Pensions Ombudsman’s Determination – Justice for Police Victim

Among the flood of apathy, laziness and callousness by ceding pension trustees since at least 2010, we now have a Pensions Ombudsman’s determination which will hopefully result in more trustees being brought to account – and more victims getting justice.

Among the flood of apathy, laziness and callousness by ceding pension trustees since at least 2010, we now have a Pensions Ombudsman’s determination which will hopefully result in more trustees being brought to account – and more victims getting justice.

The London Quantum victim who made the complaint to the Pensions Ombudsman – Mr. N – is a serving police officer with the Northumbria Police Authority. In October 2014, he was scammed out of his Police final salary pension scheme and into Stephen Ward’s pension scam: London Quantum.

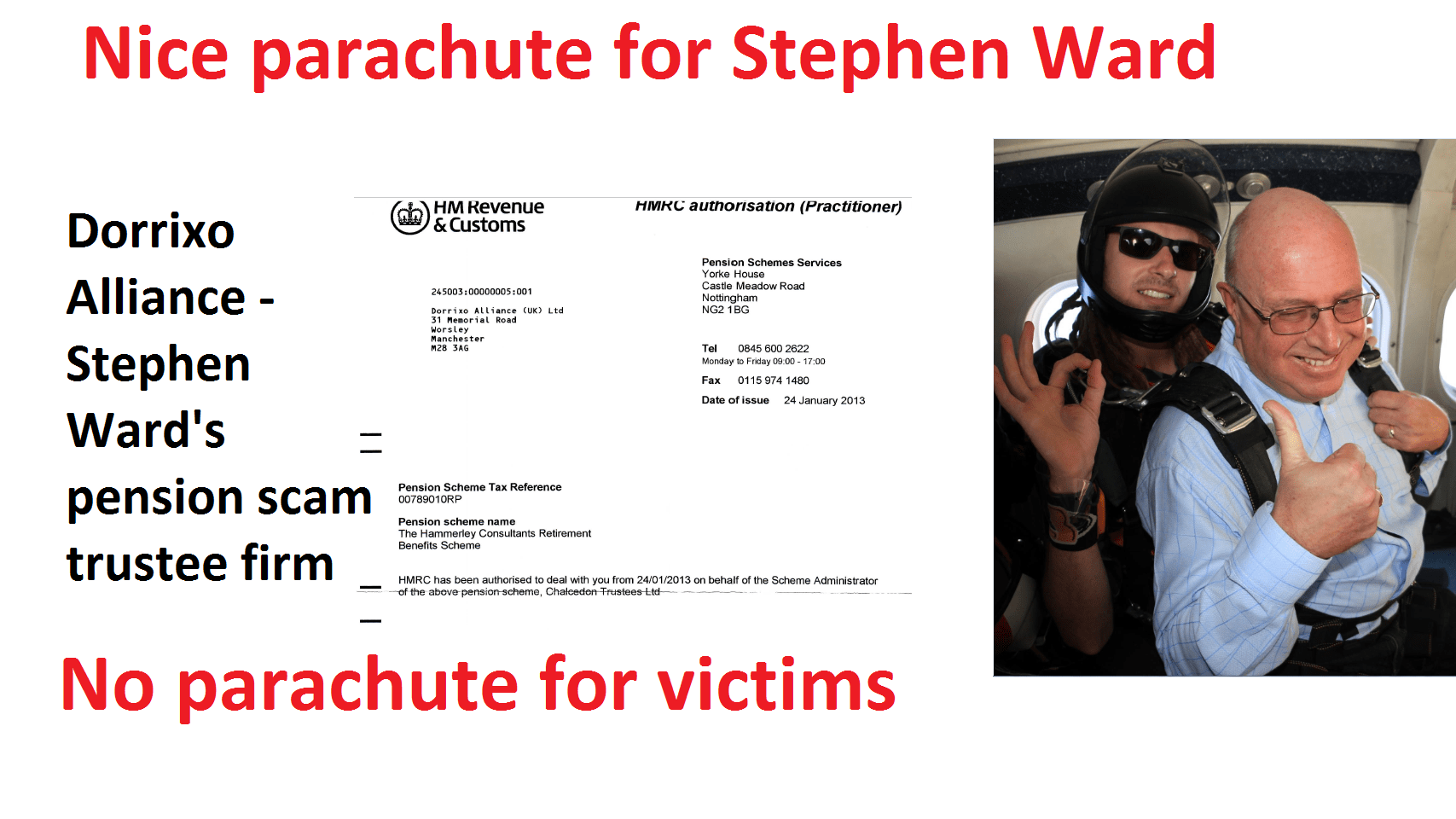

It is worth noting that, in May of 2014, I went to London and handed HMRC evidence of Stephen Ward’s various pension scams – including his pension administration and trustee firm: Dorrixo Alliance (the trustee for London Quantum). But HMRC did nothing – and hence Mr N (along with 97 other victims) got scammed into London Quantum just a few months later. The fact that if HMRC had done its job this would have been prevented is an absolute disgrace.

It is worth noting that, in May of 2014, I went to London and handed HMRC evidence of Stephen Ward’s various pension scams – including his pension administration and trustee firm: Dorrixo Alliance (the trustee for London Quantum). But HMRC did nothing – and hence Mr N (along with 97 other victims) got scammed into London Quantum just a few months later. The fact that if HMRC had done its job this would have been prevented is an absolute disgrace.

It is also worth noting that HMRC met with Stephen Ward in February 2011 to discuss the Ark pension scam – so they were fully aware back then that Ward was heavily involved with pension fraud. And yet they cheerfully registered pension schemes such as Hammerley for his firm Dorrixo Alliance which was registered at his UK address: 31 Memorial Road, Worsley.

