Looking at International Adviser’s 2017 awards, I really think the judges were having a giraffe (or they were very drunk).

Looking at International Adviser’s 2017 awards, I really think the judges were having a giraffe (or they were very drunk).

“Best regular premium investment product – Hong Kong – Zurich International Life”

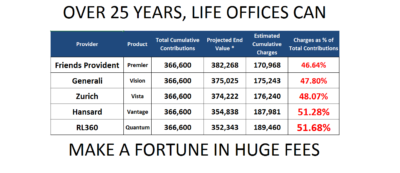

Seriously? This grim firm has one of the most expensive long-term savings plans on the market. A victim scammed into buying one of these toxic, inflexible products will pay 48.07% of their savings in fees to Zurich. To put this into real numbers, a victim who saves £366,600 over a 25-year period, will pay £176,240 in fees.

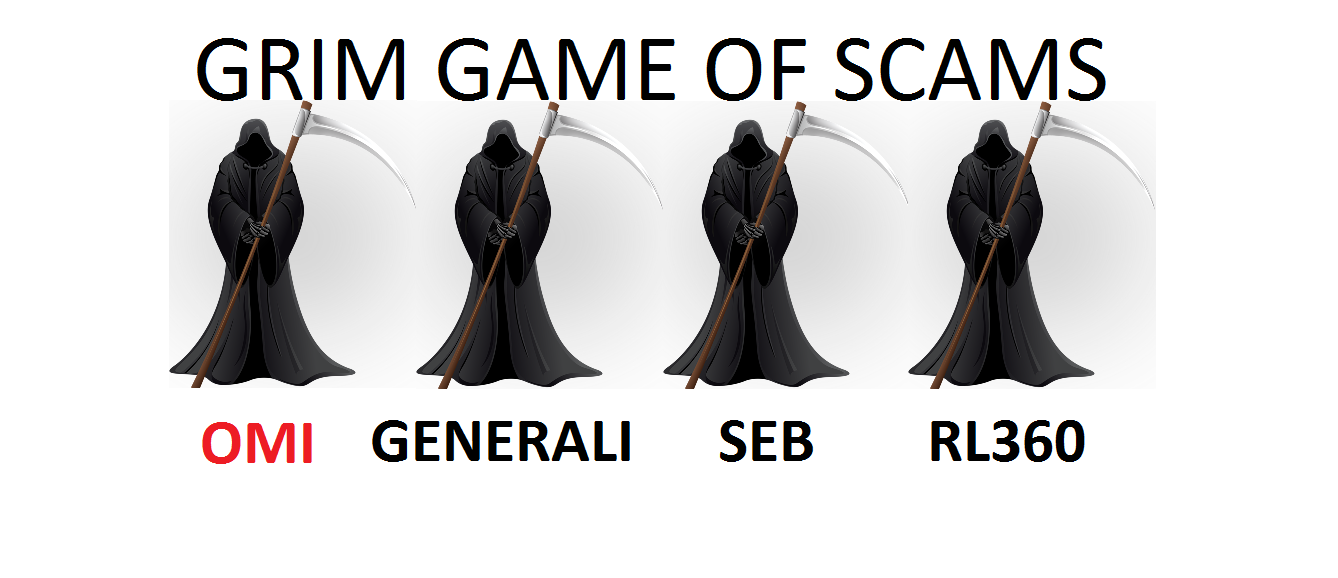

In this disgraceful long-term rip-off contest, Zurich is in the midst of the others who similarly overcharge their victims with these undisclosed charges: RL360 at 51.68%, Hansard at 51.28%, Generali at 47.08% and Friends Provident at 46.64%. Savers would be better off sticking their savings under the mattress, away from the greedy clutches of these rip-off merchants.

“Best regular premium investment product – Singapore – Friends Provident International”

OK, perhaps the least expensive of the big five, but still 46.64% is ludicrously expensive. These long-term savings plans are routinely mis-sold and victims end up losing most of what they have saved.

