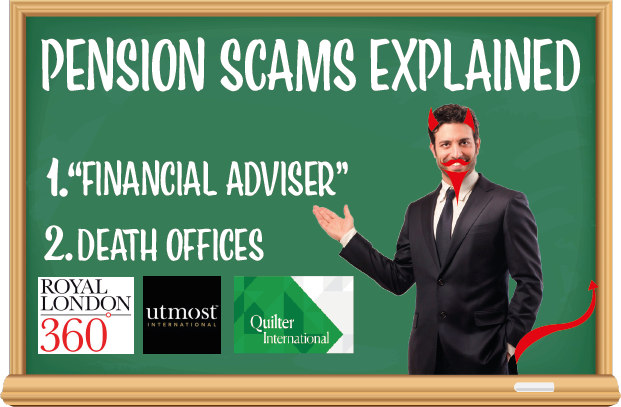

Every offshore pension scam starts with a “financial advisor”. Or, at least, a slick salesman posing as a financial adviser. This person can also call himself a “wealth consultant” or “senior associate”.

After the scammer pretending to be an adviser, the next player is the life office. More accurately described as a “death” office, this type of insurance company pollutes and corrupts financial services by ensuring three things:

- Few so-called “financial advisers” offshore are truly independent. They are tied to – and dependent on – the life offices for fat, abusive and undeserved commissions.

- There is virtually no such thing offshore as providing proper qualified advice – only selling products for commission. Products recommended to the victim are chosen because they pay the most commissions – rather than because they are in the investor’s interests.

- The victim will be placed into a “death bond” – also known as a life bond, offshore bond, portfolio bond, insurance bond or wrapper. This toxic, high-risk, expensive and unnecessary product serves only one purpose: to pay a hidden commission to the so-called adviser.

Death bond providers (also known as “life” offices) have facilitated vast amounts of fraud for well over a decade. This has resulted in the destruction of hundreds of millions of pounds’ worth of pensions and life savings across Europe, the Middle East, South East Asia and beyond.

With the recent merging of RL360 and FPI, as well as Utmost and Quilter, this trend is set to increase.

The only way to protect consumers from being defrauded in the next decade is to educate them. The next raft of potential victims needs to be warned, informed, educated and prepared – so they too don’t fall victim to the death offices and their associates.

Here we recreate a typical exchange between a potential victim and a salesman posing as an adviser. Watch and learn; read and weep. This is what has already happened to thousands of expats. Don’t be the next victim conned by a fraudster and a death office.

Introducing Darren Blacklee-Smith of High Assets Wealth and John Carson – a builder who moved to sunny Spain to retire early.

Darren: Nice to meet you John. So, you want to move your frozen pension out of the UK as you now live in Spain?

John: Yes, I’ve been in Spain a few years now, with Brexit and everything, I’m not sure I should leave my pension where it is.

Darren: Very wise to look at your options. Your pension would probably be better off in a QROPS because it would be looked after better, would be cheaper to manage, you’d pay less tax, and you wouldn’t risk losing half of it when you die. Best of all, you’d get to choose your own pension investments!

DING! This is the first warning sign. The old “you’d pay less tax” trick… normally it’s the hook, line and sinker for this type of scam. Who doesn’t want to pay less tax after a lifetime of it? However, the so-called “lower tax charges” are nothing compared to the hidden commissions on the death bond and the toxic investments.

John: That all sounds like it would be better for me in the long run – and cheaper. So where would I move my pension to?

Darren: We’d recommend a QROPS in Malta as this is one of the best countries to move your pension to. It is a safe place for your pension to be looked after properly.

DING DING!! Malta was a prolific harbour for pension scams for a decade. It was a grey area, making it easy for scammers to make as much money as possible. The Malta regulator has tried to tighten up the regulations to prevent further scams, but the scammers always find a new loophole.

John: So how much would all this cost me?

Darren: My firm would charge you a small fee for setting up the transfer and then looking after your pension investments moving forwards.

DING DING DING!!! Oh how he makes it sound so simple! The fees that these advisors take are hefty. And they are not the only charges that will contribute to the destruction of the pension – because of the hidden commissions.

John: Sorry to ask this question, but how is your firm qualified or licensed, or whatever, to look after my pension investments?

Darren: Very important question to ask John – and I am more than happy to give you all the information you need to be comfortable that we are fully licensed.

DING DING DING DING!!!!You can look up any company or person’s license to verify if they’re actually registered or not. But most consumers don’t know how to do this.

John: Oh, I’m glad about that – I didn’t want to offend you, but you do hear stories don’t you…..

Darren: Absolutely. Now, we’re fully regulated and I’m fully qualified. It’s all on our website and here’s my business card and you can see all my qualifications.

John: I’m glad about that. I worked for thirty years to build up that pension and I don’t want anything to happen to it. The wife and I moved to Spain to have a comfortable retirement, and I need to make sure I’m making the right decision.

Darren: Absolutely. Definitely. So, let’s look at all the ways you can improve your pension and make sure its protected. The first question to ask is whether you want tax efficiency? You don’t want to pay too much tax do you?

John: I’ve paid tax all my life, so I feel I’ve paid my dues. I definitely don’t want to pay too much once I’m retired because every penny is going to count.

Darren: Well, that’s why we often recommend our clients should use a tax-efficient insurance bond, like Quilter. This is one of the World’s biggest insurance companies and this will not only protect your pension, but will also make sure you don’t pay too much tax.

DING DING DING DING DING!!!!! And this is the most dangerous part. Quilter will almost certainly be the death of your pension. A bond is not suitable for a pension. It is way too expensive and inflexible. And provides no tax advantages within a pension for someone living offshore.

John: That sounds great. So how do we go about this? How do we get the ball rolling, and what do you need me to do?

Darren: Right, I’ve got some forms for you to sign……we’ll need to get your pension transferred over to Malta, and then open up the insurance bond. And then we can start investing your pension and making it grow – so you’ll be able to have a happy and healthy retirement.

Darren: So, this is the transfer application, sign here…..

John: Ooh, not sure if I’ve got a pen…..

Darren: Don’t worry, I’ve got plenty!