Malta has announced changes to the way their QROPS funds will be regulated. The changes will come into effect from 2nd July 2018, meaning that clients introduced by an adviser regulated only for insurance business will not be accepted as an investment adviser.

A letter this week from STM Malta reads:

“We are writing to inform you of some changes to Malta regulations which we believe will have a significant impact on the way that you conduct your pensions business in Malta. Whilst the final guidelines have yet to be published, it is anticipated that the changes will be brought into effect from 2nd July 2018. With these changes in mind, we felt it is a good idea that we commence discussions regarding how this will impact on some of our processes going forward.

In particular, the changes will require:

- An expectation of further oversight from pension trustees in relation to investment selections by members as recommended by advisers;

- A mandated restriction on investment in structured notes to 30% of a member’s portfolio with a maximum of 20% per issuer;

- A restriction on those permitted to give advice in relation to investment selection to advisers authorised to give investment advice via MIFID or equivalent regime. For clarity and from discussions with the regulator, we understand that a licence to advise on insurance products will not be considered an equivalent regime; and

- A requirement that Pension Trustees obtain and maintain information about the fitness and propriety of investment advisers selected by clients.

From the consultation process, we understand that the Regulator has experienced a number of complaints in relation to pensions and these changes are intended to address these issues.”

*****************************************

Whilst this is an enormous step in the right direction for Malta, they are not the only country offering QROPS and therefore here at Pension Life we are calling for these regulations to be applied worldwide.

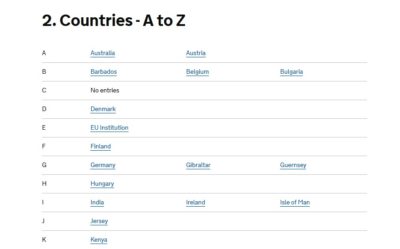

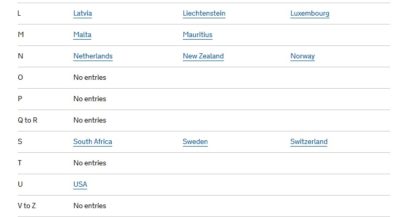

The lists here show that there are 28 other countries offering QROPS schemes. I can’t help but feel that unregulated (for investments) advisory firms will just change countries and continue to offer unregulated investment advice to innocent victims – but using QROPS in other jurisdictions.

Furthermore the decision has been made and announced, but will not come into place until 2nd July. That is nine weeks away. That’s 45 working days, 63 if they work weekends, that the unregulated advisers have to slog their guts out and get as many new “clients” to transfer their hard-earned funds – and invest them into unregulated, high risk, toxic investments. This may be the last opportunity to earn huge commissions in Malta. Then I guess these firms can have a wee holiday until they decide how best to alter the way they work.

STM’s letter goes on to state:

“Going forward we will need to fill the advice gap that is created and it occurs to us that there are two possible options for advisers going forward:

a) The adviser upgrades the license to become a regulated Investment Adviser; or

b) The investment is selected through a Discretionary Fund Manager which is a regulated Investment Manager”

What worries me is that the advisers with only an insurance license will be able to go on to become regulated, “upgraded” as the letter states, to fill the gap, so the process may be made easier for them.

- In response to the four changes reported by STM, I can see no mention of their past failures on a grand scale to carry out even the most basic due diligence on advisers or investments. STM has said nothing about the disastrous consequences of its own negligence – particularly in the case of the Trafalgar Multi Asset Fund;

- A restriction on investment in structured notes to 30% of a member’s portfolio with a maximum of 20% per issuer is still way too high – about 30% too high (and what about UCIS funds?);

- Restrictions on those permitted to give investment advice will need to be firmly policed. Firms with only an insurance license will inevitably try to continue as before. How will this be reported? And what action will be taken if trustees continue to accept dealing instructions from firms with no investment license? (A slap on the wrist with a soggy kipper?); and

- How will Pension Trustees decide whether investment advisers are fit and proper? One man’s fit and proper could be another man’s dodgy dealer.

One Pension Trustee in Malta told me recently that a grave concern of the industry is that firms who abide by the letter of the changes will lose out to firms that ignore them. This will set up an unequal competitive edge for those who interpret the new regulations more “loosely”. So, to make sure this new regime doesn’t end up as a bag of chocolate balls, the Maltese regulator has got to keep on his toes.

*****************************

As always, Pension Life would like to remind you that if you are planning to transfer any pension funds, make sure that you are transferring into a legitimate regulated scheme. Get all the information in writing and get a third party to double check the details.

FOLLOW PENSION LIFE ON TWITTER TO KEEP UP WITH ALL THINGS PENSION RELATED, GOOD AND BAD.