| Abbey National – JLT Benefit Solutions Ltd |

| Aegon |

| Aegon – SEBO |

| Aegon/Scottish Equitable |

| Aon Alexander & Alexander UK |

| Asda/Walmart |

| Aviva |

| Aviva UK Life |

| AXA |

| AXA Pension Scheme |

| B & CE |

| Bank of America |

| Bank of Ireland Life |

| Barclays |

| Barnett Waddingham SIPP |

| BBC Pension Scheme |

| British Airways |

| British Life Reliance Mutual |

| British Midland (Aon Hewitt) |

| British Steel |

| BT plc |

| Capita Hartshead |

| Cater Allen |

| CIBC Retirement Savings Plan, Mercer |

| CIS |

| Clerical Medical |

| Coats |

| Co-operative Insurance |

| Countrywide Assured |

| DBS Pension Services Ltd WYKI Group Scheme |

| DHL |

| Essex Police Authority |

| Fidelity – Lotus Development Pension – Occupational |

| Friends Life |

| Friends Prov |

| G4S |

| HSBC |

| HSBC Trust Company (UK) Ltd |

| Independent Order of Foresters |

| Invensys Pension Scheme |

| J. P. Morgan |

| Legal and General |

| LGPS Newham Council |

| Liberty Pensions |

| Lloyds TSB |

| Lloyds TSB |

| London Borough of Bromley |

| London Borough of Lewisham |

| LV= |

| Marks and Spencer |

| Mercer News International Pension Plan |

| Mercer, Scottish and Newcastle |

| Mercer/Napp Pharma |

| MGM Advantage |

| MYSIPP |

| N Brown Group Pension Fund |

| National Grid |

| National Health Service Superannuation Scheme (Scotland) |

| NHS |

| Northumbria Police Pension Scheme |

| Pearl |

| Pearl Group Staff Pension Scheme |

| Phoenix |

| Phoenix |

| Phoenix Life |

| Principle Civil Service Pension Scheme |

| Prudential |

| Prudential – Teachers AVC Facility |

| RBS |

| Reliance Mutual |

| Rolls Royce & Bentley |

| Royal London |

| Royal Mail |

| Royal Sun Alliance |

| Scottish Life |

| Scottish Life Assurance |

| Scottish Widows |

| Siemens Occupational Pension Scheme |

| Skandia |

| South Tyneside Council |

| St James’ Place Wealth Management |

| Standard Life |

| Standard Life GPP Sipson Coachworks |

| Standard Life PPP |

| Strathclyde Pension Fund |

| Sun Life Financial of Canada |

| SunLife |

| Teachers’ Pension Scheme |

| Trinity Mirror |

| Trinity Mirror, MGN Pension Scheme |

| Virgin Money |

| W. H. Smith |

| Windsor |

| Wolters Kluwer Pension Scheme |

| Xafinity Paymaster |

| Zurich |

| Zurich Assurance Ltd |

Tag: Angie Brooks

-

Ceding Pension Providers Facilitating Financial Crime

Below is a list of the ceding pension providers (CPPs) that are currently being dealt with at Pension Life and who have been facilitating financial crime. This is not a definitive list as we are currently dealing with an ever increasing pile of protected assessments appeals to process ahead of the deadline. We will be adding to the list. But all of these ceding providers have helped the scammers commit financial crime.The worst personal performer was Standard Life – by a mile, and the worst occupational performer was Royal Mail.The biggest single transfer was £800k (LV=), followed by £670k, then £400k. However, these are exceptions as the average transfer value across all members is around £75k.The other potential defendants are the advisers who introduced or sold the schemes, but there are only a handful which are regulated or still in existence. -

HMRC Pension Loan Wolf

HMRC Pension LOAN WOLF

I am writing to explain the rather confusing “assessment” and “further assessment” appeal situation in relation to HMRC’s “pension loan wolf” situation. Although this is specifically aimed at the Ark case, it will also apply in most – if not all – other cases.

In a nutshell, the assessments are for the 55% unauthorised payment tax charges on the loans. The further assessments are for the “benefit” that the member has “enjoyed” through not having paid interest on the loans.

Here is HMRC’s explanation of their reasoning to try to tax the absence of interest on the “loans”:

“If the assessments are for small amounts these are to protect HMRC against the alternative argument that the loan is a benefit under S173 FA 2004. So for members who received loans in 2010/11, under the alternative argument a benefit in kind charge arises for 2011/12 (and every year thereafter until the loan is repaid/written off) based on the Benefit in Kind calculation ie 4% of the MPVA (loan) received each year. This is taxed at 40%.

Eg Loan of £10000 – Benefit charge £400 @ 40% = £160.”

Roughly translated into ordinary language, this means that HMRC do not know what the Tax Tribunals will let them get away with, so they are going to try to tax the loans everywhere – front, back, side, top, bottom. Ark is a bit more complicated because of the “reciprocal” situation, but HMRC will inevitably try to use the same approach with other schemes.

My defense and appeal argument against the Ark further assessments is as follows:

- Dalriada Trustees will be taking legal action to recover the loan which may result in profound financial loss for the member

- This member’s pension fund is severely depleted as a result of £11 million worth of unsecured personal loans which may or may not be recoverable, and in respect of which no interest has been received by the member’s scheme

- This member’s pension fund is further seriously prejudiced as a result of five years’ worth of trustees’ and legal fees – largely fueled by HMRC’s protracted prevarication over how, when and where to tax various aspects of the transfers/loans.

- There appears to be no end in sight to the overall financial loss this member will continue to face in the run up to the appeals being referred to the Tax Tribunals.

- Any “benefit in kind” which the member is arguably “enjoying” due to below market-rate interest payments, is more than eclipsed by the financial damage caused by the combination of HMRC’s and Dalriada’s actions over the last five years. The net result, therefore, far from being a benefit in kind is a significant “loss in kind”.

This argument is tailored and adapted for other schemes. But it is very important indeed to understand the relationship between the pension transfers and the loans, and encourage HMRC to act consistently – as well as asking the Tax Tribunals to use a consistent and fair approach. HMRC’s inconsistency has to date reflected their inability to make up their minds and has resulted in some schemes having the entire transfers taxed, while in others they are only taxing the loans.

THE RELATIONSHIP BETWEEN THE TRANSFERS AND THE LOANS

Firstly, let us be 100% clear about this: the transfers and the loans are absolutely inextricably linked – like Siamese twins that can’t be separated because they share the same vital organs. It may appear that I am weakening our arguments by taking this stance, but I don’t think separating the transfers from the loans is an argument that has legs, because it supports the claim by the scammers – i.e. that “there is no connection between the transfer and the loan”. I have struggled with some of the communications with HMRC because in some cases (most notably Michael Bridges in the Salmon Enterprises cases) HMRC has said that they do not accept there was ever a loan because there was no loan agreement. This is pure nonsense because in the Ark and other cases there were loan agreements sufficiently detailed and lengthy to have rivaled the entire works of Shakespeare, but HMRC still disregarded this and said “a loan by any other name would smell as rancid, and we will still tax it – loan agreement or no loan agreement”. The word “loan” is all part of the scam – whether accompanied by elaborate loan agreements and documentation or not. Calling the liberation of part (or all) of a pension a “loan” is like calling theft “setting free”; fraud “innovation”; scam “opportunity”; toxic investments “not traditionally available”.

In the Ark schemes, the relationship between the transfer and the loan was crystal clear (ish). A transferred his £100k pension to Lancaster; B transferred his £100k pension to Cranbourne. A lent B £50k; B lent A £50k. Therefore, neither borrowed money from their own fund but from the fund belonging to an (arguably) unconnected party. The Ark administrators claimed there was a “matching” process to pair up people with similar-sized transfers, and there was, apparently, a spreadsheet showing who lent money to whom, and who received money from whom.

This was the theory; but the reality was very different.

