Pension scams have been destroying lives for more than a decade. The scammers cause poverty, marriage breakdowns and even death. Death caused by stress-related illness. And death by suicide.

A typical pension scam involves an unlicensed person pretending to be a financial adviser. This is illegal. But it goes on all the time, in the UK and offshore.

All pension scams result in the loss of part or all of the pension. And, sometimes, crippling tax liabilities on top.

Most pension scams start with a pension transfer that should never have happened. And finish with investments which are unsuitable and risky.

One particular pension scam involved an unlicensed introducer called Terence Wright (i.e. a scammer posing as a financial adviser). Wright ran a business in Spain called CLP (Commercial Land and Property).

In 2012, Wright conned hundreds of victims into transferring their pensions into a Carey SIPPS (SIPPS stands for Self Invested Personal Pension Scheme). The sole purpose for these transfers was to invest the pension funds in assets which paid the highest commissions to Wright and the other scammers involved.

One of these victims, a lorry driver called Russell Adams, felt so strongly that he had been defrauded, that he took his case to the High Court. But, in the first round, he lost.

Undaunted by his defeat, Mr. Adams came back for round two, and – represented by Gerard McMeel QC – he won.

In the landmark High Court appeal ruling, the Adams v Carey case resulted in SIPP provider Carey being ordered to put things right. After the previous judge failed to give Mr. Adams the justice he deserved, a victory was obtained which should help prevent future pension scams.

In the appeal, the judge – Justice Andrews – ruled that the case involved:

“opportunities for unscrupulous entities to target the gullible”

She ordered Carey Pensions to refund Mr. Adams his pension. She mentioned “financial crime” and placed much of the blame squarely at the door of the unlicensed introducer – Terence Wright of CLP – who gave investment advice illegally.

The Adams v Carey case is likely to herald a flood of similar claims against pension providers like Carey. So let’s have the drains up on this case – and break down the main ingredients. Then we’ll see what lessons can be learned. And how similar pension scams could be avoided in the future.

SO HOW DO PENSION SCAMS WORK?

It all starts with HMRC.

A British pension scheme (whether a personal or occupational one) starts with an HMRC registration number. The good, the bad, the ugly – and the downright stinky – pension schemes are all registered by HMRC. And in the case of occupational schemes, by the Pensions Regulator as well.

HMRC makes no distinction between schemes set up for bona fide reasons, and those which are set up for scamming. HMRC doesn’t care – and anyway they say that consumer protection isn’t their responsibility.

WHAT IS A PENSION SCHEME?

A pension scheme is just a wrapper – like a cardboard box or a paper bag. On its own, a pension scheme can’t do any harm. Try looking at an empty cardboard box for a moment and ask yourself how much damage it could do. Watch it carefully – and see if you can spot it doing anything dangerous or sinister. I reckon that however closely you watch it, nothing untoward will happen (although your cat might curl up inside it and take a nap).

Remember that it isn’t the box itself that could be dangerous, but the people handling it and

putting things inside it. An empty box could become a delightful xmas present if filled with mince pies and chocolate. Or, if filled with dynamite and nails, it could become a deadly bomb which could kill and maim hundreds of people.

Whether a pension scheme is a personal or occupational pension, a SIPP, a SSAS, a QROPS

or a QNUPS, it is just an empty wrapper. A harmless container which can be used responsibly

by good people, or recklessly and even maliciously by bad people.

The lesson is that the cardboard box itself doesn’t do the damage – it is the people who handle it.

The Adams v Carey case will inevitably be a turning point for the pension industry – both in the UK and offshore. There will now be a big question mark over the word “self” in the phrase “self invested”. This phrase may have to be upgraded to “sort of self invested”. This is because the successful appeal makes it clear there is still a duty by the trustee to make sure nothing happens to pension funds which is clearly bonkers.

Mr. Adams was one of 580 Carey SIPP members who were all invested solely in store pods in the space of one year. And none of them had a licensed financial adviser. To put this into context, nearly 50 people a month transferred their pensions into a Carey SIPP and voluntarily invested the whole lot in store pods.

