Old Mutual International (OMI) is at the heart of much of what is wrong with offshore financial services. The CWM debacle clearly evidences this.

OMI, formerly Skandia and soon to be Quilter, provided the vehicle used to wipe out thousands of victims’ life savings – not only in the CWM scam, but also with many other rogue financial advisers (often referred to by the Spanish regulator as “chiringuitos”).

OMI (Old Mutual International) is used as a bogus life assurance policy to “wrap” dodgy investments which subsequently nose dive and destroy portfolios.

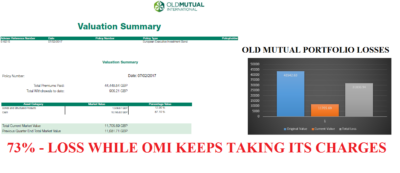

The so-called “life wrapper” serves absolutely no purpose from the investors’ point of view, other than to pay exorbitant fees to OMI and the adviser (which is often not licensed to provide either insurance or investment advice). These fees, of course, mean that the victims’ pensions and investments never have a hope in hell of growing – or even maintaining their original value.

High-risk, illiquid, professional-investor-only structured notes bought with the victims’ retirement savings by rogue advisers (such as Continental Wealth Management – CWM) frequently fail – and sometimes are even fraudulent – so bring victims’ funds crashing down even further. In the case of the CWM debacle, the structured notes were mostly Commerzbank, Nomura, RBC and Leonteq, and many of the notes crashed – costing the victims millions of pounds.

OMI charged the victims the following fees:

- Regular Management Charge 1.15% for ten (yes – TEN!) years

- Admin Charge Eur 144.00 annually

- Early Surrender Charge 11.5% – reducing by 1.15% a year to nil after ten years

But did OMI do any actual “management”? No. They never monitored the losses, alerted the investors or offered to do anything to help stem the hemorrhaging of victims’ funds. OMI just sat there like a lazy, greedy, callous parasite and watched the victims’ retirement savings dwindle. OMI must have known that this would be condemning thousands of people to poverty in retirement and yet they obviously did not care two hoots.

Did they do any actual “admin”? Yes. They reported the losses and ever-shrinking funds. But they took no action to help the thousands of victims or prevent further losses.

Was it reasonable to tie victims into a useless, pointless insurance bond for ten years? After all, the bond clearly offered no protection or guarantee of the capital invested. And was it right to charge 11.5% for the privilege of losing huge proportions of the funds? No, absolutely not. In law, a pension scheme member has a right to transfer and needs the flexibility to alter their pension arrangements whenever they need to. Being tied into a useless and expensive insurance bond FOR TEN YEARS is the last thing a retirement saver needs.

In the wake of this appalling tragedy, what has OMI done to put things right?

Has OMI offered to pay compensation to the victims?

NOPE

Has OMI offered to rebate its (extortionate) charges?

NOPE

Has OMI offered to waive the punitive exit fees for those who want to try to rescue what’s left?

NOPE

Has OMI lowered the 25% barrier so that ruined and desperate victims can access some income to avoid starving to death?

NOPE

Has OMI learned anything whatsoever from the CWM debacle? Has it turned over a new leaf and stopped accepting business from unlicensed scammers such as CWM? Has it stopped making exorbitant charges which drag retirement savings down? Has it stopped paying huge commissions to scammers to encourage them to destroy thousands of victims life savings? Has it stopped allowing and promoting toxic structured notes?

The answer to all of the above is a resounding NO. OMI knew exactly what terrible fate it was condemning the victims to for the past seven years.

OMI knew that the victims could face losing significant parts of their retirement savings – and stood by while it happened. Well, not exactly just stood by – they made huge profits in the process.

