2021 was a tough year for everybody in the world. But for Pension Life it was especially frustrating because courts and law firms were severely held up as they got to grips with the challenges of Covid, travel restrictions and working remotely.

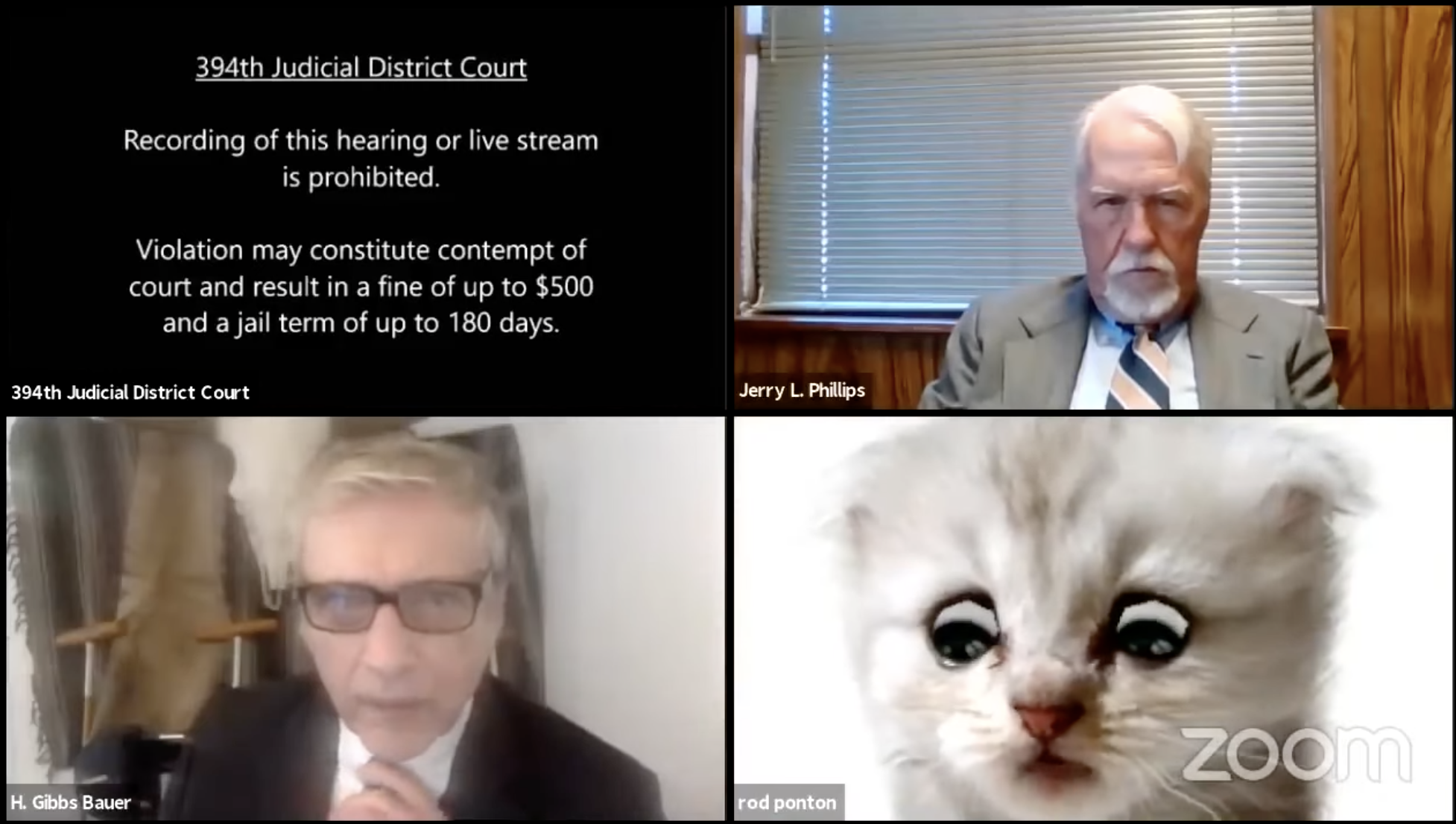

Attending hearings and meetings by video conference was a hit-or-miss affair. The success of the communication depended on the reliability of the wifi, the quality of the microphone and camera, the ability of the participants to manage (often complex) IT issues.

