OLD MUTUAL INTERNATIONAL HYPOCRISY OVER NEW MALTA REGULATIONS

OMI’s Peter Kenny advises the industry to “keep calm”.

He obviously wants to be able to keep flogging these useless, pointless and exorbitantly expensive insurance bonds to thousands of innocent victims.

With the announcement of new regulations in Malta for QROPS, International Adviser has quoted managing director of OMI (soon to be Quilter) Peter Kenny: “Old Mutual International is encouraging all market participants to help rid the industry of inappropriate structured products“.

Kenny´s statement, to the untrained eye, may seem logical and thoughtful. However, here at Pension Life we are well educated about OMI´s dirty laundry and routine use of toxic structured notes.

The statement Peter Kenny made is downright hypocritical. He is clouding the irresponsible and negligent actions OMI have made in the past, and the damage the high-risk structured products have inflicted on pension funds. Kenny hasn´t even mentioned the huge quarterly fees OMI have applied to ever-dwindling pension funds.

These fees are OMI´s way of clawing back the commissions paid to the scammers. And this is why victims are tied into these insurance bonds for so many years, and why there are such enormous penalties for exiting the bonds.

Kenny told International Adviser:

Kenny told International Adviser:

“The Malta Financial Services Authority’s proposed new regulations are sensible, appropriate measures to be taking.

Specifically, we welcome greater restrictions on structured notes. Old Mutual International is encouraging all market participants to help rid the industry of inappropriate structured products which are having a damaging impact on investor confidence and outcomes.

Over the years, Old Mutual International has taken action to tighten its criteria, introduced a maximum fee level, and in some cases banned certain types of structured products from certain institutions.

Not all structured products are bad, and they can be useful for clients who want a degree of capital protection whilst also providing exposure to investment markets or a fixed return. However, many structured products are often very complex in design. Regrettably, some investors and advisers will not always possess the depth of knowledge required to fully understand the risks and rewards associated with investing in such structured products.”

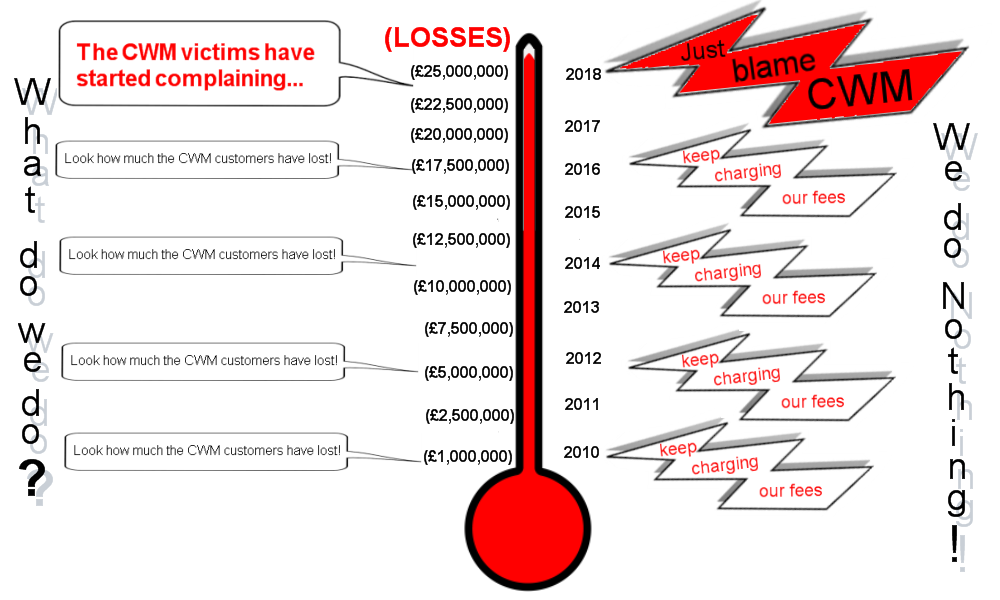

Doesn´t that sound lovely in theory! However, I´m sure the victims of the CWM pension scam would not agree.

