Julian Hanson – why pension scammers must be prosecuted.

And jailed.

BARRATT AND DALTON PENSION SCAM: The Pensions Regulator has announced that on 23 January 2018, four pension scammers have been ordered to pay back £13.7 million they stole from their victims.

BARRATT AND DALTON PENSION LIBERATION SCAM:

245 victims had their pension funds stolen by David Austin, Susan Dalton, Alan Barratt and Julian Hanson. Their company – Friendly Pensions Limited (FPL) – acquired the pension funds using cold calling techniques with promises of ‘tax-free’ payments.

The Pensions Regulator (TPR) had asked the High Court to order the defendants to repay the funds they dishonestly misused or misappropriated from the pension schemes – the first time such an order has been obtained.

But this clearly demonstrates that pension scammers should be prosecuted and jailed quickly before they go on to scam thousands more victims. Julian Hanson – an integral part of the Barratt and Dalton scamming team – was also an integral part of the Ark scam.

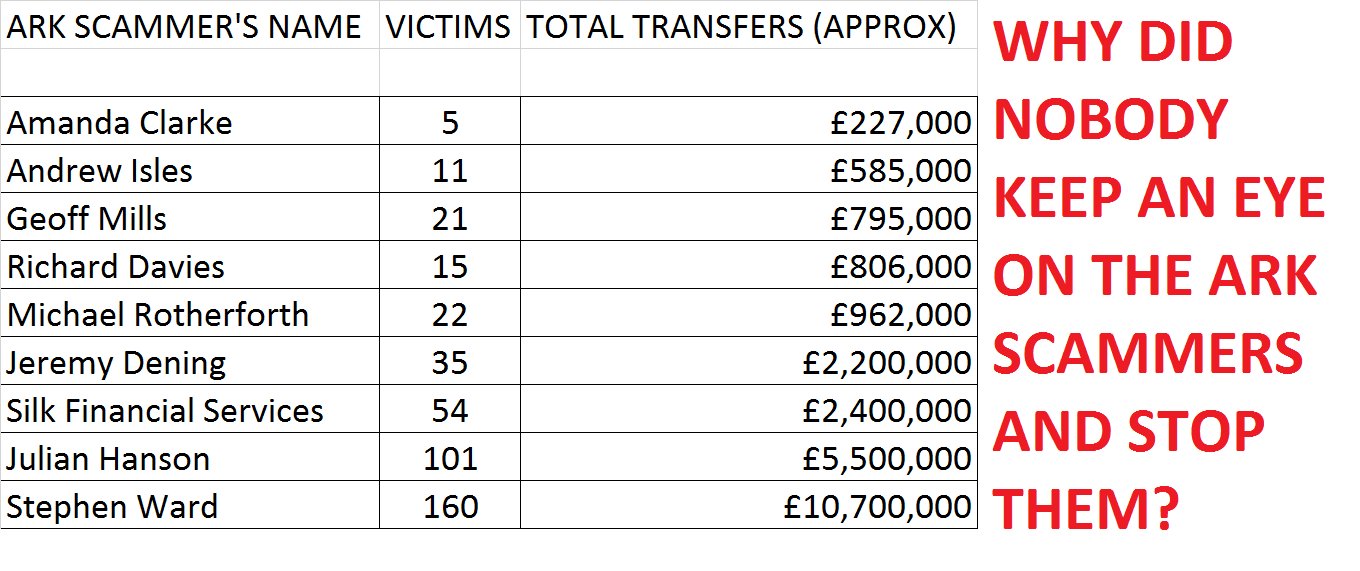

Julian Hanson acted as an introducer/adviser in the ARK case (also in the hands of Dalriada) in 2010/11. He scammed over 100 victims out of their pensions – totaling around £5.5 million worth of retirement savings. Hanson, in common with the many evil scammers creating scam after scam, was happy to push aside the appalling predicament of his Ark victims and stroll on to find new victims for the Barratt and Dalton scam.

