Edward Troup 11th March 2016

Chief Executive’s Office

HM Revenue & Customs

100 Parliament Street

London SW1A 2BQ

Dear Mr. Troup

HMRC’S ROLE IN SIX-YEAR PENSION LIBERATION FRAUD

Congratulations on your appointment as head of HMRC. I am sure you will have a great deal of work on your plate cleaning up the many problems left behind by your predecessor Lin Homer, but I must ask you to address the issue of HMRC’s involvement in pension liberation fraud/unauthorised payment tax as a matter of priority.

I have asked HMRC and government ministers on numerous occasions to address the question of a tax amnesty for victims of pension liberation fraud. The answer has always come back that this would not be considered as it would “send out the wrong message”.

I must point out that HMRC and the government have already sent out a very clear message to the British public that Homer’s long series of professional disasters and incompetence have been rewarded with her being made a Dame; avoiding being sacked; receiving a handsome pension of £2.2 million. This was not just a “wrong” message, but a disgraceful one.

Further, the recent scandal of major corporations such as J. P. Morgan, Amazon, Google, Starbucks and Netflix being let off £ billions in tax has not only undermined the principles of national fiscal responsibility, but it has also sickened the public and brought disgrace on both HMRC and the government. Another “wrong” message which harks back to Homer’s equally inept predecessor, Dave Hartnet, who was caught doing cosy “sweetheart” deals over lunches with tax dodging corporations.

The catalogue of HMRC’s numerous blunders and failures is too long to go into here, and of course the message for many years has been that HMRC have forgotten that they are public servants, and have ignored their own taxpayers charter: “We want to give you a service that is fair, accurate and based on mutual trust and respect. We also want to make it as easy as we can for you to get things right.” That would be the right message if it were true. But, sadly, it isn’t.

Turning to the question of the tax amnesty for victims of pension liberation fraud, HMRC’s role in facilitating this massive, international financial crime has been significant and culpable. HMRC registered all the scams in the first place, deploying zero due diligence, responsibility or common sense. Then, when HMRC realised that they had been responsible for greasing the scammers’ wheels, they did nothing to de-register the schemes and prevent victims from being scammed. There is substantial irrefutable evidence that HMRC was repeatedly registering occupational schemes to known scammers – without any regard whatsoever to the obvious fact that the scammers habitually used the term “HMRC approved” to dupe the victims into believing that the schemes were legitimate. The message that this has sent out to the British public is that HMRC has not only been profoundly inept and irresponsible, but has also fuelled the suspicion that HMRC may even have been deliberately complicit in the scams since they have potentially raised many £ millions in tax revenues. This sends out the message that in fact HMRC is no better and no less culpable than the scammers themselves.