“Specifically, we welcome greater restrictions on structured notes. Old Mutual International is encouraging all market participants to help rid the industry of inappropriate structured products which are having a damaging impact on investor confidence and outcomes.”

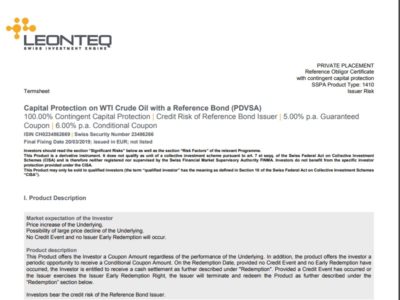

For the last eight years at least, OMI have allowed the use of structured notes. We have seen many examples of victims having 100% of their portfolios invested in structured notes – including the fraudulent Leonteq ones. We have the hundreds of victims of the CWM pension scandal as evidence of this.

Peter Kenny must surely be aware that OMI were happy to invest the life savings of the CWM victims into structured products which clearly stated at the top of the investment sheets (so as even the most short-sighted OMI employee could not miss it):

HIGH-RISK AND FOR PROFESSIONAL INVESTORS ONLY

Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual.

Here at Pension Life, we do hope that even trainees at OMI are aware that pension fund members are retail investors and should be placed into low to medium risk, liquid investments. However, it seems that these details obviously don´t feature in OMI´s training manual.

Structured products are illiquid and they often lock the fund in for fixed terms – up to 5 years. Added to this is the fact that victims were also locked into ten or eleven-year term OMI´s life assurance policies. It is absolutely ridiculous to lock people into a product which does nothing to protect the funds and only serves to erode the value of the funds with the exorbitant quarterly charges which inexorably “drag” the fund down.

“Over the years, Old Mutual International has taken action to tighten its criteria, introduced a maximum fee level, and in some cases banned certain types of structured products from certain institutions.”

This is an outright lie and we have hard evidence that even in the past couple of years, OMI has done nothing to tighten its criteria in any of the CWM cases. In fact, OMI were still accepting fraudulent Leonteq structured notes up until very recently. Peter Kenny is being dishonest as the reality is that there was no thought or care at all over a very long period.

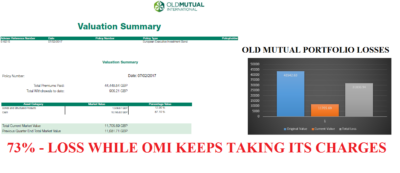

One Pension Life member started with a fund of £38,000. His last valuation showed that it was now worth just £800. When OMI apply their next quarterly fee, the entire fund will be wiped out as OMI simply kept taking their fees based on 11% of the original value (as opposed to the constantly dropping value). But clearly OMI didn’t care or even show any interest – they made a packet in fees, paid a huge commission to the CWM scammers and sat back and did nothing while the fund dwindled to nothing.

“Not all structured products are bad, and they can be useful for clients who want a degree of capital protection…”

I highlight here a “degree of capital protection” – just a degree? Pension funds are normally a person’s life savings. So what does a “degree” mean? 10%, 50% perhaps 75%? The degree of capital protection in the case of the CWM/OMI scam was 0%.

“Regrettably, some investors and advisers will not always possess the depth of knowledge required to fully understand the risks and rewards associated with investing in such structured products.”

Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

Regrettably for the investors who were victims of the CWM scammers and OMI, they most definitely did not possess the depth of knowledge required to fully understand the risks. They put their faith in the smartly- dressed scammers. With promises of high returns, the high risk of the investments and high fees to be charged were left unmentioned. OMI were supposed to protect the victims’ interests but failed dismally to lift a finger to help arrest the downward spiral of the funds.

OMI just sat there like a lazy, greedy, callous parasite and watched the victims’ retirement savings dwindle.

Malta´s new regulations have been put into place to protect investors from scammers like CWM and firms like OMI. I think OMI are secretly seething as the changes to the regulations will surely affect their already dropping profits.

