Holborn Assets’ Kensington Fund – Another trap to ruin victims. Why do I say that? There are many reasons:

Holborn Assets’ Kensington Fund – Another trap to ruin victims. Why do I say that? There are many reasons:

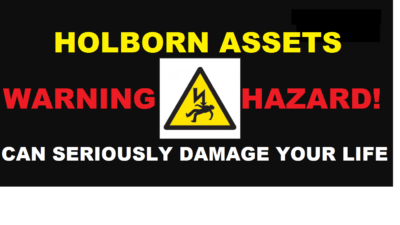

- Firstly, Holborn Assets should compensate the existing victims of past scams before contemplating moving on to new ones. There are plenty of Holborn Assets clients facing disastrous losses because of being invested in toxic UCIS funds such as Premier New Earth Recycling and high-risk, professional-investor-only structured notes. Surely, a firm which is as hopeless as that with investments shouldn’t be allowed anywhere near an investment fund? Holborn Assets has already proved it doesn’t understand investments and only has the mentality to flog whatever high-risk crap earns the most commission.

- Secondly, Holborn Assets’ previous in-house fund, LF Partners, was a dismal performer. It flat-lined at best, and the high charges ate into what little was left of the investments. Holborn Assets have demonstrated they have zero expertise in choosing or managing funds. But what do you expect – they are a shower of ice cream salesmen with few qualifications in financial services, and hardly likely to have any training in investment fund management

- The way Holborn Assets encourages their troupe of snake-oil salesmen to recruit as many victims as possible is to encentivise them with “privileges” based on their sales volume. This includes invitations to the booze and drug-fuelled orgies – such as earlier this year in Tanzania (with an even more depraved version planned for 2019 in Cambodia).

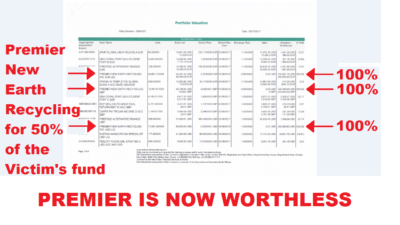

- Holborn Assets employs the dregs of the financial services World – mostly unqualified, unprincipled and unscrupulous. Including Paul Reynolds – banned and fined by the FCA – and Darrin Brownlee-Jones – jailed for killing a motorcyclist – the Holborn Assets staff are a motley crew at best. A den of thieves at worst. Even worse, everyone in the firm seems to be happy to stand by and see innocent people’s lives destroyed by Holborn Assets‘ hard-sell tactics, and greedy investment arrangements which disadvantage the investors but pay handsome commissions to the Holborn Assets salesmen.

Back to the Kensington fund. I posted an invitation to comment on the fund yesterday on Linkedin – Monday 18th June 2018. My post has got over 2,300 views in less than 24 hours – and the industry experts are clearly outraged. The views range from Cape Town to Edinburgh; from Aviva and Brooks Macdonald to Globaleye and Standard Bank Group.

Back to the Kensington fund. I posted an invitation to comment on the fund yesterday on Linkedin – Monday 18th June 2018. My post has got over 2,300 views in less than 24 hours – and the industry experts are clearly outraged. The views range from Cape Town to Edinburgh; from Aviva and Brooks Macdonald to Globaleye and Standard Bank Group.

Some of the comments include:

“With so many multi-manager, multi-asset funds with demonstrable track records, why would a company chose to recommend a fund that is only weeks old and potentially risk clients money?”

“High commissions, zero repercussions”

“Kensington – is being promoted as Holborn Assets’ “flagship” fund whilst sharing the same Director”

“If you read the instrument of incorporation on the above link and look at “Fees” it suggests the fund can pay 7% up front on a share trade to a range of bodies….”

“No sign of a prospectus or Kiid document either …. about as transparent as a brick…. avoid”

The Kensington Fund website doesn’t tell us much about the fund. It claims to “partner” with Schroders, Rathbones and Marlborough (I wonder if these funds even know!). It doesn’t tell us who is running the fund or responsible for investment decisions.

The Kensington Fund was listed on 12.4.2018 – so it is a brand new fund with no information, no history and no performance. It quotes “virtual” performance by quoting a backtest to try to create the illusion that it can, in the future, perform well.

There are no details of costs, no fact sheets, no details of who is making the investment decisions. The directors are Scott Balsdon, Director of Holborn Assets, Globaleye and Adamou Riyad, CCO of Holborn Assets (and Noel Ford). So the fund is run by the same cowboys who run Holborn Assets – yeehaa!

There are no details of costs, no fact sheets, no details of who is making the investment decisions. The directors are Scott Balsdon, Director of Holborn Assets, Globaleye and Adamou Riyad, CCO of Holborn Assets (and Noel Ford). So the fund is run by the same cowboys who run Holborn Assets – yeehaa!

So, apart from all the above reasons why Holborn Assets’ Kensington fund should be drowned at birth, is the fact that nobody will just pick up the phone and sort out the mess of the past. Instead, they just want to go ahead and cause more messes.

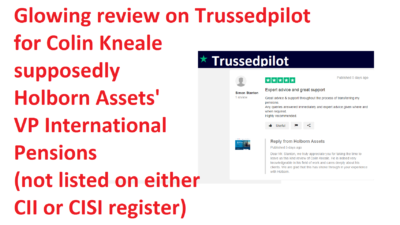

And, finally, Holborn Assets forge five-star Trustpilot reviews. How sad is that?

And, finally, Holborn Assets forge five-star Trustpilot reviews. How sad is that?

My advice to any potential victims of Holborn Assets’ Kensington fund: remember that by the time you have paid for the ten-year insurance bond and then have 100% of your life savings invested in this dreadful fund, you will have lost 15% of your money. Avoid Holborn Assets’ Kensington Fund – or, better still, avoid Holborn Assets.

Oh dear, Holborn Assets has fallen at the first fence – even before I’ve started the race! You couldn’t make it up. And typical of scammers, Holborn Assets is very concerned about the interests of their company and their profits, but couldn’t care less about the victims it has ruined.

Oh dear, Holborn Assets has fallen at the first fence – even before I’ve started the race! You couldn’t make it up. And typical of scammers, Holborn Assets is very concerned about the interests of their company and their profits, but couldn’t care less about the victims it has ruined. Interestingly, I had an email from a chap this weekend who explained that he and a number of his colleagues had left the firm last year. He was very discreet about the reasons, but it was clear he was smart enough to see the writing on the wall and get out before his personal reputation was damaged. Who knows – maybe he even works for Guardian Wealth Management now?

Interestingly, I had an email from a chap this weekend who explained that he and a number of his colleagues had left the firm last year. He was very discreet about the reasons, but it was clear he was smart enough to see the writing on the wall and get out before his personal reputation was damaged. Who knows – maybe he even works for Guardian Wealth Management now?

Investors are likely to have lost all their money in

Investors are likely to have lost all their money in