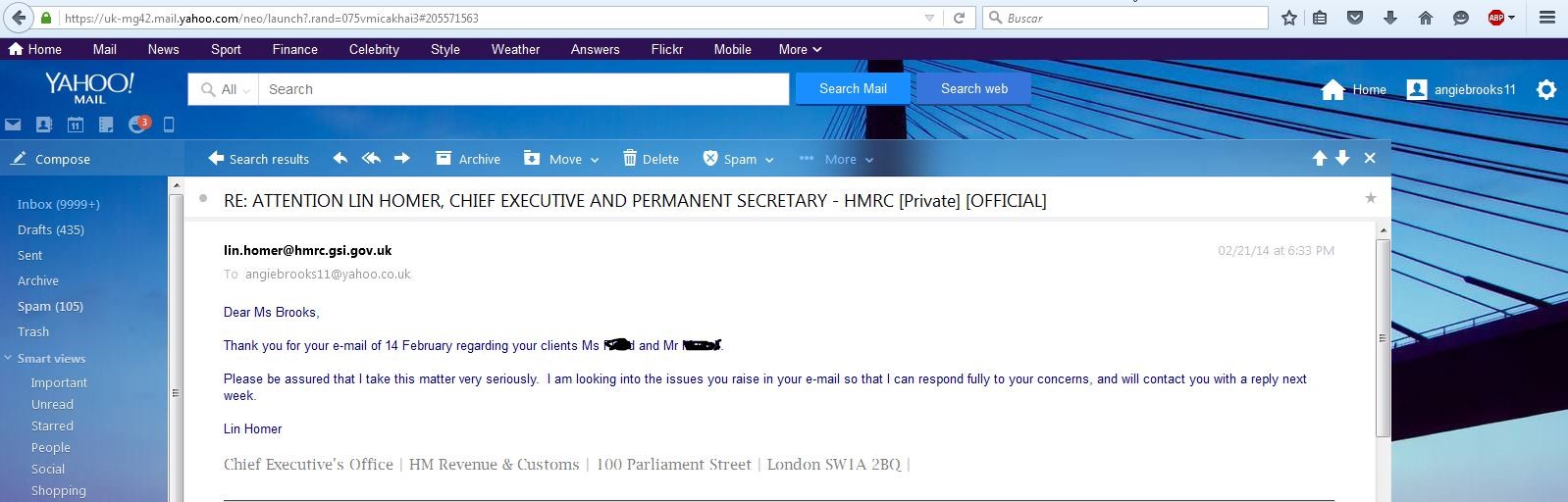

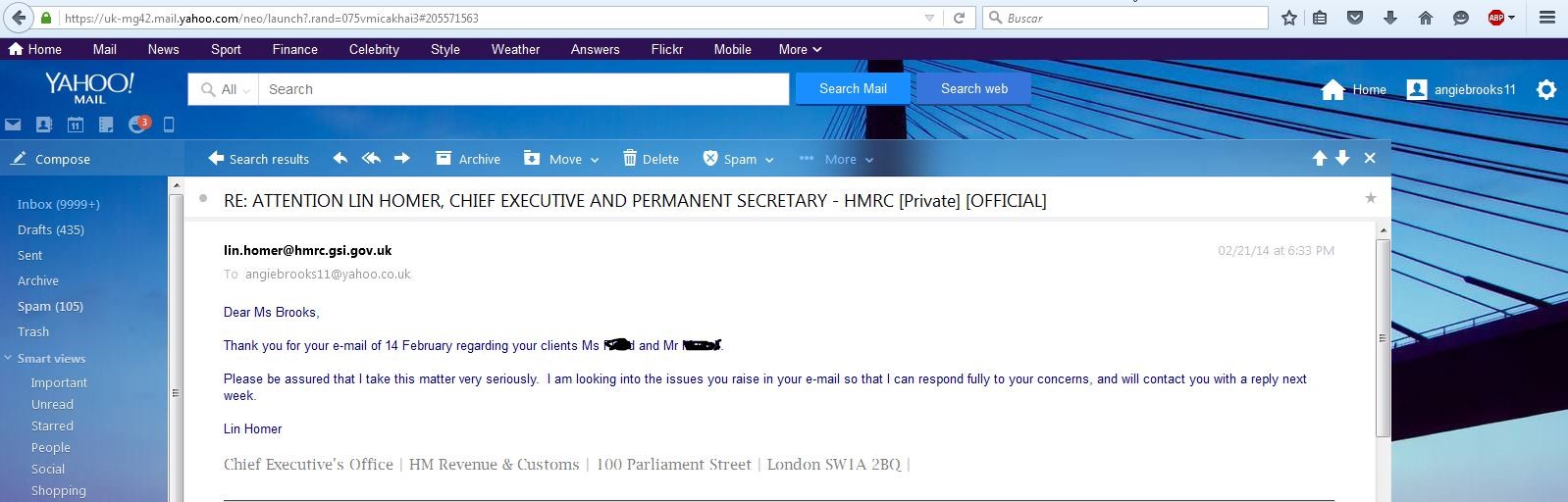

On 21 February 2014, Lin Homer emailed me to assure me she would be investigating HMRC’s failings and promised she would be taking the matter very seriously. She undertook to get back to me the following week. That was the last I heard from her – despite me emailing her many times in the past two years.

I trust you will ensure that appropriate sanctions are imposed on Homer for her abject failures and a full investigation undertaken to establish whether she has in fact been in league with the scammers. This would, of course, explain why so many schemes were repeatedly registered to the same, habitual scammers.

It would also explain another mystery. In June 2014, I handed evidence of a large number of pension liberation schemes being run by Stephen Ward – including the pension trustee firm Dorrixo Alliance which had registered many schemes with HMRC over a long period of time. One of the occupational pension schemes registered by Dorrixo Alliance was London Quantum. But neither HMRC nor tPR did anything about London Quantum and it was not de-registered – as it clearly should have been immediately.

In August 2014, a serving Police officer lost his Police pension fund to London Quantum. But it was not for a further year that tPR placed the scheme in the hands of Dalriada Trustees. The scheme was filled with the usual toxic, illiquid assets which would have earned handsome investment introduction commissions for the trustees, administrators and promoters.