Holding virtual meetings with lawyers working from home often became challenging when interrupted by small children or pets (or partners in the background nipping to the bathroom wearing only a towel).

The term “beware of the dog” took on a whole new meaning – as well as extending to the cat and budgie. Conversations became disrupted by all sorts of background sounds, and it was frequently possible to miss important bits of a conversation because of noise pollution. This was made even more challenging when trying to work in Spanish and wearing a mask and glasses.

But still the essential task of working towards pursuing those who carried out or facilitated the scams and preparing claims for victims of pension scams continued. Albeit more slowly and haltingly than normal.

So, here is a brief round-up of the main developments for Pension Life from 2021 and the plans for 2022.

Ark – Tax Tribunal trial for pension scam victims

After a frustrating ten-year wait, the pre-trial conference took place with Judge Kempster and all the parties involved in the Ark Tax Tribunal trial. With desperate attempts by HMRC to put the trial off until the end of 2023, the trial date was finally – thankfully – set for December 2022.

There are more than half a dozen different categories of appellant; member who did receive a loan; member who didn’t receive a loan; member who did make a loan; member who didn’t make a loan; member who paid their loan back; member who paid the tax on the loan…….

Most of the appellants have dropped out of the trial for one reason or another. I think the reality of actually appearing in court and being subjected to HMRC’s barrister’s inevitably hostile cross examination may have finally sunk in for some people. We are now down to just two appellants – one represented by me and one by Rebecca Sheldon from Old Square Tax Chambers. Essentially, this will be a contest about who is going to have to pay the tax: those with a loan or those without a loan.

The next eleven months will see an increasingly urgent series of communications between the court, the appellants and their representatives. In the background, there are now two separate All Party Parliamentary Groups trying to lobby parliament for an amnesty for victims of pension and investment fraud who are facing tax penalties.

Also, the FCA has asked pension scam victims to submit evidence following an investigation into the activities of Premier Pension Solutions, AES Financial Services and International Pension Transfer Specialists (all involving Stephen Ward and Sam Instone).

Capita Oak – Tax liabilities and recovery of Store First assets

Capita Oak was a bogus “occupational” pension scheme set up with a mythical employer in Cyprus by Stephen Ward of Premier Pension Solutions and his pensions lawyer Alan Fowler. The scheme remains in the hands of Dalriada Trustees (appointed by the Pensions Regulator).

With £10 million of the 300 members’ funds invested solely in Store First, and “loans” paid out by a Gibraltar company called Thurlestone, the victims remain trapped and unable to withdraw their tax-free 25% lump sums, or access a retirement income.

Dalriada had rejected an offer to sell the store pods back to Store First several years ago. There may be another offer this year – although it is unlikely to be as high as the one Dalriada previously turned down. Sadly, whatever offer is made and accepted, a large chunk of this money would be used up in paying trustees’ and other fees (such as legal costs).

There had been a large crew of scammers behind the Capita Oak scheme – as well as the parallel Henley and Westminster schemes. Two significant figures among those who operated and distributed these scams were Phillip Nunn and Patrick McCreesh.

Despite the Insolvency Service carrying out a comprehensive investigation into these cases, Nunn and McCreesh were not sanctioned by either the Insolvency Service or the FCA for carrying out regulated activities illegally. Nunn & McCreesh went on, in 2014, to set up the Blackmore Group and launched the Blackmore mini bond which was promoted by Surge Group (which also promoted the London Capital & Finance mini bond which is now being wound up by Duff & Phelps).

Nunn and McCreesh also issued the Blackmore Global investment fund which is now reported to be worthless. The destruction of the original value of the fund is believed to be due to investing in over-priced, speculative property. Any remaining value was extinguished by paying out hefty commissions to the introducers and “advisers” who promoted the fund.

