Capita Oak pension scam: Imperial accounts 23.1.15

Ark Class Action

24 Calle Cuatro Esquinas, Lanjaron 18420, Granada, Spain

angiebrooks@pension-life.com angiebrooks99@gmail.com

0034674746663 (mobile) 0034858995645 (landline) www.pension-life.com

Roger Chant, Director – Imperial Trustee Services Ltd. 28th January 2015

Brian Downs, Downs & Co Accountants

Imperial House

21-15, North Street

Bromley BR1 1SD

Copies to:

Pensions Ombudsman; Pensions Regulator; D.S. Rob Harvey, Economics Crime Unit; Dalriada Trustees; FCA; TPAS; HMRC; SRA; ACCA; Iain Duncan Smith (Minister for Work and Pensions); Steve Webb (Minister for Pensions); BBC; ITN; Daily Mail; The Times; Insolvency Service; members of Capita Oak and Westminster pension schemes.

Dear Sirs

CAPITA OAK AND WESTMINSTER PENSION SCAMS

The responses below (in bold) to the “announcement” and “financial report” purportedly from Roger Chant of Imperial Trustee Services Ltd. (ITSL) must be taken into context with the Westminster pension liberation scam operated by those who set up, promoted and administered Capita Oak.

“In the second member announcement, I indicated that I had authorised the preparation of a financial report, to be prepared by an independent registered firm of accountants, Downs & Co.”

First of all, ITSL has no authority to issue financial reports or announcements. ITSL was apparently appointed as administrator in the invalid and possibly forged “trust deed” dated July 2012 and apparently signed by Alan Fowler and Karen Burton (although not in her handwriting but with a signature that looks suspiciously like the handwriting of Anthony Salih of Premier Pension Transfers. Downs & Co is not an independent firm of accountants. Brian Downs was brought on board on board by Christopher Payne (sole shareholder and at the time director of ITSL – but also owner/director of TKE Admin to whom the scheme fees were paid) in October 2014 to try to deflect the questions by Sean Hughes of the BBC X-Ray programme. Roger Chant was also already a client of Downs before he was appointed a director of ITSL. This could hardly be called an independent firm as Downs has admitted he is a “close friend” of Bill Perkins who acted as a shadow director of ITSL. A truly independent accountant and auditor need to be appointed in full consultation with the board of trustees and a proper forensic analysis done on all financial transactions carried out by ITSL, TKE Admin, Premier Pension Transfers and Metis Law, and reported properly to the members. Robert Stell is still happy to carry this out.

“I have now authorised that a copy of the financial summary prepared by the accountants and certified by them should be distributed to all members. A copy of the certified financial statement is attached. Disclosure of the certified financial statement provides transparency to Scheme members.”

The financial statement issued is far from complete, only covers the period to September 2013, and raises many questions. My specific queries on the accounts are set out below.

“As stated in the second member announcement, it can be seen, quite clearly, that (other than the amount deducted for administration) the totality of the funds received into Imperial’s bank account were transferred, on the instructions of the directors at the time, to the account of a UK registered law firm, Metis Law, who are based in Leeds. This is evidenced by the bank accounts reviewed by the independent accountants.”

Not evidenced at all because not reviewed by independent accountant/auditor – and the missing £1.22 million/47 transfers is still not explained. I have provided a complete schedule of all the transfers processed to Downs via Paul Thomas showing the transfers which were included in the £10,810,301.57 originally disclosed and the extra transactions which were not transferred to Metis Law to purchase store pods, but Downs has refused to acknowledge these missing transfers and provided no explanation. He has also refused to explain a number of suspicious entries on both the bank statements for accounts 03841928 and 83365921 (sort code 20-25-42).

“In summary, 95% of the funds received into Imperial’s bank account in respect of Scheme members was transferred to Metis Law. The 5% deduction for administration was made, which deduction was clearly specified in the Scheme membership documentation signed by each member.”

The members were clearly given the impression that the 5% was for administration, although 5% was grossly over-priced for a simple transfer for which no competent or diligent administration was carried out. I submit that this should be refunded to the members immediately by TKE Admin. The subsequent investment of 100% of the funds in Store First was clearly negligent and irresponsible, with no regard to the obligations for prudent investment principles required by law for a pension scheme.