We have warned about the significant dangers of unregulated firms, unqualified advisers, bogus occupational schemes, toxic investments and liberation fraud for years. Yet still, the ceding trustees have stubbornly ignored us – and also ignored the Pensions Regulator’s Scorpion campaign (published in February 2013).

And now the chickens have come home to roost thanks to the Pensions Ombudsman’s determination in Mr N’s favour – and hopefully this will bring to justice to more victims of negligence by similarly lazy trustees.

Highlights from the Pensions Ombudsman’s determination are quoted below – with my comments in bold. First, however, it is important to understand the background and put the Police Authority’s negligence into context.

In 2010/11, dozens of trustees handed over £ millions to the Ark scam. The worst offender in the personal pension sector was Standard Life; the worst offender in the DB sector was Royal Mail – by a royal mile. We were denied permission to bring complaints to the Pensions Ombudsman as the Ark transfers were effected prior to February 2013 – the date the Pensions Regulator’s “Scorpion” warning was published.

In 2010/11, dozens of trustees handed over £ millions to the Ark scam. The worst offender in the personal pension sector was Standard Life; the worst offender in the DB sector was Royal Mail – by a royal mile. We were denied permission to bring complaints to the Pensions Ombudsman as the Ark transfers were effected prior to February 2013 – the date the Pensions Regulator’s “Scorpion” warning was published.

And this, of course, was a great shame. Because Standard Life and Royal Mail – along with dozens of other negligent trustees – went on to hand over more £ millions and ruin thousands more lives. Three of the other worst-performing personal pension trustees in the subsequent Capita Oak and Westminster scams (now under investigation by the Serious Fraud Office) were Scottish Widows and Prudential.

None of these lazy, box-ticking ceding providers has ever paid redress to their victims (to our knowledge). Further, in the case of Royal Mail, PASA (Pension Administration Standards Association) has given Royal Mail trustees not one but two accreditations – despite the fact that they have never compensated any of their members for handing over their pensions to the scammers.

Before we look at the determination, let us look at a depressingly common thread which runs through these pension scams.