A reasonable person might ask why Carey didn’t ask themselves why there was this sudden stampede coming out of the blue? Why so many people wanted to invest their entire pension funds into the same illiquid property asset? Why so many different people were advised and represented by an unlicensed introducer in Spain?

Perhaps after the first month, Carey might have raised a bit of an eyebrow. After the second and third months, Carey’s CEO Christine Hallett might have decided to question whether Terence Wright of CLP in Spain was a suitable person to advise so many different people to invest in the exact same asset.

But she didn’t. She let the torrent of victims of Terence Wright’s unlicensed “advice” continue unchecked. Hallett is described on her LinkedIn profile as:

“one of the country’s most knowledgeable experts in the SIPP world and a highly respected leader in the financial services industry”

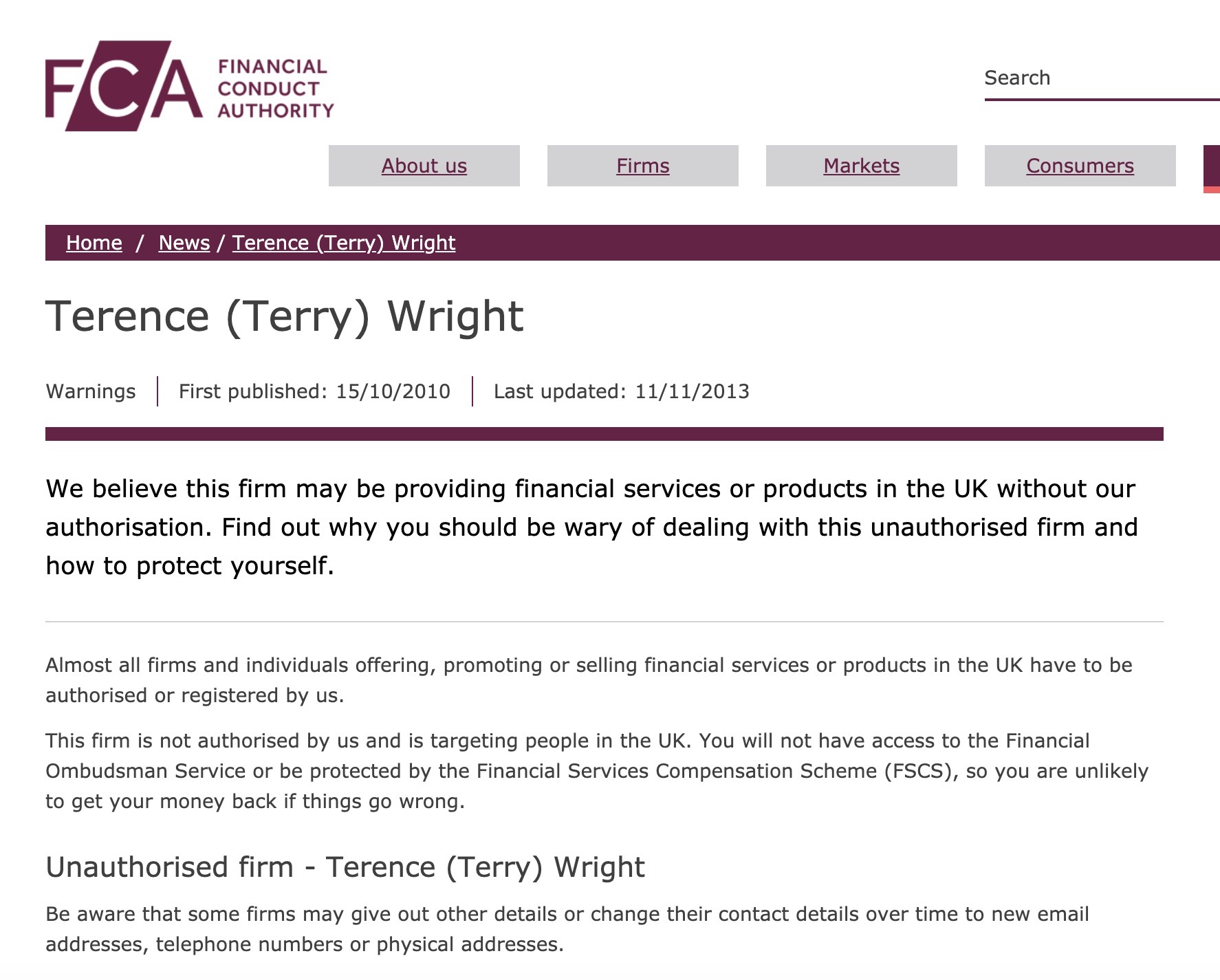

And yet she didn’t check the FCA website to see whether Terence Wright was legit. Had she done so, she would have found a clear warning that he was providing financial advice without a license. And that is a criminal offence.

