Long-term savings plans by Friends Provident, Generali, Zurich, Hansard and RL360. These have been around for years and are typically mis-sold by seedy, unregulated advisory firms. Why don’t we come up with an alternative? THE LONG-TERM SAVINGS PIG!

Long-term savings plans by Friends Provident, Generali, Zurich, Hansard and RL360. These have been around for years and are typically mis-sold by seedy, unregulated advisory firms. Why don’t we come up with an alternative? THE LONG-TERM SAVINGS PIG!

Roughly speaking, the con artists at Friends Provident, Generali, Zurich, Hansard and RL360 structure these products so that for every two pounds saved, one pound goes to the life office and the spiv who sold the plan to the victim in the first place.

The adviser earns a packet by selling these useless plans and few victims continue saving for more than a few years – long before the end of the term. Pretty quickly, the con artists’ clients realise they’ve been scammed and that they’ve inadvertently signed up to an expensive, unworkable plan with no flexibility. They really would have been better off sticking their money under the mattress.

So here’s my suggested alternative: the LONG-TERM SAVINGS PIG:

So here’s my suggested alternative: the LONG-TERM SAVINGS PIG:

You see, the problem with most long-term savings plans is that you are locked in and there is no flexibility. Plus there are heavy penalties and half of what you save goes in fees and commissions.

Imagine being able to save what you want, when you want, for free! All you have to do is be strict with yourself and save as much as you can, regularly and generously.

The problem is, of course, that so many offshore advisory firms sell products – rather than provide advice. Advisers earn huge commissions from mis-selling these appalling long-term savings plans – and ruin their clients in the process.

After as little as a year or two, the victims realise they’ve been conned and that they are simply pouring their hard-earned money into the pockets of the adviser and the life office.

In a perfect world, these dreadful products should be banned. All the advisers who have conned so many victims into believing they are paying into a flexible plan which is good value for money should be prohibited from ever working in financial services again. And the rogue life offices should be brought to justice and made to refund the victims’ money.

The reasons why these savings products don’t work are:

- Few people can guarantee they will be able to save the contracted amount each month for the agreed period. People’s earnings do fluctuate and circumstances change.

- Few people actually realise what they are signing up to. The advisers don’t tell them how expensive and inflexible the plans are.

- Few people understand that half of what they save will be eaten up by fees and commissions.

- Most people who get conned into these plans end up abandoning them and writing off what they have lost.

Remember, it’s your money and your life. Don’t get conned into giving half your savings to the scammer and the life office.

Remember, it’s your money and your life. Don’t get conned into giving half your savings to the scammer and the life office.

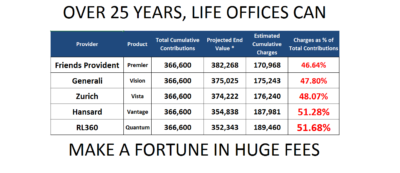

Just to make things crystal clear, if you sign up to a 25-year savings plan with one of the leading life offices, you will pay the following amount of fees over the life of the plan:

46.64% Friends Provident Premier

47.80% Generali Vision

48.07% Zurich Vista

51.28% Hansard Vantage

51.68% RL360 Quantum

So, if you save a total of £366,600 over 25 years with RL360, you will pay them (and your adviser) £189,460 in fees and commissions.

BE SMART. BUY A PIGGY BANK – YOU CAN GET A GOOD ONE FOR UNDER A TENNER WITH 100% BUYER SATISFACTION.

Risky illiquid investments from Katar Investments.

