HMRC is reported to have collected a billion quid in APN tax demanded (Accelerated Payment Notice) in the past year. A figure of £2 billion is also reported in other Google searches according to other reports.

We are talking about over 1,000 different types of tax – er – “planning” schemes flogged by accountants and tax advisers. If the gentle reader wants to be picky, the actual number is 1,181. Should the gentle reader still want to be picky, tax planning is another term for tax avoidance. Which is legal – as opposed to evasion which is illegal – but HMRC still doesn’t like it.

When HMRC issues an APN (aka “demand”) the tax must be paid within 90 days without appeal. Challenges and appeals don’t have much effect and HMRC loves APNs because it allows them to collect the tax and ask questions later (or possibly never). APN recipients can get tax demands for crippling amounts and even face bankruptcy.

So how would a person know whether an avoidance scheme was likely to result in an APN tax demand? Most people rely on their accountant to advise them. If an accountant says “here’s a legal way to pay less tax – it will work, trust me I’m an accountant”, the client usually jumps at the opportunity. After all, what could possibly go wrong if one’s own accountant suggests it? The answer is, sadly, everything. Because at the end of the day, if HMRC decides to issue an APN, it is not the accountant who gets clobbered for the tax, it is the client.

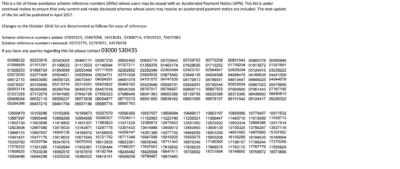

How would the client know if his accountant was giving him wrong advice?  He could try checking the HMRC website – but all he would get is a bewildering list of numbers rather than the names or descriptions of the avoidance schemes themselves. Sometimes the accountant isn’t even using a named scheme but rather relying on his own experience and expertise to use a strategy he thinks/believes/considers/hopes will work for his client without risk of challenge by HMRC.

He could try checking the HMRC website – but all he would get is a bewildering list of numbers rather than the names or descriptions of the avoidance schemes themselves. Sometimes the accountant isn’t even using a named scheme but rather relying on his own experience and expertise to use a strategy he thinks/believes/considers/hopes will work for his client without risk of challenge by HMRC.

So why am I going on about tax avoidance schemes? What has this got to with pension and investment scams? The answer is EVERYTHING. HMRC’s £1 billion (or £2 billion – take your pick) tax take from APNs – at the rate of 3,000 a month – is designed to plug loopholes exploited by taxpayers and their advisers. The “everything” bit is in the word “approved” – which is what the advisers tell their clients the tax avoidance scheme is. Tax avoidance schemes can be registered by HMRC. But that doesn’t make them safe or approved as they can be added to the naughty list at any time without either warning or explanation.

Similarly, many financial advisers (or chiringuitos masquerading as financial advisers) tell their clients that a pension scheme – such as an occupational scheme or a QROPS (or a ROPS, or an OPS, or a PS, or an S) – is HMRC “approved”. Of course, there is no such thing. Just because HMRC registers a scheme doesn’t mean it is safe and not a scam registered by a known serial scammer. In fact, all the big, high-viz pension scams were HMRC registered. It is, indeed, a curious thing that HMRC never thinks to ask any questions about the validity of a scheme – but then they are probably far too busy issuing APNs to do so.

Celebrities are particularly at risk of being sold high-risk – and ultimately highly expensive – tax avoidance schemes:

- Michael Caine, George Michael, Anne Robinson and Gary Barlow among 1,600 people who contributed £1.2 billion to the Liberty tax avoidance scheme: artificial losses created to reduce tax liabilities

- David Beckham, Wayne Rooney and Andrew Lloyd Webber among a group of people stung with a £520 million tax bill after investing in blockbuster films such as Life of Pi and The Girl with the Pearl Earring

- Gary Barlow (again) in the Icebreaker scheme involving intellectual property rights set up to make tax-deductible losses

- Chris Moyles and 450 other celebrities in the Working Wheels scheme – a car dealership which cranked up huge losses so the investors could claim tax against them

- Sven Goran Erickson and Alex Ferguson in the Eclipse 35 scheme

- Jimmy Carr among 1,100 participants in the K2 offshore loans scam run by Roy Lyness of Peak Performance

The term “offshore loans” will, of course, ring some very unpleasant bells for victims of pension scams such as Capita Oak who started receiving their tax demands in March 2017. The pension scheme was 100% invested in Store First store pods and the victims received “loans” (you know – the sort you never have to repay, nudge/wink) from Seychelles-based loan company: Thurlstone.

So, what a murky old World! Seems accountants and tax advisers can be just as bad as the rogue cohort of the financial and pension advice industry. Meanwhile, HMRC continues to crank the tax-take machine while the victims face financial ruin.