JUSTICE MORGAN’S MAD MISTAKE

(IN THE HIGH COURT OF JUSTICE, CHANCERY DIVISION)

This judgement makes the law not just an ass, but a whole herd of donkeys.

Dear Justice Morgan

I refer to your judgment in the matter of Donna-Marie Hughes and Royal London Mutual Insurance Society Case Number CH/2015/0377 on 19th February 2016.

With absolutely no apology whatsoever, I must point out that your judgment – overturning the Pensions Ombudsman’s Determination in this matter – is so stark staring, raving mad that it verges on utterly bonkers.

In a number of complaints, the Ombudsman has found that although the legislation is missing a few key words, it is clear that a person should only transfer into an occupational scheme if they are genuinely employed by the sponsor of the scheme. The Ombudsman drew attention to the fact that the words “employed by the sponsor of the scheme” are, curiously, missing (obviously, whoever wrote that passage nipped out for a liquid lunch at the crucial moment). But he used his common sense and pointed out that it would be a “very strange result” if a person wanted to transfer into an occupational scheme without any employment relationship or arrangement with the sponsor.

It is my obligation to refer you to the fact that the industry, regulators, law enforcement agencies, courts, ombudsmen and victims (existing and future) desperately need the legislation to be tightened – not relaxed (or, as in this case, made completely impotent). This judgment has effectively given the green light for hundreds of scammers to scam innocent victims out of their hard-earned pensions.

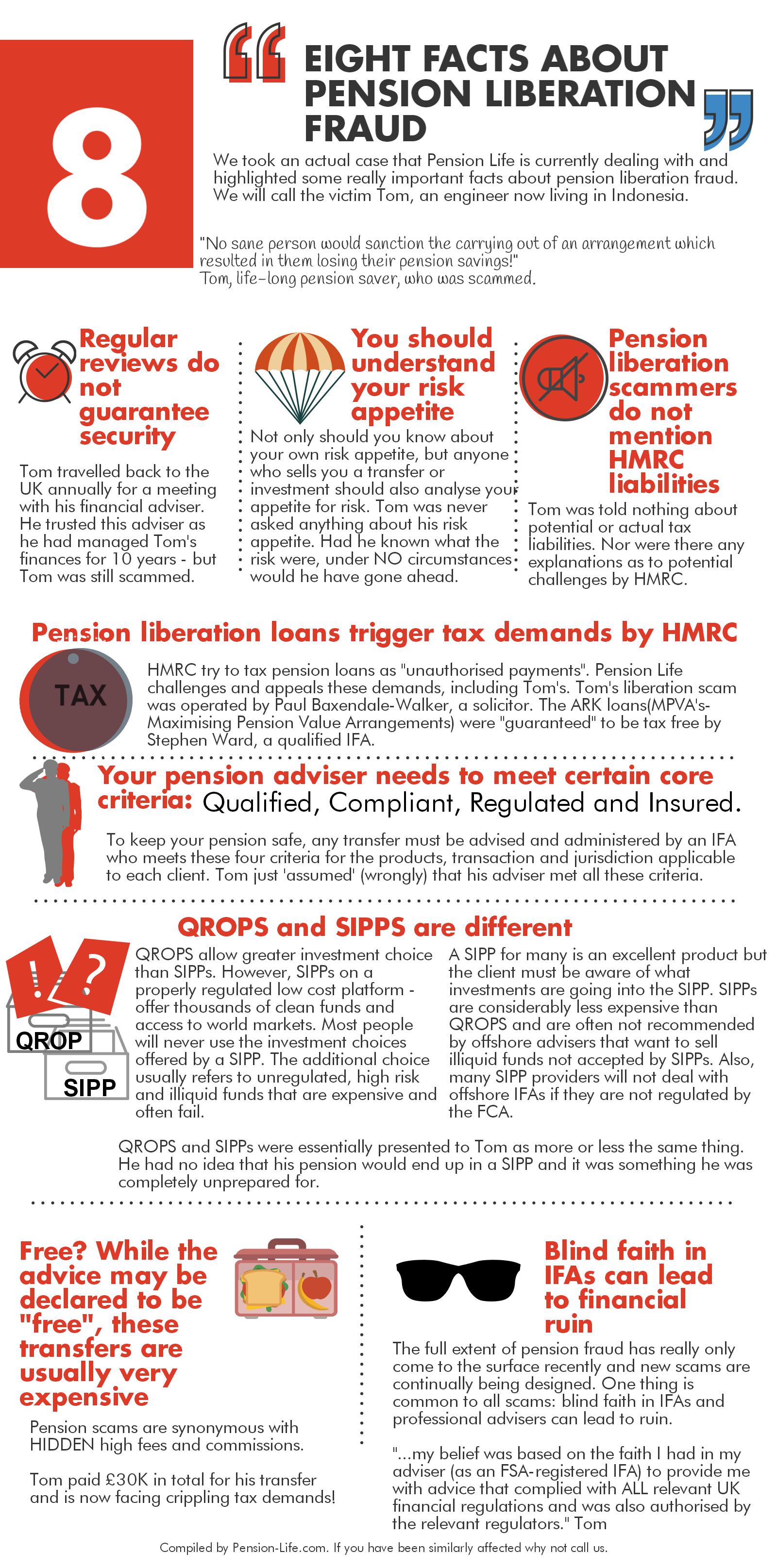

History, since 2011, shows that various pension liberation scams including Ark (Lancaster, Portman, Cranbourne, Woodcroft, Tallton, Grosvenor) Capita Oak, Westminster, Evergreen, Salmon Enterprises, Eric’s Yard, Pennines, London Quantum, Headforte, Southlands etc., all share a collection of common traits:

- They were set up, administered and promoted by unregulated firms

- These firms obscure the identity of the team

- The address of the firm is a virtual office

- The assets of the scams being peddled include high risk, illiquid, speculative investments entirely unsuitable for pensions

- Bogus “occupational” schemes are registered with HMRC and tPR (who do nothing to check that the sponsoring employers actually trade or employ anybody – or indeed even exist at all)

- Pensions are liberated using a variety of “loan” structures which victims are assured are legitimate “loopholes”

- Transfer and loan fees are extortionately high

- Victims are promised unrealistic gains such as “guaranteed 8% return per annum”

- Assets are entirely unsuitable for pension schemes and often include huge “kickbacks” for the introducers

The firms and individuals offering these schemes have included:

- Premier Pension Solutions in Spain (run by Tolleys Pensions Taxation author Stephen Ward – available on Amazon if you need a copy: http://www.amazon.com/Tolleys-Pensions-Taxation-2014-2015-Stephen/dp/0754549356)

- Gerard Associates http://www.gerardassociates.co.uk/

- Frost Financial

- Continental Wealth Management

- J. P. Sterling

- Viva Costa International

- Windsor Pensions

- Blu Debt Management

- Wealth Masters

- Paul Baxendale-Walker

- James Lau

Thousands of victims have lost £ billions and gained £ millions in tax liabilities. The assets of these schemes have included offshore property, store pods, car parking spaces, unregulated collective investments, eucalyptus forests, hedge funds, forex, Cape Verde etc.

Now, I am not saying that Bespoke Pension Services are scammers. http://bit.ly/1VGeSPn but on the back of their victory in the case of Ms. Hughes, there are a further 160 blocked pension transfers sitting with the Pensions Ombudsman. We have no way of knowing whether they will all be pension transfers invested in Cape Verde, but we do know the Hughes case must have been very important to Bespoke Pension Services’ business. After all, they must have invested a considerable amount in legal fees to take an £8,000 transfer attempt to the High Court.

Interestingly, Bespoke Pension Services are unregulated and their address is a virtual office. According to their latest published accounts the firm is insolvent. The two directors/shareholders – Mark Anthony Miserotti and Clive John Howells – have between them an impressive portfolio of investment, consultancy, property development, investment and financial planning companies – one of which is called “Fortaleza Investments” which suggests something Brazilian.

On the back of your judgment in respect of Royal London, there will be a serious problem for all the pension providers who performed so appallingly in Ark, Capita Oak, Westminster, Evergreen et al: the worst of which being Standard Life, Prudential, Scottish Widows, Aviva and Legal and General. Having handed over £ millions worth of pension funds since 2010 – in a lazy, negligent, box-ticking fashion – there is evidence that they are trying to mend their ways. Or there had been, until your judgment in the Hughes/Royal London/Bespoke Pension Services case.

I would draw your attention to Clause 53 in Justice Bean’s Ark ruling where he makes it clear that legislation wording must be interpreted intelligently – and not blindly.

He is obviously trying to make the point that it is essential to avoid an anomalous or unjust result from failing to look behind the intended meaning of wording. Indeed, the Pensions Ombudsman had already done that when looking at the wording when he said that he found that a transferee did need to be employed by the sponsor of an occupational scheme in order to avoid a “strange result”.

Your judgment has put at risk thousands of victims’ pensions. There have already been suicides, nervous breakdowns, life-threatening illnesses, broken marriages and families. There will be widespread poverty in retirement and many people will lose their homes. A strange result indeed – which does rather beg the question of how victims will get any protection or justice now?

This judgment makes the law not just an ass, but a whole herd of donkeys.

Regards, Angie Brooks