Phillip Nunn has been reported to Action Fraud – which John Ferguson of Square Mile Financial Services describes as being “nobody and with no authority” – on numerous occasions by victims of various scams.

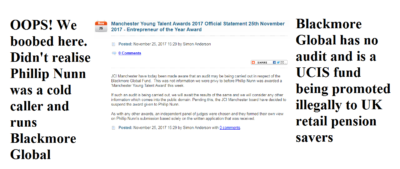

Phillip Nunn, cold caller and “fund manager” of the Blackmore Global investment scam, was given the Entrepreneur of the Year Award by JCI Manchester, but this was reversed shortly afterwards:

“JCI Manchester have today been made aware that an audit may be being carried out in respect of the Blackmore Global Fund. This was not information we were privy to before Phillip Nunn was awarded a ‘Manchester Young Talent Award’ this week.

If such an audit is being carried out, we will await the results of the same and we will consider any other information which comes into the public domain. Pending this, the JCI Manchester board have decided to suspend the award given to Phillip Nunn.”

“An independent panel of judges formed their own view on Phillip Nunn’s submission based solely on the written application received.”

I would love to read Phillip Nunn’s submission. It would certainly make very interesting reading. I doubt it would have included the fact that Nunn and his accomplice Patrick McCreesh were cold callers and lead generators in the Capita Oak/Henley Retirement Benefits/multiple SIPPS/Store First scam – which led to well over 1,000 victims losing over £120 million worth of pensions.

The Insolvency Service produced a witness statement which stated:

“Members of CAPITA OAK indicated they were initially contacted by Craig Mason or Patrick McCreesh of Nunn McCreesh of Its Your Pension Ltd and offered pension review services prior to them being referred to JACKSON FRANCIS or Sycamore for the transfer of their pension to CAPITA OAK.

On 3.3.15 I received an undated letter in which it was stated that Its Your Pension had not traded and was a dormant company and that Nunn McCreesh had traded as an insurance brokerage between 2009 and 2012 when they entered into a verbal arrangement with TRANSEURO where in return for providing pension leads to JACKSON FRANCIS they received a commission from TRANSEURO.

Nunn McCreesh provided JACKSON FRANCIS with 100-200 leads per month which were provided by email and/or telephone for which they received £899,829.86 from TRANSEURO during the period 26.3.12 to 14.5.14.”

Phillip Nunn’s lawyers, Slater and Gordon (funny that, also nominated for an award) tried to claim that Nunn McCreesh’s involvement in the Capita Oak scam was “minimal”. But I wouldn’t describe generating 5,000 leads, cold calling thousands of victims and being paid nearly £900k “minimal”.

On the subject of Slater and Gordon, earlier this year they threatened me with defamation proceedings for exposing Nunn’s scamtivities. It was curious that they couldn’t see any conflict of interest in representing Phillip Nunn when they were also representing the very victims (of Capita Oak) whom he had cold called in the first place.

Slater and Gordon’s Steve Kunziewicz claimed that “Blackmore Global is a prestigious, multi-asset investment house with over £60 million in assets under management, offering institutional and high net-worth clients access to a wide variety of investment products in order to maximise their returns.”

But there is no audit for Blackmore Global and only evidence suggesting the fund is invested in toxic, high-risk, illiquid crap including:

Swan Holding PCC

Kingston Capital Partners (Belize private equity vehicle controlled by Nunn & McCreesh)

GRRE Invest

Spinaris 90 ( UK sports spread betting)

The Blackmore Global audit was promised more than a year ago but never materialised. The audit has now been promised “by the end of the year” – but Grant Thornton won’t specify which year.

However, far from the Blackmore Global fund being aimed at “institutional and high net worth clients”, Phillip Nunn targets low-risk pension savers using a variety of unregulated so-called “advisers” such as David Vilka of Square Mile Financial Services. Many of the Blackmore Global victims were cold-called and/or introduced by Phillip Nunn’s cold-calling outfit, Aspinall Chase. Some were transferred to Maltese QROPS run by Integrated Capabilities and Harbour (now taken over by STM) and to Hong Kong.

Blackmore Global is a UCIS fund – unregulated collective investment scheme. And it is illegal to promote these to UK retail investors as this was banned by the FCA in 2014.

I doubt the other nominees and award recipients will appreciate having been listed alongside Phillip Nunn who has a history of promoting other scammers’ pension scams and is now running one himself. Perhaps JCI Manchester ought to vet candidates for the Manchester Young Talent Awards more carefully in the future.

Not only is it unlawful to promote Unregulated Collectives to retail clients (FSMA 2000 s.238) but operating a collective in the first place is a regulated activity and a criminal offence to set one up and operate one when not authorised by the FCA (FSMA 2000 s.19 & 23). It is not difficult to show Blackmore Global, whilst a Closed-Ended Investment as a legal entity domiciled in IoM, in susbtance it is operating as a collective. With reference to the appeal case of FCA vs Capital Alternatives in 2015, Lord Justice Vos concluded that it is the substance and not the form that counts and concluded in the case of Capital Alternatives they were a collective by showing the conditions for a collective defined in FSMA 2000 s.235 were met. Any two-bit lawyer (even Kunziewicz) could easily conclude Blackmore Global operates as a collective using FSMA 2000 s.235 in exactly the same manner as Lord Vos. And what are the FCA doing about it even though I alerted them to this in 2016? Nothing!

Whilst Nunn & McCreesh claim they do not “invite” retail clients to invest in Blackmore Global, they are the directors of both Aspinal Chase & Pensions & Life UK Ltd. that together carried out the end to end process of transferring my pension – even to the point of providing a pre-filled application form with Blackmore Global specified as the investment – to an offshore QROP (Optimus Retirement Benefit Scheme No.1) managed by Optimus Pensions Administration Ltd on behalf of a Maltese Trustee, Integrated Capabilities Ltd, 75% of which was subsequently invested in their own fund. By the way, in 2015, Integrated Capabilities took on c.100 new members per month so it begs the question just how many people have been mis-advised to transfer their pension into Blackmore Global or other unregulated funds?

So whilst Nunn & McCreesh may well feel they can always point to David Vilka (a director of Square Mile and unregulated to give investment advice) as the person who invited me to participate in the unregulated collective, in contravention of FSMA 2000 s.238, they were, in fact, “knowingly concerned” in the contravention of s.238.

Section 382 (d) of FSMA enables the court to require persons who have contravened the Act, or been knowingly concerned in a contravention, to make appropriate restitution to investors who have suffered loss.

The Authorities however, in all jurisdictions that I have complained to, just do not give a sh1t about the activities of Nunn & McCreesh nor Square Mile. However, it seems, Nunn is deemed worthy of “Entrepreneur of the year” and Blackmore Global were held up as a stalwart of society by the Manchester Evening news – which has got to be the worst case of journalism I have ever seen – even though the newspaper seems to have removed the articles it published. My advice to the journalist of the Manchester Evening News is, be a real journalist, turn over some stones, see what crawls out and you will have a serious front page scoop!

Phillip Nunn is a massive scammer. Have you seen, they filed a lawsuit and got this post redacted from Google?

Dangerous, they are able to bully Google to removing these articles. Did you just loose a lot of traffic? You probably did.

Look at this, they keep all the DMCA notices that people fill:

https://lumendatabase.org/notices/15945293#

These are all the websites Phillip Nunn and his goons were able to delete of the web. We can’t let this go on. Please if you have other websites that can post this article that would really help, we can’t let him get away with this. I have read the articles where his company the Blackmore Group paid of people to keep their mouth shut.

Scammers have no place in the free internet and the information is crucial for people that cross path with this guy. I can also see that many of the newspapers have removed the articles they published, I wonder if they were bullied to remove it by lawyers. I am happy to see that your article about Phillip Nunn and Blackmore is still here, you should also do one about Wealthchain.

Keep up, try to get your website listed again for the keyword Phillip Nunn.

I hope you post this comment and the reason I am using his own name and businesses such as Wealthchain is so that this becomes visible again but for new keywords relating to Phillip Nunn.

Please continue writing similar articles about this crook but on other websites. We need to warn everybody about him.

Yes enrolled by Aspinal chase .Told I could get my pension anytime .Later find out Global had locked me in a 10 year scheme .Now I hear they have gone bust .Can I retrieve my money ?

Are you in a QROPS?

They are all part of these scam platforms, we were a group of people who had to file reports to Westinghousef.com who helped to recoup all of our investments we could not be more thankful.