Adams v Carey

In 2021, the Appeal Court ordered the SIPP provider Carey (now Options and owned by STM) to reinstate appellant Russell Adams’ pension. Adams had been “advised” by unlicensed scammer Terence Wright of Country Land and Property in Spain. The advice had been to transfer his pension into a Carey SIPPS and invest all of it into Store First.

The Appeal Court decided that Carey should have rejected the advice as there had been an FCA warning about Terence Wright. However, Christine Hallett – CEO of Carey – deliberately ignored this warning and accepted Wright’s instructions to invest not just Mr. Adams’ pension in Store First, but also hundreds of others.

At one point, Hallett finally realised that she had been wrongly accepting pension transfers from Terence Wright, refused to accept more transfers, but continued to act on Terence Wright’s investment instructions and invested £millions more in Store First.

The Appeal Court determination has set a powerful precedent for hundreds more victims to take similar action to have their original pensions reinstated. Ironically, the Store First store pods are now doing well and more storage facilities are going to be built. However, the fact remains that store pods are not suitable assets for a pension, as they are illiquid and – as Justice Andrews ruled – they are “hard to value”.

Acquisition of Quilter by Utmost

In 2020, RL360 acquired Friends Provident International. And late in 2021, Utmost (formerly Generali) acquired Quilter (formerly Old Mutual International). So, as hundreds of millions of pounds have changed hands across these two buyouts, deceased victims of fraud facilitated by these four death offices will inevitably turn in their graves.

Former CEO of Quilter, Peter Kenny, has moved on to even greener pastures as he “pursues different opportunities”. Kenny, who – in 2018 – promised to pay compensation to some of the victims (two of whom have since died), will have done very nicely out of the Utmost acquisition.

As a former regulator, Kenny should certainly have known better than to do business with the hordes of unlicensed scammers. Who knows – perhaps he will use his ill-gotten gains to set up a charity for death office victims in 2022….

GFS – Hong Kong QROPS gone bad

In 2022, the pension-scam focus will drift as far offshore as Hong Kong. Bogus occupational schemes had originally been the speciality of Stephen Ward (Ark, Capita Oak, Westminster, Henley, London Quantum etc). But, in 2014, a group of scammers set their sights on a bogus superannuation scheme in Hong Kong.

In the UK, anyone with any kind of earnings can join an occupational pension scheme. A person does not need to be employed by the sponsoring employer – as determined by Justice Morgan in the Hughes v Royal London case. This does, of course, sound completely barmy and opens the doors wide for all sorts of scams and scammers.

However, in Hong Kong, a person can only – by law – join an occupational (superannuation) pension scheme if they are genuinely employed by the sponsoring (principal) employer.

In 2014, a group of scammers got together. This included John Ferguson, David Vilka and Charlie Goldsmith of the Square Mile group, and Phillip Nunn and Patrick McCreesh of Blackmore Group.

Hundreds of mainly UK-based pension holders were conned into transferring their pensions into the GFS QROPS in Hong Kong. The money was then invested in toxic UCIS funds and unregulated mini bonds. Of course, none of these British victims was employed by the employer.

The investments included Blackmore Global, Christianson Property Capital, Swan, GRRE and other investment scams. In total at least £27 million was invested – some of it in insurance bonds such as Quilter, Utmost, Hansard and Friends Provident. An attempt was made to transfer some of the funds into Gravitas bonds (a death office in Mauritius), but this was thwarted in 2015 when a new trustee took over.

In 2022, the Hong Kong version of the Pensions Regulator (the MPFA) will be deregistering the GFS scheme and a liquidator will be appointed. The liquidator will need a robust shovel to dig through all the toxic rubbish assets and recover several million pounds’ worth of stolen cash.

The good news for some of the members, however, is that Square Mile is now in liquidation. This means that there is a valid claim on the Financial Services Compensation Scheme of up to £85,000 per victim.

FSCS claims will be made for qualifying GFS members early in 2022 and hopefully this will result in at least some victims getting part or all of their pensions back.

