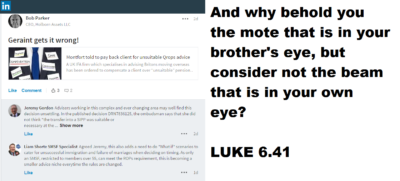

Structured notes – say NO to them if an adviser wants to invest your pension in them. They are high-risk investments which are for professional investors ONLY – and not for ordinary retail investors – especially pensions.

Structured notes – say NO to them if an adviser wants to invest your pension in them. They are high-risk investments which are for professional investors ONLY – and not for ordinary retail investors – especially pensions.

Say NO to structured notes for pensions!

Structured notes have been used as pension investments for some years. Many advisers don’t understand them – and certainly, no retail pension investors understand them either. Structured notes are definitely not the low risk, high return investments originally promised – and the capital is NOT protected as claimed by some advisers.

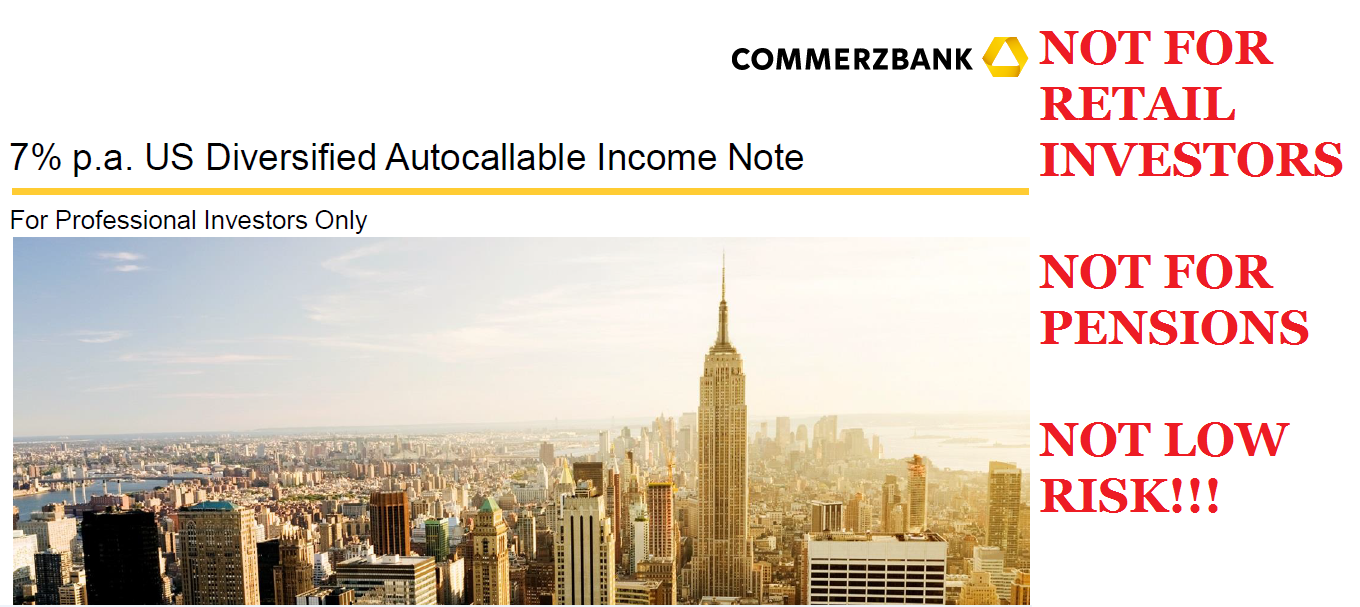

As in the above example, it is a disgrace that structured note providers such as Commerzbank, Nomura, RBC and Leonteq have allowed their toxic products to be used for retail pension savers. Even when these rotten products have nosedived repeatedly, these dishonest and dishonourable providers keep on flogging them to destroy victims’ retirement savings.

