STM Fidecs needed a safe Harbour. And now they’ve got one – but is it really safe?

LETTER TO ALAN KENTISH – CEO OF STM FIDECS:

Dear Al, hope you are well. I’m not anticipating a response to this because I know how difficult it must be to type emails when you’re wearing handcuffs. However, I thought I would drop you a line because I am genuinely worried about you.

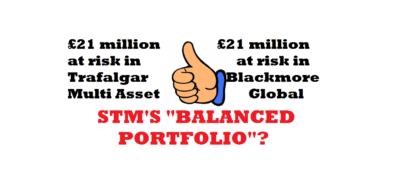

You see, I heard you’d bought Harbour Pensions for £1 million – a book of 1,600 members. But how many of these members will want to stay once they find out they are now in the hands of STM? If any of them have got any sense they will transfer out to a decent QROPS trustee who can be trusted to look after their pensions. STM Fidecs allowed hundreds of victims – advised by a known scammer running an unlicensed firm (XXXX XXXX) of the Pensions Reporter/Global Partners Limited) – to be 100% invested in XXXX’s own fund, Trafalgar Multi Asset (now suspended, under investigation by the SFO and being wound up).

The Trafalgar Multi Asset Fund was a sub-fund of the Nascent Platform – one of many operated by Custom House Global offering scammers a cost-effective place to waste pension pots. This provided a low-cost solution to wannabe fund managers to try their hand at playing musical money with victims’ life savings.

What surprises me, is that having proved that STM Fidecs is an incompetent firm run by inept – or perhaps even crooked – people, you would be splashing money around acquiring more victims and more toxic assets. Instead, you should have been paying compensation to your existing victims who may well have lost a substantial proportion of their retirement savings due to STM Fidecs’ own failings.

Having acquired Harbour, you have now added the toxic, illiquid, high-risk, un-audited Blackmore Global fund to your portfolio of worthless crap. Your balance sheet must need disinfectant and a good old scrub.

Furthermore, you will now be in league with not one but TWO lots of scammers who are under investigation by the Serious Fraud Office. XXXX XXXX (Trafalgar Multi Asset) and Nunn McCreesh (Blackmore Global) were both behind the Capita Oak and Henley Retirement Benefit pension scams – all 100% invested in Store First store pods.

Seriously, Al, you should think about cleaning up your act – not making it dirtier and murkier. Hope those handcuffs don’t chafe too much.

Best, Angie