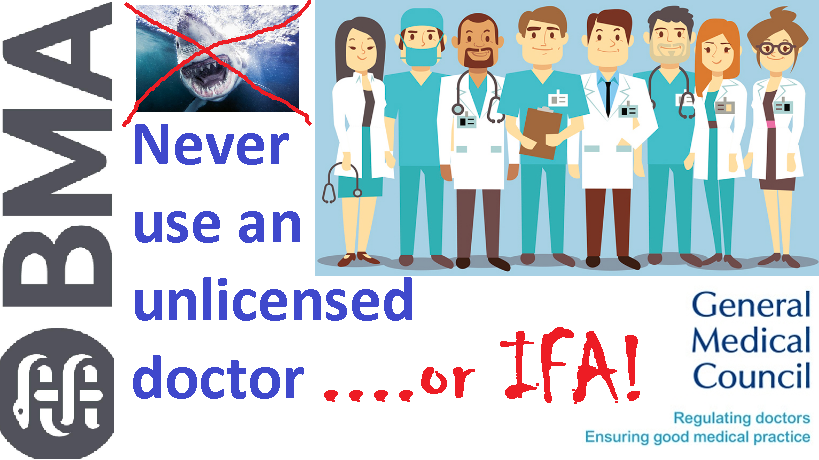

CRIMINAL CASE AGAINST UNLICENSED FINANCIAL ADVISERS

haps “the end” will be just the beginning. A new dawn for an offshore financial services industry which sells proper financial advice – and not just commission-laden products.

CRIMINAL CASE AGAINST UNLICENSED FINANCIAL ADVISERS Read More »