In the case of the Store First store pod pension investment scandal, well over a thousand victims lost their pensions totalling over £100 million to a number of pension scams – including Capita Oak which was administered by Stephen Ward. Approximately half of this was paid out in commissions. But, instead of hounding the scammers who received these commissions, or Store First’s owner Toby Whittaker who paid them, HMRC will be pursuing the victims who liberated part of their pensions in the form of “loans”. Not only does this send out the wrong message, but it also raises the question as to what extent HMRC were indeed complicit in all of this financial crime.

I have sent out a questionnaire to hundreds of pension liberation scam victims asking them why they believed their pension loans were legal and tax compliant. The answers were pretty much all identical (and I will be sending you a summary separately): they were told there was no connection between the pension transfer and the loan and that the transaction would not trigger an unauthorised payment charge as it used a legitimate tax “loophole”. Many were told that the scheme was approved by HMRC and of course the HMRC registration certificate gave credence to that claim. The parties who “advised” the victims to enter into these scams included regulated and unregulated IFA’s; practising solicitors and accountants; various introducers and promoters; debt management consultants; mortgage and insurance brokers; and Stephen Ward – government consultant, former pensions examiner and author of Tolleys Pensions Taxation.

The claim by the government and HMRC that a tax amnesty for victims “would send out the wrong message” is absolute nonsense and an insult to all those who are existing victims of scams and all those who will now become victims as a result of Justice Morgan’s recent ruling. I know of not a single person who deliberately and consciously set out to liberate their pension in the full knowledge that it was not a tax-compliant transaction. Furthermore, ruining thousands of fraud victims with crippling tax liabilities will force many into bankruptcy and they will lose their homes. These people will then become dependent on State benefits for the rest of their lives – and the unauthorised payment tax collected will last a mere couple of years before the Treasury is out of pocket. On top of this, there will be the vast cost to the NHS of the long-term health problems these victims will inevitably suffer.

Please let me know what date will be convenient for an urgent meeting to discuss this and agree a solution. Just to be clear, the agenda will be to agree a tax amnesty for victims of financial crime facilitated by HMRC and to seek compensation for the damage that HMRC’s negligence has caused. At this meeting we will need to examine in depth the various issues surrounding HMRC’s role in pension liberation fraud during the past six years and explore some appropriate remedies.

For the avoidance of doubt, I set out below the key items:

- Since 2010, HMRC have been registering schemes without checking the credentials of the trustees, the sponsoring employer or the purpose behind the scheme (i.e. to provide income in retirement, to operate pension liberation or to earn huge commissions on investment introductions).

- Why did HMRC fail to de-register schemes as soon as there were concerns in order to prevent victims from losing their pensions and gaining crippling tax liabilities? If you remember, HMRC had a meeting with Stephen Ward of Premier Pension Solutions to discuss the Ark schemes in February 2011. At this time, there was about £7m in Ark, but HMRC did not suspend the registration and nothing was done to close the scheme down until three months later by which time there was £30 million in Ark. Hence, HMRC was directly responsible for hundreds of victims’ financial ruin and is currently pursuing these people for tax which was entirely preventable had HMRC suspended the schemes.

- Subsequently, having known that Stephen Ward was heavily involved in pension liberation, HMRC then went on to accept numerous pension scheme registrations from him and his company Dorrixo Alliance at 31 Memorial Road, Worsley. These included Southlands, Headforte and London Quantum – among many others.

- HMRC was handed evidence of these various schemes in May 2014, and yet took no action to suspend any of the schemes. Then in August 2014 a serving police officer lost his police pension to London Quantum.

- In 2010/2011, HMRC, the Crown Prosecution Service and the Pensions Regulator were all investigating the fraud being perpetrated by pension trustees Tudor Capital Management. But although there were a total of 25 different schemes involved – one of which was Salmon Enterprises (yet another bogus “occupational” scheme) – HMRC did nothing to suspend the schemes and prevent victims from losing their pensions and being exposed to tax liabilities.

- HMRC is currently pursuing thousands of pension scam victims for tax on transactions which could – and should – have been prevented had HMRC acted diligently. HMRC’s negligence must be acknowledged and this anomalous, unjust situation must be put right in accordance with HMRC’s own charter.

Yours sincerely

Angela Brooks – Chairman, Pension Life

c.c. Justice Morgan (Chancery Division); Steve Webb (Royal London); Ros Altmann (Pensions Minister); Andrew Warwick-Thompson (the Pensions Regulator); Boris Johnson (Mayor of London); David Gauke (Treasury Secretary); George Osborne (Chancellor)