Every time I think this book about pension scams is done and I can put it away, a new scam or scammer pops up and I have to rethink it. And every time I add in a new sentence or paragraph, the formatting and pagination need to be adjusted. But, however imperfect and unfinished it may be, it is available on Amazon:

It has been much harder to write than I ever thought it would be. But nowhere near as hard as it is for the victims who have to live with the consequences of losing their pensions and investments – and gaining tax liabilities.

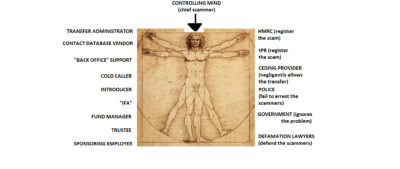

The purpose of this book is to warn the public against current scams and scammers (the same ones who have been doing it since 2010) and encourage the police and regulators to criminalise all forms of scams. The Pensions Regulator’s Lesley Titcombe has clearly stated that scammers are “criminals” and it is hoped they will all be prosecuted. The victims and the ethical members of the financial services industry want to see a zero-tolerance policy and a military-style campaign to stamp out this horrendous crime wave.

Evidence suggests that in the past seven years, there have been many £ billions lost to pension and investment scams – there are no precise “official” figures. But the dreadful fact is that the scammers who were targeting victims back in 2010, continued doing it in 2011; and 2012; and 2013; and 2014; and 2015, and 2016. And they are still doing it today. Happily and profitably. And nobody has stopped them or brought them to account for the horrific financial damage and distress they have caused.

It is hard to decide which is worse: the vicious, greedy, cold-hearted scammers or three sets of inept government or the feeble authorities who let them get away with it. Repeatedly. But it has to stop. A military-style, zero tolerance campaign has to be waged against all the guilty parties until every last one of them is brought to justice.

The tragic thing about these scams and the misery and financial ruin caused to so many thousands of victims is that this disaster was preventable. HMRC were warned by the industry about the potential for scams if the role of compulsory professional trustee was removed pre 2006. In a letter of March 2004 a specialist pension solicitor warned:

“It is essential that schemes offering self-administration and wide investment choice should have in place an independent person who has sufficient control of scheme assets to prevent abuse and sufficient knowledge and experience to know abuse when he sees it.

That does not necessarily mean that the system of pensioneer trustees should be retained in its current form but, if it is abolished without an effective replacement, we envisage that within the next 5 years the degree of abuse of such schemes by both incompetent and dishonest individuals will:

- further stain the reputation of pensions generally; and

- severely embarrass the government responsible for letting it happen.

Reputable professionals in the industry and the Government share a common aim of building a system of tax rules that is simple but is robust enough to last for a working lifetime without major overhaul. Such a system needs to contain adequate protections against abuse.”

The warning was ignored. And precisely what was predicted would happen, happened. And it will go on happening until and unless government, HMRC, regulators and police take responsibility for their failings and put in place robust measures to clean up the mess of the past/present and prevent future disasters.

This clear warning was brought to my attention by Martin Tilley who is director of technical services at Dentons Pension Management. Martin has written some excellent blogs and articles on the subject of pension scams and my favourite has to be this one:

http://www.retirement-planner.co.uk/9344/cleaning-up-pension-scams-with-soap-operas

I know the government is jolly busy at the moment with Brexit. But earlier this year there was a government consultation on pension scams – and still no word about what the battle plan is. In fact, neither Damian Green (Secretary of the DWP) nor Richard Harrington (Pensions Minister) will engage at the moment as they claim there is no point until after the consultation.

But they didn’t say how long after: three months? three years? With every day that they dither about, more victims will lose their life savings; more damage will be done to the reputation of the industry; more expensive will it become for the State to support those who have no retirement income; louder will be the ticking of the pension scam time bomb.

Richard Harrington recently stated that Britain can’t afford to implement transitional arrangements for 1950s-born women who weren’t notified their State pension age was going to be increased from 60 to 67. He reckons this would cost the country around £30 billion. With scams reportedly costing the British public £11 billion a year, the cost of supporting these thousands of victims throughout their retirement will be staggering. Plus the cost to the NHS (because of the amount of mental and physical health damaged caused by the stress of being scammed) will add to this enormous cost.

If you have read this blog from start to finish, it will have taken you seven minutes. During that time at least one person will have been scammed out of their life savings. If you read the Anatomy of a Pension Scam ebook from beginning to end, it could take you up to five hours if you read slowly and carefully. Think how many people could be scammed in that time. Avoidably.