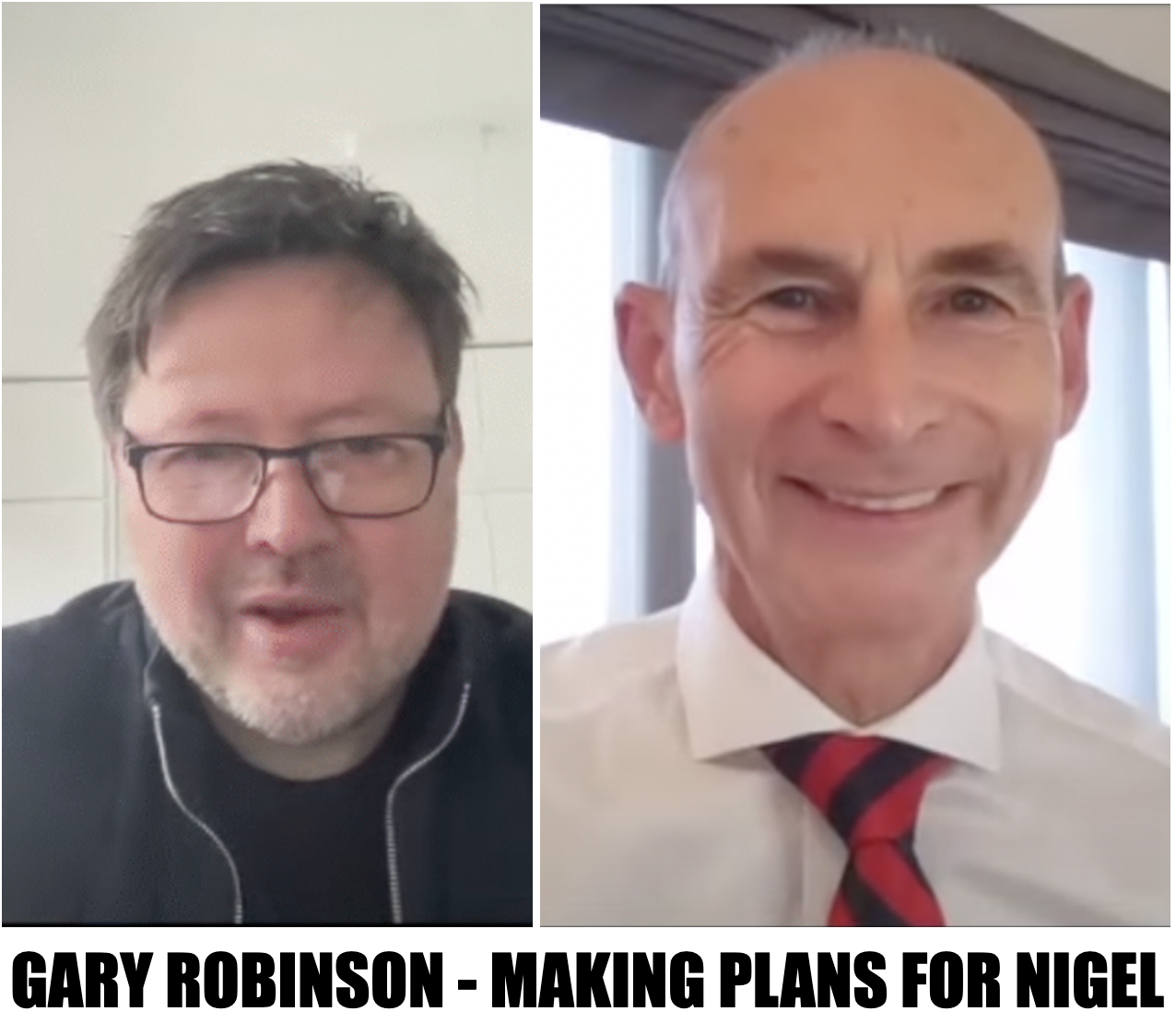

Gary Robinson of International Adviser celebrates global undisclosed commissions on June 25th 2025.

Gary Robinson, journalist and filmmaker, now heads up International Adviser. IA poses as a financial services news magazine. In reality, it is a rag for promoting the products of the life offices (more accurately known as death offices) such as Utmost International, RL360, Hansard and Investors Trust. This enriches the commission-hungry firms – such as DeVere, Guardian Wealth Management, Holborn Assets and Mondial in Dubai. (See victims’ reviews below).

