook Capital; KJK Investments; Ledger and Simmons; London Quantum; Malvern; Mendip; RL360; Hansard/Trafalgar; LM; Optimus Retirement Benefit Scheme No 1; Peak Performance; Pennines; Salmon Enterprises; Store First SIPPS; Trafalgar Multi Asset Fund/STM Fidecs; Tudor Capital Management; Westminster; Windsor Pensions.

Sadly, most months we hear about new ones.

Day to day work in the office consists of managing Angie’s crowded diary, keeping the accounts, liaising with members to keep them abreast of new developments, preparing scheme and member files for the legal teams, responding to the demands of HMRC and various trustees. I also work on campaigns to raise awareness of pension scams, or to campaign for changes in the law to protect pension investments.

My first few weeks passed in a whirl of new jargon and abbreviations – UTR, Q10, MPVA EIS, PCLS, etc. Some days I spend the day designing and completing databases with members’ information for the solicitors. Other days I’m number crunching the transfer and loan amounts for an individual scheme. Some days we all have to change direction as there has been an urgent development. A recent example of this was the Standstill Agreements sent out by Dalriada – the trustees of the Ark Pension schemes. Our first member received an agreement in August 2016. We have warned all the members that they will be receiving one, and worked with our solicitors to redraft the agreement to protect the members’ interests.

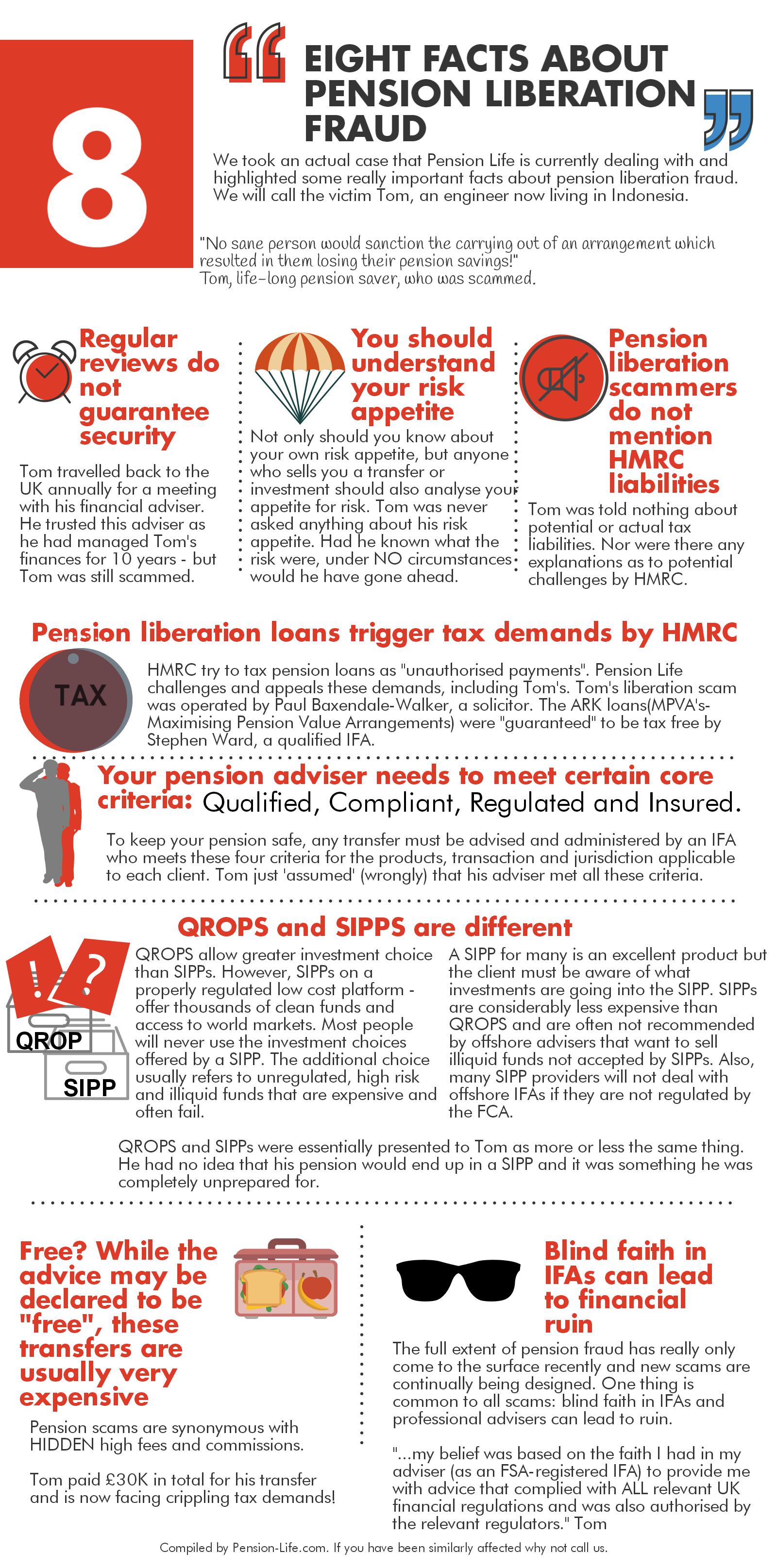

Being a small, busy team in a hectic office, there is never a dull moment. Aside from the daily nitty-gritty of the work, there are also the heart-breaking accounts of the members who have been scammed out of their pensions. Consequently, I have felt disbelief at the cruel contempt of the scammers. Reading members’ stories of how they were conned into investing their entire pensions or life savings into dodgy, illiquid schemes is utterly heart-breaking. Speaking to people who have lost everything – their homes, their marriages and their health – through the actions of these arrogant, greedy con-men fills me with horror.

The greatest shock to me since joining Pension Life has been how the scammers have continually got away with fraud and theft for years. Also, how ceding providers routinely transfer pensions with hardly even the most rudimentary checks. It has amazed me how so many different types of pension scams are allowed to be set up time and time again, with no thorough controls by HMRC or the regulators. Moreover, I can’t understand why it takes so long for the scams to be shut down – long after they have been identified.

We may be a small team here at Pension Life, but with the government’s recent realisation that cold calling needs to be outlawed and the consultation on pension scams:

https://www.gov.uk/government/consultations/pension-scams

we are hopeful that there may finally be light at the end of the tunnel for existing victims and jail for the scammers.