CWM Criminal Trial – awaiting court’s decision

The trial against the members of Dénia-based Continental Wealth Management finally concluded in December 2021. The criminal proceedings had been held up for a year due to COVID. But finally, the last of the defendants testified before the judge and procurador. These included Darren Kirby and his girlfriend Jody Smart (formerly Bell, Kirby and now Pearson). While Jody did appear and testify in court, her former boyfriend Darren Kirby remains on the run.

“Advisers” Dean Stogsdill, Neil Hathaway and Anthony Downs also appeared – along with Darren Kirby’s original partner and co-founder Paul Clarke. Clarke had left CWM early on to run AES Spain for Sam Instone – and continued to operate Darren Kirby’s business model by scamming victims into illegally-sold death bonds and structured notes. Clarke now runs a new firm called Roebuck Wealth under the German license of Trafalgar International.

In December, the last of the victims appeared in the Dénia court to testify. The judge has now heard 17 victims’ testimonies, and seen the documentary evidence of the investment scams operated by the various members of the CWM team – headed up by company director Jody Smart/Bell/Kirby/Pearson. One victim passed away in early 2021, so the re-starting of the criminal proceedings sadly came too late for him.

Also in 2021, Jody denounced me for sharing a photograph of her dressed as a prostitute. I did indeed share the photo – as did hundreds of other CWM victims as it was all over social media. Everyone who saw this revolting picture felt and expressed the same disgust. It became ever more astonishing that Quilter, Utmost and SEB had been accepting investment instructions from this woman’s firm.

The judge dismissed the accusation against me. The photo is now irreversibly in the public domain. (It was so graphic that it can unfortunately never be “unseen” – and would put even a rhinoceros off its lunch).

