Unqualified Pension Scammers Banned

Articles like New Model Adviser’s report on some of the scammers behind the Capita Oak/Henley/Store First scam getting banned always makes me smile. Knowing that a few pension scammers (four in this case), are being named and shamed – as well as banned from being directors – motivates me to share information about these evil scams with the public.

Directors handed 34-year ban for £57m cold call pension transfers

Citywire stated:

“An investigation led by the Insolvency Service revealed the directors were connected with Transeuro Worldwide Holdings, which helped fund two introducer firms Sycamore Crown and Jackson Francis. The firms were involved in the transfer of £57 million of pension savings.

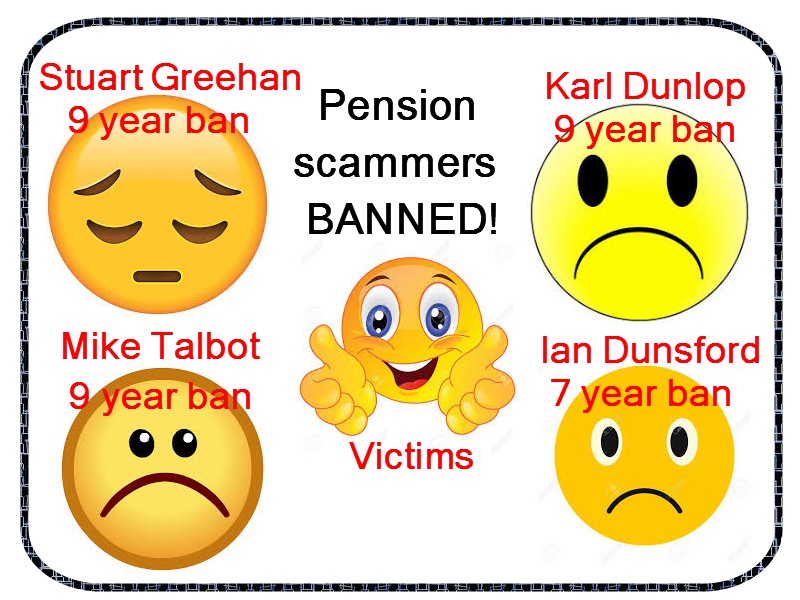

Sycamore Crown director Stuart Greehan agreed to a nine-year voluntary ban as a result of false and misleading statements to encourage investors to transfer their pensions.

Karl Dunlop, director of Imperial Trustee Services, and Ian Dunsford, director of Omni Trustees, agreed to bans of nine and seven years, respectively, for failing to act in the best interests of members and ‘failing to ensure investments were adequately diverse’.

While not a formally appointed director of Transeuro Worldwide Holdings, Mike Talbot (AKA Stephen Talbot) accepted a nine-year disqualification undertaking for failing to disclose what happened to the millions of pounds of pension assets.”

BUT, IN ADDITION TO THESE EVIL SCAMMERS, THERE WERE OTHER PLAYERS IN THIS APPALLING TRAGEDY AND THEY WERE NOT MENTIONED. SO HERE ARE THE OTHER PEOPLE WHO PLAYED LEADING PARTS IN THIS FOUL PLAY:

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd – he handled the transfer administration from the original (ceding) pension providers. He was, apparently, paid £300 per Capita Oak transfer – and would have known that he was condemning each member to certain loss of his or her pension.

Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd – he handled the transfer administration from the original (ceding) pension providers. He was, apparently, paid £300 per Capita Oak transfer – and would have known that he was condemning each member to certain loss of his or her pension.

XXXX XXXX of Nationwide Benefit Consultants, The Pension Reporter, Victory Asset Management and Tourbillon, was clearly the “controlling mind” behind Capita Oak. He also ran the Thurlstone loan scheme which paid 5% in cash to the Capita Oak victims as a “bonus” or “thank you”. HMRC is now taxing these payments at 55% as they qualify as unauthorised payments. XXXX XXXX then went on to launch the successful Trafalgar Multi Asset Fund scam which saw over 400 victims lose their pensions to high-risk toxic loans to Dolphin Trust in an STM Fidecs Gibraltar QROPS. XXXX – as with most pension scammers – subsequently ignores the plight of the victims when the schemes eventually and inevitably collapse. XXXX is under investigation by the Serious Fraud Office and was also responsible for the Westminster pension scam.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Mark Manley of Manleys Solicitors – acting for XXXX XXXX.