International Adviser also reported on 30 Apr 18:

“Quilter, formerly Old Mutual Wealth, said its assets under management and administration had fallen in the first quarter of 2018.”

Here´s hoping they fall further – much further – 2/3rds further like Pension Life members Pete and Val´s did. Peter Kenny needs to experience a taste of how the victims of the CWM scam felt at finally receiving the news that their pension funds had been left in tatters.

I’ve decided on a radical career change. I’m going to study to become a psychiatrist. My first patient is going to be

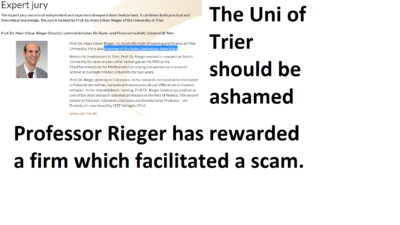

I’ve decided on a radical career change. I’m going to study to become a psychiatrist. My first patient is going to be  Professor Rieger was chairman of the

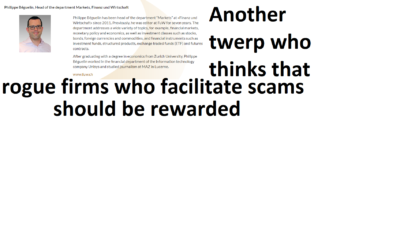

Professor Rieger was chairman of the  Professor Rieger is not the only one who has caused this award abomination. On the panel of judges was another academic who should have known better: Philippe Béguelin. He appears to have a decent pedigree and was editor at FuW for seven years. He is reported as having a background in financial markets, monetary policy, economics, investments, foreign currencies, commodities, and financial instruments such as structured products.

Professor Rieger is not the only one who has caused this award abomination. On the panel of judges was another academic who should have known better: Philippe Béguelin. He appears to have a decent pedigree and was editor at FuW for seven years. He is reported as having a background in financial markets, monetary policy, economics, investments, foreign currencies, commodities, and financial instruments such as structured products.

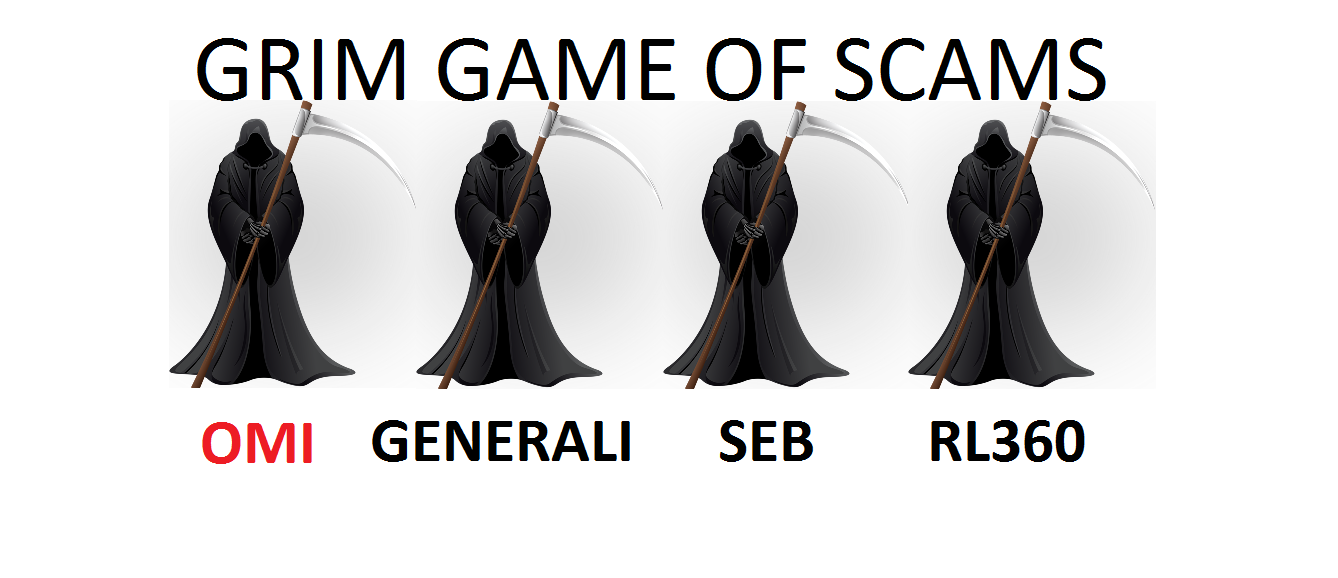

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years.