Has OMI learned anything from this tragedy? Has it turned over a new leaf? Absolutely not. In November 2017, it was still offering – and even aggressively pushing – structured notes to financial advisers and offering meaty commissions – obviously trying to replicate the huge success it made out of the Continental Wealth Management scam. On 30th November 2017, OMI sent out a bulk email to advisers:

From: Old Mutual International mail: [email protected]]

From: Old Mutual International mail: [email protected]]

Dear Greedy Broker, HURRY HURRY HURRY! SPECIAL OFFER ON STRUCTURED NOTES TO FLOG TO UNSUSPECTING VICTIMS. GET YOUR RUNNING SHOES ON – THIS OFFER CLOSES 15TH DECEMBER 2017. WE NEED MORE UNSUSPECTING MUGS LIKE THE CWM VICTIMS SO WE CAN MAKE MORE HUGE PROFITS AND CONDEMN MORE PEOPLE TO POVERTY IN RETIREMENT.

“The latest, tranche of structured products provided by BNP Paribas is available now through our portfolio bonds. But you don’t have long to get business in – this tranche will now close on 15th December 2017.

The products on offer during this tranche are:

Global Equity Income 5 – with a five year term paying quarterly income of 6% a year in USD or 5% a year in GBP – capital at risk product

Global Equity Autocall 9 – autocall product with a six year term paying 10% a year in USD or 8.25% a year in GBP – capital at risk product

Multi-Asset Diversified Global Certificate 10 – with a five year term and 100% capital protection

Full details, including how to access the products, are on our dedicated structured products page.”

Notes pay initial commission of 5.88% to Old Mutual of which 4.69% is paid to the adviser. OMI pockets 1.19%. No wonder OMI are pushing this!

The BNP Paribas “handbook” spouts the same old same old rubbish that CWM was using to con around 1,000 victims out of their retirement savings between 2011 and 2017:

“Structured Products are investments that are fully

customised to meet specific objectives such as capital

protection, diversification, yield enhancement, leverage,

regular income, tax/regulation optimisation and

access to non-traditional asset classes, amongst others.

The strength of a Structured Product lies in its

flexibility and tailored investment approach.

In their simplest form, Structured Products offer

investors full or partial capital protection coupled

with an equity-linked performance and a variable

degree of leverage. They are commonly used as a

portfolio enhancement tool to increase returns

while limiting the risk of loss of capital.”

The hundreds of CWM victims know that this is all lies: with structured notes, there is no capital protection; no flexibility; no portfolio enhancement; no increased returns and no limit to the risk of loss of capital. Shame on BNP Paribas for helping OMI to dupe more victims into losing their retirement savings and facing financial ruin.

So, the message to the public is:

DON’T TOUCH OMI – OLD MUTUAL INTERNATIONAL – WITH A BARGEPOLE

DON’T TOUCH STRUCTURED NOTES IN GENERAL WITH A BARGEPOLE

DON’T TOUCH STRUCTURED NOTES BY BNP PARIBAS WITH A BARGEPOLE

DON’T BELIEVE THE LIES TOLD BY ROGUE FINANCIAL ADVISERS, OMI OR BNP PARIBAS

DON’T BECOME ANOTHER VICTIM OF THE INSURANCE BOND/STRUCTURED NOTE SCAM

Lastly, OMI’s self-congratulating rubbish on their website crows about their “customer principles” and the many awards they have won. An example of this is the following statement:

Giving good service to financial advisers and their clients is at the heart of our business. We work hard to constantly improve our standards in this area. Our track record speaks for itself.

And yes, OMI’s track record does speak for itself – and anyone who does even the most basic maths will inevitably say “Oh My God!”.

And BNP Paribas’ claim that “a Structured Product lies” sums it all up nicely.

Feeling sick from the pit of my stomach after reading this. How dare they carry on doing this to decent hard working people, who the hell allows them to do this, they claim to have won many awards, who gives these and for what reasons. It,s all a closed club, they are daylight robbers without masks.

I am just one of far too many clients that have been scammed then ripped off for hugely out of proportion fees, screwed if you exit etc. Beware, we have all worked hard for many many years with a plan of retirement and that has all changed with the click of a pen and these Oxygen Bandits are laughing in our faces. I would have rather given all my pension to a homeless person or hospice, at least I could have slept at night knowing it had done some good rather than lining the pockets of these s******s. I could go on but am too angry inside and stressed to write any more. BEWARE – AVOID AT ALL COSTS.