Stuart Chapman-Clarke, Christopher Payne, Ben Fox, Bill Perkins, Alan Fowler, Karen Burton, Tom Biggar, Sarah Duffell, Jason Holmes, Metis Law Solicitors, Roger Chant, Brian Downs, Phillip Nunn and Patrick McCreesh all played further prominent roles in this series of scams and profited to a greater or lesser degree.

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were Henley Retirement Benefit Scheme (HRBS) and Capita Oak Pension Scheme (COPS). But the scammers also used a variety of SIPPS which included Berkeley Burke, Careys Pensions, Rowanmoor, London and Colonial and Stadia Trustees.

It is believed that cold calling techniques were used to lure unsuspecting victims into this series of unregulated investment scams. Victims’ pension savings were transferred into bogus occupational pension schemes whose trustees/administrators were Omni Trustees and Imperial Trustee Services. The schemes were Henley Retirement Benefit Scheme (HRBS) and Capita Oak Pension Scheme (COPS). But the scammers also used a variety of SIPPS which included Berkeley Burke, Careys Pensions, Rowanmoor, London and Colonial and Stadia Trustees.

As is often the case in scams like these, the victims were lured in with promises of so-called guaranteed high returns by spivs masquerading as advisers, who were also unqualified and unregulated to give financial advice.

The unqualified advisers were able to transfer millions of pounds’ worth of pension savings into these schemes which included investments in unregulated storage units and over £10 million into COPS (Capita Oak) and over £8 million into HRBS (Henley). The promised high returns were never paid to the investors – but handed over to the scammers instead. The pension funds are now suspended with the funds trapped in these illiquid investments.

The company directors have received a total ban of 34 years collectively. Here at Pension Life we would have liked to have seen lifetime bans all round.

The Serious Fraud Office (SFO) is now moving forward with their investigations against Omni and Imperial. They urge people who are members of HRBS (Henley) and COPS (Capita Oak) to contribute to criminal evidence against the scammers via a questionnaire.

As always, the team at Pension Life urges pension holders to be wary of pension scammers. Never accept a cold call offer, be aware that scammers lurk everywhere and if it seems to good to be true it probably is!

Yeah, I have to say this is a great blog! Well researched and factually accurate. I like it! But ….

This statement: “… agreed to bans of nine and seven years, respectively, for failing to act in the best interests of members… ” is the key failing in all scams.

All these “advisers” whoever they are, including David Vilka, Square Mile International Financial, now Michalska Holdings s.r.o – changing names does not hide the fact you scammed ME and dozens of others – do NOT act in the “best interest of their clients” but purely for their own enrichment, as testified by Ferguson’s email of August 2015 https://pension-life.com/not-so-square-mile-and-far-from-lilly-white/ which unequivocally shows they were advising investment in the introducer’s funds, regardless of the client’s best interest! This, by the way is a clear breach of the “duty of care” they owe their clients by virtue of the “Hedley Byrne rule”. [And yes, Vilka, you want to go head-to-head in a court of law? – then bring it on sunshine! You know I have a shed load of incriminating written evidence of fraudulent misrepresentation, from you, that would crush you in court! So you try and bring another stupid pathetic litigation threat against Angie, you had better have the balls to go through with it cos I am right behind her!]

These people that “… agreed to bans of nine and seven years, respectively, for failing to act in the best interests of members… ” is in my opinion a cop out! They are without doubt guilty of “tort by deceit” and should have been made to pay compensation to the victims of the scams they were complicit in. The “bans” are “punishments that do not fit the crime” by any means!!

These people have been let off far too lightly. These “bans” and “disqualifications” are completely insufficient. The scammers have yet again “got off lightly” and once again the victims have not seen any justice whatsoever!

It is disgusting!!!

Me, I would strip them of all their assets, distribute it as compensation to victims, and lock the bar stewards up and throw away the key! They are a scourge on society.

Totally agree, can’t wait to see what happens to that SOB xxxx, I hope when he ends up in jail he meets a nice big bloke called Mavis who’ll take a shine to him lol

Two comments:

1. It’s more than three years since these rogue trustee companies were wound up.

2. It’s also worth remembering that the Chairmen and CEOs of the two failed banks, HBOS and RBS had no banking qualifications.