If you have been following Pension Life´s blogs you will know that we have been conducting a series of investigations into qualified and registered financial advisers in various firms. Today is Spectrum IFA Group – qualified and registered?

IFAs and their clients are invited to add to it, correct it, improve it. Here’s a link to the two registers if you want to double check:

http://www.cii.co.uk/web/app/membersearch/MemberSearch.aspx

https://www.cisi.org/cisiweb2/cisi-website/join-us/cisi-member-directory

Please note that this data is correct as of 9am 29/06/2018

edit: we have been informed that there is a third website we can check for qualifications, so this page is in the process of editing whilst we see if any names appear on the libf members website.

https://www.libf.ac.uk/members-and-alumni/sps-and-cpd-register

The Spectrum IFA Group – qualified and registered? They have six Spanish offices, plus offices in France, Italy, Switzerland, Luxembourg, Belgium and the Netherlands. They claim to have a presence in Portugal, but nobody seems to work there.

In the Continental Wealth Management disaster, 1,000 victims had £100 million invested by unqualified scammers in “life bonds” provided by OMI, SEB and Generali – completely pointless and unnecessary except to pay fat commissions to the scammers; then invested in high-risk, professional-investor-only structured notes which were entirely unsuitable for pensions and resulted in crippling losses.

The lessons have to be learned from the Continental Wealth scam, and it is really important that all advisory firms make it clear how their advisers are qualified and also make it easy for the public to check out their qualifications. Let’s have a look at another European advisory firm: Spectrum IFA Group.