“My enquiries suggest that of the 5%, some 3% was applied to TKE Admin Ltd., who arranged for the administration and other necessary services. In this regard, it should be noted that there is no annual administration charge applied to your funds within the Scheme. The remaining 2% was directed by the directors at the time to be paid to Mr. GS.”

What “other necessary services”? The only necessary service was to ensure that the funds of the scheme were properly invested and the scheme run responsibly with a view to providing retirement income for the members, rather than just fees and commissions for the operators/promoters of the scheme. This requires further explanation and complete disclosure of exactly who was paid what and why. It was agreed between Perkins, Fowler and Mr. G.S. that 3% would go to towards “processing” with Stephen Ward of Premier Pension Solutions SL and Premier Pension Transfers Ltd receiving £250 per transfer. So where did the remaining 2% go and to whom was it paid? It is not accounted for. The statement that “no annual administration charge would be applied to the scheme” also needs explaining. How would the scheme be administered going forward for years to come? This suggests there never was any intention to manage the scheme properly in the long term and deal with members’ interests (such as retirement, transfers out, death of members and also diligent control of the assets and income). It is clear that the high level of up-front fees were intended as a quick way for the organisers of Capita Oak to earn a large amount of fees and then abandon the scheme altogether and ignore the many appeals by members for information, accounts, and data on the scheme and the investments. This includes Mr. X whose case was investigated by the Pensions Ombudsman who found ITSL guilty of mal-administration and referred to Capita Oak as being typical of a pension liberation scheme and organized crime.

No mention has been made as to who has provided “services” to the scheme or in what capacity. Full disclosure and complete transparency is now formally requested as to who was behind these services and what services were provided. There has not been any evidence of any service to the members – other than complete silence and refusal to communicate. The people behind Capita Oak have provided no accounts, no reports, no transfers, no asset valuations and have ‘lost’ £1.6 million in “guaranteed” rental income: the main selling point that convinced members to transfer to Capita Oak.

“There is a further purpose that is served by distribution of the certified financial report. I had hoped to avoid drawing these matters to your attention, preferring instead to focus on material and factual matters. In summary, I have been made aware of a number of comments and statements (many anonymous, others adopting obviously fictitious names) having been made on various social media or similar sites. Apart from being grossly misleading and wholly without foundation, some of the comments and statements are, frankly, shocking, containing as they do lurid and defamatory statements against a number of persons, including some who have provided services to the Scheme. In particular, some of the statements make allegations as to financial impropriety.”

There is clear financial impropriety. To suggest otherwise is ridiculous. Not only has there clearly been obvious “financial impropriety” but also obvious fraud on the part of the operators and promoters of Capita Oak. The statements clearly and transparently made by me contained facts and hard evidence on the WhoCallsMe forum.

http://whocallsme.com/Phone-Number.aspx/01516680386/120#p831709128742963577

Various other contributors have posed as me and Downs using fictitious names, but although some have clearly sought to disrupt the flow of genuine information, there has been some valuable information provided about the activities of Perkins, Fowler and Downs. I stand by everything I have said on the forum and have always stated that if evidence can be provided that I have been mistaken I will gladly make a full retraction and apology. The only connected individuals I have ever communicated with have been Downs, the individual operating the Thurlstone loans and members of the Perkins/Fowler/Ward team who are disgusted at the wholesale defrauding of victims in Capita Oak, Westminster and other scams. I have also communicated extensively with Metis Law and JWK Solicitors acting for Toby Whittaker, but they have both now “pulled up the drawbridge” as they are now in contentious communication with each other.

“As can be seen from the certified financial statement enclosed with this announcement, all monies transferred into the Scheme referable to members have been fully accounted for.”

I refer to my previous comments about an independent auditor, only then will the members be satisfied that all monies have been accounted for. There is evidence that there is still 1.22 million missing and unaccounted for, with several members having confirmed that their funds are amongst the missing funds. In other words, members have transferred their pensions and yet these transfers are not on the list of transfers that went to Store First via Metis Law. The 100k paid to Thurlstone (which operated the pension liberation loans) remains unexplained, despite my asking about this repeatedly. Now, presumably, the 100k is hidden within the administration expenses. Further, my specific accounts queries below need to be addressed immediately.

