£11,000,000,000. That is an awfully big number. But this is what financial fraud of pension and investment scamming cost thousands of victims in 2016 according to reported statistics. This begs the urgent question: why have so few – if any – of them been prosecuted?

The Pensions Regulator’s Lesley Titcomb has now officially and publicly declared that scammers are criminals.

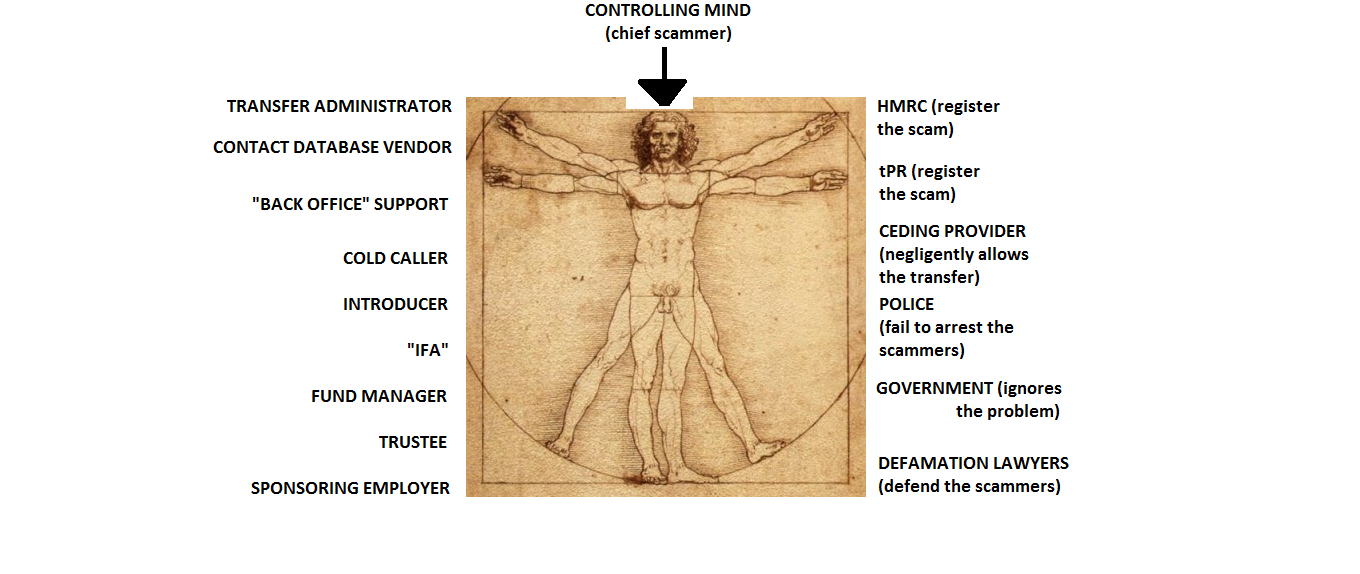

Pension Life´s book: Anatomy of a Pension Scam is going to be made into a series of blogs. The purpose of the book is to get the message out there and warn the public; the financial services industry in the UK and offshore; governments; regulators; ombudsmen; crime agencies, HMRC, and the scammers that this huge-scale financial crime will NO LONGER BE TOLERATED. The authorities who have stood by and allowed this to happen have to snap out of their complacency, laziness and incompetence, and actually take some action to bring these criminals to justice.

What we need now is all of the scammers behind bars and the keys thrown away.

The actions of these fraudsters have shaken the confidence in the pensions and investment industry as a whole. Not to mention the harm it has inflicted upon innocent, hard-working people on a huge scale.

Evidence suggests that in the past seven years, there have been many £ billions lost to pension and investment scams – there are no precise “official” figures. But the dreadful fact is that the scammers who were targeting victims back in 2010, continued doing it in 2011; and 2012; and 2013; and 2014; and 2015, and 2016. And they are still doing it today. Happily and profitably. And nobody has stopped them or brought them to account for the horrific financial damage and distress they have caused.

With this in mind it is hard to decide who is the devil himself, the vicious, greedy, cold-hearted scammers or the feeble authorities who let them get away with it. REPEATEDLY!

HMRC were warned by the industry about the potential for scams if the role of compulsory professional trustee was removed pre 2006. In a letter of March 2004, Nick White, specialist pension solicitor warned: “It is essential that schemes offering self-administration and wide investment choice should have in place an independent person who has sufficient control of scheme assets to prevent abuse and sufficient knowledge and experience to know abuse when he sees it.

That does not necessarily mean that the system of pension trustees should be retained in its current form but, if it is abolished without an effective replacement, we envisage that within the next 5 years the degree of abuse of such schemes by both incompetent and dishonest individuals will:

- further stain the reputation of pensions generally; and

- severely embarrass the government responsible for letting it happen

Reputable professionals in the industry and the Government share a common aim of building a system of tax rules that is simple but is robust enough to last for a working lifetime without major overhaul. Such a system needs to contain adequate protections against abuse.”

Nick White’s warning was brought to my attention by Martin Tilley who is director of technical services at Dentons Pension Management. Martin has written some excellent blogs and articles on the subject of pension scams and my favourite has to be this one:

http://www.retirement-planner.co.uk/9344/cleaning-up-pension-scams-with-soap-operas

Either way the one thing we can be sure of is that it has to stop NOW.

So watch this space as we at Pension Life, prepare a documentary series about pension and investment scams. There are many victims who would be only too happy to help recreate the exact wording – both written and verbal – of the scammers’ pitch. With their help we hope to create a military-style, zero tolerance campaign to wage against all the guilty parties until every last one of them is brought to justice.

Again and again I’ll say it, you are paid by DeVere and Nigel.

You put in that video that “free pension review”, guaranteed 8%, toxic structured notes, unnecessary insurance bonds etc etc are all part of pension scamming when all of the aforementioned are used by DeVere still today!! I worked for them for many years, I should know.

But you never attack them. And I’m sure paid plenty to attack their competitors and ex employees like Mike Coady.

Who’s the real crook, Angie Brooks?

How exciting! When will the cheque be arriving?

An interesting question, if all the ‘how to spot a scam’ boxes are ticked why DeVere is not on the list of “known pension scammers” although I can’t see them paying Angie to attack competitors. That is a bizarre concept.

Their website reads like a scammer’s website but their regulatory status page references their FCA number 469151 and shows they are regulated and permitted to give retail investment advice and advise on personal pensions. There are however a number of companies with ‘DeVere’ in their name that are not authorised but it isn’t clear they have any association with the one listed as 469151.

It’s an interesting question and throws up a number of questions about their operation. There appear to be anomalies but they also appear to be kosher.

I don’t know the author of the comment, but if he has any evidence of DeVere engaging in pension scams why not present it rather than make an off the wall comment they are paying Angie?

@Stephen, more damning DeVere evidence in Angies latest post… (from me of course as she keeps quiet whilst they keep wrecking pensioners savings).

I think your number is wrong. Should be £1,000,000,000 ie £1bn not £11bn. See …

https://www.parliament.uk/documents/commons-committees/work-and-pensions/Correspondence/Letter-from-Chief-Executive-The-Pensions-Regulator-to-the-Chair-relating-to-Project-Bloom-13-November-2017%20.pdf

Don’t be picky – what’s £10bn between friends!

@ Stephen. Here you go mate… MUCH more of a horror story than the CWM and other stories Angie bothers with…

https://www.google.com/amp/s/www.biznews.com/belvedere/2015/03/25/belvedere-ponzi-the-devere-connection-victim-or-partner/amp/

Yet another firm that does not own up to their part!

And another:

https://www.thenational.ae/business/devere-unit-stops-assisting-on-uk-pension-transfers-overseas-1.17948

And another:

https://youtu.be/BeAsOo2NMcU

And another:

https://www.telegraph.co.uk/finance/personalfinance/investing/11726158/Exposed-the-rip-off-investment-advisers-who-cost-British-expats-billions.html

And another:

https://www.complaintsboard.com/complaints/devere-group-unethical-business-c615515.html

Should I continue??? There are hundreds more like this!!

OK, these are great articles and do show DeVere had a role in Belvedere but the Biznews article couldn’t decide if DeVere were a victim or a partner and does say they tried to get investor’s money back.

I didn’t get to see Marchant’s 17th March Belvedere article; I bought a months subscription in 2015 and got hold of the May 22 2015 article (because of it’s Brian Weal connection – a director of Blackmore Global that took 75% of my pension). The May 22 article doesn’t mention DeVere (don’t know about the 17th March article) so I am not sure even Marchant believed they were a “willing partner”.

However, I am not convinced they are paying Angie. That doesn’t make sense to me. Angie, btw hasn’t taken on the Belvedere scammers to my knowledge.

Imho, Angie is an irritation to companies engaged in scams but from what I have seen to date has not made any significant contribution to their demise such that it would be worth one of them paying her to leave them alone. The scammers I got caught up in are still going (and going from strength to strength if their announcements are to be believed). Angie is not significant enough, imho, for a company like DeVere to be so worried they would think of paying her. Scammers don’t fear Angie, they are just fed up with her.

btw, Biznews has a great “back story” with a load of links that I will study – thanks for that link.

Demise is a gradual process I am afraid. You just have to keep at it doggedly and make sure they know you are watching their every move. And reporting on it. Some of the firms and individuals have told me that I have cost them a great deal of money, but none of them has ever offered to pay me off to shut me up. As we know, they throw a lot of money at their lawyers to shut me up – that idiot Steve Kunziewicz at Slater and Gordon being a prime example. He is now with this firm: https://www.blmlaw.com/people/steve-kuncewicz

Angie, your comments please….

https://www.google.com/amp/s/mobile.reuters.com/article/amp/idUSKCN1J02O2

Will comment when I have a spare minute – always crazy/hectic when I’m in London.