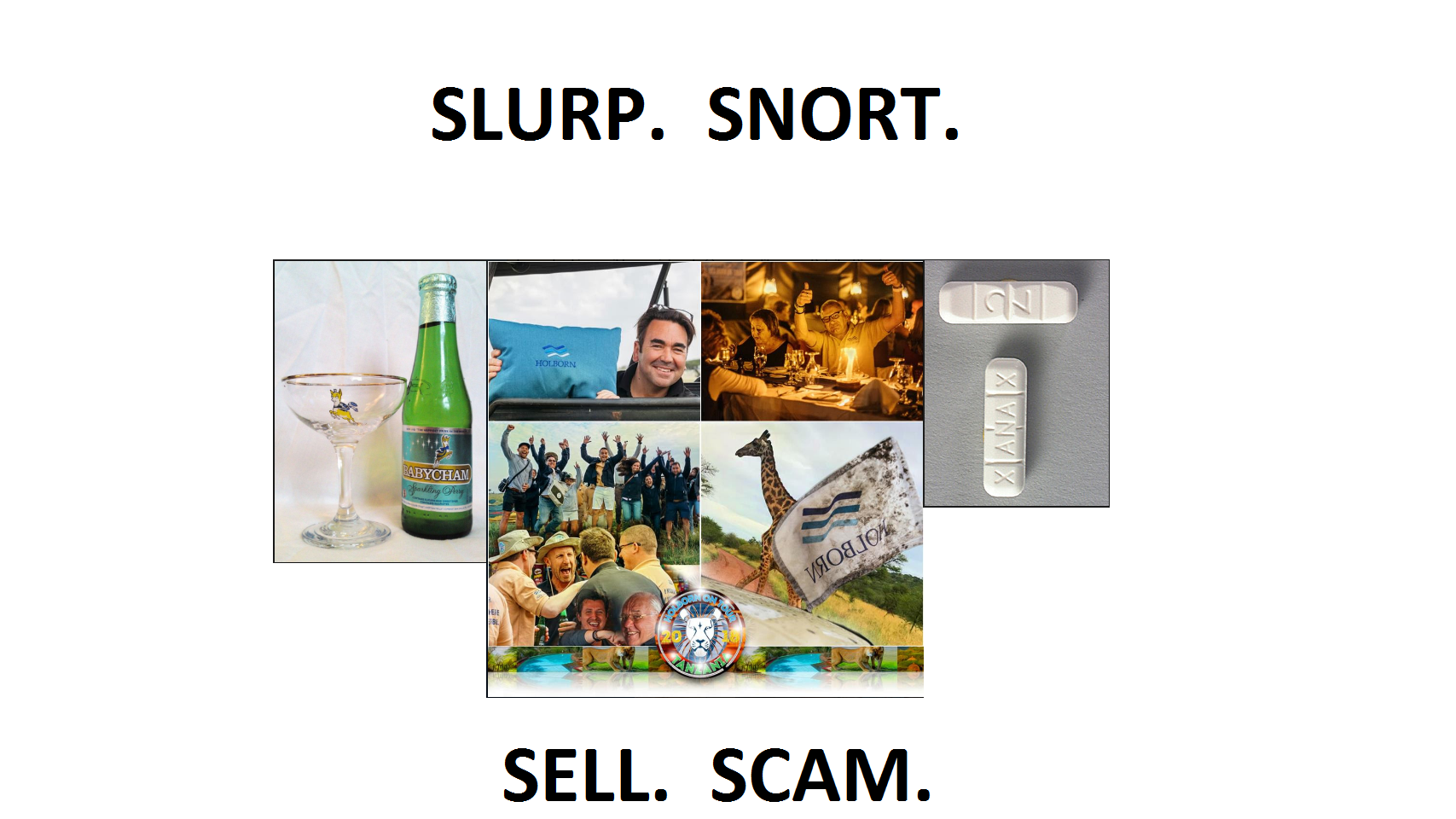

I am disappointed that Holborn Assets didn’t invite me to their Tanzania convention extravaganza – as it sounds like it was a lot of fun. And I do enjoy the occasional glass of Babycham and a nibble on a tiny sausage.

I am disappointed that Holborn Assets didn’t invite me to their Tanzania convention extravaganza – as it sounds like it was a lot of fun. And I do enjoy the occasional glass of Babycham and a nibble on a tiny sausage.

But I am hoping to be invited to the next one in Cambodia in 2019. As that is where Continental Wealth Management’s Darren Kirby has been hiding for the past few months, perhaps he’ll be popping in for a wee drinkie and a quick snort.

Apparently, the fun I missed included Holborn Assets’ scammer Nick Thompson being comatose the whole time. And Thompson showed up one morning with a black eye (was he pushed or did he fall?).

I also gather that the salesmen were threatening each other with knives. I am sure that was just some good-natured teasing and not some predatory tussle over territories or clients. Heaven forfend!

It has also been reported that the “advisers” at the party were openly crushing and smoking Xanac tablets. Apparently, Bob Parker stood by and just let this happen. I guess if all he is interested in is optimum sales he doesn’t really care how his snake-oil salesmen behave in public.

The motivation for being invited to the Holborn Assets booze/snort fest is described by Bob Parker thus:

The motivation for being invited to the Holborn Assets booze/snort fest is described by Bob Parker thus:

Here we are at the end of Q1: if you are on $200k or more you are on target for Summit, and $75k or more puts you on target for Convention. By mid-April, we had 65 advisers with over $75k written – so this will be our biggest Convention yet! And, when it comes to laying on the big time, we know what goes off with a bang:

But what troubles me somewhat is that there is no mention of quality. Only volume. And Holborn Assets has no compliance function – so what Parker is exhorting his snake-oil salesmen to do is sell $200k of toxic investments in order to get invited to a seedy party where everybody gets drunk or stoned or both. Some inducement!

But what troubles me somewhat is that there is no mention of quality. Only volume. And Holborn Assets has no compliance function – so what Parker is exhorting his snake-oil salesmen to do is sell $200k of toxic investments in order to get invited to a seedy party where everybody gets drunk or stoned or both. Some inducement!

Apparently, Holborn Assets salesman Stefan Terry is leading the race in having a team who can scam victims out of their retirement savings and is well ahead with a total sales by end of Q1 of $1.2 million. I wonder how many people that means have lost their life savings?

Apparently, Holborn Assets salesman Stefan Terry is leading the race in having a team who can scam victims out of their retirement savings and is well ahead with a total sales by end of Q1 of $1.2 million. I wonder how many people that means have lost their life savings?

This means that the “top teams” have written $8.5 million worth of business up to the end of March 2018. I wonder how many people’s lives have been ruined as a result of that scamming spree?

Holborn Assets cold-called thousands of potential victims in recent years, and persuaded many to transfer their pensions unnecessarily. The victims generally had good pension plans already but with the persuasion of the cold callers, they agreed to let Holborn Assets work their “magic” on their funds. The magic was investing the funds into toxic, high-risk investments such as New Earth Recycling and toxic structured notes, as well as applying sky-high fees for the privilege of losing some or all of the money.

And the Holborn Assets “crew” want to celebrate this amazing achievement and encourage their snake-oil salesmen to destroy as many more lives as possible.

Here’s the announcement of Holborn Assets’ next booze’n drugs fest:

“For Cambodia Convention & Summit 2019, we’re heading straight for the record books! We’re committing to more investment than ever before, more winners than ever before, and more planning than our 3 previous Conventions put together.”

Committing to more investment than ever before! Personally, I wouldn’t call that an investment, I would call it an obvious attempt to incentivise the Holborn Assets army of slimy salesmen to con as many victims into losing their life savings as possible. The amount spent on the last convention in Tanzania was somewhere in the region of £500,000. And I hear they will almost double this in 2019.

What I´d like to know is, if Holborn Assets have got all this spare cash to throw at booze and drugs, why aren´t they paying redress to their victims? At the Tanzania convention, unlimited supplies of booze were available 24/7, with advisors spending much of the duration in a booze-induced haze. These are the same “advisors” being entrusted with people’s precious life savings.

Tanzania was Holborn Assets’ third major convention. They boasted “We’re really getting the hang of putting conventions together. And then some! Like many of you, I have experienced similar FTSE 100 company events (with all the money that can be thrown at them), but none have matched the attention to detail and delivery of Holborn Conventions.”

Maybe they will one day get the hang of learning how to give sound and prudent advice on pensions and investments – and have an effective compliance function. And it would be nice if they had paid some degree of attention to detail when they were investing victims’ life savings into high-risk, illiquid, toxic funds.

Holborn Assets claims: “We are a family company with family values.” If “family values” means lying, defrauding, conning and walking away from the devastation left behind, this is one “family party” I definitely don´t want to be involved in. Bob Parker has brought his kids up to commit financial crime. That is not a family value any decent person would endorse.

Bob Parker has also lied about paying £150k in compensation to his victim Glynis Broadfoot. She has never received a penny from Holborn Assets for the destruction of her pension.

Just to be clear, the Holborn Assets “advisers” tagged in this blog are all those announced by Parker as being the top snake-oil salesmen.

TAGGED:

Tyrone Skipper

Craig Turner

Veena Singh

Adrian Lyons