“It should further be noted that the certified financial statement was prepared with the independent accountant having been provided with copies of the bank statements for Imperial’s bank account. In view of this, I again ask that members rely solely on official announcements and information issued by Imperial and to ignore comments and statements issued by others, some of whom it must be assumed have ulterior motives.”

The question remains: why did Downs refuse to provide the bank statements to the board of trustees? Further, I repeat, Downs is NOT independent. And this “financial statement” is far from complete and transparent as will be seen from my comments on the very incomplete “Analysis and Summary of Bank Account”. The question: why were the limited accounts only made up to September 2013? must also be answered. I would also like a proper explanation as to why the appointment of a truly independent (not previously connected with any of the parties who operated and/or promoted Capita Oak) accountant/auditor, Robert Stell, was rejected.

“My enquiries, through my professional advisers, as to the investments made with the funds transferred to Metis Law are continuing.”

I think at this point we have got to cut through all the obfuscation and ask who this communication is actually from? Imperial has had various directors since July 2012: Christopher Payne; Karen Burton; Karl Dunlop; Maria Orolfo (nominee in Dubai with false address in UK); me (immediately removed by Christopher Payne as I predicted); Christopher Payne (again); Roger Chant. Why so many directors? Why do they keep resigning? Why did Payne – the sole shareholder – resign from his own company? Then re-appoint himself and remove me? Why do the shadow directors Bill Perkins and Alan Fowler fail to appoint themselves as directors? Perkins, Fowler and Ward were clearly behind Capita Oak and Imperial Trustee Services. Ward had details not only of Capita Oak on his system but also of Westminster – which had the same sponsoring employer – RP Medplant in Cyprus (but whose assets have totally disappeared, totaling between 3m and 7m and clearly also run by Fowler and Salih). Although this letter appears to have been written by Roger Chant, why would a complete stranger, previously unconnected with ITSL and/or Capita Oak elect to be a director in the full knowledge that ITSL is in serious trouble over a fraudulently-operated pension scheme with compromised assets and stolen income? And why have neither Perkins nor Fowler appointed themselves as directors instead of Roger Chant?

It must further be raised that Imperial (and the directors/shadow directors/shareholder) were entirely legally responsible for the set up, structure and operation of the scheme, as well as the illiquid investments in Store First. Christopher Payne – the founding director and sole shareholder of Imperial (as well as TKE Admin to whom the “administration” fees were paid) was clearly heavily involved from the start and is well known to Downs, so why does this letter seek to create the impression that investigations are required? Perkins, Ward and Fowler know everything about the Capita Oak scheme so why don’t they just come clean?

“I will authorise the preparation and distribution of a further announcement regarding the Scheme’s investments as soon as possible.”

Further “announcements” will have much greater credibility if they are issued by the people who operated Capita Oak: Perkins, Ward and Fowler, rather than an un-connected person who has had no experience of the scheme and whose sudden, unexplained appointment as director appears to be a rather ham-fisted attempt to shield Perkins’, Ward’s and Fowler’s responsibilities and culpabilities.

“I am also seeking information regarding the investment return that was due on the investments.”

This statement unfortunately stretches credibility beyond the limit and is also insulting to the intelligence of the members. Perkins, Fowler and Ward devised and operated the scheme and Craig Hollingdrake of JWK Solicitors, acting for Toby Whittaker of Store First, confirmed to me that the 8% “guaranteed rental income” was paid to Transeuro Worldwide Holdings on the instructions “of the people operating Capita Oak”. According to the BBC, Toby Whittaker himself also confirmed this to the BBC investigating journalist. Let us be clear, the investments in Store First were done with the explicit intention of extracting the 30% introduction commission for those directly and indirectly connected with ITSL – not providing a secure retirement investment or income for the members. ITSL’s directors and shadow directors never intended running a long-term pension scheme for the benefit of the members: if they had, they would have invested the funds in diverse, prudent, liquid assets to provide for transfers, retirement and death. To claim to be “seeking information” is just nonsense. If the rental income of £1.6m has been stolen, then Chant and Downs have a duty to report the matter to the police and provide them with all the evidence. Have they done this?

