Having read Henry Tapper’s A Master Class in Fractional Scamming, here at Pension Life we feel we should share some facts with our readers about the “trending” investment and pension scam of 2018 – fractional scamming.

First of all here´s a bit about the fractional scam:

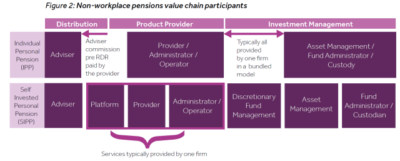

Today with new regulations, pension liberation has pretty much gone out of the window. Instead, victims are being offered to transfer their pension fund into a “new” scheme and invest in funds with promises of high returns and low risks. What is hidden in the small print is that whilst there MIGHT be high returns (possibly, if the wind is blowing in the right direction for long enough), the fund has to work its way through the hands of many parasitic introducers and advisers – each one taking their own fraction of the fund.

Henry Tapper uses a Pizza as a great example. Say you ordered a pizza which has been cut into eight slices. On its way to you, the pizza goes past 6 people, and each one takes a slice. Therefore 3/4 of the pizza has already been eaten by the time it gets to you. That does not leave much for you, the person whose pizza it was supposed to be.

This is what is happening to pension funds subjected to fractional scamming, they are being passed from one adviser to another and each one takes their slice.

So whilst the pension fund may well be going into a high-return investment, (when they finally arrive there), the fund has to recover from the percentage slices taken before any profit can be made. Using the pizza as an example, 75% of it was eaten before it arrived at its promised destination. 75% is a pretty high figure – even if the investment interest is 6.5%/7.5% – it is going to take another lifetime to get it back to its original value. Something the victims of fractional scamming don´t have.

The trending pension scam, fractional scamming – this image shows how the scammers skim their slice of the victims’ pension fund in this new wave of pension scam. Chip, chip, chipping away until the original pot is but a fragment of its original state.

What is most frustrating about the situation is that many of the people benefiting from the fractional scam are unregulated advisers. They are the unauthorised introducers who work with unauthorised – as well as authorised – IFAS who worked with Pension Trustees to transfer money into overseas funds. Each one taking their fraction of the fund.

Ways to avoid falling victim to fractional scamming are to ensure that the adviser you are proposing to use is fully authorised by the FCA in the UK. Or by the appropriate regulator in whichever jurisdiction you are resident. Do your own due diligence to ensure that you know all the facts about the transfer of your pension fund. What are the fees – as in ALL THE FEES – relating to the transfer; where will the fund be going and what exactly will it be invested in.

If you are cold called – HANG UP IMMEDIATELY

Do the adviser’s promises sound too good to be true? IF THEY DO, THEY PROBABLY ARE

High return/low risk investment – NO SUCH THING

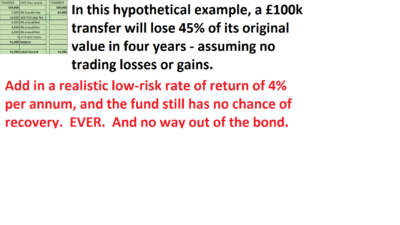

The illustration on the left is based on the Continental Wealth Management scam which saw nearly 1,000 people have around £100 million worth of retirement savings put at risk. The first year would have cost the victim at least 16% of the fund, and thereafter around 8% a year. So it never had any chance of growing – while the “advisers”, bond provider and structured note providers got fat and rich.

The illustration on the left is based on the Continental Wealth Management scam which saw nearly 1,000 people have around £100 million worth of retirement savings put at risk. The first year would have cost the victim at least 16% of the fund, and thereafter around 8% a year. So it never had any chance of growing – while the “advisers”, bond provider and structured note providers got fat and rich.

**************************************************************

As always, Pension Life would like to remind you that if you are planning to transfer any pension funds, make sure that you are transferring into a legitimate scheme. To find out how to avoid being scammed, please see our blog:

FOLLOW PENSION LIFE ON TWITTER TO KEEP UP WITH ALL THINGS PENSION RELATED, GOOD AND BAD.

Dear Angie

I have been approached by Carrick investments and DeVere in Harare to transfer my pension. Both companies look good from what I can tell.

Reading this fractional scamming thread, you say to only transfer to legitimate scheme. Who would you recommend? Have you heard anything about Carrick and DeVere? Can I use one of them?

Thanks,

Sue

Will reply by email.