Terence Wright was involved in both the pension transfer process and the investment process. And yet he had no qualifications or license to do either – and there was a clear FCA warning against him.

The ordinary man in the street may routinely check their emails, Facebook and Twitter, but would be unlikely to check the FCA website. However, a “highly respected leader in the financial services industry” ought to have checked the FCA website as routinely as any normal person would check their social media.

The Carey “Key Features” document stated that the member was responsible for investment decisions. And that is where the “self” bit comes from in “Self Invested Personal Pension”. But Carey also recommended that a suitably-qualified adviser ought to be used – to make sure that the pension transfer was in their best interests.

There is nothing wrong with having some illiquid commercial property in a pension portfolio. But the key to all investment decisions is “diversity” and not putting all one’s eggs in one basket (or cardboard box – or indeed pension wrapper). Had Russell Adams been advised by a proper, qualified, licensed adviser, he would have been warned against investing his whole fund in any one asset. To put everything into one single investment is always high risk and irresponsible – no matter how solid and safe the asset may be.

To be fair to Carey, they did eventually sever terms of business with CLP. But for some extraordinary reason they still acted on CLP’s investment recommendations until eventually deciding they were no longer suitable in April 2013 – nearly a year later.

The appeal judgement concluded that the Carey SIPP was recommended by Terence Wright solely for the purpose of investing in the store pods (and the accompanying introducer commissions). And that all the “advice” given by CLP was part of an inextricably-linked bundle of transactions which included the transfer and the investment.

This “bundle” of advice consisted of the transfer out of the original pension scheme; the transfer into the Carey SIPP; the investments (in the store pods). And the whole kit and caboodle was in contravention of article 53 of the FCA regulations.

Carey’s own documentation admitted that investments of less than £50k in a Full SIPP were not economically viable. This should have alerted Carey itself to the fact that many of the 580 people advised by CLP would inevitably suffer from disproportionately high fees.

The judges in Russel Adams’ case summarised the reasons for allowing the appeal:

i) Dealing with an unregulated intermediary

ii) Admitting an asset which could not be valued

iii) Proceeding with the store pod investment despite concerns in May 2012

Carey, now called Options, may come back for round 3 if they are given leave to appeal this judgement. Whether they are allowed to do this or not, this leaves the pension industry with a 100% crystal-clear message:

DO NOT DEAL WITH UNLICENSED INTRODUCERS

Most of the things that have gone wrong, in the past decade, are because of advice given by unscrupulous, unqualified, unlicensed “introducers”. And their mission is clear: to encourage victims to do what earns the introducer the most money – even though it will inevitably cause loss and damage to the victim.

The pensions industry worldwide must now get behind a coherent and determined campaign to stamp out the scourge of the unlicensed introducer. Confidence needs to be rebuilt in British and overseas pensions. And that can only be done by outlawing the rogues and scammers who have done so much damage to so many thousands of victims.

It is, indeed, ironic that Terence Wright of CLP was operating from Spain – the capital of the world of pension and investment scams. He was able to ruin UK-residents’ lives all the way from the Costa del Sol. He was given access to a harmless pension wrapper, and managed to transfer hundreds of pensions which should have been left where they were.

But the real story is that Terence Wright and his wife Lesley made a fortune out of scamming Russel Adams and hundreds of other victims. And he is still at it from his new luxury home in France: a stunning mansion in the Dordogne region of France:

https://www.theolivepress.es/spain-news/2013/04/17/terry-wrights-great-escape-from-spain/

With his own private plane and stables for his wife Lesley’s collection of horses, he now lives a life of luxury and commutes to Dubai to pursue his lucrative “business” activities.