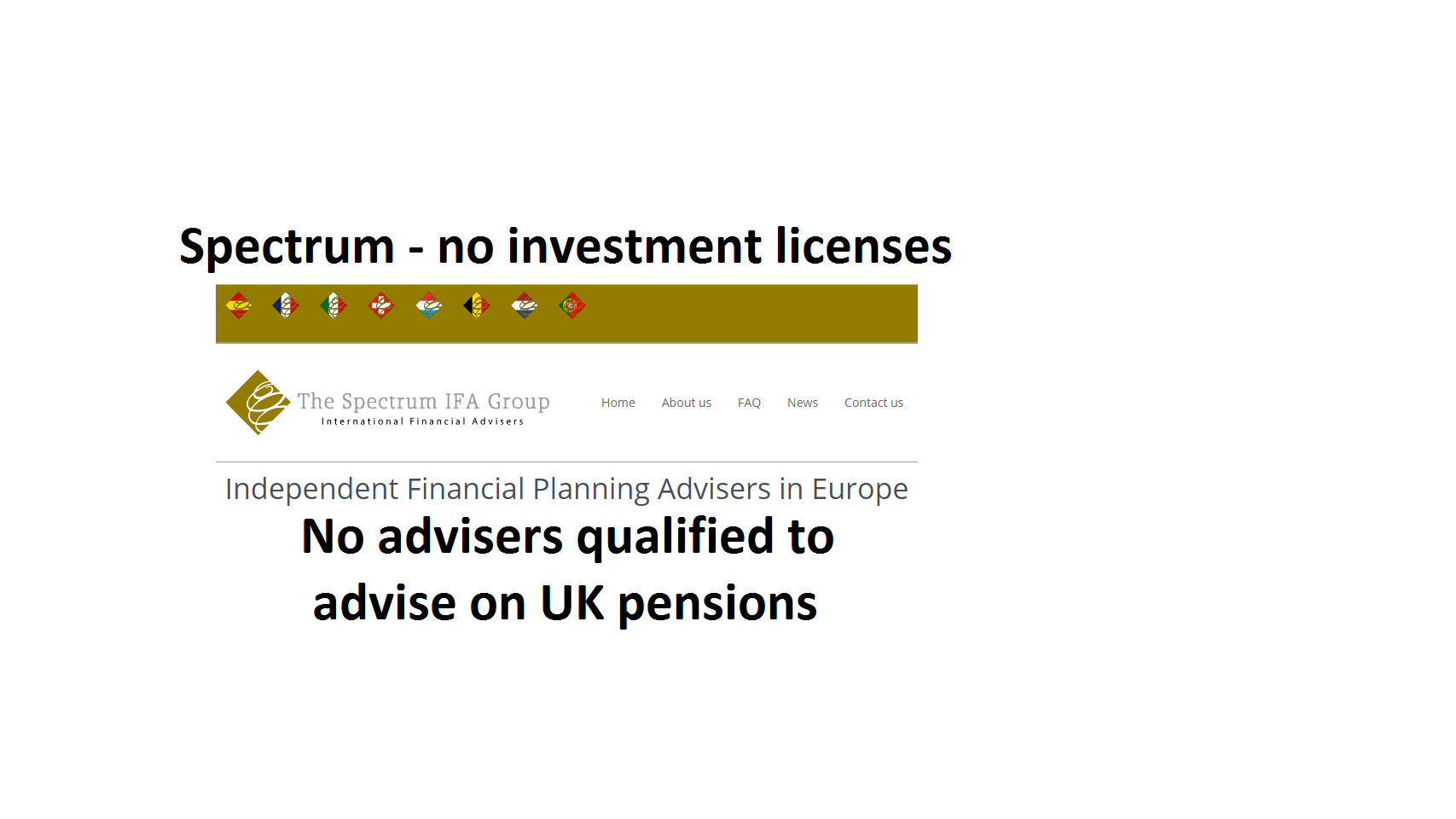

ONE THING THAT WORRIES US ABOUT THIS FIRM IS THAT THERE IS NO EVIDENCE WHATSOEVER OF THIS FIRM HAVING ANY INVESTMENT LICENSES – ONLY INSURANCE LICENSES. So, it is fine for their advisers to sell pet, car and house insurance, but certainly not to advise on pensions or investments.

ONE THING THAT WORRIES US ABOUT THIS FIRM IS THAT THERE IS NO EVIDENCE WHATSOEVER OF THIS FIRM HAVING ANY INVESTMENT LICENSES – ONLY INSURANCE LICENSES. So, it is fine for their advisers to sell pet, car and house insurance, but certainly not to advise on pensions or investments.

Spectrum IFA Group state – “Our internationally qualified, professional advisers are readily available to make certain you receive the best possible advice and superb service, bringing you peace of mind for the following areas: QROPS…Pensions in Spain.”

Unfortunately, Spectrum doesn’t score too high on their staff’s qualified and registered status…we looked them up on the CII and CISI registers. There are, of course, other institutes which can be used – but the firm should make it clear how their advisers are qualified – as well as to what level – and make it easy for the public to check this out.

Barcelona

Jonathan Goodman – CII registered Spain International – but not registered as Chartered so not qualified to give pensions advice – not on libf.ac.uk -bu t –

Paul Roberts – Not listed on either CII or CISI register – not on libf.ac.uk

Richard Rose – Claims he holds an International Financial Planning Certificate – not on either CII or CISI register – not on libf.ac.uk

Barry Davys – Not listed on either CII or CISI register – not on libf.ac.uk

Cédric Privat – Not listed on either CII or CISI register – not on libf.ac.uk

Chris Burke – Listed on the CII register for Spain – but not registered as Chartered – not on libf.ac.uk

Costa Blanca

Robin Beven – CII registered Spain international (but only Cert PFS which is Level 3 – the minimum required in the UK is Level 4, so this begs the question whether Beven should be allowed to advise on UK pensions) – not on libf.ac.uk

John Hayward – CII registered Spain international – not on libf.ac.uk

Annette Bowen – not on either CII or CISI register – not on libf.ac.uk

David Hattersley – not on either CII or CISI register – not on libf.ac.uk

Dennis Radford – not on either CII or CISI register – not on libf.ac.uk

Mike Churchley – not on either CII or CISI register – not on libf.ac.uk

Costa Del Sol

Pauline Bowden – not on either CII or CISI register – not on libf.ac.uk

Charles Hutchinson – not on either CII or CISI register – not on libf.ac.uk

Murcia & Almeria

Robin Beven – CII register Spain International (but how can he work here and also in the Costa Blanca office)

John Hayward – CII registered Spain International

Dennis Radford – not on either CII or CISI register (ANOTHER duplicate employee works for Costa Blanca also?)

Mick Churchley – not on either CII or CISI register (and yet ANOTHER duplicate employee works for Costa Blanca also?)