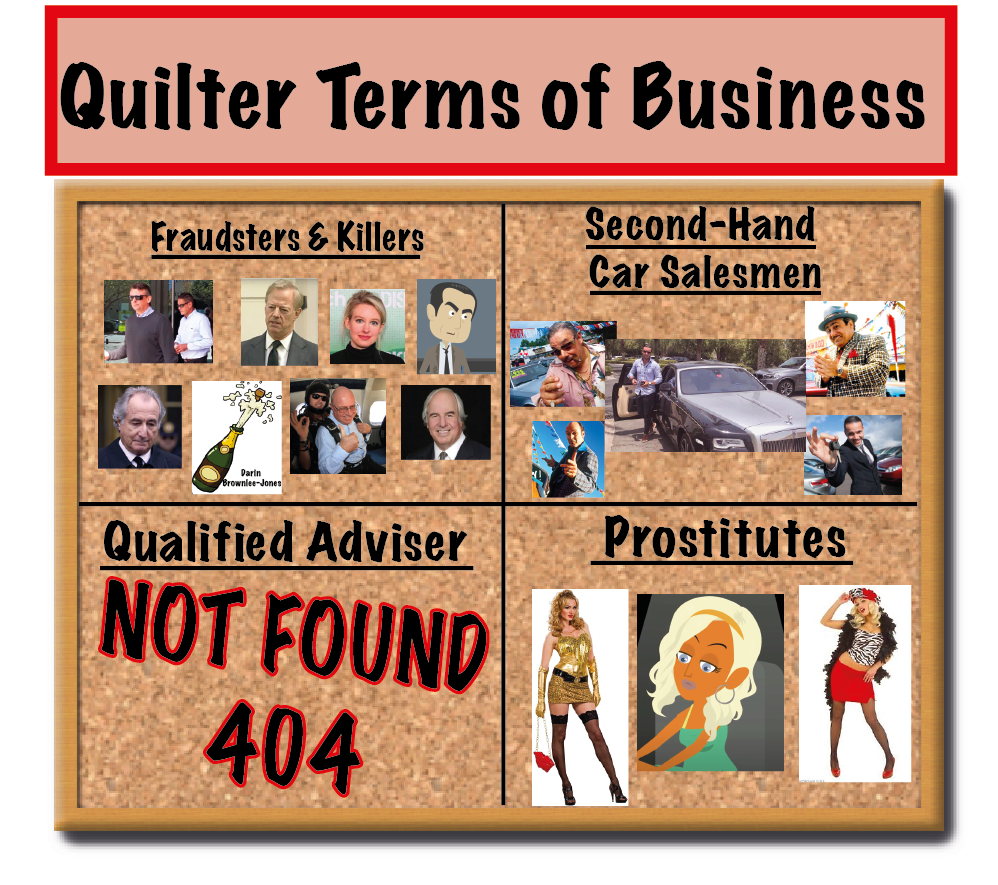

This will, hopefully, encourage death offices such as Quilter, Utmost, RL360 and Friends Provident, to be a bit more discerning in 2022 about the parties to whom they give terms of business and from whom they accept investment dealing instructions.

Malta Arbiter Appeals – Civil Court upholds most of the Arbiter’s determinations

Since 2017, around 70 victims of pension scams complained to the Malta Arbiter. The complaints were that QROPS trustees had accepted transfers and investment instructions from unlicensed and unqualified advisers. Many of the complainants reported that their pension funds were placed into insurance bonds and then invested in high-risk investments which were only suitable for professional investors.

These investments – many of them toxic structured notes from providers such as Commerzbank, Leonteq, Royal Bank of Canada and Nomura – were placed on the insurance bond providers’ platforms. From here, the scammers who had terms of business with these providers could pick and choose the highest-risk investments which paid them the most commissions. These providers included Quilter (formerly Old Mutual – recently taken over by Utmost/Generali), Utmost and SEB.

Millions of pounds’ worth of pensions were destroyed in the past decade. The Arbiter upheld most of the complaints against the QROPS trustees, but only awarded the complainants 70% of their net investment losses. This was on the basis that the defendants were only partly responsible, and that the advisers as well as the insurance bond providers were also culpable – and contributed to the losses.

The defendants appealed against the Arbiter’s decisions. In late 2021, the first civil court decisions were issued – dismissing the defendants’ appeals. The rest of the appeal decisions are expected during 2022 and are expected to uphold the Arbiter’s decisions.

Civil Cases against life offices in Spain

A determination obtained from the Spanish insurance regulator confirms that virtually all insurance bonds are sold illegally by the scammers who peddle them across the Iberian peninsula and the Balearics. This is because there are very specific regulations which must be observed when advising on any insurance products – and the scammers operating in Spain routinely ignore these.

Spanish legal experts advise that insurance bond providers have indeed facilitated fraud, abusive practices and contravention of EU and Spanish laws and regulations. There are therefore strong cases against the insurers which will be pursued during 2022 – with the first claims due to be issued during the first quarter of the year.

Obviously, the strength of the civil cases against the insurance companies will be reinforced once the criminal court issues their determination in the CWM case.

The civil claims will be seeking rescission – i.e. the reversing of the single-premium payments and subsequent unlawful investments in unsuitable, high-risk investments.

Civil Cases against life offices not in Spain

While Spanish law is fairly unique, and does not resemble the laws of England, the Isle of Man, Ireland or Guernsey (where the majority of death offices are based), there are thousands of pension scam victims who are not based in Spain.

Preparations are now being made to bring civil cases against all insurance companies such as Quilter, Utmost, Friends Provident and RL360 who have facilitated fraud and mis-selling (resulting in serious loss for the victims).

There are already several groups trying to get civil litigation against these insurers off the ground. One is being brought by Signature Litigation against Quilter and Friends Provident – mainly for the investment losses caused by the failure of UCIS funds such as LM, Axiom and Premier New Earth.

The other cases are being brought by Forsters LLP. This case suffered a setback when their funder – Affiniti – went bust in November 2021 and is now being wound up by Quantuma:

Forsters’ clients have also been told they can make claims against the QROPS providers in Malta for the losses not covered by the Malta Arbiter’s awards.