This is what is so sad and disgusting about all the scammers behind the many hundreds of pension and investment frauds this past decade or so. They reap eye-watering rewards. Despite a few limp attempts by the SFO to bring scammers to justice they rarely face jail sentences.

I have a comment but it is more the length of a blog – do you want it as a comment or publish it as a “guest” blog post?

Finally, after 2 months of radio silence, Angie Brooks once again pens an article! It’s about time!

It’s an interesting title.

I care. I don’t know why I should but I do. Maybe because I am seeing a media frenzy over the recent collapse of mini bonds in the UK (especially LC&F and Blackmore Bonds plc to name just two) while victims of pension scams from the last decade are being forgotten, swept under the carpet – much to the delight of many of those that oiled the wheels of the scams and helped them to happen – especially the QROPS and SIPPS!

There are many (especially the scammers) that really don’t like me – which is why they tried to offer me a paltry £6000 to silence me! Seriously?

There are many that don’t like my rhetoric and I regularly get blocked on twitter, or thrown off Facebook! Here, I get to tell it like it is, however unpalatable the truth may be.

What I have learned over the years is there’s an intricate web, woven around these scams, that interconnects a number of players whose names just keep cropping up. Moreover, there appears to be a disproportionate connection to Malta and STM always seems to crop up sooner or later.

In my opinion, Malta has much to answer for and really should clean up its act. Journalists rarely focus their gaze on the real facilitators of pension scams – the Mickey Mouse jurisdictions that turn a blind eye and allow it on their patch.

Malta was clearly the jurisdiction of choice for many pension scams and seems to have hundreds, if not thousands of victims, many of whom are not yet even aware they face financial ruin in their retirement.

Why are they not aware?

Because the Scheme Administrators (QROPS) are sending out fictitious statements implying member’s pensions are still intact! One member of STM Pensions Malta was sent a statement in Sep 2020 showing his pension still intact just one month after STM wrote to members invested in Blackmore Global – Nunn & McCreesh’s offshore unregulated collective – that in fact they (STM) have no idea what the value is! This in istelf is shocking and the MFSA should really sort this out or is it planning to be as ineffective as our own FCA are proving to be time and time again?

As it happens, STM did manage to get Nunn & McCreesh to publish the underlying assets for Blackmore Global, in May 2020 (over 6 years since the fund was launched) and even with this list, there is little idea what the fund is worth because the underlying assets are themselves useless, opaque, private ventures in yet more Mickey Mouse jurisdictions and one offshore fund is already being pursued by Dalriada as part of other failed pension schemes from early in the last decade but Dalriada are getting nowhere with it!

I am not convinced that “The Adams v Carey case is likely to herald a flood of similar claims …”.

The Ombudsman case that went in favour of Mr. N against the Northumbria Police Authority (PO-12763 https://www.pensions-ombudsman.org.uk/sites/default/files/decisions/PO-12763.pdf) in July 2018, was also a landmark case against a negligent UK pension provider that had a tick box culture and transferred Mr. N’s pension without due regard for the Pensions Regulator’s requirements of 2013 for extra due diligence when handling transfers.

That decision doesn’t appear to have “herald[ed] a [likewise] flood of similar claims.” three years on.

Also, the landmark appeal, Khuller v First International Trustees Ltd (Guernsey) (“FNBIT”)

(https://www.guernseylegalresources.gg/CHttpHandler.ashx?documentid=81456 ) that was won by Manita Khuller, hasn’t seen any likewise “flood of similar” cases.

Why not?

The reason, in my opinion, is twofold.

Firstly, the victims were targetted by scammers because they were “ignorant”. That’s not meant to be derogatory.

They knew didly squat about pensions, regulations, investments – nothing! They trusted the “[mis-]adviser” – the con man persuading them to transfer their pension. For a con to be successful you need the essential skill of gaining people’s trust. Scammers have this skill in abumdance! The ignorant fall for it every time!

Victims not only knew zip about pensions and investments, they didn’t even know how to spot they were being conned! They were the perfect mark for scammers. They didn’t know what they didn’t know. Like taking candy from a baby – although a baby knows it is being robbed and often screams quite loudly, so maybe not the best analogy!

