Pension Life campaigns for awareness of corrupt financial advisers and advisory firms operating without the correct licences. Outing theses advisers and firms, in the hope that the authorities will do something about the state of it all, is one way of bringing these scammers to justice and warning the public. A recent article in the Irish News about an unpaid TV licence caught my eye. I feel I must highlight the injustice of the fact that a disabled woman was prosecuted for not having a TV licence while dozens of serial pension scammers get away with scamming their victims out of their hard-earned pension funds daily without ever getting punished.

IN reports –

Ill grandmother sent to jail for not paying TV licence fines

As we reside in Spain, we are fortunate enough not to have to pay for this licence, but readers who live in the UK and Ireland (and I believe Germany) will be well aware of the fees one MUST pay if they have a television in their home. For those that don’t live in a jurisdiction that requires a TV licence, here´s what Wikipedia states about an Irish TV licence:

Television licensing in the Republic of Ireland – Wikipedia

Irish police found time to visit Anne Smith (59 – who suffers from the debilitating lung condition COPD, as well as osteoporosis and is waiting for a double hip replacement, several times to issue a warrant for her arrest and later to take her into custody. Anne’s TV licence had been left unpaid for quite some time due to her poor health.

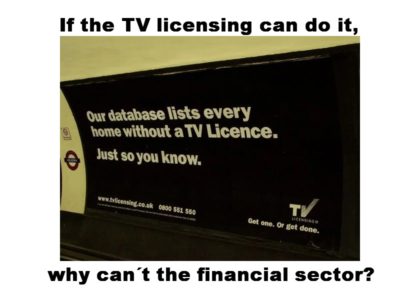

Non payment of a TV licence (when a television set is used within a house) is a criminal offence, and non-payment results in a police warrant being issued. Furthermore, men with vans are employed to visit all households on their database that do not pay their TV licence and basically harass them into proving they do not have a TV. It is just assumed that anyone without a TV licence is guilty, and so a campaign of harassment begins by letters and visits to intimidate people into buying a licence.

Non payment of a TV licence (when a television set is used within a house) is a criminal offence, and non-payment results in a police warrant being issued. Furthermore, men with vans are employed to visit all households on their database that do not pay their TV licence and basically harass them into proving they do not have a TV. It is just assumed that anyone without a TV licence is guilty, and so a campaign of harassment begins by letters and visits to intimidate people into buying a licence.

‘In a bid to clamp down on those who do not have a licence, the minister rolled out a raft of measures, including a communications campaign, as well issuing a new tender for a new TV licence agent tasked with carrying out TV licence inspections.

A spokesperson for the department said their research shows that the public campaign gave a definite push in the number of TV licences purchased. One tagline used in the ads where it highlights that buying a TV licence “is the law” resulted in a definite spike in take-up rates, they added.’

A spokesperson for the department said their research shows that the public campaign gave a definite push in the number of TV licences purchased. One tagline used in the ads where it highlights that buying a TV licence “is the law” resulted in a definite spike in take-up rates, they added.’

Can you imagine if this much effort was put into ensuring that financial advisers were fully licensed and qualified? And if the police chased after all the pension scammers? In my opinion, it is far more important to ensure that the financial services industry is operating in a fully legal and licensed manner. However, it is not so and the priority is obviously TV licence defaulters rather than pension scammers.

Serial pension scammers manage to create scam after scam after scam, posing as licensed advisers – convincing victims that they work for regulated firms – these scammers con millions out of innocent, hard-working victims every year!