Woodford Equity Income Fund – perhaps a wonderful opportunity to get investment management and advice right at last?

There is a huge difference between an investment scam and a fund which is in trouble because of an error of judgement (as pointed out by Stephen Sefton – an expert on pension and investment scams as he, himself, has been a victim). But, is this a case of the Woodford Income Equity Fund being the right investment but for the wrong investors?

But the trouble is that both scams and troubled/suspended funds have the same effect on investors: loss (and stress and – sometimes – suicide).

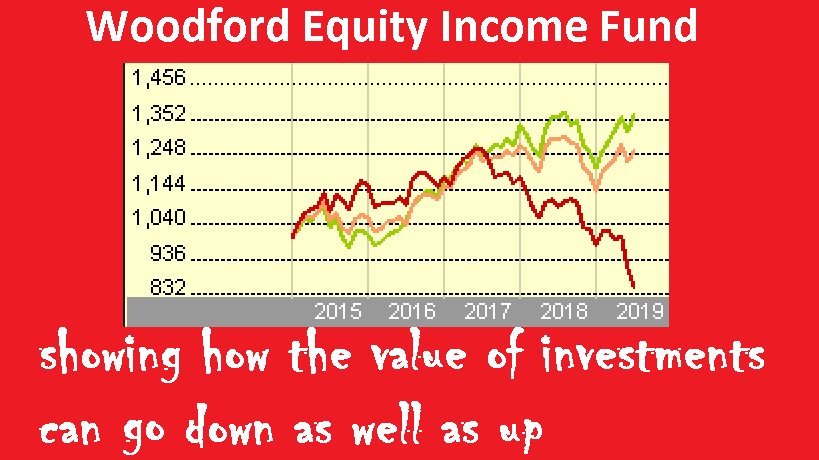

Woodford’s “flagship” fund – Woodford Equity Income – was suspended in June 2019 after a raft of poor performance figures and dropped from £10b to £3.7b after a mass exodus by spooked investors. There had been problems with liquidity and risk (same old same old) plus some investors being too heavily exposed to the fund. But whatever the causes of the catastrophe, Woodford is still charging management fees of £65,000 per day. And this is not popular with angry investors.

But who invested in this fund – and why? One investor was Kent County Council which invested £263 million in the Woodford fund. And we are right back where we started: pension funds being wrongly used for socking great investments without regard to due diversity. So the question remains: “why”? The Woodford holding represents 4% of the £6.4 billion Kent County Council superannuation fund – but who made the investment decision? Somebody was responsible for this transaction and actually transferred the money from the pension scheme into the fund. Surely this person or party should be brought to account? (Or shot).

There is always room for risky, illiquid investments on the planet. Without them, nothing – no venture or initiative – would ever get off the ground. But such funds have no place in a pension fund since pensions must – by definition – be low risk, diverse and liquid.

While Neil Woodford is busy laying off staff and remodeling his business to service a smaller number of investors, let’s reflect on how and why this catastrophe happened. More than 133,000 investors came from Hargreaves Lansdown clients who have put £1.1 billion in the Woodford Equity Income fund. So why was Hargreaves Lansdown promoting the fund to their clients? How much did they earn from it? Why was the fund listed on the Hargreaves Lansdown so-called “Wealth 50 Best Buy” list?

For how long after they knew the Woodford fund was in trouble did Hargreaves Lansdown continue to promote the Equity Income Fund?

Investors can now transfer their holdings in the Woodford fund away from Hargreaves Lansdown to other platforms – although this still doesn’t get them their money back. The fund suspension is not likely to be lifted until August 2019 and nobody knows whether investors will then get all or some of their money out. Whatever the outcome, it will have left thousands of investors severely distressed and reluctant to trust either stockbrokers or fund managers. Certainly, Hargreaves Lansdown will never recover since it is clear they don’t understand investments (and don’t care about their clients). Hopefully, the FCA will stay awake long enough to sanction Hargreaves Lansdown and stop them from pointing investors in the wrong direction ever again.

We must not, of course, compare the Woodford fund with well-known investment scams such as Blackmore Global, Trafalgar Multi-Asset Fund, LC&F, Axiom, LM, Dolphin Trust (German Property Group), eucalyptus plantations, truffle tree forests and commodities/assets such as flats in Cape Verde, student accommodation, chia seeds, “fine” wines and other assorted crap. The scammers who run and promote these funds never stick around to clean up the mess – or lift a finger to try to put things right when the funds collapse. By contrast, Neil Woodford is working hard to resolve matters and intends to rescue his tarnished reputation. Unlike the scammers, Woodford does at least have balls.

I am going to stick my neck out and make some bold predictions:

- The suspension of the Woodford Equity Income Fund is a good thing because it will encourage the FCA to clean up its act; stop greedy parasites such as Hargreaves Lansdown from misleading investors; steer pension funds away from inappropriate investments.

- The Woodford fund will recover; the issues of liquidity and risk will be addressed successfully; some die-hard, hard-core investors will stick with it and be rewarded for their tenacity and loyalty. The fund will go from strength to strength and prove all the naysayers wrong.

- Neil Woodford will turn into a magic fairy and champion the cause of investment scam victims.

- He will pioneer a system of warning labels for investments to help steer investors away from the wrong funds and towards the right funds.

I guarantee my predictions will either turn out to be right or wrong. But the lesson that must be learned from this is that only one thing matters: suitability.

Those investors who were happy to take the risk and knew what the underlying assets of the fund were, will not be upset. They will have known that the value of investments can go in both directions, and will have factored this in to their financial plans. But those who were blinded by Hargreaves Lansdown’s misleading promotion – as well as those in the Kent County Council pension scheme – will be rightly furious.

Wrong investors sure, since they were clueless what they were buying, but also wrong investments.

IMO illiquid investments have no place in an income fund (except property where it’s obviously unavoidable. )

Arguably they also have no place in an open ended fund either since a run, for whatever reason, can lead to obvious “vicious circle” issues. WPCT is full of much of the same rubbish as WEIF but there’s been no need to suspend it, people are free to take advantage view on the NAV and some of its outlandish constituents.

I can’t see how the gate will ever be removed, because when they do there will be a run on it and they will be back where they started with too higha % of illiquid rubbish no one else will buy. they will have to shut it down and liquidate it,

Oops that should be “take a view not “take advantage view”