The Difference Between Theory And Practice Is Greater In Practice Than In Theory

No segregated (separated) accounts were kept for the Ark members, so it was in practice impossible to prove who made loans because all the funds were pooled in each of the six schemes. However, HMRC are trying to tax both ends of the loans i.e. those who received loans and those who made loans. This results in an anomalous situation because those who didn’t receive loans are still getting taxed. The further anomalous situation is that those who did receive loans will be pursued by the new trustees, Dalriada, for repayment of the loans (Dalriada will be taking legal action against the members to enforce repayment), but the unauthorised payment tax will still remain payable even if the loans are repaid. Add to this the fact that HMRC are also trying to tax the scheme itself for facilitating/allowing the reciprocal loan structure, and you have the potential for 55% at the receiving end; 55% at the making end; 40% at the scheme end; plus 40% of 4% a year in perpetuity (until the loans are repaid or written off). Let’s just hope the Tax Tribunal judge is not only sane but sober.

I have explained the Ark situation because it sets the scene for most – if not all – the other/subsequent ones. The difference was that far from making the loan mechanism transparent and obvious, the organisers of the rest have gone to elaborate lengths to try to create the illusion that there was no connection between the transfer and the loan. For example, Stephen Ward and his Evergreen liberation scam: members in Spain transferred their UK pensions to a New Zealand QROPS and received a 50% loan from a company in Cyprus. Then both Ward and Simon Swallow of Evergreen tried to claim there was no connection between the transfer and the loan. What they went to great lengths to conceal was that the funds for the loans were supplied by Penrich and Spectrum; and 41% of the assets of the Evergreen fund consisted of (yes, you guessed it!) Penrich and Spectrum.

Other schemes had multiple layers of obfuscation, smoke and mirrors: members’ funds were transferred into scheme A which made a loan to B which made a loan to C which made a loan to the members (e.g. Pennines – also in the hands of Dalriada Trustees). In fact, the only scheme that I know of which didn’t bother at all with any of this (somewhat tedious) subterfuge was Windsor Pensions, run by Steve Pimlott (who, coincidentally, is based in Florida not far from where Stephen Ward is hiding out currently). Pimlott didn’t bother with any of this “loans” nonsense: he just set up fraudulent bank accounts in the names of obscure QROPS, and then duped the ceding providers into transferring members’ funds into those bank accounts. Pimlott then retained his extortionate fees and sent the rest of the pension fund to the member by cheque. He claims to have done over 5,000 of these and is still at it to this day (he offered me one a couple of months ago when I was doing some “secret shopping”).

I have gone into to this in some depth because I want to make it clear that nobody – least of all HMRC – is ever going to believe for a second that the pension transfers are totally unconnected to the loans. I don’t want to waste a second of my or your time, effort or intelligence even considering that argument. The argument which is relevant to both types of assessment i.e. the original one for 55% and the subsequent “further” assessment for 40% on the alleged “benefit in kind” on the loan interest is as follows:

- Protected Assessment of 55% on the “loan”: to my knowledge, across all the pension liberation schemes included in the Class Action – Ark, Evergreen, Capita Oak, Westminster, Salmon Enterprises, Pennines, Mendip, Headforte, Southlands, Windsor Pensions, etc., not one single member consciously took the decision to liberate part of their pension before the age of 55 knowing – or even suspecting – they were exposing themselves to an unauthorised payment charge. (Actually, that is not entirely true as I do know of two people and I have refused to represent them). Every single Class Action member was a victim of a scam and was defrauded into believing that the “loan” structure was a legitimate, lawful, bona fide mechanism which exploited a tax law “loophole” and that there would never be any tax to pay. Victims were sold/advised/introduced by a variety of parties – including IFA’s, solicitors, accountants, introducers, brokers, debt counsellors, and assorted regulated and unregulated professionals.

- Further Protected Assessment of 40% on the “benefit in kind” on the “loan”: to my knowledge, not a single member has escaped without either partial or total loss to their pension fund – and potential total financial ruin/poverty in retirement. The majority of the assets of the various schemes were invested in toxic, illiquid, high risk assets – much of which paid handsome introduction commissions to the scammers as the prices were hugely inflated to start with. In cases where Dalriada Trustees have been appointed, there are huge losses to the value of the schemes because of trustees’ and legal fees over a period of up to five years. Reverting to my point that the transfers and the loans are inextricably linked, our position is that any small benefit that a member may have “enjoyed” as a result of not paying market-rate interest, is eclipsed to an enormous extent by the losses suffered on the funds. In fact, if we were to add in the cost of loss of earnings, legal fees and medical treatment due to the extensive stress, mental/physical suffering and marriage breakdowns caused by these scams, the piffling “benefit” which HMRC is trying to tax in the further assessments would be laughable if it weren’t so tragic.

My final point is that HMRC is responsible for these scams. HMRC registered the schemes without due diligence, then failed to de-register them when it became obvious they were operating pension liberation “loans”. HMRC has been negligent, slow, inconsistent, intractable and has failed to observe its own charter:

https://www.gov.uk/government/publications/your-charter/your-charter

“We want to give you a service that is fair, accurate and based on mutual trust and respect”. I don’t think a single victim has the least degree of trust or respect for HMRC as they registered these scams – often to the same scammers over and over again.

“We also want to make it as easy as we can for you to get things right”. Registering pension schemes without due diligence to known, repeat scammers hardly makes anything easy for the victims. Failing to de-register schemes as soon as it was discovered they were scams contributed to the ease with which the scammers succeeded in continually defrauding thousands of victims.

“You can expect us to respect you and treat you as honest” All of the people sucked into these various liberation scams were victims of fraud and were entirely innocent and honest. They are now being treated and penalized as though they have done something wrong – despite having been advised by solicitors, accountants and financial advisers that the schemes were lawful and tax compliant in the first place.

“Provide a helpful, efficient and effective service” HMRC has known since 2006 that HMRC registration no longer meant HMRC “approved”. It has been clear that the scammers have used the term “HMRC approved” falsely as part of the defrauding process to lull victims into a false sense of security. But still HMRC has done nothing since 2010 to avoid registering schemes to scammers. This has not been helpful, efficient or effective, since as well as registering schemes to known repeat offenders, HMRC has not checked that sponsoring employers had ever traded or employed anybody (or were ever likely to) or – as in the case of Capita Oak and Westminster – that it even existed at all.

“Be professional and act with integrity” As above.

“Tackle those who bend or break the rules” Apart from the scammers behind Tudor Capital Management’s 25 different scams – including Salmon Enterprises – (now enjoying Her Majesty’s pleasure), the rest are still at large. Many of the known, repeat scammers have also committed large-scale tax evasion themselves, but remain free to this very day to continue their pension liberation operations in the UK and offshore. In fact, even when evidence against one of the leading scammers was handed to HMRC by me in June 2014 (including information on Stephen Ward’s Dorrixo Alliance), HMRC did absolutely nothing. Two months later a serving Police officer lost his Police pension to Dorrixo Alliance’s London Quantum scam, which is now in the hands of Dalriada Trustees. The officer is now too ill to continue his duties as a result of the stress and sleepless nights caused by this tragedy.

As HMRC’s “Dame Disaster” Lin Homer is about to be replaced by Edward Troup, and the DWP’s light-fingered, mendacious Iain Duncan-Smith has just been replaced by Stephen Crabb, perhaps we will at last be able to negotiate a tax amnesty for victims of pension liberation fraud. Despite the many disasters presided over by his predecessors, Crabb might just turn out to be the very hero within government we have so long sought. If he does turn out to be any good, let’s just hope he doesn’t get stabbed in the back by Altmann like Duncan-Smith was. Because that indeed would be tragic.

-

Pennines and Mendip Pension Liberation Scams

£19m worth of Pensions from 476 people lost though two schemes – Pennines and Mendip.

Pennines and Mendip: Hedge Capital Investments Ltd, Hedge Capital Investment Group Plc and Hedge Capital Ltd were introducers or the financial advisers who proposed the schemes Pennines and Mendip as suitable schemes for 476. The end result was that £19m was invested in Pennines and Mendip. That is an average pension pot of about £40K; a considerable life savings that most people would not throw away lightly. They invested in schemes that they were told were reliable and profitable. It turns out they were nothing like this and the investments are now either locked or lost. There will also be considerable tax to be paid as a result of this abuse of pension liberation.