As in the above example, it is a disgrace that structured note providers such as Commerzbank, Nomura, RBC and Leonteq have allowed their toxic products to be used for retail pension savers. Even when these rotten products have nosedived repeatedly, these dishonest and dishonourable providers keep on flogging them to destroy victims’ retirement savings.

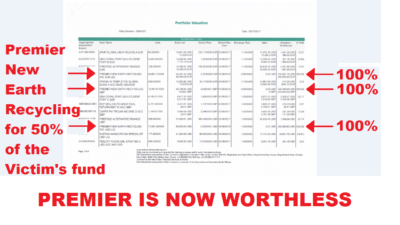

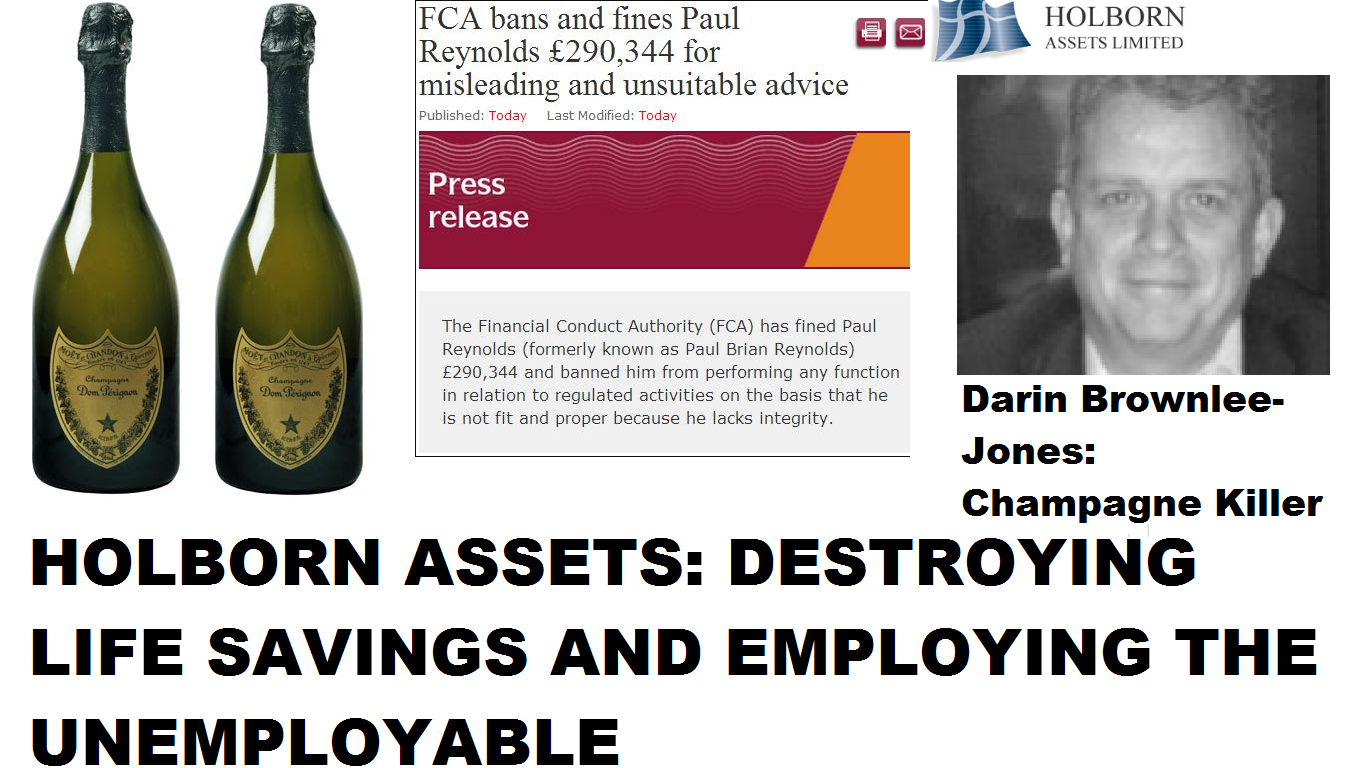

Along with the rogue advisers – such as the scammers from Holborn Assets and Continental Wealth Management – and the rogue structured note providers, there are also rogue insurance companies who accept these toxic, high-risk, professional-investor-only investments. These insurers know full well that accepting these notes will doom the policyholders to poverty in retirement, but they don’t care. Some of the worst of these “life offices” are Old Mutual International, SEB, and Generali. These companies are no better than scammers and really should be called “death offices” since they effectively kill off thousands of victims’ life savings with their extortionate charges.

