Old Mutual International (OMI) is at the heart of much of what is wrong with offshore financial services. The CWM debacle clearly evidences this.

OMI, formerly Skandia and soon to be Quilter, provided the vehicle used to wipe out thousands of victims’ life savings – not only in the CWM scam, but also with many other rogue financial advisers (often referred to by the Spanish regulator as “chiringuitos”).

OMI (Old Mutual International) is used as a bogus life assurance policy to “wrap” dodgy investments which subsequently nose dive and destroy portfolios.

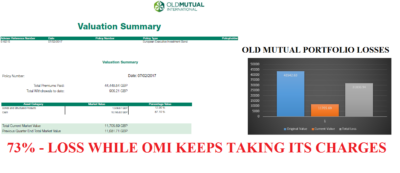

The so-called “life wrapper” serves absolutely no purpose from the investors’ point of view, other than to pay exorbitant fees to OMI and the adviser (which is often not licensed to provide either insurance or investment advice). These fees, of course, mean that the victims’ pensions and investments never have a hope in hell of growing – or even maintaining their original value.

High-risk, illiquid, professional-investor-only structured notes bought with the victims’ retirement savings by rogue advisers (such as Continental Wealth Management – CWM) frequently fail – and sometimes are even fraudulent – so bring victims’ funds crashing down even further. In the case of the CWM debacle, the structured notes were mostly Commerzbank, Nomura, RBC and Leonteq, and many of the notes crashed – costing the victims millions of pounds.

OMI charged the victims the following fees:

- Regular Management Charge 1.15% for ten (yes – TEN!) years

- Admin Charge Eur 144.00 annually

- Early Surrender Charge 11.5% – reducing by 1.15% a year to nil after ten years

But did OMI do any actual “management”? No. They never monitored the losses, alerted the investors or offered to do anything to help stem the hemorrhaging of victims’ funds. OMI just sat there like a lazy, greedy, callous parasite and watched the victims’ retirement savings dwindle. OMI must have known that this would be condemning thousands of people to poverty in retirement and yet they obviously did not care two hoots.

Did they do any actual “admin”? Yes. They reported the losses and ever-shrinking funds. But they took no action to help the thousands of victims or prevent further losses.

Was it reasonable to tie victims into a useless, pointless insurance bond for ten years? After all, the bond clearly offered no protection or guarantee of the capital invested. And was it right to charge 11.5% for the privilege of losing huge proportions of the funds? No, absolutely not. In law, a pension scheme member has a right to transfer and needs the flexibility to alter their pension arrangements whenever they need to. Being tied into a useless and expensive insurance bond FOR TEN YEARS is the last thing a retirement saver needs.

In the wake of this appalling tragedy, what has OMI done to put things right?

Has OMI offered to pay compensation to the victims?

NOPE

Has OMI offered to rebate its (extortionate) charges?

NOPE

Has OMI offered to waive the punitive exit fees for those who want to try to rescue what’s left?

NOPE

Has OMI lowered the 25% barrier so that ruined and desperate victims can access some income to avoid starving to death?

NOPE

Has OMI learned anything whatsoever from the CWM debacle? Has it turned over a new leaf and stopped accepting business from unlicensed scammers such as CWM? Has it stopped making exorbitant charges which drag retirement savings down? Has it stopped paying huge commissions to scammers to encourage them to destroy thousands of victims life savings? Has it stopped allowing and promoting toxic structured notes?

The answer to all of the above is a resounding NO. OMI knew exactly what terrible fate it was condemning the victims to for the past seven years.

OMI knew that the victims could face losing significant parts of their retirement savings – and stood by while it happened. Well, not exactly just stood by – they made huge profits in the process.

Has OMI learned anything from this tragedy? Has it turned over a new leaf? Absolutely not. In November 2017, it was still offering – and even aggressively pushing – structured notes to financial advisers and offering meaty commissions – obviously trying to replicate the huge success it made out of the Continental Wealth Management scam. On 30th November 2017, OMI sent out a bulk email to advisers:

From: Old Mutual International mail: intmarketing@engage.omwealth.com]

From: Old Mutual International mail: intmarketing@engage.omwealth.com]

Dear Greedy Broker, HURRY HURRY HURRY! SPECIAL OFFER ON STRUCTURED NOTES TO FLOG TO UNSUSPECTING VICTIMS. GET YOUR RUNNING SHOES ON – THIS OFFER CLOSES 15TH DECEMBER 2017. WE NEED MORE UNSUSPECTING MUGS LIKE THE CWM VICTIMS SO WE CAN MAKE MORE HUGE PROFITS AND CONDEMN MORE PEOPLE TO POVERTY IN RETIREMENT.

“The latest, tranche of structured products provided by BNP Paribas is available now through our portfolio bonds. But you don’t have long to get business in – this tranche will now close on 15th December 2017.

The products on offer during this tranche are:

Global Equity Income 5 – with a five year term paying quarterly income of 6% a year in USD or 5% a year in GBP – capital at risk product

Global Equity Autocall 9 – autocall product with a six year term paying 10% a year in USD or 8.25% a year in GBP – capital at risk product

Multi-Asset Diversified Global Certificate 10 – with a five year term and 100% capital protection

Full details, including how to access the products, are on our dedicated structured products page.”

Notes pay initial commission of 5.88% to Old Mutual of which 4.69% is paid to the adviser. OMI pockets 1.19%. No wonder OMI are pushing this!

The BNP Paribas “handbook” spouts the same old same old rubbish that CWM was using to con around 1,000 victims out of their retirement savings between 2011 and 2017:

“Structured Products are investments that are fully

customised to meet specific objectives such as capital

protection, diversification, yield enhancement, leverage,

regular income, tax/regulation optimisation and

access to non-traditional asset classes, amongst others.

The strength of a Structured Product lies in its

flexibility and tailored investment approach.

In their simplest form, Structured Products offer

investors full or partial capital protection coupled

with an equity-linked performance and a variable

degree of leverage. They are commonly used as a

portfolio enhancement tool to increase returns

while limiting the risk of loss of capital.”

The hundreds of CWM victims know that this is all lies: with structured notes, there is no capital protection; no flexibility; no portfolio enhancement; no increased returns and no limit to the risk of loss of capital. Shame on BNP Paribas for helping OMI to dupe more victims into losing their retirement savings and facing financial ruin.

So, the message to the public is:

DON’T TOUCH OMI – OLD MUTUAL INTERNATIONAL – WITH A BARGEPOLE

DON’T TOUCH STRUCTURED NOTES IN GENERAL WITH A BARGEPOLE

DON’T TOUCH STRUCTURED NOTES BY BNP PARIBAS WITH A BARGEPOLE

DON’T BELIEVE THE LIES TOLD BY ROGUE FINANCIAL ADVISERS, OMI OR BNP PARIBAS

DON’T BECOME ANOTHER VICTIM OF THE INSURANCE BOND/STRUCTURED NOTE SCAM

Lastly, OMI’s self-congratulating rubbish on their website crows about their “customer principles” and the many awards they have won. An example of this is the following statement:

Giving good service to financial advisers and their clients is at the heart of our business. We work hard to constantly improve our standards in this area. Our track record speaks for itself.

And yes, OMI’s track record does speak for itself – and anyone who does even the most basic maths will inevitably say “Oh My God!”.

And BNP Paribas’ claim that “a Structured Product lies” sums it all up nicely.

Leave a Reply