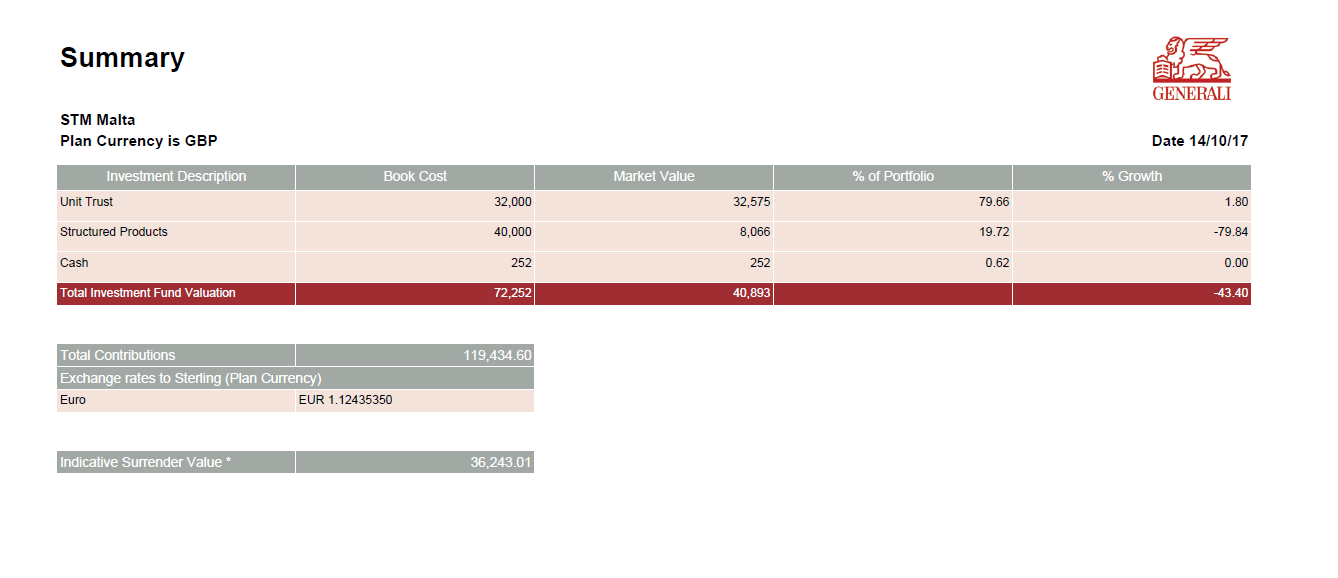

OMI – Old Mutual International (Quilter), SEB, ZURICH, GENERALI, FRIENDS PROVIDENT, ZURICH INTERNATIONAL, RL360 AND HANSARD INTERNATIONAL. They are all as bad as each other. They rip their clients off, charging them huge fees and commissions, tying them into useless, pointless products for years. One Generali victim saw her £119k pension fund plummet to £36k in five years.

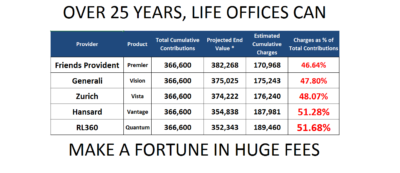

One Generali victim saw her £119k pension fund plummet to £36k in five years. Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.

Pension scams are not the only arrangements that these life offices profit handsomely from. Another method they use to rinse extortionate fees out of unsuspecting victims is the LONG TERM SAVINGS PLAN. Clients think these are a good idea until they realise the huge hidden charges which decimate the funds they put towards these plans.

From: Old Mutual International mail:

From: Old Mutual International mail: