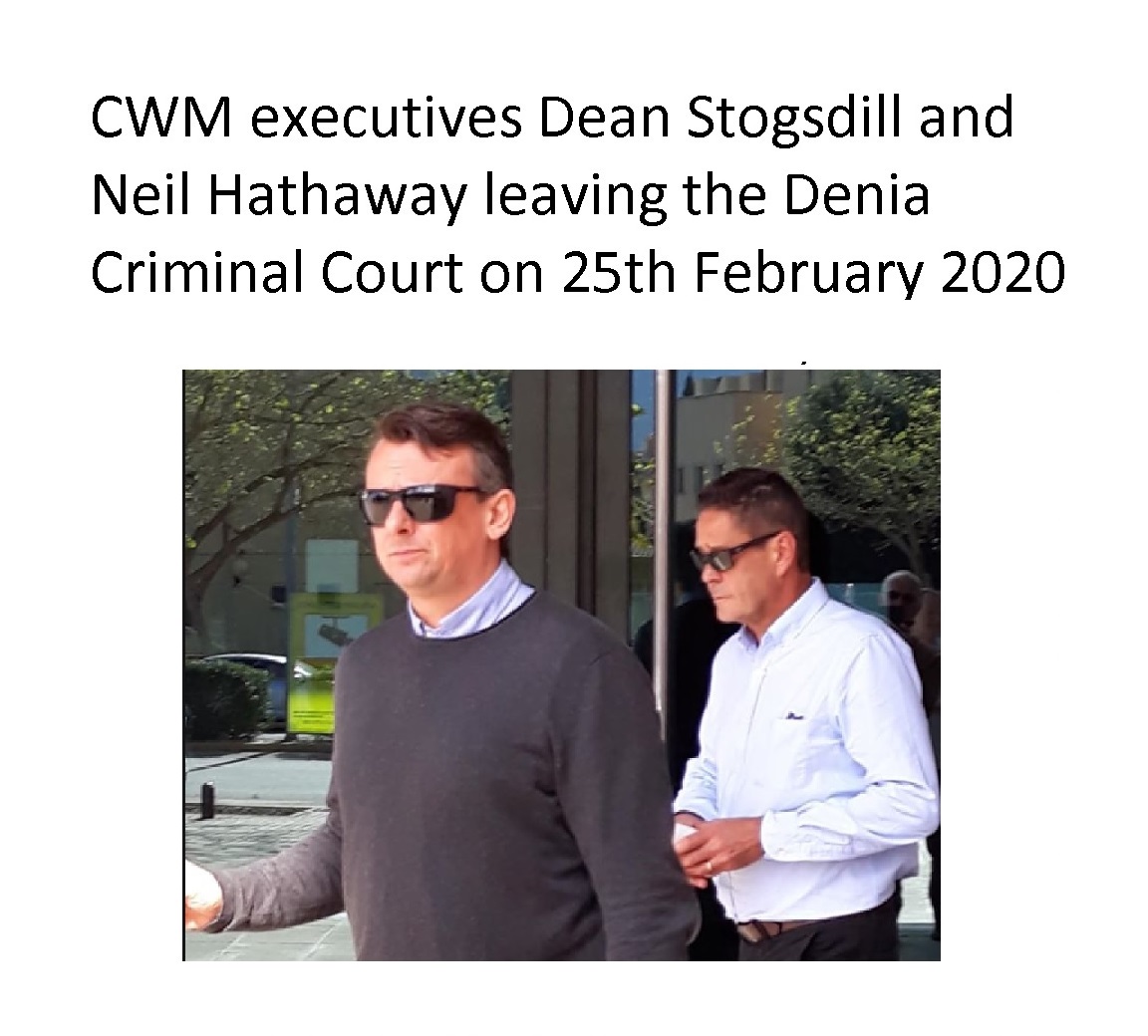

CWM Criminal Case and Business Plan

This landmark Continental Wealth Management criminal case will inevitably shine a much-needed spotlight on the issue of offshore financial services generally. CWM was just one example (albeit an extreme one) of an international financial services culture which generally disadvantages and/or defrauds consumers. The cause of this culture is a combination of the obsession with the insurance bond cartel; the total reliance on (hidden) commission; the practice of churning (investing the same sum of money as often as possible to generate as much commission as possible) and the view that the client’s money and interests are secondary to the adviser’s.

CWM Criminal Case and Business Plan Read More »