Gary Robinson, also MD of Money Map Media, pictured above promoting Nigel Green of DeVere, claims:

“Really exciting to bring back the IA Global Financial Services Awards 2025 where the shortlist is solely decided by our advisers, brokers and wealth managers.”

But Gary’s “excitement” is disingenuous as he knows full well that the advisers, brokers and wealth managers are at the receiving end of the fraudulently-concealed commission machine operated by the death offices. This leads to sales of inappropriate and risky investment products. And the word “adviser” is grossly misleading as the majority of the firms don’t sell advice – they sell products for fat and destructive commissions.

Gary’s predecessor was Kirsten Hastings. In 2020, Hastings handed out awards to her paymasters to rapturous canned applause:

“And the winner of international life group non-UK is Quilter International. Congratulations!”

“And the winner of International Portfolio Bond is Quilter International. Congratulations!!”

“And the winner of Digital Proposition is Quilter International. Congratulations!!!

Hastings said that Quilter had been “overwhelmingly nominated by the advisers”. Hardly surprising since that’s where their juicy, fraudulent commissions come from.

These undisclosed commissions come in two layers: 7% or 8% on the portfolio bond itself. Then commissions of up to 19% or more on the toxic, high-risk assets on the investment platforms provided by the death offices. So the “advice” to get sucked into these products is certainly not “independent”.

Five years later, the 2025 IA awards not only target the death offices but also the rogue jurisdictions which act as enthusiastic incubators for so much international financial crime. IA Nominations for International Financial Centre of the Year include:

Hong Kong, Guernsey, Jersey and the Isle of Man.

All of which have harboured fraud, negligence and mis selling – with little or no intervention by the regulators.

Hong Kong is not as popular among fraudsters as Malta, Gibraltar and the Isle of Man. However, in 2014 a group of conmen in Hong Kong – including Neil Masters, Michael Foggo, Mark Wearmouth and Chris Beale – launched the GFS Superannuation Scheme 2 occupational pension. They then operated a multi-million-pound investment fraud in partnership with Czech broker Planet Pensions (aka Aktiva and Square Mile).

Hundreds of UK-residents were then conned into transferring their pensions to GFS in Hong Kong. They lost everything in toxic, unregulated, high-commission investments. Convicted criminals Mark Donnelly and Gordon Couch of Brite Advisors then tried to take over the scheme using Donnelly’s Hong Kong company Tribune – set up jointly with Nigel Green of DeVere. Donnelly then bought Planet Pensions for £650,000 using money stolen from his Brite Advisors clients.

The Hong Kong regulator did at least deregister the scheme when it realised it had been used for investment fraud – but then took no criminal action against the perpetrators.

Guernsey and Jersey have also been involved with various investment scams over the past decade. These include the 💲100 million unregulated collective investment EEA Life Settlements scam based in Guernsey and the £40 million Privilege Wealth payday loans swindle used as 100% investments in pension portfolios in Jersey.

The Isle of Man hosts some of the World’s worst facilitators of fraud – including Hansard, Utmost, Quilter, Friends Provident International and RL360. These firms have been responsible for the destruction of billions of pounds of life savings and are currently standing trial in the Isle of Man for misrepresentation and undisclosed commissions in two claims for £400 million worth of losses for hundreds of victims. And these death offices have for many years paid millions of pounds in secret commissions to the worst of the commission-driven “advice” industry.

The IA Award nominations for best international pension provider include Momentum Pensions in Malta. This is astonishing as Momentum has the most Arbiter complaints of all the QROPS providers in this ineptly-regulated and corrupt jurisdiction. The Malta Arbiter’s website clearly contains details of nearly 100 serious complaints against Momentum – most of which were upheld. The Arbiter found that Momentum had failed to comply with the Malta financial services regulations and to have failed in its fiduciary duty to the scheme members. And yet still the Malta regulator – despite the Malta Arbiter’s damning condemnation – has still not shut down Momentum (or STM for that matter – which came a shameful second to Momentum).

Momentum Pensions had allowed millions of pounds’ worth of investments in toxic, high-risk structured notes by unregulated Spanish firm CWM. Most of these failed, wiping out hundreds of members’ pensions. The sole director of CWM has recently been convicted of fraud and sentenced to four years in prison.