Trafalgar Multi Asset Fund – Cayman Islands

The victims of the STM Fidecs/Trafalgar Multi Asset Fund pension and investment scam are now mostly out of time to bring civil claims in Gibraltar. The scammers behind the investment of the funds transferred into the STM Fidecs QROPS are now under criminal investigation by the Serious Fraud Office. Once convicted, this should help with the criminal proceedings being launched in Gibraltar – although this does not stop the criminal proceedings from going ahead anyway. As they are criminal, as opposed to civil, the time limits do not apply.

Much of the Trafalgar Multi Asset Fund was invested in the Dolphin Trust investment/loan scam – later re-named as the German Property Group. This fund was paying out huge commissions of around 19% to the scammers who introduced thousands of victims to the “loan” scheme. There is now mounting evidence that Dolphin was nothing more than a Ponzi scheme and that many of the purported property purchases were fictional.

I have a QROPs with Quilter international invested in Momentum Malta. My original advisors were AES International but changed last year to a firm on the Costa Blanca.

It appears to be doing ok and has done for the last 10 years or so but should I be worried. From my understanding, my pension is invested in tracker funds.

Unfortunately, AES International had some very dark associations with well-known scammers such as Stephen Ward of Premier Pension Solutions and Paul Clarke of Continental Wealth Management – now Roebuck Wealth. Both Ward and Clarke are now facing criminal charges. AES then went on to appoint another Continental Wealth Management scammer: Phil Pennick of Pennick Blackwell. Through this company, AES placed at least one victim in an Old Mutual International (now Quilter) insurance bond and allowed an unqualified former pub barman (Kris Taft) to provide investment advice which resulted in serious losses. Although Pennick is not currently facing criminal charges in the same case as Ward and Clarke (fraud, disloyal administration and falsification of commercial documents), I am considering issuing criminal proceedings against him once we get the final verdict on Ward and Clarke and the other Continental Wealth scammers. I would be very interested to know which firm you are now using on the Costa Blanca.

I have a QROPs with Quilter international invested in Momentum Malta. My original advisors were AES International but changed last year to a firm on the Costa Blanca.

It appears to be doing ok and has done for the last 10 years or so but should I be worried. From my understanding, my

pension is invested in tracker funds.

I’m a pensioner, I moved to Spain 17 years ago. I been robbed of all my money . Would you be interested to hear my story and maybe help me to get justice.

My email address is: ritacordon246@hotmail.com.

Kind regards

Rita Cordon

Please do tell your story – there may be civil, criminal or regulatory actions you could join to try to get your money back.

@David Rowland

In my opinion you should be very worried. There seems to be a number of errors in your understanding. Firstly Quilter are an insurance company. Quilter is a more recent name. 10 years ago the name you may be familiar with is Skandia. They put you into an insurance bond which was totally unecessary and served only to drain fees from your pension. Momentum are the QROPS – a pension trustee in Malta. You were never “invested in Momentum”. Momentum are simply the trustee. Further, I seriously doubt your pension went into “tracker funds”. Around a decade ago, seriously high commissions were paid to invest people’s pensions into Structured products (scammers product of choice at that time) – see the CWM part of the above write up. Malta, at that time was the jurisdiction of choice by scammers because of its “relaxed regulations” concerning the need for advisers to be licensed.

However around 2016, Malta introduced an Arbiter (equivalent of our Ombudsman) and since then many victims (who were members of the Momentum scheme) have been able to recover about 70% of their losses (as described above) by submitting complaints against Momentum (and other trustees in Malta) for breaches of Malta’s Trust laws.

If I were you I would do some serious investigation and double check your understanding.

I would wager – a lot – your understanding is not accurate.

I agree Stephen, had to pay £10,000 to OMI/Quilter & £1000 to MPM to get the remaining quarter of my money that was left out last year & into another Pension Fund due to the 10yr tie in to the “Bond”!!

Getting 70% of my investment losses back along with 8% interest since Arbiter Decision from MPM as part of the Arbiter Decision & Maltese Civil Court upholding that, but it’s still been fun & games to get them to pay-up for the last 4 months!!! Need all the Fees back now as well, but that’s a different story.