Basically the Murcia & Almeria office just lists some of the Costa Blanca office employees – a cause for concern??? The two members of the team that we can find on the register are not qualified to give pension advice and no information as to whether the rest have a financial qualification at all

Mallorca & Menorca

Susan Worthington – not on either CII or CISI register – not on libf.ac.uk

Madrid

Chris Webb – Claims CISI – not listed on the register – not on libf.ac.uk

edit: despite the libf register NONE of the Spectrum IFA group in Spain appear on it, this means the original score sticks.

Spectrum IFA Group – qualified and registered? score just 4/16 so far (but we will see what the score is when we finish reporting on all the advisers in all the offices in Europe).

….and on to the rest of Europe…

And still no reporting of the $8 million fine, is there any explanation AB?

What registers are you referring to ? You are quite correct, people should be able to look up what these IFA’s qualifications are, but just because they are not on a website does not mean that they are not qualified (it would be helpful if you could show what registers you are referring to). Incidentally, your website should have a privacy policy as you are collecting people’s data when they are commenting on these posts. Failure to do so could get you in hot water with the ICA.

I seem to remember you claimed to be an IFA but then refused to give us your qualifications or evidence of who you worked for and how you were regulated. In fact you started off claiming you were a victim, and then little by little it became clear what your true agenda was. You were after the Continental Wealth Management contact database. The fact that you are spending so much time trolling me makes it obvious you are not a very busy chap.

There are public registers for those that are current paid-up members of the institutes. One can ask the relevant bodies about the qualifications held by an individual, if not on the register, but that would involve getting the permission of that individual to provide that information.

The answer to all of this seems straightforward to me. The management of the various firms mentioned should make sure that only those with membership of an institute should be able to claim membership and, perhaps, provide a statement that they have verified the qualifications of those that list them.

Some of the names listed are, in fact, making false claims as evidenced by the registers. What does that tell you about the integrity of the firm and the adviser? After all, we are only talking about people’s lifetime savings here.

And this is what you are all about, Brian (or whatever your real name is). You wanted me to “hand over” the CWM victims to you last year and I wouldn’t. So instead of going out and doing some actual work, you think that attacking me is a useful way to spend your time. Jog on.

Response from The Spectrum IFA Group

We completely understand the mission you are on as there are a number of firms giving or who have given very poor advice around pension transfers in Spain and other Countries.

We are quite surprised you have highlighted our group ahead of certain other perhaps higher profile firms operating in Spain and would like to put the following facts in front of you.

For your information we are a Spanish brokerage that is part of a larger European group which includes both Insurance and Investment Advisory firms.

All our advice comes from our centralised technical team. In particular, for all pension transfers we provide a free Pension Transfer Value Analysis report prepared by a Fellow of the Chartered Insurance Institute (higher level than Chartered) who holds all the relevant UK pension qualifications. In addition, where the pension is a Defined Benefit scheme (Final Salary) an FCA registered adviser with all current UK permissions provides a further report for clients as required under UK rules.

The major problem we see in the Spanish market is the use of “boutique” investment funds and structured products. It is our opinion that these are only sold to generate additional commissions for the brokers. Our client charter spells out how we operate. We use only daily traded funds from large, well known investment houses that do not pay initial commission. If we do ever use a structured product, we undertake to rebate any commission to the clients.

In Spain, most of our pension business is placed using Prudential International’s PruFunds, entirely appropriate for pension investing.

Finally our website makes clear we do not have an operation in Portugal but service clients there from our Barcelona office.

In light of the above facts we request that you take down from your site and linked in the erroneous posts about our group.

Should you require any further information please email [email protected]

I am not an expert in these offshore funds, so bear with me if you think these are not intelligent questions-

1. What is the investment group you are part of that provides the investment advice, I can only see an insurance licence on your website? Who are the investment advisers and who gives advice to the actual investor?

2. How does this “Fellow” earn a living if he does not charge a fee? I am sure many people would love free reports, can you provide his details? A Fellow is Chartered but took a couple more papers.

3. Who is the FCA registered adviser that provides the reports? Is he part of your company or not? This leads to my, possibly misplaced concerns so please bear with me, next point.