Momentum Pensions was not the only QROPS provider in Malta to facilitate investment fraud by rogue brokers. This is borne out in detail through serious complaints published on the Malta Arbiter’s website also include Dominion Fiduciary Services, STM, Optimus, ITC and Mark Donnelly’s MC Trustees. All these firms negligently allowed high-risk, high-commission, unsuitable investments by unscrupulous brokers (resulting in total loss for the victims).

These Malta-based pension providers open the gateway to the death offices in the Isle of Man – who host the high-risk investments and facilitate the illegal commissions. The Asset Review Team at Quilter International had reported concerns about this a decade ago:

“Commerzbank and Leonteq structured products appear to be risky and not good value due to relatively high commissions.”

The Asset Review Team also described the undisclosed commission arrangement operated by Nigel Green’s DeVere:

“DeVere’s model is that they take 4% for advice plus an arrangement fee of 4%. The 4% advice fee is disclosed. The arrangement fee is not disclosed to the customer. The client pays 104% for a structured product with an issue price of 100%. If the client tried to exit the product on day 2 they would receive 96% for something that they paid 104% for.”

(And let us not forget that this is just DeVere’s commission on the investments – they also receive up to 8% on the insurance bonds as well).

Former IoM regulator Peter Kenny – as MD and CEO of Quilter International – did accept liability in 2018 for facilitating the CWM fraud. He agreed to compensate the victims. But then he realised this could compromise the £200 million claim against rogue structured note provider Leonteq – and reneged on the agreement.

So, Gary Robinson, Head of International Adviser, before you start popping the champagne corks and handing out awards to firms which have facilitated fraud, why not announce a minute’s silence to remember the victims. Describe the misery they have suffered; the poverty; the loss of a lifetime’s work to build up a pension; the broken marriages; the lost homes; the distress and depression. And don’t forget the deaths. NEVER FORGET THE DEATHS GARY.

DeVere Reviews

de Swaan 30 Mar 2025

Stay away from DeVere at all cost

A few weeks ago I wrote a review of the pathetic service that, for four years (from 2020 to 2024) I received from the Mexican subsidiary of de Vere Group. Today I received a message from Trustpilot informing that my review was removed for “containing possible defamatory accusations”. I have expressed to Trustpilot my absolute willingness to present the evidence for each of the arguments contained in that message, which I summarize below.

1. de Vere Group is the typical financial company that will approach you with a lot of kindness and good treatment in the first meetings, but then it will basically disappear and it will be up to the customer to chase it to be served.

2. de Vere Group has the highest personnel rotation you’ve ever seen in a company. In four years I had five financial advisors, which basically leaves the client in an absolute state of defenselessness, because there is no institutional strategy and invariably the advisor in turn will blame the previous one for the decisions and poor performance of your portfolio.

3. De Vere Group has no incentive for its clients to do well (and it shows) because its commissions are totally unrelated to the financial performance of its clients. Always look for advisors whose fees are related to the performance of your financial boards.

4. After the departure of each advisor, with de Vere Group it will be up to the client to pursue the company to be served again and it is impossible to demand that there be the slightest continuity in the strategy because the new advisor will start the relationship as if you were a new client and promote new strategies criticizing his predecessor.

5. When they retire, each advisor will seek to get you to maintain the relationship with him or her by talking badly about the company they are leaving (and I don’t blame them)

I have dozens of emails that can prove every word of what I expose here. I wish de Vere were as good a financial advisor as he is to accuse defamation.

Date of experience: 30 June 2024

Joe Dobert 24 Feb 2025

They have possibly up to 10% markups on their structured notes and their advisors are not even aware of this. My recommendation: always compare with other providers.

Date of experience: 24 November 2024

David 15 Apr 2025

I have lost more than 80 % of what I invested in cash more than 18 years ago.invested USD 103,000 in a collective…

I invested USD 103 000 in a collective investment bond with this company in Qatar in 2007. I was promised quarterly meetings with the advisor for him to give me advise. Subsequently, the company closed their Qatar office, closed their Dubai office, closed their Oman office, closed their South African office etc. As of 2025, My investment is worth USD 21000 and I am battling to get the money out of a company Utmost in the Isle of man. They are making me jump through hoops to provide them with all sorts of information before they will pay out. I have received no advice in 18 years, the bond has been handled by several organisations over the years and I have made several attempts to stop the constant fees. I hold De Vere totally responsible for the losses. What they are doing is destroying peoples lives by hiding behind their lawyers, the small print in their systems and collusion with other corrupt financial organisations.

