Our last blog in this series recreated the offshore pension scam process. We covered the set up and hard sell. The slick salesman prepared the unwitting victim and convinced him his pension would be better off out of the UK.

The silver-tongued spiv, Darren, posing as an adviser, conned his new client with no problem at all. The poor victim was duped into believing he should transfer his pension into a QROPS – an overseas pension scheme. The con worked because the experienced scammer pressed all the right buttons:

Your pension will be looked after better, it will be cheaper to manage, you’ll pay less tax, you won’t lose half of it when you die, you’ll get to choose your own pension investments!

Of course, the scammer, didn’t point out that once out of the UK, John’s pension would have no protection. Complete control of the money would be squandered will now lie in the hands of the unqualified, unlicensed scammers.

The victim, John had stressed:

I’ve paid tax all my life, so I feel I’ve paid my dues. I definitely don’t want to pay too much once I’m retired because every penny is going to count.

But sadly he’s played right into the scammer’s hands. His precious pension will be transferred into a QROPS and then into an insurance death bond:

John: I worked for thirty years to build up that pension and I don’t want anything to happen to it.

Darren: So, let’s look at all the ways you can improve your pension and make sure its protected.

But far, far from improving or protecting the investor’s pension, the scammer has removed the precious retirement fund from the safety of the UK. He’s sent it off to Malta or Gibraltar and then on to the Isle of Man or Guernsey. The money is now well beyond the protection of British regulation or compensation.

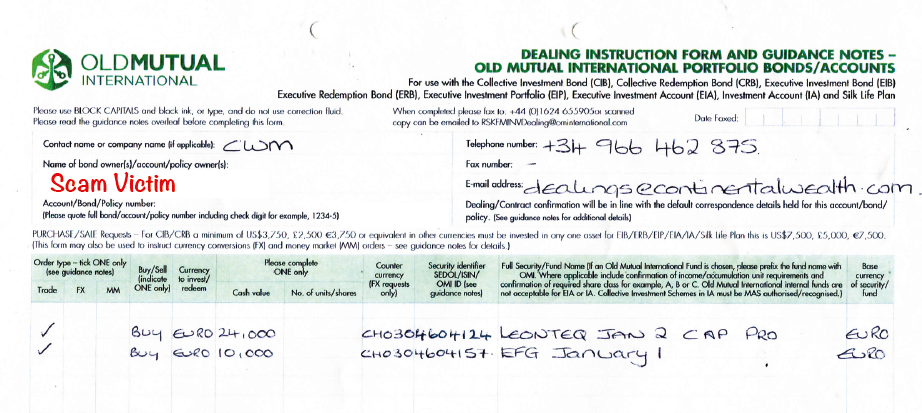

John had stressed how he wanted low risk, but has now signed dozens of forms – and this will guarantee that his pension will be exposed to high risk. Darren didn’t give him a chance to read or understand these long and complex forms. And the most important form of all was a blank investment dealing instruction. Once this has been signed by John, the scammer can copy it dozens of times and invest the pension money in whatever pays the highest commission.

The whole point of this scam is for the scammer to make money out of the victim by a whole series of hidden commissions.

Darren: My firm would charge you a small fee for setting up the transfer and then looking after your pension investments moving forwards.

But what will actually happen is that the scammer will openly charge three or four – or more – percent in set-up fees, plus one or two percent a year service charge. But, under the table, he will earn a further 7% hidden commission from the death office – such as Quilter International, Utmost International, RL360 or Friends Provident.

Darren: Right. And then we can start investing your pension and making it grow – so you’ll be able to have a happy and healthy retirement.

John, and all the other victims, will be a long way from being happy or healthy. Because the death office has a platform that the scammer will use to pick the highest-commission investments. So John’s pension fund will be used to line the scammer’s pockets for the next ten years – as he will be stuck in the death bond for that long.

Investments that pay the highest commissions – such as structured notes and unregulated collective investment schemes – are also the highest in terms of risk. John’s pension can now only lose money. And as the value of his hard-earned retirement savings goes down and down, the scammer’s commissions will keep on going up and up.

John, along with all the other victims, will end up losing part – or all – of his pension. He may well lose his home, see his marriage break up, develop depression or a life-threatening illness. He may even take his own life.

Leave a Reply