“Readers choice – Europe – SEB International”

This life office was routinely ripping off pension savers by taking business from unlicensed, unqualified, unscrupulous scammers Continental Wealth Management from 2010 to 2017. To the tune of 1,000 victims with £100 million worth of investments. About half of which has been destroyed. SEB stood by and watched CWM invest hundreds of victims’ life savings in toxic, high-risk, professional-investor-only structured notes. As the scammers gambled away millions of pounds, SEB kept taking their fees – based on the original investment value. In this case, all of SEB’s victims lost part or all of their retirement funds.

I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY:

I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY:

THE GIRAFFE AWARDS

My proposal is that awards are given every year for the worst performers in terms of either operating scams or facilitating them. Let us be very clear – we are talking about financial crime here. It is extremely important that publications such as International Adviser do their bit in cleaning up the financial services industry. That is why these awards are so important.

The judges should be the victims themselves. Here are my nominations – but am more than happy for victims to suggest others:

Advisory Firms: Continental Wealth Management, Holborn Assets

Pension Trustees: Concept, STM Fidecs, Fast Pensions

Life Offices: SEB, Generali, Hansard

Funds: Blackmore Global, Trafalgar Multi-Asset, Christianson Property Capital

Structured Product Providers: Leonteq, Nomura, RBC, Commerzbank

Regulators: Isle of Man, New Zealand, United Kingdom

It is clear that regulators and ombudsmen are useless, limp and disinterested in how their respective jurisdictions operate financial crime so routinely. International Adviser could emerge the hero by exposing the appalling practices in offshore financial services which routinely destroy victims’ retirement savings. (Or not, as the case may be).

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years.

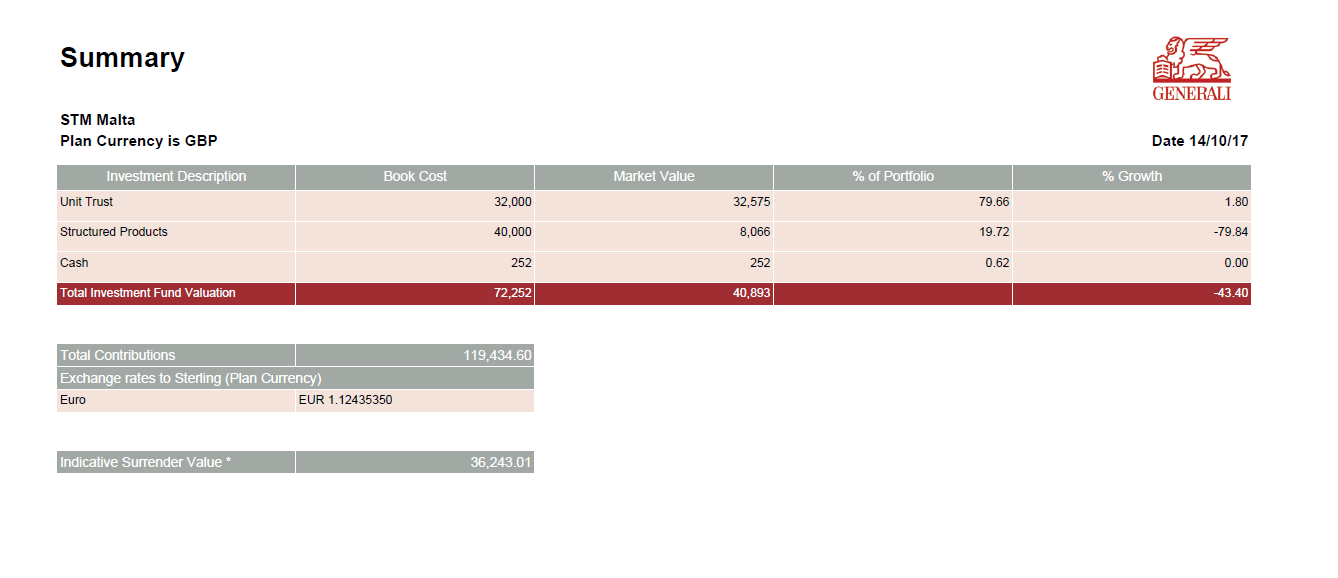

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years. One Generali victim saw her £119k pension fund plummet to £36k in five years.

One Generali victim saw her £119k pension fund plummet to £36k in five years. Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.

Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.