4. Prufunds – I was not aware of International Prufunds and so got onto Google. Is this the correct link? http://www.prudential-international.com/es-en-adviser/why_ipb/funds/prufund/ This seems to be an offshore insurance bond with rather limited investment options. The KID has a whopping 13% to 14% RIY in year one, that is off the scale. Compare this to a UK version of the same bond https://www.pru.co.uk/content/dam/prudential/kids/PRU_IOD_IE00B00GXM08.PDF and the RIY is 1.25%, the UK version has many more investment options. What am I missing here?

5. If 4. above is correct, then how can an insurance bond possibly be suitable for an individual personal pension arrangement? There appears to be a 5 to 10 year charging structure that would limit the investor from moving the funds without penalty.

I am asking this from a UK perspective, after all we are talking about UK pensions and so should not expats get the same quality of product and advice as they would have been able to get in the UK?

This “Fellow”, he would not happen to be part of a newly established firm that is owned by a SIPP/QROPS provider would he?

A number of UK advisers are aware of this and watching.

Spectrum IFA stole my pension , it now lies in different currencies in the Isle of Man having made no gains in 8 years !!

Barry Davys told me a web of lies when advising me to take out my final salary pension with my employer, the damage he and your company have done has ruined life !!

Have you complained to Spectrum Colin? If so, what has their reply been? What did they invest your funds in?

@Colin,

I had a search and found this https://feifa.eu/its-easy-when-you-know-how-2/ My word, if this is the level of knowledge, this is worrying.

The LTA will be increased annually by the CPI and has increased since this was written, so he just made up the fact that the LTA could be reduced when the Government has a stated policy of increases.

The pension in the UK is not subject to Inheritance Tax, moving a pension will make no difference.

In the example given, I can only assume this is a very wealthy man who has no intention of drawing an income from his fund when he retires. Given what you , Colin, have just said about the investment performance then I would suggest that the fund would not increase as he suggests.

The tax on income over the LTA is 25% (conveniently not mentioned). If people are sold insurance policies for their investments with the usual funds then the total costs are at about 4.5% pa and this is more than double what we in the UK would charge. In other words, people are paying more than this “55%” tax already as the fund would grow at 0.5% pa not 5% pa. Colin can testify to that, I am sure.

Since this firm is not on the CNMV register, then I can only assume insurance policies are sold. Let me guess, OMI or RL360 with a 10 year lock in on full commission?

The tax “saved” in the example takes no account of the rising LTA. If one assumes an average CPI increase of 2.5% pa to 75 then (if the guy is now 60 as there is no date on this article, another error as any technical article should have one of they become misleading) there are 15 years to 75. By my reckoning, going by the current legislation which can change of course, the LTA will be 1,490,000. If the CPI averages 3% pa, then 1,600,000.

When the fees that are applied at this level, the investor would probably take an income in retirement also, then I don’t think there would be any reason to move the funds to a QROPS . Better to leave the fund in the UK regulated environment of lower charges, even if the UK fund hit the LTA and there was some tax to pay then the net would result would be far better than the example given.

As a final note, my wife is an English teacher and has told me that her year 9 students would be for the high jump if they put together something with such poor grammar and poor use of tenses.

Dear Ms Brooks

Please be aware that Spectrum companies are passported across the whole of the European Union under either Freedom of Establishment or Freedom of Services rules and this includes both Spain and the UK. We are therefore properly licensed and insured to provide all the advice for all the business we conduct.

My CEO will be writing to you at your Granada address to explain in detail all the rules regarding financial advice in Europe, to answer your questions and to put right your misconceptions about our business.

In the meantime he respectfully requests that you remove any reference to Spectrum from your website and that you and your colleague Rosemary Wallsworth cease making inaccurate claims about our group.

Example – Rosemary implied in a Facebook post that Spectrum had lost her £150,000. She has never been a client of Spectrum and in fact has admitted she was a client of CWM.

@ John

Answer UK Oriented Questions. Why not explain it all on here?

No attempt to answer a single question raised by him.

RIY means reduction in yield and that is a cost to investors. Why is there a huge difference between international and UK? Can you explain this?

Are you registered for investment advice or not?

Smoke and mirrors, that is all this expat financial advice is about.

Does Spectrum have an investment license?