“Currently, and it must be stressed subject to confirmation, the position appears to be that the funds transferred to Metis Law (from which it can be expected that legal fees will have been deducted, but again that has still to be confirmed) were subsequently applied in the purchase of commercial property, principally storage pods with a company called Store First. These investments appear to have been made at the direction of the directors at the time. The former directors who were in office at the time that Scheme assets were transferred to Metis Law and/or were applied in the investment of those assets appear to be a Mr. Karl Dunlop and a Ms Maria Orolfo.”

“These investments appear to have been made….” This is an unbelievable statement. A quick phone call to Metis Law would clear that up, though the fact that that current director of a pension scheme is not sure is damning in the extreme. The directors at the time were Christopher Payne, Karen Burton and Karl Dunlop – so what questions have been asked of them? And why did they resign? Metis Law confirmed that they were instructed by Karl Dunlop. Reverting to my previous comment above, the writer appears to express surprise at the position regarding the investments and the activities of Metis Law. ITSL was the “administrator” and instructed Metis Law. If (and it is a BIG if) Chant has no communication with Payne (who instructed Downs in the first place), Dunlop, Burton and the shadow directors Perkins, Ward and Fowler, why doesn’t he ask them? Why doesn’t he ask Ward whose 31 Memorial Road address was used as the Capita Oak address? Why doesn’t he ask Whittaker whose Goodlass Road address was subsequently used? Why is he purporting to “seek” information when the various parties who operated Imperial/Capita Oak are right under his nose?

I have already sent in a much more complete set of accounts than the one submitted by “Chant” showing what was paid to Metis Law and TKE Admin but this was ignored by Downs and those instructing him. The investments were clearly made at the direction of those who set up, promoted and operated the scheme i.e. Perkins, Fowler and Ward. If another party had instructed the purchase of the pods or any other transaction connected with the scheme, this does not absolve the directors or shadow directors of legal responsibility and accountability.

“Should any members have information as to how (and by whom) they were made aware of the Scheme, or if members have details of any promotional material or statements made (including, but not limited to, those regarding any investments and the expected return on investments) it would be appreciated if members could provide a copy or details to Imperial, either by post or by email. This information may assist in the enquiries being undertaken by my professional advisers.”

This is an admission that the scheme has no idea how it was promoted to its members. I suspect that the director’s advisers are looking for evidence that the agents and promoters of the scheme are guilty of misleading statements to deflect the blame from those that set up the scheme itself. Many members have written and emailed “Imperial” and been denied any kind of response for many months. Indeed the Pensions Ombudsman has declared that this constitutes mal-administration over a prolonged period of time, and has described the scheme as typical of pension liberation and “organized crime”.

“In response to the second member announcement, a very small number of members have enquired about, or have requested, a transfer payment to another scheme or arrangement. Until full details of the location, security, liquidity and value of the Scheme’s investments, and the investment return paid on those investments, is fully understood, in the short term it is not possible for transfer values to be quoted or transfers to be made. Naturally, as soon as it becomes possible, we will advise members as to next steps regarding the availability of transfers.”

This statement really does again stretch credibility to the limit, and beyond. Could we have confirmation how many have enquired? It is surprising that only a very small number want to transfer out. The directors and shadow directors of ITSL clearly set up and ran this scam. They instructed Metis Law to effect the purchases of store pods using virtually 100% of the members’ funds, instructed Store First to pay the 8% 2-year guaranteed rent to Transeuro Worldwide Holdings Ltd., and operated the Thurlstone pension liberation scam. So how can they not know? It defies belief. The very fact that this letter appears to be trying to create the impression that ITSL was not responsible for everything that has gone wrong is damning in itself. Also, the fact there is no liquidity for transfers out, demonstrates again that this scheme has not been managed for the benefit of the members.

“Please be assured that Imperial continued actively to pursue all matters relating to the Scheme, with the best interests of the members its paramount aim.”

Am not sure any of the Capita Oak victims will believe this statement, having seen that they have been scammed out of £10.8 million (plus the £1.22 million missing transfers), as well as ITSL failing to account for the missing £1.6m rental income.

“This is being done within the very limited funds available to Imperial.”

Bearing in mind ITSL charged 541,775.51 by its own admission, according to the “financial analysis” reported by Chant, I would have thought Imperial had plenty of funds to “actively pursue” these matters. (Plus the 70,162.19 they are supposed to have as a “balance” which should be held in cash. Plus the 31k that Metis Law are sitting on.)