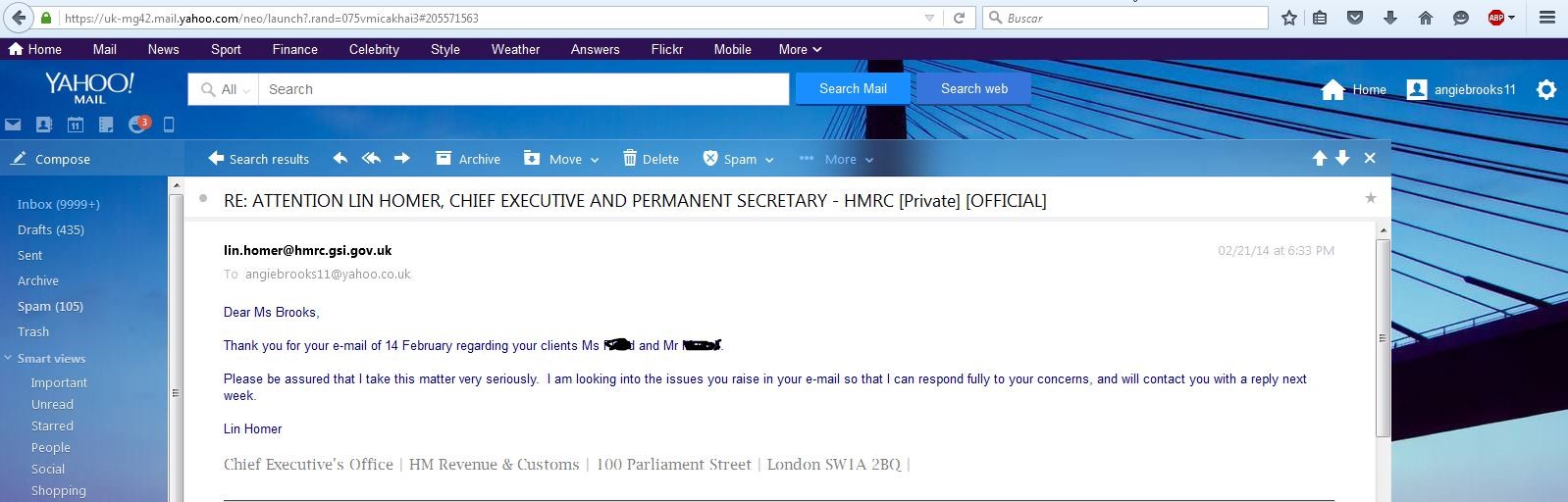

Hanson had promised his Ark victims their pensions would be profitably invested in “high-end London residential property” and would grow sufficiently to discharge the 50% they were allowed to take from their funds. This, he assured the victims, would NOT be taxable.

As soon as the Pensions Regulator placed the Ark schemes into the hands of Dalriada Trustees, Julian Hanson should have been prosecuted and prevented from ever scamming pension savers again. But, sadly, he was left free to continue his evil trade. Hanson was one of a whole army of scammers peddling the Ark scam:

And hereby lies a basic flaw in the system: had Julian Hanson (along with his fellow scammers) been prosecuted and jailed for scamming the Ark victims, in 2011, the subsequent Barratt and Dalton victims might have been saved. However, it will hopefully be the last one that Julian Hanson is allowed to get away with, as his name will now be synonymous with pension scams.

The same is true for the other introducers/advisers peddling Ark who remain free to continue their trade:

Andrew Isles is still a practicing accountant at Isles and Storer

James Ian Hobson of Silk Financial went on to operate more companies which operated lead generation and cold-calling services for further scams such as Fast Pensions and Trafalgar Multi-Asset Fund

Stephen Ward went on to scam thousands more victims out of their pensions and into toxic investments as well as illegal liberation in the Evergreen QROPS; Capita Oak, Westminster, Southlands, Headforte, and London Quantum.

The mastermind behind the Barratt and Dalton scam was apparently David Austin – a former bankrupt with no experience of pension investments. He invested victims’ pension funds in truffle trees and St. Lucia timeshares, and then laundered the victims’ pension funds through relatives in the UK, Switzerland, and Andorra. Austin used a number of businesses he had set up in the UK, Cyprus and the Caribbean – including Friendly Pensions Ltd. Austin’s family clearly had no shame about where their money came from and flaunted their new-found wealth all over social media. Fortunately, this vulgar and heartless bragging made the job of gathering evidence for the High Court much easier for tPR

TPR had appointed Dalriada Trustees to the case, and with this ruling, they will be able to attempt to recoup the stolen money from the four scammers. Unfortunately it is unclear how much money is actually left to recoup as scammers are notoriously clever at hiding their ill-gotten gains offshore and presenting themselves as “men of straw”.

