The Web of Pension Scams

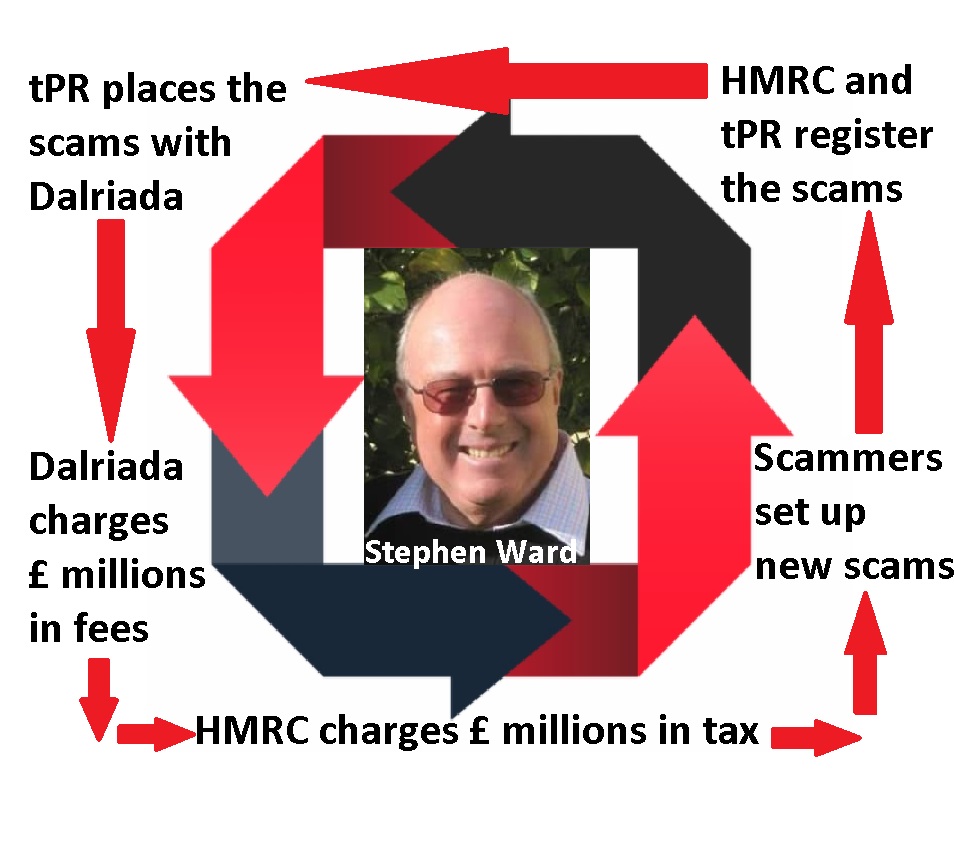

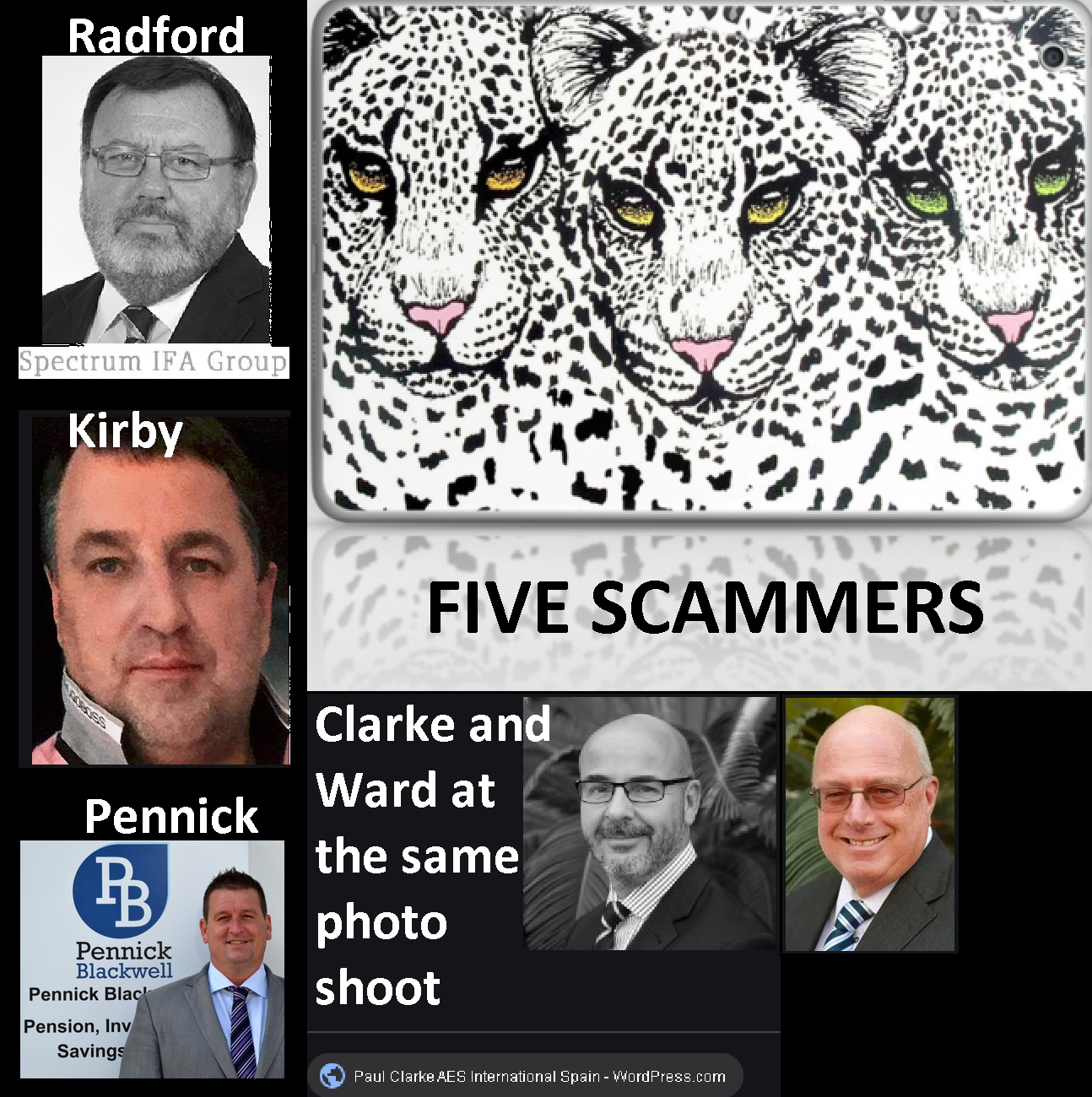

On the web of pension scams It seems as though criminal convictions against pension scammers might be getting popular. More than a decade has gone by with virtually none of the usual suspects getting jailed – despite a few criminal investigations (that, so far, have not resulted in convictions). Is the system really that hopeless […]

The Web of Pension Scams Read More »