Thankyou C-W-M AND O-M-I for screwing us all, may God give you early graves and turn you away at the Pearly gates.

Dirka

It is a disgrace that the so called “financial industry” and the so called “justice system” allows such organisations as OMI to continue to exist. Are fraud and corruption at epidemic levels throughout the financial organisations and their government puppets to such an extent that every honest citizen is seen merely as a future victim? The parasites of CWM and OMI have impoverished many. They must not be allowed to move on to do the same to others.

Skandia/OMI was desperate to sell the high-risk products which gave it the best commissions. The FCA would never have let them get away with this in the UK – so they decided to dump them overseas. To do this they offered large commissions as inducements to so-called “Independent Financial Advisers” (IFAs). Despite their claims, these people were rarely properly regulated or qualified and were operating illegally in these countries.

Skandia did not do adequate financial analysis of these high-risk products.

They did not check the IFAs.

They did not do adequate background checks on people behind the funds on their platform.

In some cases, they had no idea what the money would be used for.

There were so many middle-men taking their cut that it was unlikely that investors would ever see any return. Not only that, but it was almost impossible to withdraw money without heavy penalties – even when money had been held for several years. Some investments have been frozen for several years and Skandia maintain that they may be released at some stage, but there has been little progress. You have the choice of writing off your investments or letting Skandia bleed them dry through continuing administrative charges.

Skandia was particularly active in South-Easrt Asia. Investors in Thailand and the Philippines have obtained SEC judgements of fraud against IFAs in these countries, only for the IFAs to flee. There is evidence that Skandia had been made aware that one of their biggest disasters, LM Australia, was a Ponzi scheme. They continued to sell it and it went bust.

This was not a case of careless or greedy investors. Most were ordinary people who thought they were being prudent in seeking low-risk products, through regulated advisers and financial institutions formerly thought to be reputable. The 2008 banking crisis showed that nobody was reputable. As soon as one institution found a way of fleecing its clients (Subprime, PPI, fixing LIBOR, etc) the rest did the same. Insurance companies are no different.

Skandia even acted as a platform for a fund set up by one of the IFAs. They could have had no idea where the money would be sent as the prospectus made it clear that absolute secrecy was necessary, supposedly to protect hedging operations. This was in contravention of anti-money laundering legislation. Funds could have been used to finance arms, drugs or terrorism. In fact, some of the money was sent back to companies where the IFA and his colleagues were officers. These companies never made any sales but paid large fees to their officers.

Skandia/OMI has a Complaints Department but it is simply for PR. They considered it “inappropriate” to give details of background checks on IFAs or to give the names of people behind funds. Where the evidence of fraud was completely overwhelming they just referred clients back to their IFA. They justified their charges as “high set up costs”, even though they did no proper analysis. The high costs were simply the commissions paid.

What recourse do you have? The FCA will refer you to the Financial Ombudsman, who will refer you to the IOM Financial Ombudsman. By now you may have run out of time. When there is compelling evidence they advise that you can take legal action – at your own cost and risk, against an entity with huge resources. Some people contacted their MPs, who referred them to the FCA – and so on…..

Skandia’s approach has been to try and rebrand itself a few times, in order to escape from its shady past. Other insurance companies have done the same. Sadly, they still appear to be pushing the same garbage. The best thing is just to avoid them all.

So, in other words Old Mutual are just crooks.

All of the comments above are supported by solid documentary evidence. You can make your own conclusions.

You also need to ask why Skandia rebranded as Old Mutual, then as Quilter.

If you Google using “Royal Skandia scam” you will find a lot of people complaining, plus articles from respected newspapers explaining how these worthless products were sold. A Google search on “Old Mutual scam” pushes these comments further down the page and allows Old Mutual to replace them with their own warnings to clients to beware of scams. Not surprisingly, they don’t attribute blame to themselves.

They are the same people and they still appear to be pushing the same products.