-

In 2010/11, Stephen Ward (Level 6 qualified, former pensions examiner) was promoting and administering the Ark pension liberation scam. 486 victims lost £27 million worth of pensions and face £ millions in tax charges. The schemes are now in the hands of Dalriada Trustees and Stephen Ward has never been prosecuted. Dozens of ceding providers handed over hundreds of personal and occupational pensions without question.

-

In 2012, Stephen Ward was promoting and administering the Evergreen New Zealand QROPS/Marazion liberation scam. 300 victims lost £10 million worth of pensions and face £ millions in tax charges. The scheme is now being wound up and Stephen Ward has never been prosecuted. Dozens of ceding providers handed over hundreds of personal and occupational pensions without question.

-

In 2012/13, Stephen Ward was administering the Capita Oak liberation scam (now under investigation by the Serious Fraud Office). 300 victims lost £10 million worth of pensions and face £ millions in tax charges. The scheme is now in the hands of Dalriada Trustees and Stephen Ward has never been prosecuted. Dozens of ceding providers handed over hundreds of personal and occupational pensions without question.

-

In 2013, Stephen Ward was administering the Westminster liberation scam (now under investigation by the Serious Fraud Office). 200 victims lost £7 million worth of pensions and face £ millions in tax charges. The scheme is now in the hands of Dalriada Trustees and Stephen Ward has never been prosecuted. Dozens of ceding providers handed over hundreds of personal and occupational pensions without question.

-

In 2014, Stephen Ward was promoting and administering the London Quantum pension scam. 100 victims lost £3 million worth of pensions. The scheme is now in the hands of Dalriada Trustees and Stephen Ward has never been prosecuted. Dozens of ceding providers handed over hundreds of personal and occupational pensions without question.

I apologise if the above is somewhat repetitive. I did omit the dozen or so other schemes that Stephen Ward was also promoting which might have mixed it up a bit – as none of these is in the hands of Dalriada (yet).

Ombudsman’s Determination Applicant Mr N Scheme The Police Pension Scheme (the Scheme) Respondent Northumbria Police Authority (the Authority) Complaint Summary

https://www.pensions-ombudsman.org.uk/wp-content/uploads/PO-12763.pdf

“Mr N” (a serving Police officer) complained that the (Police) Authority transferred his pension fund to a new pension scheme (the London Quantum scam) without having conducted adequate checks in relation to the receiving scheme, and failed to provide him with a sufficient warning as required by the Pensions Regulator.

Mr N did indeed complain – and has been complaining for four years. To put his complaint into context, he was advised to make the transfer by a regulated advisory firm: Gerard Associates – run by Gary Barlow. Both the firm and Mr Barlow are on the FCA register. Barlow is also Level 4 qualified with the CII http://www.cii.co.uk/web/app/membersearch/MemberSearch.aspx?endstem=1&q=n&n=gary+barlow&c=&ch=0&p=0

The complaint is upheld against the Authority because it failed to conduct adequate checks and enquiries in relation to Mr N’s new pension scheme; to send Mr N the Pensions Regulator’s transfer fraud warning leaflet; and to engage directly with Mr N regarding the concerns it should have had with his transfer request, had it properly assessed it.

The ceding provider in Mr N’s case – the Police Authority – has been denying for almost four years that they were negligent (well they would – wouldn’t they!). But surely, of all providers, the Police pension trustee ought to have known better. The Police were involved in Project Bloom – the multi-agency project including regulators, police authorities and HMRC that aimed to combat pension fraud.

In February 2013, the Pensions Regulator issued an action pack for pension professionals headed “Pension liberation fraud – The predators stalking pension transfers”. This said that: “Government enforcement agencies and advisory services have worked to produce a short leaflet that you (the ceding pension trustee) can use to help pension scheme members understand the risks and warning signs of pension liberation fraud.

But, of course, the Police Authority – along with hundreds of other ceding providers – totally ignored this warning and doomed thousands of victims to financial ruin by cheerfully handing over victims’ pensions to the scammers.

Mr N received a phone call from Viva Costa International, an unregulated introducer of work to independent financial advisers, and was referred to Gerard Associates Limited (Gerard), a firm of financial advisers.

The unregulated “introducer” has been the scourge of financial services in the UK and offshore for years. They con victims into believing they are some kind of qualified and regulated “adviser”, but in fact they are nothing more than slimy salesmen chasing commission. Of even greater concern, however, was the fact that there was an FCA-regulated firm – Gerard Associates – involved in this scam. Gerard Associates, run by CII qualified Gary Barlow, had a track record of working with Stephen Ward of Premier Pension Solutions – helping him with his various pension scams.

The London Quantum Retirement Benefit Scheme (London Quantum) was subsequently recommended to Mr N. Based on the information available, London Quantum appears to be a defined contribution occupational pension scheme established in 2012. The sole sponsoring employer of London Quantum was Quantum Investment Management Solutions LLP, based in offices in London. That company is now in liquidation. London Quantum was originally administered by Dorrixo Alliance (UK) Limited (Dorrixo). Dorrixo became the trustee of London Quantum in 2014.

London Quantum was, in fact, a bogus occupational scheme. Dorrixo Alliance was a firm run by Stephen Ward of Premier Pension Solutions and used for a variety of his pension scams.

Gerard took a fee of nearly £5,000 out of the transfer payment. On 11 November 2014, Mr N received confirmation that the transferred funds had been invested. In 2015, Mr N looked again at the documents that he had been given in 2014, and was concerned to note that he had signed up to a high risk investment as a sophisticated investor. He was unable to obtain satisfactory responses from Gerard or Dorrixo about this.

(Note: Gerard have never refunded the £5,000 to Mr N – and, presumably, have held on to the fees charged to the other 97 victims). This is entirely typical of how pension scams work. Mr N was in fact invested in high-risk, toxic, illiquid, speculative funds which were totally unsuitable for a pension fund. The only parties who benefited from this transaction were the scammers themselves, as they would have received high investment introduction commissions. The investments included:

(Note: Gerard have never refunded the £5,000 to Mr N – and, presumably, have held on to the fees charged to the other 97 victims). This is entirely typical of how pension scams work. Mr N was in fact invested in high-risk, toxic, illiquid, speculative funds which were totally unsuitable for a pension fund. The only parties who benefited from this transaction were the scammers themselves, as they would have received high investment introduction commissions. The investments included:

- Quantum PYX Management FX Fund – risky and illiquid forex trading

- Park First – UK airport car parking spaces

- Best Asset Management – Dubai car parking spaces

- The Resort Group – holiday properties in Cape Verde

- Reforestation Group – eucalyptus plantations

- Colonial Capital (three-year bonds in distressed US property)

- ABC Alpha (four-year bonds in business centres)

Most of these assets would have paid commissions to the scammers of up to 30%.

I note that Mr N’s transfer request was received by the Authority in November 2013, nine months after the Pensions Regulator’s pension liberation fraud guidance of February 2013 was issued, and his transfer was completed in August 2014. The pensions industry was aware of pension scams before the scorpion warning was published.

It is ironic – as well as extremely sad – that the Police Authority took no notice of the regulator’s fraud warning. And the victim who paid the price for this disgusting negligence was a serving police officer.

The Authority has admitted that it did not send Mr N a copy of the scorpion warning. The scorpion warnings were designed to be sent individually to scheme members. So, I am satisfied that maladministration has occurred.

It is indeed utterly disgusting that the Police Authority failed to send one of their own officers (who was indeed contemplating a transfer) a copy of the scorpion warning.

The next question is whether the Authority only had to send the scorpion warning to Mr N, or should have done more. I consider that it should have done more. I accept that when Mr N made his transfer request London Quantum was not a new scheme. However, the Authority ignored a number of features which other pension schemes identified as potential ‘red flags’ and accordingly refused transfer requests to that arrangement. These included that London Quantum was sponsored by a dormant company that was registered at an address far removed from the scheme member.

It has long been a disgrace that ceding providers have allowed members to transfer to a bogus occupational scheme – the sponsor of which neither traded nor employed anybody (or ever intended to do so). Justice Morgan’s overturning of a Pensions Ombudsman’s determination in the Hughes v Royal London case appalled the industry and the public. Morgan determined that a member only had to have earnings – rather than earnings with the sponsor of the scheme.

The Authority was fully aware, however, that although Mr N was a deferred member of the Scheme he was still employed as a policeman in Northumberland and he was still living in that county. The question of why he was requesting a transfer to an occupational pension scheme sponsored by a company that he did not work for, and based at the other end of the country, appears not to have concerned the Authority. I consider that the Authority should have had concerns about London Quantum, even the name might have rung alarm bells for a North-Eastern employer, and therefore it should have made some enquiries about London Quantum before it allowed the transfer to be made. Unfortunately, it failed to do so.

The Authority took the view that Mr N’s proposed transfer had none of the features of a potential pension transfer scam. However, I do not agree. In several previous determinations, we set out the type of due diligence expected of transferring schemes.

Within 28 days of the date of this Determination the Authority shall reinstate Mr N’s accrued benefits in the Scheme and pay Mr N £1,000 to reflect the materially significant distress and inconvenience that he has suffered as a result of the Authority not making appropriate checks in respect of London Quantum, and not giving Mr N the appropriate warnings.

Hopefully, now the Ombudsman will find in favour of thousands of other victims of pension scams facilitated by negligent, lazy, box-ticking ceding providers. However, the £1,000 “compensation” (for distress and inconvenience) order by the determination does not scratch the surface in terms of making up for the ordeal that Mr N has gone through. And he has suffered this profound torment while protecting the British public in the North East of England this past few years.

Thanks for this, very informative piece. The Ombudsman puts a lot of weight on the Scorpion campaign in February 2013, but do you think now they may at least entertain similar claims from before then? I’d argue the campaign didn’t give them new duties, just reminded them of the duties that, as trustees, they already had in place.

@Dave That’s an interest argument, however other Ombudsman determinations have ruled out cases prior Feb 2013.

But I agree with you. Trustees have, and always have had, a duty of care which it seems they just do not understand – in ANY jurisdiction! It is a meaningless mantra that they completely ignore. Not only do they ignore it when they hand over 1000’s of pensions to scammers, but when they get called out, they blame the victim! They refuse to own the duty of care that they sign up to as providers.

Do you blame the patient for taking harmful medication that was wrong for them, or the doctor with the duty of care for prescribing it?

This ruling will see providers taking much more care and due diligence before transferring pensions in my opinion and will do more to protect future victims than all the “cold calling” bans promised by politicians trying to make a mark. This ruling could see providers having to reach into their pockets and there is no better motivation for getting things changed! I think this is a turning point in the fight against pension scams.

All we need now are some convictions against the pond life like Ward (and many others) who orchestrate these scams. Then we might see an eradication in these vermin! They should be made to serve time! Such a pincer movement – attacking providers on the one side and scammers on the other – and we would see a) justice for current victims and b) a sharp reduction in future victims. This is the ideal.

I feel this ruling is a giant leap in the right direction and was very brave of the Ombudsman for doing it and Mr. N for pursuing it.

It is also good that the Police Authority are accepting the ruling and not challenging it in an appeal and having some judge overturn it as in Hughes v Royal London linked in the article above. Will it get challenged by other providers who find they negligently handed over pensions and have to compensate them? Who knows? I hope not or if it is, I hope any appeal by providers is not upheld!

Hundreds of victims should be preparing their own cases already and seeing the light at the end of a very long tunnel! I am looking forward to reading more such rulings against negligent providers who handed over pensions to scammers like sweets.

I think now is the time to mount a high-profile campaign against the widespread negligence, laziness and callousness of a wide range of ceding providers. This includes personal providers such as Standard Life, Prudential, Aviva and Scottish Widows, as well as occupational providers such as Royal Mail, Mercer, LGPS etc. Hopefully, organisations such as PASA http://www.pasa-uk.com/board/margaret-snowdon – who have given Royal Mail not just one but TWO awards for excellence – will bring pressure to bear and take these awards away if the providers don’t compensate their victims.

You are absolutely right Dave. Also, there were warnings well before Scorpion in 2013. The predecessor of the Pensions Regulator was OPRA and it was dishing out (albeit fairly limp) warnings many years ago – pre 2013. Also, HMRC was giving out stern warnings. I think we need to test some post 2013 complaints, and then move on to the pre-Scorpion cases.

I could be the next test case against my ceding provider – Mercer who have admitted in writing they didn’t do any checks nor did they send me the Scorpion Pack but instead sent it to the scammers and asked them to pass it on – seriously? – and I have that in writing also! One person on twitter has repeatedly said this was standard practice if there was a Letter of Authority (“LoA”) on file however I have two counters to that argument:-

a) The Ombudsman has already established the leaflet should be sent to members individually and failure to do so calls it maladministration but also believes third party administrators (TPA’s) should go further and engage in an open dialogue… and

b) I was in an open dialogue with Mercer BEFORE there was an LoA on file because I first enquired, in Jan 2015, IF I could use the new pension freedoms from within the scheme I was in – i.e.no intention of transferring out at that time, and Mercer said no and told me (in writing) I would have to transfer OUT. That was the IDEAL time to alert me to the dangers of falling into a scam – already established within the industry – and provide the Scorpion Campaign material to inform me of the dangers of being scammed should I then choose to transfer out. They did not give me any such warnings.

Furthermore, I have evidence that the LoA they subsequently received from the advisory firm seems fraudulent and should have been easily spotted by Mercer who after all are experts in an industry, that by then was well aware of the growing concerns from scams – the advising firm makes the claim on the LoA, dated Jan 2015, they were regulated by the Czech National Bank, but the CNB register shows they were not registered until May 5th 2015 – 4 months later. At the material time this was an untrue statement on the LoA that could have been easily checked by my ceding provider – they have admitted they did not. I hold this was yet further maladministration and I am confident the Ombudsman will agree.

My case against Mercer, I feel, is even more compelling than Mr. N’s.

Watch this space.

Part of the problem was that in many cases a “warning” was sent out by the ceding provider. But it was the “scorpion” warning and only talked about liberation. People who had no intention of liberating tended to disregard it as they thought it didn’t apply to them. And this was AFTER I had warned the Pensions Regulator about the weakness in the scorpion warnings (and was told to eff off by Andrew Warwick Thompson and his two lawyers).

Like Dave said earlier, trustees and TPA’s were not limited to Scorpion either before or after Feb 2013 and a key phrase in the Ombudsman’s ruling is “I consider that [the Authority] should have done more” and suggests they should have engaged in an open discussion to learn more about where the money was going. In my case Mercer could have asked why I was transferring to a QROP and informed me how “scams” have operated in the past by investing in UCIS’s once the money is offshore …. the education costs nothing but would have informed me I was walking into a possible scam. I got zero from mercer, not even the Scorpion warning or links to where I could find such information.

This “doing more” could be used not only to counter Mercer’s – and other’s – reliance on there not being legislation in place at the material time to do “anything” let alone more, but could also be used against TPA’s prior Feb 2013 who will rely on there being no “Scorpion” guidelines … it’s the “doing more” than just the minimum – which Mercer didn’t even do that – that leaves other cases open to very possible success.

I feel this ruling is basically telling providers it’s time to step up and own their duty of care, not just chant it like some mantra.

I transferred my police pension into Ark before 2013.

I wrote a letter of complaint to the police authority ( I think I used a template from Angie?) and they replied with a letter giving their reasons why they felt they were not liable.

I didn’t pursue it any further at the time but perhaps now could be the time.

We applied to the Pensions Ombudsman a couple of years ago to have pre-Scorpion complaints heard and we were turned down. But, now I think the time has come to revisit that refusal and have another crack at getting justice. Antony Arter, head of the Pensions Ombudsman, is an ex pensions lawyer with Eversheds. I think we should go to him and seek his acceptance of pre-Scorpion complaints. Will you be willing to be the lead case as the recent determination was also in respect of a police pension – transferred into a scam run by the same scammer who ran Ark two years earlier.

This is without doubt one cracking account of the scam Mr. N was a victim of and of the Landmark ruling by the Ombudsman. This paves the way for many victims who were failed by their providers that had not only a duty of care but also an obligation to the Pensions Regulator’s campaign (named Scorpion) to protect their members from the increasing number of pensions scams springing up like weeds.

I expect Angie, now to overwhelm the Ombudsman with dozens of similar cases that warrant the same ruling against negligent providers that failed in their duty of care and rely on the excuse “there was no legislative requirement to go the extra mile” (see Ombudsman ruling para 96).

There must be a shed load of providers shaking in their boots at the prospect victims will unleash a torrent of complaints against them! I will for one!

This is a cracking precedent and victims should heave a sigh of relief that finally the Ombudsman is on their side!

Carpe Diem!!!

There is light at the end of the tunnel!!!!

This is indeed very good news – and no reason at all why all 97 of the other London Quantum victims shouldn’t have their complaints upheld. Plus all victims of other scams – whether run by Stephen Ward or not.

Very good news indeed, outstanding work from everyone involved, particularly Mr N himself!

I have a couple of clients who transferred their pensions to another classic in the genre, the Henley Retirement Benefit Scheme. I’ve been looking at them for months trying to find some sort of way to get their money back- they’ve clearly been treated terribly, and at least now this may give us something to go at, where previously I just kept running up against brick walls.

The key points are that the ceding provider did nothing to make me aware of any potential issues. Scheme run by dormant employer and did not signpost or send me scorpion warning. If they had given me this information the decision would not have been in my favour. Good luck to others in seeking justice. I am working hard towards criminal action and a crown court case against “introducer” company scheduled for September. Happy to help others if I can.

Thanks Mr N – we are all very proud of you. I know how hard you worked to achieve this wonderful result – as well as how much it has cost you. Such a shame an innocent victim had to fight for so long for justice. Now all we want is to see the scammers behind bars and the world will be a safer place.

A criminal case against the introducer firm I assume is “Viva Costa International, an unregulated introducer of work to independent financial advisers” named in the above text?

However, this won’t do much to jail the architect of this and other scams – Stephen Ward.

I also believe the FCA should take action against Gerard Associates for categorising you as a “sophisticated” investor. There is a clear, unambiguous definition in the legislation of “sophisticated” and “High Net Worth” and consequently they should not have done so.

Any plans for these also?

Ward should not be hard to find. Here he is with his team next to the lady in the green dress at the front.

https://www.aesinternational.com/about/team

I think Ward is kind of busy right now – he has increased his luxury Florida villa portfolio from 6 to 10 and I think he spends quite a lot of his time out there enjoying a care-free life. After all “Ark is history” – and so are Capita Oak, Westminster, Evergreen, Southlands, Headforte, London Quantum and all the other scams he was running.

Here’s the issue. To maintain such a lifestyle the income has to continue flowing IN. You can’t maintain 10 Florida villas without money – and lots of it coming IN. I would argue “historic” scams are insufficient – you need current ones.

Therefore there HAS to be current ventures which bring in sufficient income to continue the lifestyle. The conclusion is obvious – MORE VICTIMS being created as we speak!

Where are they and how do we stop them? Not a dissimilar situation and question for Tweedledum & Tweedledee!

If we can frustrate “new/current” ventures the current costs of their lifestyle starts to bite when they can’t meet their bills! That’s what I think is causing Vilka to act so desperately to shut you up! https://pension-life.com/david-vilkas-vile-us-attorney/

Never heard a dickybird from that one-bit so-called attorney. He probably went back to his day job (emptying bins perchance?)

@Found Him. He seems to have done a runner, the photo has been changed. Good spot though, hope you kept the screenshot.