Secondly, even if victims have now discovered they have lost their pension, they have absolutely no idea what next to do about it. The ones I have come across are like fish out of water. Completely at a loss of where to go!

On Angie’s facebook group, one person recently told of their father’s loss of pension to Nunn & McCreesh’s Blackmore Global. In an attempt to do “something” the person went to the FCA on behalf of their father only to be told that investing in unregulated funds on the advice of unregulated advisers bars them from the compensation scheme and Ombudsman service. The FCA suggested looking into the Malta compensation scheme – which is a joke! That was the extent of help from the FCA. As useful as a chocolate teapot!

It hadn’t occurred to this person that either the ceding provider is guilty of maladministration for the transfer in the first place, AND/OR the receiving scheme in Malta is in “breach of trust” because it too is bound by legislation controlling its activities.

So the best next step is to pursue one or other side of the transfer – or both!

Manita Khuller (referenced above) went after the receiving trustee through the courts and eventually won. However, such legal action is not for the faint hearted. It cost her huge sums of money, which she took out loans to fund, and losing was definitely not an option, on top of already losing her pension! It was a nightmare for her – I know I was with her every step of the way since early 2018 when we were introduced to each other by a journalist! But this course of action was her only option because the Mickey Mouse jurisdiction, Guernsey, had no “Ombudsman” service. Moreover, the incestuous nature in Guernsey meant law firms declined to represent her and she had to go it alone for the first trial, adding a layer of stress no person should be subjected to! There are very few victims with this determination or courage to take this course of action – so they don’t, even though she has paved the way.

We in the UK, at least have the Ombudsman and now, relatively recently, Malta also has one, called the Office of the Arbiter for Financial Services (“OAFS”).

Guernsey however is a backward, biased, Mickey Mouse, incestuous jurisdiction – which is why scammers love it.

The Scheme administrators on both sides of the transfer will fight tooth and nail and argue the victim is wholly to blame for their losses and many victims just have no idea how to go about presenting their case.

There is no “free” professional service available to help victims navigate this minefield. Mr. N (referenced earlier) paid lawyers £25k to make his case but the Ombudsman did not award costs saying that it is not necessary to engage lawyers. However, it is not easy to fight a pension scheme that will employ a top notch law firm to present its defence! So by and large, the victims I have come across are at a serious disadvantage because they have no idea how to seek justice and have nowhere to go and don’t know how to present their case. That’s why they were targetted by scammers in the first place. They were (and still are) easy pickings.

In the article above, Ms. Brooks’ quoted from the appeal. I will do same.

A more appropriate section, §115(i), “… while consumers can to an extent be expected to bear responsibility for their own decisions, there is a need for regulation, among other things to safeguard consumers from their own folly.”

These victims are indeed victims of their own folly, but they never realised what they were doing. On both sides of the equation (ceding providers and the receiving schemes) there were duties of care designed to protect these victims “from their own folly”. In all cases I have come across, neither side fulfilled those duties of care. On the UK side there was contempt for the Pensions Regulator’s requirements of 2013, despite growing industry concerns for pension scams and on the receiving side, the QROPS didn’t (and still don’t) care less about their members – period – and neither did the authorities in these Mickey Mouse jurisdictions. It was the perfect match and thousands of vulnerable victims are paying the price.

Carey Pensions was started in 2009 by the Carey Group. The Group is controlled in Guernsey by ten partners and ex-partners of the Law Firm Carey Olsen. This is an amusing coincidence in my opinion. Carey Olsen, perhaps the top law firm in Guernsey, represented FNBIT against Manita Khuller – and LOST at appeal by the way!

STM acquired Carey Pensions in 2019 ( https://www.stmgroupplc.com/media/media/130219 ).

STM also had/has victims of the Trafalgar Multi Asset Fund scam which collapsed in 2016 ( https://www.internationalinvestment.net/internationalinvestment/news/3505179/qrops-clients-reported-devastated-suspended-trafalgar-fund-news )

STM announced its purchase of Harbour Pensions https://www.stmgroupplc.com/media/media/131117c with some 1600 members. Some are invested in Blackmore Global! At least one was invested in The Resort Group according to this money maketing article: https://www.moneymarketing.co.uk/news/ifa-warns-of-db-transfers-to-illiquid-investments-danger/

Harbour Pensions was started by Justin Caffery, in 2013 and says in the STM announcement, “Harbour was always a five year plan…”. Justin made his money and now runs meditation classes (seriously?): https://www.justincaffrey.com/ He should meditate on the misery, caused by Nunn & McCreesh, of hundreds if not thousands of vulnerable victims of Blackmore Global that he allowed into his pension scheme, in my opinion, willingly and knowing the consequences of such an unsuitable investment. He permitted 100% allocation of one member’s pension into a fund that has never published audited accounts. At the material time, knowing the fund was opaque and unregulated, Harbour (and other QROPS) were happily permitting transfers and 100% allocations.

The fund’s offer document, which Harbour had, says the investment has a ten year lock-in. That condition, which the QROPS knew and willingly accepted, effectively locked Harbour (and subsequently STM) into an asset they knew nothing about – and still don’t – for ten years, with absolutely no knowledge or control of what Nunn & McCreesh were doing with the money! The Scheme administrator’s in these QROPS in Malta were and still are completely at the whim of Nunn & McCreesh who could misappropriate the pensions as they wish and the administrators could do absolutely nothing about it. The QROPS effectively abdicated all powers they had to run the scheme and mitigate risks in the interest of members, to Nunn & McCreesh and have been passive bystanders to the destruction of their member’s pensions ever since. This is, in my opinion, in breach of the Malta Trust and Trustees Act. In my opinion, they are all willingly and knowingly in breach of trust.

All this really begs the question whether STM go looking for dodgy pension schemes or are they just plain stupid? What on earth is going on and why hasn’t the MFSA taken them to task? They seem to attract scams like flies to a pile of dung!

These victims are being forgotten by the media and authorities. These victims had no idea what they were doing and have no idea how to seek restitution. They are guilty of nothing but ignorance and ALL the actors in these scams have gotten away with it. They have ALL dipped their hand in the pension pots and kept the spoils and now moved on leaving the pension pots empty.

This is frustrating in the extreme because I see no evidence of any “flood of similar claims”. The victims are, for the most part, still ignorant and there is no one “helping” them! This site once purported to “help” victims but I am not at all convinced it has done much and now has long periods of radio silence, seemingly doing even less. The newbies in this scam space, the journalists claiming to be the heroes that “blew the whistle” or warned the FCA – blah blah blah, are just chasing big headlines for their editor on today’s flavour of the month – mini bonds. Soon the mini bond victims will be forgotten just like the victims of Defined Benefit Pension transfers, and the blood sucking journalists will move on to the next headline! I have no time for these insincere upstarts because they don’t stay in it for the long haul.

Victims are on their own by and large and still ignorant. No one seems to care and there is no help from any quarter. They face a retirement with a significantly reduced standard of living and that’s the hard truth of the matter. There will be no “flood of similar cases”.

I havent heard a better description of the Guetnsey system. I assume youre being nice.

We followed the Manita Khuller judgment as we were in a Guernsey court around the same time. Due to tardiness of judges we had to apply for a second hearing. 4 years and two hearings and a he’ll of a lot of money. The same judge had overseen all the preliminary hearings as well as the two big hearings. We have present damning evidence of serious breaches in two hearings and discussions seemed to avoid it. We don’t know if we can even trust the police with what we have. It’s true that people don’t know where to start.

It’s true people don’t know they’ve been scammed. Their families find put after the person has died.

Guernsey has all the handbooks and regulations in place but nobody seems to want to use them.

The ombudsman is a bully more intent on intimidating those who complain about pension companies. The pension providers go on personal attacks and the courts don’t seem to mind.

Guernsey is a lovely place but the financial services is dirty.

There is a good reason why HMRC removed Guernsey from the QROPS list – as they saw evidence that pensions were being routinely abused and that would have included pension liberation and all sorts of other non compliance. Guernsey has earned its soiled reputation since the regulator, ombudsman and courts have made it clear they will do everything in their power to deny any complaints against Guernsey-based companies and stop wronged-consumers from achieving justice and redress. However, to be honest, Ireland is even worse. They will only accept complaints from Irish residents, and the Irish authorities deem the scammers to be the consumers rather than the scamees (victims).