STM Fidecs and the Gibraltar FSC – Evil lives on at the rock

STM Fidecs and the Gibraltar FSC – Evil lives on at the rock

I have read the report about what happened to the scammers at STM Fidecs in the wake of the Gibraltar FSC’s investigation and Deloitte’s so-called “expert report”.

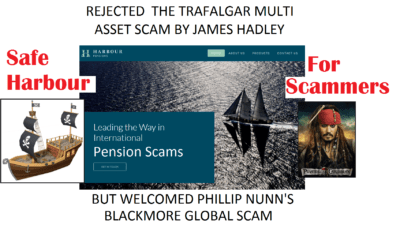

Frankly, I am stunned. I have members who are victims of the Trafalgar Multi-Asset Fund and STM Fidecs and they are, understandably, stunned as well. I have met the people at the Gibraltar FSC and they had seemed decent guys |(but WTF do I know?!). Maybe they’ve all left, because the people I met appeared enthusiastic and conscientious. But perhaps they’ve been replaced by a bunch of malfunctioning robots, or ex-scammers or – much worse – ex STM Fidecs employees.

The bottom line is that STM Fidecs scammed hundreds of victims out of their pensions. STM Fidecs took business from unlicensed scammer XXXX XXXX of Global Partners Limited (only had an insurance license with Marcus Groombridge’s firm Joseph Oliver) and then invested 100% of the victims’ funds into an illegal UCIS fund – run by XXXX XXXX (now under investigation by the Serious Fraud Office – although I really don’t know what they are playing at because XXXX still isn’t behind bars).

The rest is history. The Trafalgar Multi-Asset Fund is being wound up, and after paying the liquidation costs to Stephen Doran, of Doran + Minehane, there is unlikely to be much – if anything – left. Deloittes spent weeks supposedly investigating STM Fidecs’ books. I reckon the chumps at Deloittes probably spent most of that time on the golf course with Alan Kentish having a chuckle and a side bet about how feeble the Gibraltar FSC was likely to be. And, of course, they were right.

Now, of course, Deloittes and STM Fidecs are celebrating, as the GFSC has done nothing to stop this iniquitous, dishonest, incompetent and negligent firm from trading. Whether STM Fidecs bribed the Gibraltar FSC, or merely got them drunk on the golf course, we will never know. And it makes no difference. But certainly the matter has been brusquely brushed under the carpet and the hundreds of ruined lives have been conveniently ignored and forgotten.

Now, of course, Deloittes and STM Fidecs are celebrating, as the GFSC has done nothing to stop this iniquitous, dishonest, incompetent and negligent firm from trading. Whether STM Fidecs bribed the Gibraltar FSC, or merely got them drunk on the golf course, we will never know. And it makes no difference. But certainly the matter has been brusquely brushed under the carpet and the hundreds of ruined lives have been conveniently ignored and forgotten.

Neither STM Fidecs nor the Gibraltar FSC has said a word about redress for the Trafalgar Multi-Asset Fund victims.

The only words spoken are that the Gibraltar Regulator has told STM Fidecs to “improve its compliance”. Improve?? How can you improve something that doesn’t even exist at all? We know that one victim (of scammers Holborn Assets) was bullied by STM Fidecs for trying to improve compliance and harassed for trying to stop obviously non-compliant transactions when she was employed by them. She was subsequently “paid off” and threatened with a gagging order.

“STM is now expected to engage with the Gibraltar FSC in order to discuss the Recommendations of the report, and agree a plan of action to implement them.” (according to the report by FT Adviser). Recommendations? Where are the sanctions? Where are the appropriate fines? Where are the bans to stop Alan Kentish and David Easton from ever practising in financial services again? Where is the cancellation of STM Fidecs‘ license?

With this in mind, here are some idiots’ guides as to how to become a pension trustee, and how to become a regulator. Both are equally easypeasylemonsqueasy – any old idiot or scammer could do it.

HOW TO BE A PENSION TRUSTEE IN EASY STEPS

- Think of a catchy name: obviously inspired by the acronym STD, Alan Kentish came up with the name STM. FIDEC is an acronym for “Fighting Infectious Diseases in Emerging Countries”. Here’s my suggestion: Trussed4U – wadya fink?

- Think of a jurisdiction with the most ineffective, pathetic and corrupt regulation – such as Gibraltar

- Find an unlicensed scammer like XXXX XXXX who will transfer lots of UK-resident victims into an offshore QROPS and invest their life savings in whatever crap will pay him the highest commissions

- Sit back and rake in the profits

- Forget fiduciary obligations or anything with the word “trust” in it – only concentrate on the word “trussed“

- Play golf with the regulator

HOW TO BE A REGULATOR

- Join a golf club (that isn’t too picky about who it lets in)

- Give licenses to as many scammers as possible – the more the merrier

- Buy lots of blindfolds (to help turn a blind eye to scams and scammers)

- Play lots of golf with the scammers and bent pension trustees who facilitate financial crime

- When an advisory firm or a trustee firm gets caught scamming, slap a few people on the wrist with a wet fish

- Write meaningless reports about robust compliance

HOW TO BE A SCAMMER

- Find yourself a bent jurisdiction (such as Gibraltar)

- Find a bent trustee who will accept business from any old unlicensed scammer (such as STD FIDEC)

- Find a bent “umbrella” fund which will facilitate financial crime – such as Richard Reinert’s Nascent Fund

- Find a Ponzi scheme such as Dolphin Trust which will issue “loan notes” at 10% interest per annum (and up to 25% in introduction commission)

- Transfer hundreds of UK residents to a Gibraltar QROPS scam

- Get the trustee to agree to invest 100% of 100% of the victims’ retirement savings in … your own fund!

See how easy it is to be either a trustee, a regulator or a scammer? But, equally, remember how easy it is to be a victim!

Quite frankly, Gibraltar should be towed out to sea and sunk. It is a disgrace to the British nation. Just give it back to the Spanish and let them clean it up – they would soon kick the likes of STM Fidecs out and stop any further scams and scammers from operating on Spanish soil. Soil being the operating word.

Rather than going on about how utterly disgusted I am with the Gibraltar regulator, I will leave it to the eloquent words of one of the STM Fidecs/Trafalgar Multi-Asset victims to put this sickening disgrace into perspective.