Commerzbank, Nomura, RBC and Leonteq all claim to be “award winning and innovative companies” and yet they show zero compassion to the victims who lose huge proportions of their retirement savings. The structured note providers keep paying commissions to the scammers – ranging from 6% to 8% of the investments. And then, when the structured notes go belly up, they simply sell more of the same toxic rubbish to the same scammers in an attempt to further ruin the victims.

So what the hell are structured notes? And why should investors say NO to them?

A structured note is an IOU from an investment bank that uses derivatives to create exposure to one or more investments. For example, you can have a structured note betting on the S&P 500 Price Index, the Emerging Market Price Index, or both. The combinations are almost limitless.

Say NO to structured notes for pensions!

Structured notes are frequently peddled by less-scrupulous financial advisers – as well as outright scammers – as a “high-yield, low-risk” supposedly backdoor way to own stocks. However, regulators have warned that investors can get burned – which they frequently do. If the investment banks can flog it, they will make just about any toxic cocktail you can dream up. In reality, a structured note is an unsecured debt issued by a bank or brokerage firm – and the amount of money the investor might (or might not) get back is pegged to the performance of stocks or broad market indexes.

Read more: Structured Notes: Buyer Beware!

On the surface, the ‘cocktails’ the structured note providers make seems like they could generate a great return. However, the truth is they often benefit the financial adviser rather than the investors.

On the surface, the ‘cocktails’ the structured note providers make seems like they could generate a great return. However, the truth is they often benefit the financial adviser rather than the investors.

Structured notes are suitable for professional investors only – and the fact sheets issued by the providers state this clearly. Whilst they do offer high returns if successful, they are also high risk with no protection on the amount invested. Structured notes should not be used for pensions.

Continental Wealth Management(CWM) invested over a thousand low to medium risk clients’ retirement savings in structured notes – mostly provided by Commerzbank, Nomura, RBC and Leonteq. These clients now have seriously decimated funds and are worried sick. But Commerzbank, Nomura, RBC and Leonteq have shown neither remorse for their toxic, high-risk, illiquid products nor concern for the hundreds of victims.

OMI (Quilter), Generali and SEB have also been totally disinterested in the thousands of failed structured notes they have facilitated. Indeed they are even charging the victims crippling early exit penalties when they decide to get out of the expensive and pointless insurance bonds which are further eating into the remaining funds.

Most structures notes have no guarantee, so their worth often depreciates to less than the paper they are printed on. Much like a bet at the races, if you bet £10 on Noble Nag to win in the 2.30 at Kempton Park at ten to one, you are guaranteed to win £100 if the horse wins. But if the horse doesn’t win, you say goodbye to your money.

Most structured notes are dressed up to look appealing to the uninformed victim. But in reality they are high risk and illiquid and can result in total decimation of a victim’s life savings. The advisors rarely disclose the commissions they are earning from the purchase of the structured notes (or from the insurance bond). Plus, once the structured notes start showing a serious loss, the adviser just dismisses this as “only a paper loss”. As the advisors have already taken their cut, they are rarely bothered if this high-risk investment does lose the client money.

So if you hear the term ‘structured note’ in connection with your retirement fund, just say ‘NO’. The only people profiting from this type of investment are the advisers.

********************************************

As always, Pension Life would like to remind you that if you are planning to transfer any pension funds, make sure that you are transferring into a legitimate scheme. To find out how to avoid being scammed, please see our blog: