HOW DO PENSION SCAMS WORK?

HOW DO PENSION SCAMS WORK?

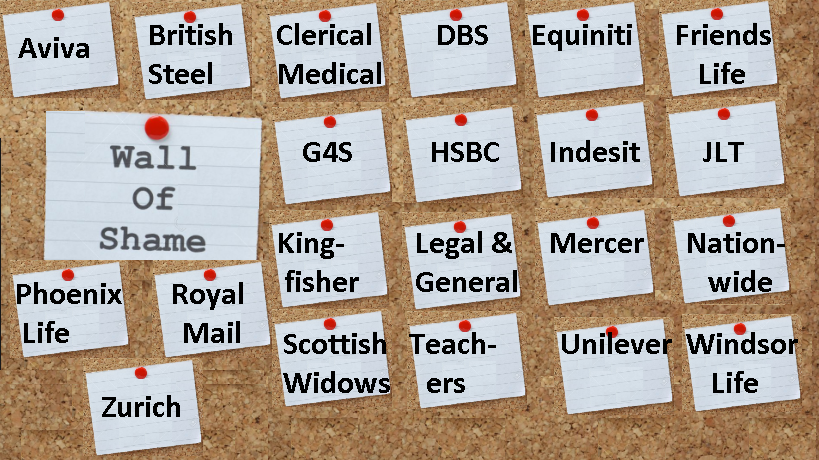

Every pension scam starts with a negligent transfer. Ceding providers hand over millions of pounds to pension scammers every year. Firms – from Aviva to Zurich – ignore warnings by regulators and HMRC. The providers tick their boxes; the scammers make their millions; the victims are ruined.

The ceding providers have something significant in common with the scammers. When we expose some of the scammers, their lawyers swing into action. I once had letters from Carter Ruck, Mishcon de Reya and DWF land on my desk all in one day. The scammers’ lawyers bleat loudly about their “poor” clients’ reputations.

Every pension scam starts with a negligent transfer

But the ceding providers are just as bad: their lawyers think it is fine to facilitate financial crime. Here’s an extract from recent letter from one of them:

“You state you have “hard evidence” that our customers “have suffered serious loss because of our negligence”. You

have not provided any such evidence. Please therefore produce such ‘hard evidence’ by return.”

This lawyer went on to request evidence that the provider ought to have known that the receiving scheme in

question was a scam. She went on to state that my allegations were “wholly unfounded” and to demand that I take down this blog:

PENSION OMBUDSMAN COMPLAINTS AGAINST NEGLIGENT CEDING TRUSTEES

But this pension provider has given me no reason to take the blog down – and no justification for the claim that the firm is “innocent” of handing over victims’ pensions to obvious scammers. Back in 2010, the Pensions Regulator warned providers about transferring pension funds to scams:

“Any administrator who simply ticks a box and allows a transfer post July 2010 is failing in their duty as a trustee and as such are liable to compensate the beneficiary.”

But the providers have studiously ignored the regulator’s warning for nine years. And thousands have lost their pensions as a result of this sickening negligence.

Transferring pensions to scammers

Here is an “A to Z” of the pensions industry’s negligence in handing over thousands of pensions in defiance of numerous warnings since 2010. Note: to my knowledge not a single administrator has voluntarily compensated their victims – and all have emphatically denied they did anything wrong.

Transferring pensions to scammers – the ABC of shame

Aviva: Second only to Aegon in our list of shame, Aviva transferred numerous pensions from October 2013 onwards. This was well after the Pensions Regulator’s “Scorpion” warning. The largest of these was £258,684.05 at the request of well-known scammer Stephen Ward of Premier Pension Solutions. Ward had been behind the £27 million Ark liberation scam in 2010. On 21st January 2015, Aviva’s Robert Palmer told me they needed no help or advice with avoiding negligent transfers to obvious scams. One month later, Aviva handed over £23,500 to the GFS scam.

British Steel: Long before the much-publicised handing over of multiple members to scammers in 2018, British Steel was handing over pensions to the Hong Kong GFS QROPS scam in 2014 . Mainly advised by serial scammer David Vilka of Square Mile International Financial Services in the Czech Republic, the GFS scam invested hundreds of victims’ funds in UCIS funds such as Blackmore Global.

Clerical Medical: Another disgraceful firm with a long history of handing over pensions to Ark, Capita Oak, Westminster and GFS in 2014.

This A to Z of shame goes on and on – and includes all the big names (who should have known better):

“You state you have “hard evidence” that our customers “have suffered serious loss because of our negligence”. You

have not provided any such evidence. Please therefore produce such ‘hard evidence’ by return … This lawyer went on to request evidence that the provider ought to have known that the receiving scheme in question was a scam”

I am disappointed with blood sucking lawyers. They don’t really “advise” their clients, they simply take down “dictation” and wrap it in legalese but the substance of what they say is, in essence, garbage.

We have seen litigation threats from lawyers representing the scammers, who for some unknown reason object to being called scammers! They consider it a defamation of their “unblemished” character – seriously? However the letters from the lawyers show absolutely zero due diligence and zero intellectual input. They often quote whatever their client tells them and never question it. The problem with this approach is the scammer – by nature – is a professional liar, using fraudulent misrepresentations to persuade innocent people to transfer their pensions into their own unregulated funds for their own enrichment. The blood sucking lawyers simply wrap those same misrepresentations in some other legalese and fire off a letter.

It is not rocket science for the ceding provider to realise that IF they ignore the Pensions Regulator’s requirement that they should do a little due diligence before granting a transfer, in order to discharge their legal responsibility for duty of care, then it is “negligence” when it turns out they handed over their member’s pension to a scammer.

The whole point of the Pensions Regulator’s requirements for this was to capitalise on the expertise of ceding providers to recognise the characteristics of a scam and alert their member of their concerns in the hope this would limit the scammers ability to get their grubby mits on the member’s pension. Utilising that expertise for the benefit of members was not expected to be onerous and for an expert it is easy to spot a scam. When I discovered I had been scammed, back in 2016, I called several regulated IFA’s for advice and assistance to get my pension back. In the first minute of the phone call many IFA’s said they thought I had been scammed and would most likely never see my pension again! They wouldn’t take on the job claiming they knew nothing about QROPS. However I did find one IFA who did take on the job and did help me.

This was the point of the Regulator’s requirement as far back as 2010, and more formally in 2013 and then legislatively in 2015. Now either the ceding providers are not training their staff adequately enough to spot a scam – which is negligence – or they are simply ignoring it when they spot it – which is also negligence. Whichever way you cut this cake – it is negligence. I complained to my provider that they failed to carry out due diligence in 2015 – two years after the Scorpion Campaign – and they replied they were under no legislative obligation to check the regulatory status of the adviser – David Vilka, mentioned above – and so their procedures did not include such checks. Now if that doesn’t sound like at best, contempt for the Scorpion Campaign and at worst out and out negligence, then what does? By the way, not only did my ceding provider admit to not doing any due diligence on the grounds there was no legislative requirement to do so, but sent the Scorpion material to the scammer and asked them to forward it on to me! Yep, I kid you not! No direct engagement with me whatsoever.

The provider’s mentioned in the blogs, whingeing they did no wrong must know whether they carried out due diligence or not on either the adviser to their member, or the receiving scheme? They don’t need Angie to provide the “hard evidence” before they realise they didn’t carry out their duty of care to their member as required by the Pensions Regulator.

The blood sucking lawyer quoted above, could ask their client if they carried out the required due diligence before transferring the pensions to a scam surely and then they wouldn’t need to ask Angie to provide “evidence” – they’d have it. The arguments would be much more intellectually challenging if the lawyer were to argue their client carried out the said due diligence, had “robust and compliant procedures” – to quote the Ombudsman in the case of PO-12763 – but instead they simply fire off useless letters and get paid an arm and a leg for them.

I really dislike lawyers, who will be first against the wall when the revolution comes, along with telephone sanitisers (for those that can remember them) – to quote Douglas Adams.

Following the Royal London case in 2015, ceding providers have no legal responsibility to carry out due diligence where the funds are being sent.

Although for a minor amount of transfer, £9k, the providers have been free reign to carry out their activities with no comeback. Sad but true.