Investors are likely to have lost all their money in Premier New Earth Recycling fund – now in liquidation. The liquidator is Deloittes and they can’t say much, if anything, about what is happening as they are looking into the possibility of claims against third parties and don’t want to prejudice any possible action.

Investors are likely to have lost all their money in Premier New Earth Recycling fund – now in liquidation. The liquidator is Deloittes and they can’t say much, if anything, about what is happening as they are looking into the possibility of claims against third parties and don’t want to prejudice any possible action.

Rather than getting into the nitty gritty of the liquidation of this fund – and the appalling possibility that the investors may very well have lost everything – let us take a good look at the fund itself.

It is a UCIS. Nothing more to say – except:

“Specialist, qualifying, and qualifying-type experienced investor funds are unregulated collective investment schemes which are neither approved nor reviewed by IOMFSA. Once launched, the funds must be registered with the authority within 14 days. These types of funds cannot be sold to the retail public. Access to such funds is only available where investors confirm that they meet the fund type’s minimum entry criteria. This includes a statutory certification that they have read the scheme’s offering document and understand and accept the specific risks associated with that type of fund.”

So, instead of writing lots of fascinating stuff about the wonderful topic of generating energy from rubbish (which I am sure is really interesting and good for the planet), why don’t we stick with the unchallengeable fact that the fund was a UCIS and should not have been promoted to retail investors. End of. No argument. Non-negotiable. Talk to the hand. Stick your UCIS where the sun doesn’t shine.

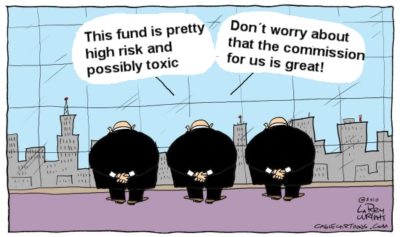

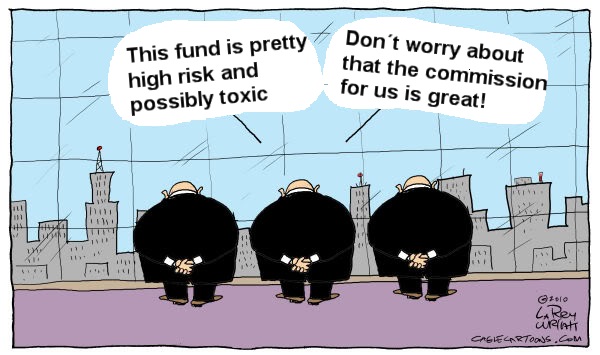

In fact, the same was true (should have been true) of the Connaught bridging loan fund; EEA Life Settlements; LM; Store First, Park First, Trafalgar Multi-Asset Fund and Blackmore Global. So why did so many advisers promote them and invest their clients’ money in them? £$£$£$£$£!!! Commissions. Backhanders. Sandwiches. And the distressed investors are now paying the appalling price for rogue advisers’ greed and negligence.

And what does this look like from the investor’s point of view?

**************************************************************

As always, Pension Life would like to remind you that if you are planning to transfer any pension funds, make sure that you are transferring into a legitimate scheme. To find out how to avoid being scammed, please see our blog:

FOLLOW PENSION LIFE ON TWITTER TO KEEP UP WITH ALL THINGS PENSION RELATED, GOOD AND BAD.

Leave a Reply