The registration of the schemes:

Pennines Scheme was registered with HMRC on 22 August 2011 as an occupational pension scheme governed by a trust deed dated 23 August 2011 executed with Clarendon Hill Investments Limited which is referred to as “the

Provider” and the Trustees of the Scheme, John Laurence

Woodward and Jennifer Doris Ilett

Pennines Scheme was registered with the Regulator on 31 August 2011 as a 9 member defined contribution scheme while the scheme received payments of £3,950,193.78, made up of almost entirely what appear to be transfers in from other pension schemes, of which £3,825,346 (almost 97%) has been transferred out to an entity called “Hedge Capital Investments Limited”

Mendip Scheme was registered with HMRC on 9 September 2011 as an occupational pension scheme governed by a trust deed dated 9 September 2011. The Mendip Scheme was registered with the Regulator on 28 September 2011 the Scheme received payments in of £3,280,325.27, made up of almost entirely what appear to be transfers in from other pension schemes, of which £2,965,701.82 (90%) has been transferred to an entity or entities that are referenced in the accounts as “H Capital I” and “Hedge Capital”

Malvern Scheme

Malvern Scheme was registered with HMRC on 13 December 2011. The scheme was registered with HMRC being established by Clarendon Hill as “Provider“. Eventually with considerable investigation the Pensions Regulator found serious grounds to believe that the Schemes are being used as vehicles for pension liberation.

Pennines and Mendip Schemes have the same sponsoring employer, which is registered as a dormant, non-trading company. Between September 2011 and

January 2012, the Pennines and Mendip Schemes received approximately 140 transfers into the schemes to the value of over £7,000,000.00

Some members may be transferring into the Pennines and Mendip Schemes, and possibly the Malvern Scheme, with a view to receiving a lump sum payment or “loan”, calculated as a percentage of the transfer value of their pension “pot”

It also appears that some members who are receiving a “loan” are also paying interest on that loan back to the loan company.

Dalriada trustees appointed on the 28th March 2012. They froze the assets of these schemes. They also declared that the expenses of the schemes subsequent to this date would be taken from the scheme assets.

Pension Life work at exposing, preventing and for the main part aiding those that have been affected by these fraudulent schemes. Please make contact.

-

Crabb New Secretary of DWP

Dear Mr. Crabb – latest DWP SecretaryCongratulations on your appointment as Secretary of State for Work and Pensions – DWP. I wish you well, and would ask you to engage urgently with the Ark Class Action representing hundreds of victims of pension fraud as we urgently need your help and support as we have been spurned and betrayed by both Duncan-Smith and Altmann. The DWP has indeed been a dismal failure.The Ark Class Action addresses a multi-billion pound problem, with thousands of people having lost their pensions and being targeted by HMRC with crippling tax demands. The tax collected will be a drop in the ocean compared to the long-term cost to the State of supporting and housing people who will be ruined and made homeless to pay the tax, and there is no mathematical or economic case for continuing with these demands. Please see the our letter to Lin Homer’s replacement Edward Troup (LINK TO BE PLACED ON PUBLISH) for a more in-depth explanation of why this situation is such a disgrace to the government.Your predecessor has, unfortunately, disgraced himself with the Class Action as over a year ago he promised to champion our cause and arrange meetings with David Gauke and George Osborne. It turned out he never had any intention of doing so, then he stole one of the victims’ Ark files and subsequently lied about it. Ros Altmann has been little better, as she refused to meet two victims and me last December even though we had told her we were coming to her office. You are therefore going to have to address a substantial amount of damage limitation in terms of your department’s performance.Pension scams are a huge international problem, with pension liberation being just one of the types of fraud perpetrated – not just in the UK but also all over Europe, the Middle East and beyond. There are regulated and unregulated firms, operating outright scams or grey-area cons. The vast numbers of British victims losing their pensions to the scammers and con men undermine confidence in the financial industry and the financial services profession. The disastrous “pensions freedoms” and the recent Justice Morgan case have made the situation significantly worse.Regrettably, your former job as Welsh Secretary has left a huge problem unresolved. A Middle-Eastern firm of financial advisers was given a grant of £750k by the British government to create jobs in Wales, but instead of doing so, the money was taken offshore to the Gulf area and is now being used for illegal activities – including crimes against British citizens in Dubai, Saudi Arabia and Qatar. This firm, which is not being pursued for repayment of the grant, is using this money to pay substantial bribes of hundreds of thousands of pounds to widen the scale of their market penetration. I am happy to work with you to ensure the principals of this firm are brought to justice and the money repaid in full. -