If the funds are limited, how was the scheme ever going to be administered going forwards? Not only do we not have audited accounts, there are no individual statements for members. Why were the funds not segregated into individual accounts? It is not just a question of illiquid assets, the scheme cannot even tell an individual what the transfer value is in the first place. A shocking state of affairs that has not been addressed. Why not?

“ITSL c/o Downs & Co

Signed Roger Chant”

PURPORTED “ANALYSIS AND SUMMARY OF BANK ACCOUNT” BY IMPERIAL

Transfers Received: 10,835,510.21 (why is this 25,208.64 greater than stated in the original Imperial accounts and where is the missing 1.22 million made up from 47 transfers?)

Interest Received: 832.11

To open account: 75.00

TOTAL: 10,836,417.32

Pension cash lump sums: 82,911.31

Bank charges: 812.33

Administration fees: 541,775.51 (why did the original Imperial accounts state 441,751.85 and does this revised figure include the 10k paid to Christopher Payne when Barclays realised that ITSL was operating a scam? And further, does it include the 100,557.58 paid to Thurlstone by Metis Law?)

Pensions Regulator: 157.71

Metis Law re investment: 10,140,598.27

Balance held by ITSL: 70,162.19 (does this include the 31k held by Metis Law which they are refusing to release?)

Where are the following items in the financial statement?:

9,828,750.00 paid to Store First – of which 30% was paid in introduction commission

2,948,625 paid in commission (to whom?)

647.00 in bank charges

720.31 in courier services

61,172.98 in fees to Metis Law

3,990.00 to Harper McLeod

1,696.00 in indemnity insurance

12,370.00 in Land Registry fees

5,194.20 to SDLT

94,165.00 to Stamp Duty

100,557.58 to Thurlstone

It must be clearly declared that taking into consideration the 30% introduction commission and the 8% “guaranteed rental income” that in fact Imperial effected payment of 9,828,750 for property which was worth 46% less than the purchase price at the very least (and which may have a zero re-sale value). Furthermore, aside from the 5% “admin fee” paid to Imperial/TKE Admin, a further 179,955.29 in assorted costs added to the dilution of the value of the transfers.

Finally, kindly respond to the following by return:

- Comments are sought on the invalid and forged “trust deed” which appointed ITSL as administrator but not as trustee. The signatures look like they could be Alan Fowler and Karen Burton (although it is not the same signature as Karen Burton used to sign letters to Capita Oak members and the handwriting is identical to that of Anthony Salih of Premier Pension Transfers at 31 Memorial Road, Worsley). Why were the signatures not identified, dated and witnessed? And why was no trustee appointed? Where is the original, witnessed trust deed?

- Who registered Capita Oak with tPR and HMRC?

- Why were the pods registered in the name of ITSL (as trustee of Capita Oak) when it was not the trustee? This means that the Capita Oak scheme is not the legal owner of the pods, but ITSL is. How will HMRC treat this?

- Why were the Barclays Bank accounts in the name of ITSL/Christopher Payne and not ITSL/Capita Oak?

A full and prompt response to the above queries would be much appreciated. This letter is being copied to the Police Economics Crime Unit, the Pensions Regulator, the Pensions Ombudsman, the Insolvency Service, the members, the press as well as the SRA and Mr. Downs’ professional body.

Angela Brooks

Chairman – Ark Class Action

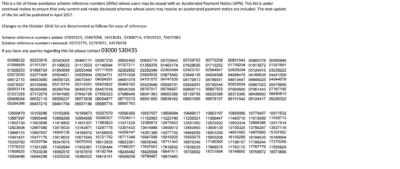

He could try checking the HMRC website – but all he would get is a bewildering list of numbers rather than the names or descriptions of the avoidance schemes themselves. Sometimes the accountant isn’t even using a named scheme but rather relying on his own experience and expertise to use a strategy he thinks/believes/considers/hopes will work for his client without risk of challenge by HMRC.

He could try checking the HMRC website – but all he would get is a bewildering list of numbers rather than the names or descriptions of the avoidance schemes themselves. Sometimes the accountant isn’t even using a named scheme but rather relying on his own experience and expertise to use a strategy he thinks/believes/considers/hopes will work for his client without risk of challenge by HMRC.

In the

In the