TPR had appointed Dalriada Trustees to the case, and with this ruling, they will be able to attempt to recoup the stolen money from the four scammers. Unfortunately it is unclear how much money is actually left to recoup as scammers are notoriously clever at hiding their ill-gotten gains offshore and presenting themselves as “men of straw”.

Nicola Parish,TPR’s Executive Director of Frontline Regulation, said: “The defendants siphoned off millions of pounds from the schemes on what they falsely claimed were fees and commissions.

“While Austin was the mastermind, all four took part in stripping the schemes almost bare. This left hardly anything behind from the savings their victims had set aside over decades of work to pay for their retirements.

“The High Court’s ruling means that Dalriada can now go after the assets and investments of those involved to try to recover at least some of the money that these corrupt people took. This case sends a clear message that we will take tough action against pension scammers.”

One the investments in the Barratt and Dalton scam was £2 million in an off-plan timeshare development in St Lucia called Freedom Bay. This same development also took millions of pounds’ worth of funds from the victims of the ARK scam. Freedom Bay is now in administration.

In this scam, operating between November 2011 and September 2014, 245 people were cold called, promises of a cash lump sum and compliant investments at 5% were promised.

The reality of what happened to the funds was:

- More than £10.3 million was transferred to businesses owned or controlled by Mr Austin

- Just £3.2 million of the funds was invested

- False documents were made to cover these figures

- Funds given back to the victims were a % of their actual funds and NOT profits

- More than £1 million was paid to the “ introducers” or “agents” who conducted the cold calls

One of the victims, Colin, from South Wales, had become the full-time carer for his partner when he was approached via text message. Promised investments in the now bust St Lucia Developments, a lump sum which he planned to spend on a holiday. Having heard about the pension scams, he tried to contact the scammers with no success.

One of the victims, Colin, from South Wales, had become the full-time carer for his partner when he was approached via text message. Promised investments in the now bust St Lucia Developments, a lump sum which he planned to spend on a holiday. Having heard about the pension scams, he tried to contact the scammers with no success.

Colin, 48, said: “I should have known that it was too good to be true. I should have sought advice and asked more questions, but I didn’t.

“I had contributed towards my £50,000 pension pot, for which I had worked really hard, and now that has been taken from me.

“The loss of my pension will have a massive impact on my life. When my children finish school I will be around retirement age. There will be no money to draw down when I turn 55 and no pension savings for later life.

“I was greedy. I feel stupid for throwing away my financial future for £4,200.”

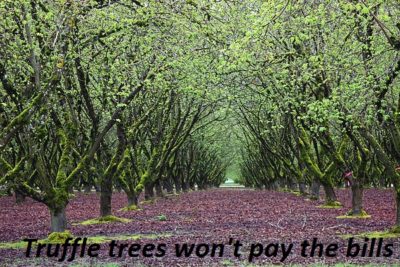

A couple, John and Samantha, both fell victim to this scam despite being advised by their pension provider that it could be a scam. They received their lump sum and were told their pension was invested in truffle trees. After reporting the case to the police, they were later informed that their lump sum was from their own funds and HMRC promptly served them with a large tax bill.

A couple, John and Samantha, both fell victim to this scam despite being advised by their pension provider that it could be a scam. They received their lump sum and were told their pension was invested in truffle trees. After reporting the case to the police, they were later informed that their lump sum was from their own funds and HMRC promptly served them with a large tax bill.

John, 46, said: “As a result of my dealings with Alan Barratt my final salary pension is in a scheme that I don’t understand the status of but which I have been told is a scam.

“As far as I know, the majority of my pension fund is invested in truffle trees but I doubt whether that is legitimate. My partner appears to have lost her pension too.

“I deeply regret ever listening to Mr Barratt.”

Why has cold calling not been banned by the government?

Why has cold calling not been banned by the government?

Why are ‘introducers’ still be used?

Why are the scammers in the Ark case not under criminal investigation?

Serial pension scammers like Julian Hanson and all the others need to be stopped now. New laws need to be introduced so hard working and trusting citizens aren’t left with decimated pension funds and huge tax bills they can’t pay.