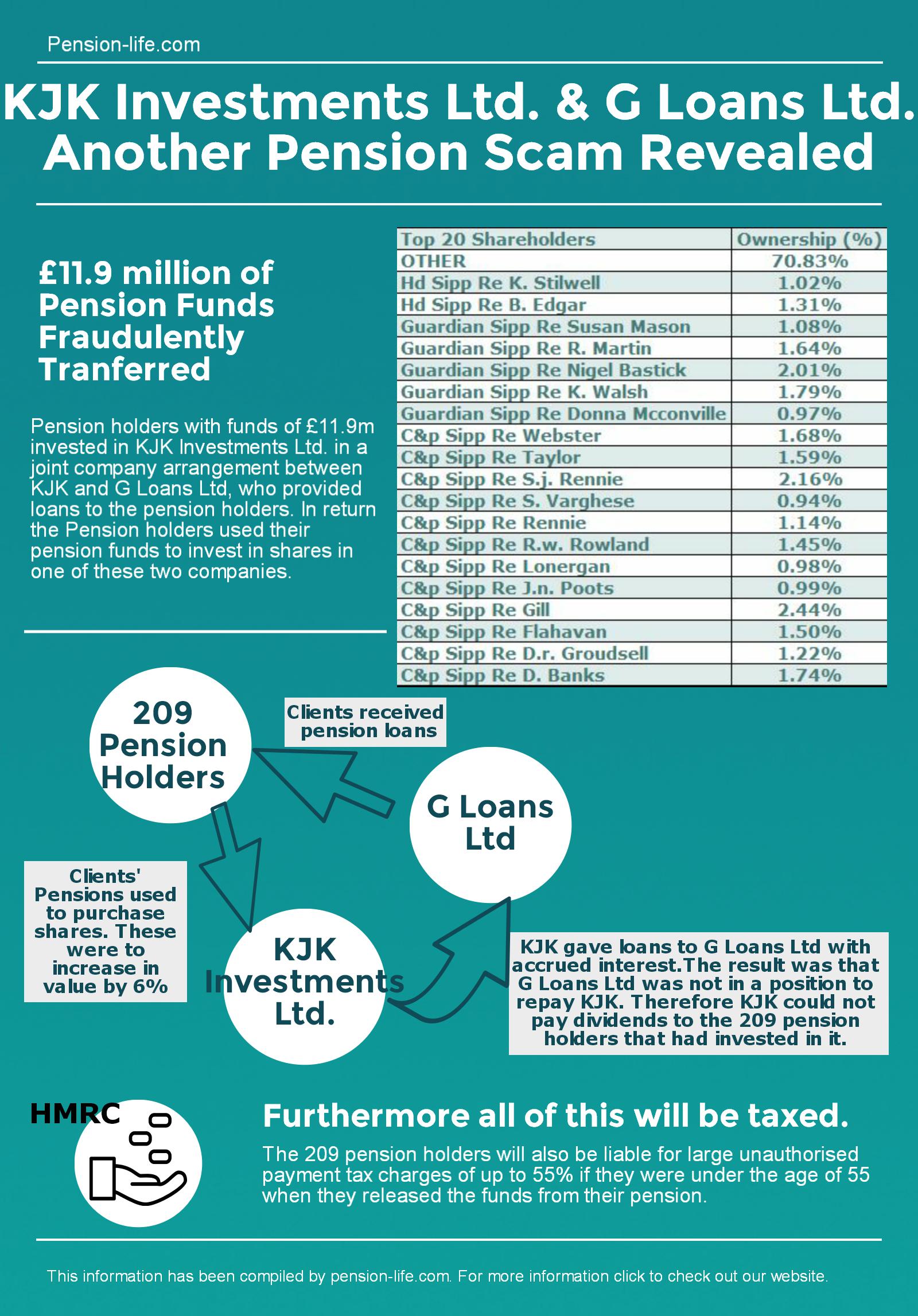

KJK Investments Ltd. & G Loans Ltd. Another Pension Scam Revealed

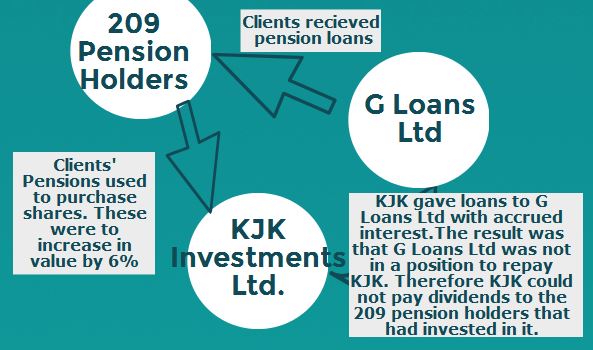

Pension scams have been a very clear and present danger since large-scale pension liberation fraud was unleashed on British pension holders on A day. Victims lose a life time of savings and face onerous unauthorised payment tax charges of up to 55% by HMRC. The latest one to come to our attention is a pension liberation scam involving two companies: KJK Investments and G Loans.

G Loans received loans from KJK Investments Ltd. The interest on the loans was accrued so G loans were never able to pay back the loans. The 209 pension holders were awarded loans from G Loans while their pension funds were used to purchase shares in KJK Investments. These shares were purportedly estimated to grow at 6%.

As loans to G Loans had their interest accrued, G Loans were unable to repay the loans. This meant the shares in KJK Investments did not grow by the estimated 6%. There were 209 pension holders who invested a total £11.9m in KJK Investments shares with the hope of 6% investment gain. They also liberated some of their pension under what they were told was a legitimate pension liberation. Furthermore because of the non-commercial nature of the loans, as well as the high fees and commissions paid there was never any possibility of regaining the pension funds which were initially invested.

This was a scam from start to finish and has now been wound up by the High Court. Furthermore the 209 pension holders who liberated funds from their pensions are now facing up to 55% unauthorised payment tax charges.

Pension-life.com is helping some of these victims and appealing the tax liabilities, as well as preparing to take action against the negligent parties.

If you have been likewise affected please make contact.

These are the significant share holders of the KJK Investments Ltd. It is yet to be revealed if these significant shareholders released their pensions to buy shares.

Top 20 Shareholders Ownership (%) OTHER 70.83% Hd Sipp Re K. Stilwell 1.02% Hd Sipp Re B. Edgar 1.31% Guardian Sipp Re Susan Mason 1.08% Guardian Sipp Re R. Martin 1.64% Guardian Sipp Re Nigel Bastick 2.01% Guardian Sipp Re K. Walsh 1.79% Guardian Sipp Re Donna Mcconville 0.97% C&p Sipp Re Webster 1.68% C&p Sipp Re Taylor 1.59% C&p Sipp Re S.j. Rennie 2.16% C&p Sipp Re S. Varghese 0.94% C&p Sipp Re Rennie 1.14% C&p Sipp Re R.w. Rowland 1.45% C&p Sipp Re Lonergan 0.98% C&p Sipp Re J.n. Poots 0.99% C&p Sipp Re Gill 2.44% C&p Sipp Re Flahavan 1.50% C&p Sipp Re D.r. Groudsell 1.22% C&p Sipp Re D. Banks 1.74% -

Pension Transfer decision from Ceding Provider to Pensions Ombudsman to the High Court

Pension Transfers are the cornerstone of pension scams. We expect to be looked after by the law, the large financial institutions and the government institutions such as ombudsmen but when they disagree our best interests often form the debris of the squabble. If you have saved for a pension, worked for years and years earnestly squirrelling away what you can for those golden years, you do not want to lose it. In fact that is what has happened to countless pension holders when they decided to transfer their pensions into what were presented as legitimate pension schemes. Some transfers were for liberation and some were to increase value of the pension. A recent High Court decision has opened the doors for scammer to legitimately roll out more of these scheme. Here is what happened when the High Court overruled the upright decision of the Pensions Ombudsman.

£8000 in a Secure Occupational Pension Scheme

£8000 in a Secure Occupational Pension Scheme Ms. Hughes was an Occupational pension holder with Royal London. Her Occupational Scheme was generated by the company she worked for and would have been available as a benefit of employment with that company. Had it been a contributory scheme both Ms.Hughes and her employer would have contributed to a fund which grows free of tax during the savings period. In non-contributory schemes, only Ms. Hughes’ employer contributes. The amount paid out to Ms. Hughes on her retirement will depend on the type of scheme and reflect either the contributions put in or the number of years’ service and the final salary of the employee. The main point of this is that the Occupational scheme is a benefit of employment with a particular company and this is managed by a trustee, in this case Royal London.

Royal London acts on behalf of the employee

Royal London acts on behalf of the employeeRoyal London is the largest mutual life, pensions and investment company in the UK. They are undoubtedly a secure pension trustee. They were the ceding provider for Ms. Hughes’ £8,359.71 occupational pension. As the pension trustee Royal London technically held the pension scheme’s assets for Ms.Hughes (the beneficiary of the occupational pension scheme). They act separately from Ms.Hughes’ employer for her benefit. Royal London’s powers are written in the trust deed and the scheme’s rules.

Bespoke Pension Services (Virtual Office)

Bespoke Pension Services made contact with Ms.Hughes through a cold calling operation First Review Pension Services, a UK promotor. Bespoke Pension Services claim to be ‘experts in pension scheme design, administration and regulatory pension guidance in the UK and EEA, including the Isle of Man’. They ‘design and implement pension schemes in the tax jurisdiction that is most advantageous to your requirements’. They do not have the same weight of reputation or confidence that a company such as Royal London have in the area of insurance and pensions.

Bespoke Pension Services made contact with Ms.Hughes through a cold calling operation First Review Pension Services, a UK promotor. Bespoke Pension Services claim to be ‘experts in pension scheme design, administration and regulatory pension guidance in the UK and EEA, including the Isle of Man’. They ‘design and implement pension schemes in the tax jurisdiction that is most advantageous to your requirements’. They do not have the same weight of reputation or confidence that a company such as Royal London have in the area of insurance and pensions. The process starts with a Letter of Authority

The process starts with a Letter of AuthorityHaving engaged Bespoke Pension Services, they would have produced a Letter of Authority (LoA). This was sent to Ms. Hughes to complete, sign and return. She signed would have signed it. The LoA was then sent to Royal London (Ceding Scheme) to provide authority to Bespoke Pension Services to act on the client’s behalf. The LoA instructs the Ceding Scheme to send Ms. Hughes’ existing pension information (type of pension, investment structure, charging structure, growth rates, etc) to Bespoke Pension Services with Discharge Forms and Ms. Hughes’ pension documents.

To facilitate the Transfer Ms. Hughes needs her own company and a SSAS

In order to facilitate the transfer Ms. Hughes needed a company in her own name and so Babbacombe Road 1973 was set up for this purpose. This company is the sponsor for the SSAS Small Self Administered Scheme. This is a type of UK Occupational Pension Scheme which is trust based and established individually, usually by directors of limited companies for specified employees of the company. Babbacombe Road 1973 ltd. was possibly never intended to trade and was set up solely for the purposes of the pension transfer. All of the pension scams we have been dealig with to date have involved a bogus sponsoring employer which never traded or employed anyone

In order to facilitate the transfer Ms. Hughes needed a company in her own name and so Babbacombe Road 1973 was set up for this purpose. This company is the sponsor for the SSAS Small Self Administered Scheme. This is a type of UK Occupational Pension Scheme which is trust based and established individually, usually by directors of limited companies for specified employees of the company. Babbacombe Road 1973 ltd. was possibly never intended to trade and was set up solely for the purposes of the pension transfer. All of the pension scams we have been dealig with to date have involved a bogus sponsoring employer which never traded or employed anyone

Royal London declined the Transfer

Royal London informed Ms. Hughes in September 2014, that they would not be able to facilitate the transfer to the Babbacombe Road 1973 SSAS. Through their investigations they were unable to confirm that the transfer would result in appropriate pension benefits for Ms. Hughes. They were also unable to determine that the scheme was a registered pension scheme. This was the first stumbling block for Bespoke Pensions Services and Ms. Hughes.

Bespoke Pension Services Apply to the Pensions Ombudsman

The Pensions Ombudsman settles disputes and acts within the laws set up for Pensions and Pension holders. They are an independent organisation for the moderation of pension administration. Ms. Hughes via BeSpoke Pension Services complained to the Pensions Ombudsman about Royal London’s decision to decline the pension transfer request. Anthony Arter, the Pensions Ombudsman, upheld Royal London’s decision describing it as “typical of one presenting itself across the pensions industry in relation to pension liberation”.

The Pensions Ombudsman settles disputes and acts within the laws set up for Pensions and Pension holders. They are an independent organisation for the moderation of pension administration. Ms. Hughes via BeSpoke Pension Services complained to the Pensions Ombudsman about Royal London’s decision to decline the pension transfer request. Anthony Arter, the Pensions Ombudsman, upheld Royal London’s decision describing it as “typical of one presenting itself across the pensions industry in relation to pension liberation”.And finally…..to the High Court and the case is presented to Justice Morgan

Determined to put the transfer through for Ms. Hughes, the case is taken to the High Court by Bespoke Pension Services. Justice Morgan decided to overrule the Pensions Ombudsman’s decision and allow the pension transfer to go through. His decision was based on the wording of the legislation which in fact states that a member of an occupational pension scheme should have some sort of earnings/employment – but falls short of saying that the earnings/employment should be with the sponsor of the occupational scheme (to which a member is intending or attempting to transfer).

Determined to put the transfer through for Ms. Hughes, the case is taken to the High Court by Bespoke Pension Services. Justice Morgan decided to overrule the Pensions Ombudsman’s decision and allow the pension transfer to go through. His decision was based on the wording of the legislation which in fact states that a member of an occupational pension scheme should have some sort of earnings/employment – but falls short of saying that the earnings/employment should be with the sponsor of the occupational scheme (to which a member is intending or attempting to transfer).Pension Scammers will delight in this decision by Justice Morgan

Were this is a decision which only affected Ms. Hughes and her £8,359.71, it really would not be newsworthy at all. The fact of the matter is that it sets a precedent as an interpretation of the law surrounding many pension transfers. When the expertise of the pension trustees such as Royal London and the Pensions Ombudsman can be overrriden in this manner (i.e. an interpretation of legislative wording which is too weak and takes away the intelligence factor), you have to ask are whether ordinary pension holders in the UK are the first priority? Has this opened the flood gates for more fraudulent pension transfers? Have pension scammers been given the green light?

Were this is a decision which only affected Ms. Hughes and her £8,359.71, it really would not be newsworthy at all. The fact of the matter is that it sets a precedent as an interpretation of the law surrounding many pension transfers. When the expertise of the pension trustees such as Royal London and the Pensions Ombudsman can be overrriden in this manner (i.e. an interpretation of legislative wording which is too weak and takes away the intelligence factor), you have to ask are whether ordinary pension holders in the UK are the first priority? Has this opened the flood gates for more fraudulent pension transfers? Have pension scammers been given the green light? -

Justice Morgan Disaster

The Justice Morgan Disaster was a real setback for justice for victims of pension scams and emasculated the pensions ombudsman. Shame on the High Court.

Judgement in the matter of Donna-Marie Hughes and Royal London Mutual Insurance Society

Case Number CH/2015/0377 on 19th February 2016

In the High Court of Justice, Chancery Division

Letters to:

- Justice Morgan

- Steve Webb, Royal London (former pensions minister)

- Pensions Ombudsman

- Ms. Hughes

- Bespoke Pension Solutions

- HMRC

Background: This is the introduction to letters to parties responsible for, involved in and affected by this matter.

THE EFFECTS OF PENSION SCAMS

Pension scams since at least 2010 have caused serious loss and damage to thousands of victims. There have been suicides, nervous breakdowns, life-threatening illnesses and broken marriages as a result of the stress, despair and horror of pension frauds. The Royal London vs Hughes judgement has put at risk thousands of existing victims and has now potentially opened the flood gates to thousands more. The vast majority of the existing victims fear above all losing their homes and facing poverty in retirement – despite having worked hard all their lives to save diligently for their retirement. Providers and advisers are utterly horrified and disgusted at this judgement because it further compromises confidence in the pensions industry and the principal of saving for retirement.

I would draw attention to Clause 53 in Justice Bean’s Ark ruling where he makes it clear that legislation wording must be interpreted intelligently – and not blindly. Judges can (and should) use their common sense and make ‘purposive’ judgements where necessary. In other words they can decide, where the wording of a clause is poor, weak or ambiguous, on the basis of the obvious purpose or intention of the legislation. Clearly, Justice Morgan failed to do this and relied on the exact wording in the legislation and ignored the obvious intention of the wording.

A substantial number of victims have been appalled by this ruling. The saying “the law is an ass” has been used repeatedly – and with some considerable disgust. I have always found this to be an anomalous saying since a donkey is a dependable, reliable, strong, faithful and obedient creature. And these are all the attributes the law is supposed to have. Legislation is supposed to protect the rights of citizens, but in this matter Justice Morgan’s ruling has had the opposite effect.

OCCUPATIONAL PENSION SCHEME/LIBERATION SCAMS

Let us look at the facts regarding occupational pension schemes/liberation scams to date which have cost victims somewhere between £1 billion and £55 billion (depending upon which quoted authority’s figures are used):

- All the known pension liberation scams have to date used occupational schemes

- Not a single one of the sponsors of these “occupational” schemes had ever traded

- It was never intended that any of the sponsors of these “occupational” schemes would ever trade

- Not a single one of the sponsors of these “occupational” schemes had ever employed anybody

- It was never intended that any of the sponsors of these “occupational” schemes would ever employ anybody

- Some of the sponsors of the “occupational” schemes didn’t even exist

- The companies (whether they existed or not) were set up purely for the purpose of running a pension scam

The legislation does in fact state that a member of an occupational pension scheme should have some sort of earnings/employment – but falls short of saying that the earnings/employment should be with the sponsor of the occupational scheme (to which a member is intending or attempting to transfer). The Pensions Ombudsman spotted this omission and made it clear that a person should indeed have earnings/employment with the sponsor of the scheme otherwise it would be a “very strange result”. In other words, he interpreted the wording of the legislation intelligently – he looked behind the weakness in the wording of the legislation and applied the clear intention of the condition.

The Pensions Regulator’s Scorpion campaign specifically warns against the dangers of the way “occupational” schemes are set up for fraudulent purposes in the case of pension scams:

- A recently set up small self-administered scheme – SSAS, where the member is a trustee sponsored by a newly registered employer

- A scheme sponsored by a dormant employer

- A scheme sponsored by an employer that is geographically distant from the member

- A scheme sponsored by an employer that doesn’t employ the member

- A scheme connected to an unregulated investment company

WHAT ACTUALLY HAPPENED IN THE HUGHES CASE?

Ms. Hughes’ proposed transfer from the Royal London scheme ticked these warning boxes. But now Justice Morgan’s ruling has disarmed and emasculated the Pensions Regulator, the Pensions Ombudsman and the ceding pension trustee.

