Back due to popular demand, qualified and registered company blogs. Today, I am looking into Belgravia Wealth, a Swiss based company. Belgravia Wealth – qualified and registered? Lets see if you are.

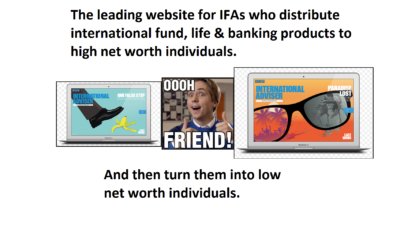

Belgravia Wealth has an impressive list of services offered. However, those who follow our blogs will know that the terms “structured products” and pensions together, makes us shudder with horror. We have seen so many pensions ruined by being invested in high-risk, fixed-term, for-professional- investor-only structured products.

Whilst I have a queue of trolls telling me that structured notes are “not all that bad”, take a look at this video we created about John Rodgers and the ´blue chip notes´ that destroyed his pension fund. He was a victim of a pension scam courtesy of Continental Wealth Management, which affected around 1,000 members.

What Belgravia say on their website:

“Belgravia Wealth Management is a Swiss-established and regulated company founded to fill the advice gap that currently exists between the retail financial companies and the services available to the UHNW clients. As an independent company, we ensure that you benefit from impartial advice and access to offerings from all the financial providers available in the market.”

It is great to read that Belgravia Wealth is regulated. Many firms I have written about fail to meet this simple – but essential – requirement. They claim to be independent and suggest that their advice is impartial. I wonder, though, with all this transparency in their blurb – are their staff qualified and registered to give this “impartial” advice?

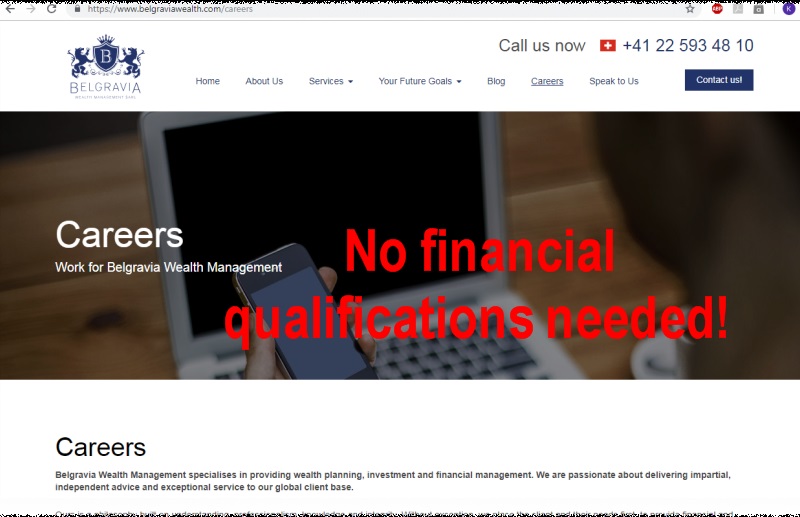

Whilst their website offers a tab entitled “Careers”, it does not offer a list of staff that actually work for Belgravia Wealth. So, over to Linkedin to see if Belgravia Wealth staff advertise their employment with the company.

As with all these blogs, we only go by the information we can find, which is the same information potential clients would be able to access.

IFAs and their clients are invited to add to this blog, correct it, improve it. We will gladly edit our information if proof of qualification certificates can be supplied. Here’s a link to the three registers if you want to double check for yourself:

http://www.cii.co.uk/web/app/membersearch/MemberSearch.aspx

https://www.cisi.org/cisiweb2/cisi-website/join-us/cisi-member-directory

https://www.libf.ac.uk/members-and-alumni/sps-and-cpd-register – Claim to a DipFA

- Spencer Freeman-Haynes – Director Zurich and Basel region at Belgravia Wealth Management – claims CISI – DOES not appear on the register

-

Emmanuel Obi, Jr. LL.M – Head of Compliance – Switzerland at Belgravia Wealth Management – no financial qualifications claimed (but how can he oversee the compliance function if he isn’t qualified?)

-

Regional Manager – Geneva Area, Switzerland – lists various CII qualifications – DOES NOT appear on the register

-

Director at Belgravia Wealth Management SARL – Claims CISI – DOES NOT appear on the register

-

Belgravia Wealth Management – Basel Area, Switzerland – No financial qualifications claimed

- Mystery Man (I do not have access to the profile) – Manager of Business Development – Belgravia Wealth Management – without a name I can not check his qualifications

Belgravia Wealth Switzerland has 6 members of staff listed as working for them, and from what I can tell NONE of them are qualified or registered to give financial advice.

Belgravia Wealth- qualified and registered 0%

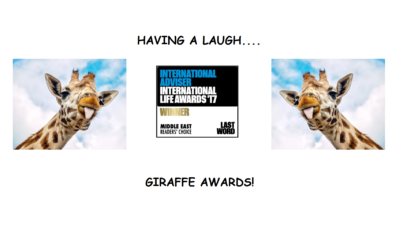

Looking at International Adviser’s 2017 awards, I really think the judges were having a

Looking at International Adviser’s 2017 awards, I really think the judges were having a  I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY:

I HAVE DECIDED TO INVITE MY FRIENDS AT INTERNATIONAL ADVISER TO LAUNCH A NEW AWARDS CEREMONY: