HMRC Pension Loan Wolf

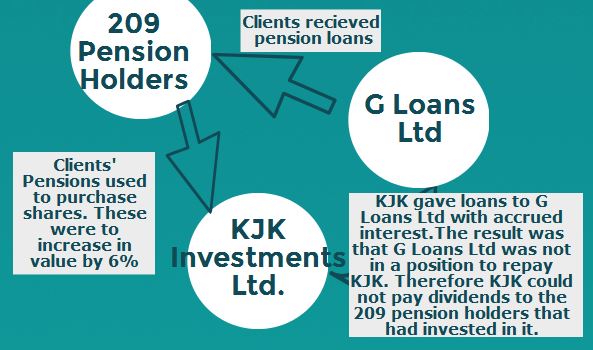

HMRC Pension LOAN WOLF I am writing to explain the rather confusing “assessment” and “further assessment” appeal situation in relation to HMRC’s “pension loan wolf” situation. Although this is specifically aimed at the Ark case, it will also apply in most – if not all – other cases. In a nutshell, the assessments […]

HMRC Pension Loan Wolf Read More »