The simple fact is that, leaving all legal jargon aside, trustees could now be under a legal duty to effect a transfer to a scheme, even when there is reasonable (or even compelling) suspicion that the transfer is to a bogus scheme. It may now be the case that when all the warning signs clearly outlined by the Pensions Regulator should be ignored even when, as in Ms. Hughes’ case, every single warning bell is sounding loudly and clearly.

It is my obligation to refer you to the fact that the industry, regulators, law enforcement agencies, courts, ombudsmen and victims (existing and future) desperately need the legislation to be tightened – not relaxed (or, as in this case, made completely impotent). This judgement has effectively given the green light for hundreds of scammers to scam thousands of innocent victims out of their hard-earned pensions.

HISTORY OF HOW PENSION SCAMS ARE SET UP

History, since 2011, shows that various pension liberation scams including Ark, Capita Oak, Westminster, Evergreen, Salmon Enterprises, Eric’s Yard, Pennines, London Quantum, Headforte, Southlands etc., all shared a collection of common traits:

- They were set up, administered and promoted by an unregulated firm

- The firm obscured the identity of the team

- The address of the firm was a virtual office

- The assets of the scams being peddled included high risk, illiquid, speculative investments entirely unsuitable for pensions

- Bogus “occupational” schemes were registered with HMRC and tPR (who did nothing to check that the sponsoring employers actually traded or employed anybody – or indeed even existed at all)

- Pensions were liberated using a variety of “loan” structures which victims were assured were legitimate “loopholes”

- Transfer and loan fees were extortionately high

- Victims were promised unrealistic gains such as “guaranteed 8% return per annum”

- The schemes’ assets often included huge “kickbacks” for the introducers (up to 60%)

The firms and individuals offering, promoting, and running these schemes included:

- Gary Collin of Asset Harbour https://register.fca.org.uk/s/firm?id=001b000000bOu6zAAC

- Premier Pension Solutions in Spain (run by Tolleys Pensions Taxation author Stephen Ward – available on Amazon if you need a copy)

- Premier Pension Transfers Ltd (31 Memorial Road, Worsley)

- Fraser Collins, Villa Financial

- Julian Hanson

- Gerard Associates http://www.gerardassociates.co.uk/

- Frost Financial

- Continental Wealth Management, Spain

- P. Sterling

- Viva Costa International

- Windsor Pensions

- Blu Debt Management

- Wealth Masters

- Paul Baxendale Walker

- James Lau

- Silk Financial Solutions, Alexander Johnson – now James Alexander Enterprises

- Hudson Clarke

- Jackson Francis

- Jeremy Denning

- Tony Jimenez (Newcastle United and Charlton Athletic FC)

- Wightman, Fletcher McCabe

- Spain Wealth Management

- Mark Ainsworth

- Ralph Noel and Sons

Thousands of victims have lost £ billions worth of hard-earned pension funds and gained £ millions in tax liabilities in the past six years. The assets of these schemes have included offshore property, store pods, car parking spaces, unregulated collective investments, eucalyptus forests, hedge funds, forex, Cape Verde property etc.

THE EFFECT OF THIS RULING

I am not saying that Bespoke Pension Services are scammers but on the back of their victory in the case of Ms. Hughes, there are a further 160 blocked pension transfers sitting with the Pensions Ombudsman. We have no way of knowing whether they will all be pension transfers invested in Cape Verde assets, but we do know the Hughes case must have been very important to Bespoke Pension Services’ business.

Interestingly, Bespoke Pension Services are unregulated and their address is a virtual office. According to their latest published accounts the firm was insolvent in 2014. The two directors/shareholders – Mark Anthony Miserotti and Clive John Howells – have between them an impressive portfolio of investment, consultancy, property development, investment and financial planning companies – one of which is called “Fortaleza Investments” which suggests something Brazilian.

On the back of Justice Morgan’s judgement in respect of Royal London, there will be a serious problem for all the pension providers who performed so appallingly in Ark, Capita Oak, Westminster, Evergreen et al: the worst of which being Standard Life, Prudential, Scottish Widows, Aviva and Legal and General. Having handed over £ millions worth of pension funds since 2010 – in a lazy, negligent, box-ticking fashion – there is evidence that they are trying to mend their ways. Or at least there had been, until the judgement in the Hughes/Royal London/Bespoke Pension Services case.

It is essential to read Clause 53 in Justice Bean’s 2011 Ark ruling where he makes it clear that legislation wording must be interpreted intelligently – and not blindly. He is obviously trying to make the point that it is essential to avoid an anomalous or unjust result from failing to look behind the intended meaning of wording in legislation. Indeed, the Pensions Ombudsman had already done that when looking at the wording when he said that he found that a transferee did indeed need to be employed by the sponsor of an occupational scheme in order to avoid a “strange result”. Justice Morgan’s judgement has now put at risk thousands of victims’ pensions. There have already been suicides, nervous breakdowns, life-threatening illnesses, broken marriages and families. There will be widespread poverty in retirement and many people will lose their homes. A strange result indeed – which does rather beg the question of how victims will get any protection or justice now?

PENSION LIFE WOULD LIKE ANSWERS URGENTLY

Hopefully, the recipients of the following letters will provide some answers:

Dear Justice Morgan

Hopefully, you can clear up a few questions which are puzzling me and many other disgusted parties: why did you ignore the Pensions Regulator’s clear warnings re pension scams?; why did you ignore the Pensions Ombudsman’s intelligent interpretation of the poorly-worded legislation?; why did you ignore Justice Bean’s warnings re avoiding anomalous or unjust results in the Ark case?; how many victims will now lose their pensions as a result of your judgement?; how many of these victims will lose their homes and even their lives?; what research did you do into how pension scams have worked this past six years before making your judgement?; what steps are you now taking to highlight the urgency of reforming and re-writing pension legislation to correct the weakness in the wording relating to genuine employment by a sponsor of an occupational pension scheme?; what remorse do you now feel for the fact that you have put £ billions worth of pensions at risk?

Dear Steve Webb, Royal London

Hopefully, as former Pensions Minister, you can give some clarity to how Royal London feels this appalling judgement can be appealed, or its effects mitigated. It is obviously completely unacceptable that pension trustees may now be forced to allow transfers even when it is strongly suspected that the receiving scheme is a scam. However, an even more serious concern is that this may now compromise claims against negligent ceding providers. Dozens of negligent firms handed over £ millions worth of personal and occupational pensions to scammers from 2010 onwards. These firms asked no questions either before tPR’s Scorpion campaign or after and simply used a lazy, negligent, box-ticking approach. Obviously, these firms need to compensate their victims and restore faith and confidence in the industry. According to my own records, the worst offender overall by a generous margin was Standard Life. Other firms that performed especially badly included Prudential, Scottish Widows, Legal and General, Aviva, Phoenix Life and Aegon. My evidence suggests that Royal London was not among those who negligence was as extensive as Standard Life et al, but I do have one case that it would be useful for you to address. Your firm’s victim – whose pension was handed over to one of the Ark schemes: Portman – is currently fighting ISIS in the Middle East and is playing a significant role in defending our country from terrorism. I am sure you will be particularly keen to ensure he is compensated for the loss of his pension and the exposure to crippling tax penalties. What will definitely help to rescue the public’s and the industry’s disgust at the widespread negligence of firms such as Standard Life will be if Royal London sets a shining example and pays out the required compensation voluntarily rather than waiting for the victims to have to drag these matters through the courts.

Dear Pensions Ombudsman

Hopefully, you will have some valuable thoughts and suggestions on the effects of Justice Morgan’s ruling in the Royal London case. As I am sure you can imagine, the scammers will be absolutely delighted and will now be setting out to ruin even more victims’ lives on an even greater scale. It is obvious that pension scams are very lucrative for the scammers and their success can be measured by the impressive houses and cars they own. Perhaps you could let me have your thoughts as to what pension trustees should now be doing to protect their members? You must also be aware that targeted victims are often carefully “coached” by the scammers as to how to overcome resistance to transfer requests. In the case of the London Quantum scam (the trustee of which was Stephen Ward of Dorrixo Alliance at 31 Memorial Road, Worsley), for example, one adviser reported that he had several clients desperately trying to get out of the scheme and several more trying equally desperately to get into the scheme. Now that London Quantum is in the hands of tPR-appointed Dalriada Trustees, the assets have been disclosed as being the usual toxic, illiquid, high-risk investments such as car parking spaces, forex trading, derelict German buildings and Cape Verde properties.

Dear Ms. Hughes

Hopefully, you yourself can shed some light on why you were so desperate to transfer your Royal London £8,000 fund into a SSAS. You are registered as the sole director and shareholder of Babbacombe Road 1973 Ltd. However, there is no evidence that this company has ever traded or employed anybody since 2014. Also, it would be interesting to know what your connection to Bespoke Pension Solutions is and how this firm initially made contact with you. Your High Court proceedings must have involved some considerable time, effort and expense; did you pay your legal costs yourself? Were you aware that this firm had a further 160 pension transfer attempts hingeing on the outcome of your case? I am also curious as to why you have three different director IDs at different addresses? 905529548 at 49 Wakedean Gardens, Yatton, Bristol BS49 4BN; 918824265 at First Floor Flat, 269 Babbacombe Road, Torquay TQ1 3SZ, 912378590 at Brynteg Llangenny, Crickhowell, Powys NP8 1HE. Finally, why are you using a firm with no evidence of a premises, regulation, qualifications or team members?

Dear Bespoke Pension Solutions

Hopefully, you could explain a couple of issues that I am struggling to understand. Why do you use a virtual office rather than a physical address? Officefront Why are the members of your team not disclosed on your website? What qualifications do your team have for pensions and investment advice? Why was your firm still trading while, according to Companies House records, the company was insolvent in 2014? Did your firm pay off the £101k owed to creditors in 2014? What regulation does your firm have for pensions and investments in the UK? Which lead generation service do you use? Which cold-calling sales service do you use? What investment introduction commission relationships do you currently have? (e.g. Store First, Quantum, Cape Verde, Dubai Car Parks, Dolphin etc). Do you have professional indemnity insurance? Did you pay Ms. Hughes’ legal fees? What connection does your firm have to First Review Pensions? http://whocallsme.com/Phone-Number.aspx/01332426342/2

Dear HMRC

Hopefully, you can now – finally – provide answers to crucial questions relating to your role in pension scams. Since 2010, HMRC have been registering schemes without checking the credentials of the trustees, the sponsoring employer or the purpose behind the scheme (i.e. to provide income in retirement, to operate pension liberation or to earn huge commissions on investment introductions). Of even greater concern is the burning question as to why HMRC did not de-register schemes as soon as there were concerns in order to prevent victims from losing their pensions and gaining crippling tax liabilities. If you remember, HMRC had a meeting with Stephen Ward of Premier Pension Solutions to discuss the Ark schemes in February 2011. At this time, there was about £7m in Ark, but HMRC did not suspend the registration and nothing was done to close the scheme down until three months later by which time there was £30 million in Ark. Hence, HMRC was directly responsible for hundreds of victims’ financial ruin and is currently pursuing these people for tax which was entirely preventable had HMRC suspended the schemes. Subsequently, having known that Stephen Ward was heavily involved in pension liberation, HMRC then went on to accept numerous pension scheme registrations from him and his company Dorrixo Alliance at 31 Memorial Road, Worsley. These included Southlands, Headforte and London Quantum – among many others. HMRC was handed evidence of these various schemes in May 2014, and yet took no action to suspend any of the schemes. Then in August 2014 a serving police officer lost his police pension to London Quantum. In 2010/2011, HMRC, the Crown Prosecution Service and the Pensions Regulator were all investigating the fraud being perpetrated by pension trustees Tudor Capital Management. But although there were a total of 25 different schemes involved – one of which was Salmon Enterprises (yet another bogus “occupational” scheme) – HMRC did nothing to suspend the schemes and prevent victims from losing their pensions and being exposed to tax liabilities. HMRC is currently pursuing thousands pension scam victims for tax on transactions which could – and should – have been prevented had HMRC acted diligently. Therefore, kindly confirm what proposals is HMRC currently working on for compensating these victims for the damage and loss caused by HMRC’s negligence?

From Angela Brooks, ACA Pension Life

www.pension-life.com

-

3 Watchwords used by Pension Scammers

-

WASPI Debate in Parliament 7th January 2016 With Mhairi Black

Parliament debated the WASPI issue at the beginning of 2016. The culmination of months of hard work by the WASPI (Women Against State Pension Inequality) campaigners finally arrived on 7th January 2016. Mhairi Black (SNP MP for Paisley and Renfrewshire South) asked the Government to introduce “transitional arrangements” to help the hundreds of thousands of women suffering hardship as a result of the State Pension aged being raised from 60 to 66. It was never the campaigners’ case that the age should not have been raised at all – but that those women affected (born in the 1950’s) should have had proper notice to plan their finances and their retirement.

http://on.fb.me/1XazD71

Mhairi Black Raises the Pension Equalisation Debate in Parliament on the 7th Jan 2016

The surprise star of the show was the highly articulate and passionate Mhairi Black – aged just 21. With just eight months’ experience of being an MP, she shone out as a real champion of not just her own constituents, but all the WASPI’s who are victims of what was described as a “mess” caused by a succession of governments. This mess failed to communicate the raising of the State Pension age to those affected – either quickly enough or at all. Many women received contradictory notices from the DWP about when they could collect their pension and some received nothing. The resulting chaos is hundreds of thousands (if not millions) of women facing severe poverty, stress, physical and emotional health issues and relationship problems. Mhaira Black stated that these victims had been “shafted” by the government.

Ros Altmann: no intention of doing anything to help the WASPIs. Another surprise in this issue has been the attitude of Ros Altmann who once “championed” the cause of women pensioners – even marching in the streets with them dressed as an “ordinary” woman. However, since being made Baroness and appointed Pensions Minister, her tune has changed from public-spirited enthusiasm to outright apathy at best – and total betrayal of WASPI victims at worst. The rest of the government has been no better – completely refusing to acknowledge the plight of the women affected.

Steve Webb previous Pension Minister – “bad decision made by the government based on a poor briefing” Interestingly, former Pensions Minister Steve Webb, has admitted that the Coalition government did mess up pretty badly – both with the decisions and changes and with the way these were communicated to those affected. However, while claiming this was caused by the government not being “properly briefed” he also put much of the blame on the previous Labour government under Tony Blair and Gordon Brown.

The opposition side of the House was not only pretty full but also full of praise and admiration for Mhairi Black and the WASPI campaigners – many of whom were sitting in the gallery watching the proceedings. However, it was evident that few Conservative MP’s felt this was an important enough issue to attend the House of Commons – as only two of them turned up at the start of the debate. By the end, this had dribbled up to five. The disgrace of this apathy by the Conservatives was repeatedly noted.

Shadow Pensions Minister, Nick Thomas-Symonds Shadow Pensions Minister, Nick Thomas-Symonds, spoke in a powerful and compelling manner about the injustice of the situation addressed by the WASPI campaign. All those who heard him also heard a man of principle who will make an excellent champion for the millions of victims of pension problems in the UK.

By “champion”, I refer not just to the State Pension “mess” but also to the thousands of victims of pension scams who are facing poverty in retirement in the long term, and financial ruin in the short term at the hands of HMRC. Between 2010 and 2015 there were numerous pension liberation schemes set up, run and promoted by fraudsters who assured victims they could get “loans” from their personal and occupational pensions in a way that “exploited” tax law loopholes and that there would be no tax liabilities to pay. This has resulted in thousands of tax demands of 55% of the money “borrowed” from the pension funds – known as HMRC’s “unauthorised payment” charges.