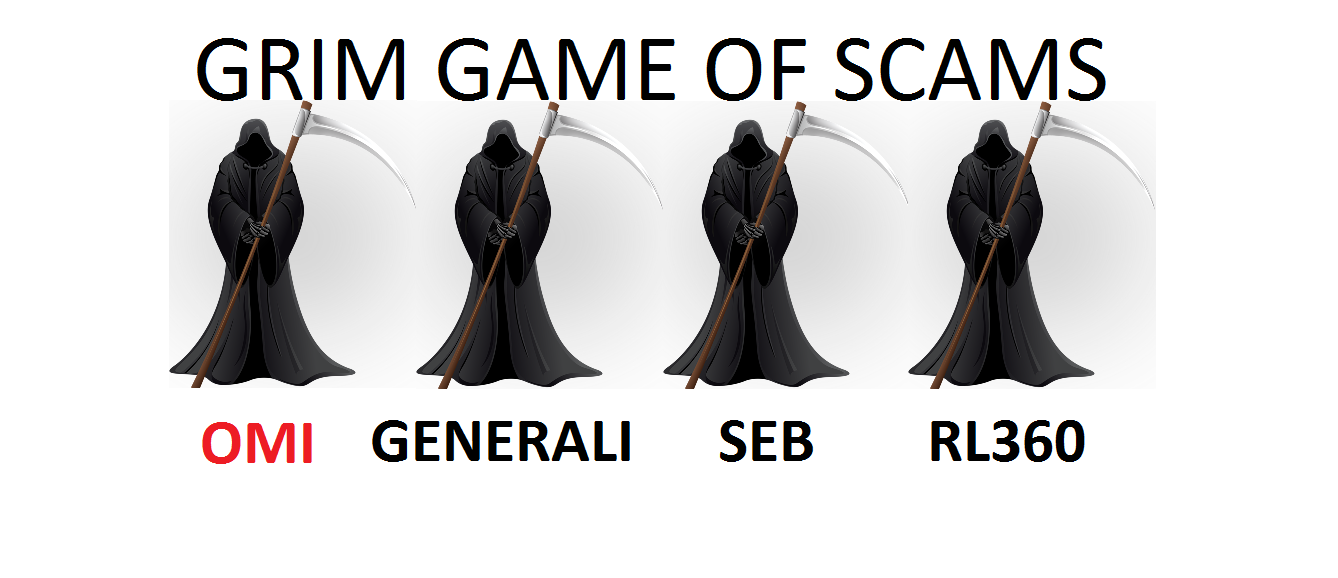

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years.

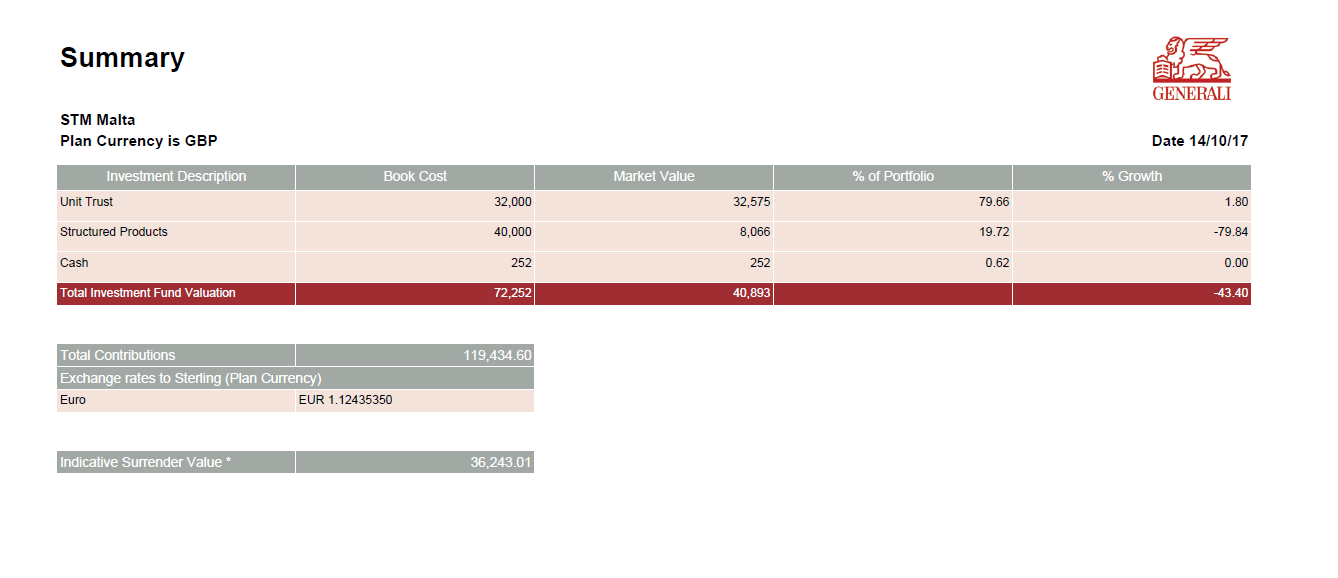

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years. One Generali victim saw her £119k pension fund plummet to £36k in five years.

One Generali victim saw her £119k pension fund plummet to £36k in five years. Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.

Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.