Date of experience: 15 April 2025

Guardian Wealth Management Reviews

R Reames 6 Nov 2023

Poor communication

Poor communication. Happy to take their fees but with no portfolio management. Allowed my investment to lose almost 40% with no intervention.

Date of experience: 06 November 2023

Martyn Kilburn 30 Sept 2023

#leavemealone

I would have not even bothered writing a review but skybound wealth keep hassling me about my investment. I looked on website reviews and they are all 5 stars. I can only imagines they have been left by the friends and family of skybound wealth. For me the whole investment thing was a bit of a mummer’s farce. I can only describe it as imagining you had two uncles visiting your house. 1. Uncle skybound wealth/uncle jimmy saville and 2. Uncle guardian wealth/ uncle rolf harris. Either way they seemed alright at the beginning but in the end violated you financially.

Date of experience: 30 September 2023

Holborn Assets Reviews

Chad Kassis 17 Dec 2024

Save Your Money And Go Somewhere Else

Holborn Assets has been one of the most disappointing companies I’ve ever dealt with. A few years ago, I entrusted them with a significant investment, expecting the typical services of a reputable asset management firm, regular updates, performance reviews, and professional portfolio management. Unfortunately, none of these expectations were met. Most of my emails went unanswered, their performance was subpar, and their high annual fees were completely unjustifiable. I was paying 3% annually for literally nothing! I initially thought the issue might be with our manager, but even escalating concerns to his superiors and their superiors proved futile. In reality, Holborn Assets seems to function more as a glorified sales operation than a legitimate asset management firm. If you’re looking for a trustworthy investment partner, a company that does the bare minimum of customer support, I strongly advise looking elsewhere. Save your money and your peace of mind! I will be writing an in-depth blog and video posts to document and share this awful experience!

Date of experience: 15 December 2024

Steve Poll 10 Nov 2024

Lost over 40% in a moderate risk fund over 7 years

We invested a lump sum with Holburn Assets in 2017 with a risk profile of moderate (so, not high risk). By 2023 we had had enough of the fund depreciating in value each year. Having requested early exit from the scheme, it took 10 months to get our remaining monies transferred out. Whenever we or our new financial advisor provided information required to complete the exit, yet another request for even more information would suddenly appear.

By the time we paid the early exit fees our investment had depreciated by over 40% (and that’s before you allow for inflation).

When we complained to Holburn Assets we were told that the low amount of monies we got back was due to the exit fees. While these exit fees were high, most of the losses were from their poor investment and high annual fees. At no time did they suggest we move the monies into another fund.

Our new financial advisor (who has performed well so far) summed up our experience with Holburn Assets very well – excessively high annual costs and extremely poor performance.

Date of experience: 10 October 2024

Mondial Reviews

M Robinson 8 May 2025

Beware. Mark Donnelly owns a large stake in this company. Mark is a convicted criminal in the UK. He oversaw the collapse of Brite Advisors which was forcibly liquidated by Australian regulator because of massive irregularities – Mark then quickly left Australia to come to the UAE.

Date of experience: 09 May 2025

15 May 2024

Be Careful!

Be Careful!

A major Owner of this business was the owner of the firm of advisors that managed my retirement savings. Margin loans were raised by the firm of advisors, using our retirement assets (which were supposed to be held in trust) as collateral. Money went missing and the loans were not repaid. The firm has been placed in receivership by Australian Authorities. Our retirement assets are now frozen.

Date of experience: 15 May 2024

Useful3Share

MU

12 May 2024

My UK offshore retirement fund (QROPS)…

My UK offshore retirement fund (QROPS) is now frozen, until the Receivers of Brite have figured out where the missing funds went and how much is left of retirement investors Assets. These assets (supposedly held in trust) were used by Brite as collateral for margin loans, to expand their portfolio of clients and to buy luxury cars. Brite stopped paying the loans, were placed in receivership and investors assets were frozen. The owner of Brite is a major owner of Mondial Dubai, think twice before investing there.

Date of experience: 12 May 2024

8 May 2024

AVOID

I don’t know about how Mondial operated previously, but recently I understand a certain Mark Donnelly acquired 75% controlling ownership. He had previously led Brite Advisors globally which was shut down by regulators in Australia early in 2024 after reporting issues and a significant hole was ‘discovered’ in client’s pensions Assets under Management – I would NOT recommend getting involved with ANY company associated with him.

Date of experience: 01 May 2024

Leave a Reply