Sadly, it is statistically inevitable that there will be some unfortunate women who are victims of both situations i.e. WASPIs who have also been scammed out of their personal or occupational pensions and will be forced to pay 55% tax charges by HMRC. The Ark Class Action (including victims of not just Ark but also Capita Oak, Evergreen, Salmon Enterprises, London Quantum and other pension liberation scams) has tried to address the tax position with the Government. The object of the exercise was to try to negotiate a tax “amnesty” for victims who were assured by the fraudsters (one of which was a government consultant) that their “loans” were legal and tax compliant.

The Secretary of the Ark Class Action met with her MP, Iain Duncan-Smith – also Work and Pensions Secretary – to raise the matter. He agreed it was an unfair situation and promised to organise a meeting with Chancellor George Osborne and Treasury Secretary David Gauke at the end of 2014. He took the Ark victim’s entire case file and assured her he would get back to her. That was the last she heard from him, and her case file mysteriously “disappeared”.

WASPI: Women Against State Pension Inequality Campaign I have been tremendously inspired by the WASPI campaign, and impressed with the support provided by MP’s and leading journalists such as Paul Lewis and Jeff Prestridge. I hope this will lead to similar support being given to the Ark Class Action – as there is much to be learned from the WASPI founders’ approach. What WASPI and ACA have in common, of course, is they both represent a group of decent, honest, hard-working people who have been victims of injustice and whose interests are being ignored by the present government.

Journalists have often asked me whether I was myself a victim of pension liberation fraud, and sometimes I have felt almost ashamed to admit that I am not, and that by definition I cannot talk with first-hand experience of the pain and distress suffered by the victims. However, I am a WASPI having been born in late 1954 and so can attest to the fact that I have NEVER received any notification from the DWP about the change in my State Pension entitlement date.

Those who watched the debate on television will have seen and heard the passion of so many MP’s who have constituents affected by the WASPI problem. Viewers may also have noticed the pathetic turn out by Conservative MP’s – suggesting not just apathy but complete contempt for the matter. I myself noticed the blond woman sitting next to Shailesh Vara who couldn’t stop yawning while he was talking. I guess it must be pretty boring and exhausting listening to a Parliamentary Under Secretary of State at the Department for Work and Pensions trying – and failing – to defend the indefensible.

Unsurprisingly, the motion was carried by 158 to nil (the government didn’t even both to vote) – but there is no obligation by the government to do anything about the WASPI situation.

STATEMENTS (SMALL SELECTION) MADE BY MP’S DURING THE DEBATE

Mhairi Black (Paisley and Renfrewshire South – SNP): The 1995 Act increased the SP age for women from 60 to 65 to equalize the pension age so that women retired at the same age as men. The Turner Commission recommended that 15 years’ notice be given to individuals if their pension arrangements were to change to give them adequate time to respond appropriately. The changes were not to be brought in until 2010 which technically gave women 15 years’ notice. The problem is that nobody knew about that. As late as 2008, fewer than half of women knew that they would be affected. The National Centre for Social Research stated in 2011 that only 43% of women were aware of the planned change. Even the previous Pensions Minister, Steve Webb, recognised that not everybody knew that the changes had happened in the 1995 Act. Paul Lewis, financial journalist, told us that after researching he could barely find any reporting of the issue at all in 1995.

A response to a Freedom of Information request states that the Department eventually wrote to individuals affected and that “Mail campaigns took place between 2009 and 2013.” That is 14 years after the 1995 Act. Women were not personally notified by anybody official until 14 years after the changes came in. That is 14 fewer years that women have had to prepare and to try to make alternative arrangements.

But when giving evidence to the Work and Pensions Committee, financial journalist Paul Lewis told us that after researching this himself he could barely find any reporting of the issue at all in 1995. There were a few small press cuttings from the business pages at the back of some newspapers. A freedom of information request revealed that the Government did fund “broader” awareness campaigns, which ran in waves between 2001 and 2004, but that these campaigns “did not focus on equalisation in particular”. In fact, only one of the press adverts in those campaigns was focused on this issue—one press cutting roughly seven years after this had already been passed into law. It is quite evident that this whole thing became a total mess. I do not know whether it was not reported deliberately, for political reasons or fear of ramifications, or whether it was a genuine accident, but what I do know is that women were not notified. It was not reported and they were not given enough time to be able to make appropriate arrangements. This brings us on to the Pensions Act 2007, which increased the equalised state pension age from 65 to 66 between 2024 and 2026. It gave all affected people 17 years’ notice. That is fair enough, but then the Pensions Act 2011 came along and said, “Forget the 17 years’ notice, we’re going to rush this through. We need to do this right now.” The 2011 Act accelerated pension age equalisation for women and the subsequent increase to 66, effective from October 2016 onwards, meaning that affected women had only five years’ notice to try to remedy life plans that had been in place for years.

Geraint Davies (Swansea West) (Lab/Co-op): The hon. Lady is making an excellent speech and I welcome the debate she has brought to the House. Does she agree that many of these women have had a lifetime of low and unequal pay in low-paid jobs? They have had broken careers, because they have brought up children. Some may have got divorced or separated. Their whole life plan has been disrupted, destroyed and impoverished by this awful change.

Mhairi Black: I could not agree more with the hon. Gentleman. The 2011 Act made women wait an extra year to a year-and-a-half to claim their state pension. However, we have to remember and take into account the context that women did not know about the initial 1995 Act. We have a situation where there is a whole host of women who read about the 2011 Act and went, “Oh, God. Okay, I am going to have to be working an extra two years. I’d better start making plans. Oh no, wait a minute, I’m working till I’m 66. Where did that come from?” There is a whole host of women who have been given a double whammy. The Government have not and are not giving women enough time to prepare alternative plans. There have to be better transitional arrangements.

The Conservative ethos is to encourage independence and responsible choice, but how can that happen if we do not give people the time to make the responsible choices? By continuing this policy at such a high speed, the Government are knowingly and deliberately placing another burden on women who are already trying to deal with consequences of an Act passed 21 years ago that they have only now found out about. To put that into context, I am 21—that’s how old this is. One of my constituents told me that she began working at 17 and chose to pay the full rate of national insurance on the basis that she would retire at 60. Other options were available to her, but she said, “I want to retire at 60 so I’ll pay the price, through national insurance, my whole working life.” She put it in a way that I think is a very good and accurate description of what is happening. She has now found out that she is not retiring until she is 66. She says: “The coalition and this present Government have stripped us of our pensions with no prior warning and with no regard to the contract we all entered when we were 17.” She uses the term “contract”. That is an important point, because pensions are not benefits; they are a contract. People enter into them on the basis that if they pay x amount of national insurance they will receive y at a certain age.

The Government have said: “The policy decision to increase women’s state pension age is designed to remove the inequality between men and women.” That is a strange definition of equality: I am being shafted and short-changed purely because of when I was born and because I am a woman. That is not my definition of equality.

Tim Loughton (East Worthing and Shoreham) (Con): I congratulate Mhairi Black on leading today’s debate, for which there is an extraordinary turnout, showing the considerable interest of so many Members in this subject. I was approached by several constituents who said they were going to be disadvantaged. I recorded a short podcast on the subject, which has now been followed by 145,000 people, many of whom have written to me about it—and not just my own constituents either. I want to pay tribute to the Women Against State Pension Inequality campaign, which has articulated the case so well in front of the Select Committee. Its petition has now been signed, I believe, by more than 103,000 people. I want to thank the WASPI campaign for the help and support it gave me, not least in telling nonconstituents to write to their own MPs rather than have them all writing to me—and I am exceedingly grateful for that. We all agree with equalisation of the pension age. Large sums of money are involved and difficult decisions have to be made, but it is important that the rule of fairness is applied as much as possible, and it is clear that a sizeable group of women seem to be bearing the brunt of these changes disproportionately.

I have had representations from constituents who were in low-paid jobs with huge caring responsibilities for children and other family members when they did not have access to free child care and other things—and we have them to thank. Yet it is those people for whom I believe there has been a breach of trust, as these changes hit them disproportionately. We have a large duty of care to them, but I do not think we are going to fulfil it.