LEONTEQ “DRIVEN BY POSITIVE CLIENT SENTIMENT” (Really?) In their 2017 annual report, rogue structured note provider Leonteq has reported “GROWTH ACROSS ALL REGIONS – Driven by positive client sentiment and solid demand for structured products”.

I have no idea what sort of claptrap Marco Amato, CEO and CFO of Leonteq, thinks he is spinning in the 2017 annual report, but if Leonteq really is “experiencing growth across all regions”, this is very serious indeed. If hundreds more victims are going to lose their retirement savings across the globe due to Leonteq’s toxic, professional-investor-only structured notes being sold to low-risk retail investors, then he should hang his head in shame.

Leonteq’s Chairman – Christopher M. Chambers – is quoted as saying:

“We are immensely grateful to Marco Amato for having served as interim CEO during a very difficult phase for our company. He has done an outstanding job. We look forward to continuing to count on his experience and leadership as Deputy CEO and CFO.”

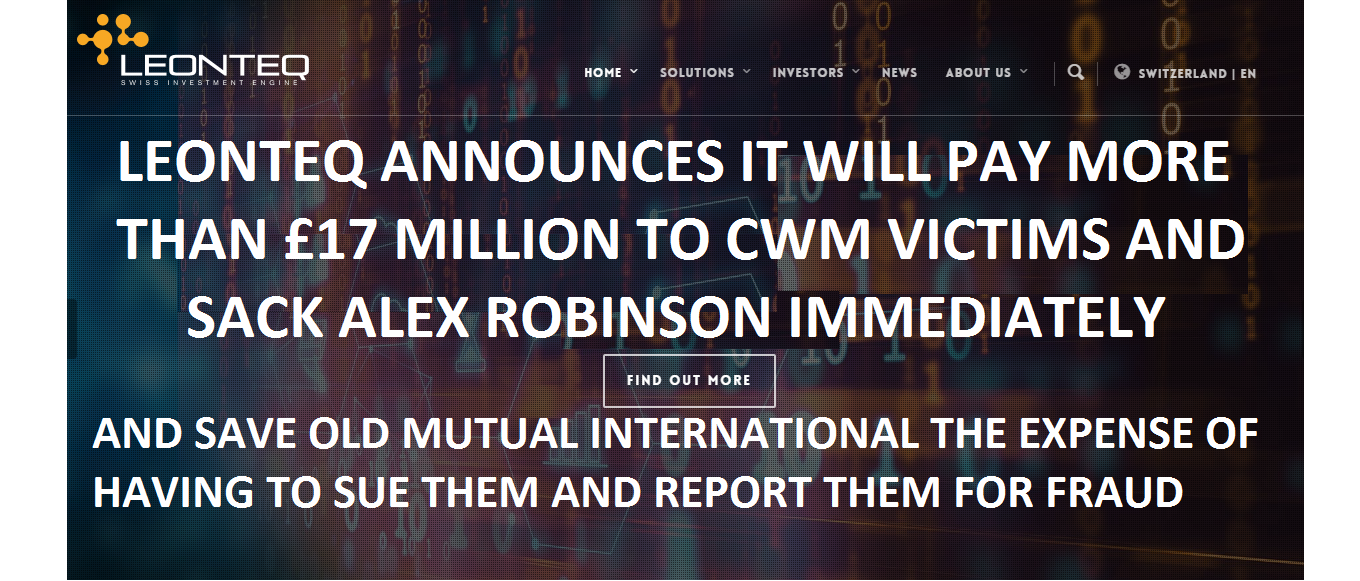

I just hope the new CEO – Lukas Ruflin – will start paying compensation to the CWM victims.

The only positive client sentiment that I can see, is that the Continental Wealth Management victims are positive that Leonteq should pay compensation for the terrible losses caused by their dodgy, toxic structured notes.

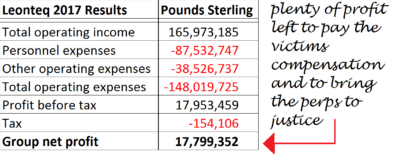

And Leonteq can, of course, afford to pay. Here are their 2017 results:

And Leonteq can, of course, afford to pay. Here are their 2017 results:

I note they paid their staff £87 million in that year. Way too much – I suggest they halve all employees’ wages until the Continental Wealth Management victims are fully compensated.

I have some other suggestions for Leonteq:

- Don’t take business from unlicensed firms

- Don’t take business from known scammers who put investors into extortionately expensive insurance bonds such as OMI, Generali and SEB

- Don’t take business from known scammers

- Don’t allow low/medium risk investors to be invested in Leonteq’s high-risk, toxic, professional-investor-only structured products which are clearly labelled:

“Danger of losing part or all of your capital”

Rogue life office, Old Mutual International, has been wittering on about suing Leonteq for many months – but never actually does anything about it other than spout a lot of meaningless hot air.

Rogue life office, Old Mutual International, has been wittering on about suing Leonteq for many months – but never actually does anything about it other than spout a lot of meaningless hot air.

Time to make up your mind Old Mutual. Your victims are suffering terribly – and you don’t seem to care.

Regarding Leonteq,i couldn’t agree with you more Angie.Leonteq are a disgrace.Its about time they thought about compensating the victims of their highly toxic,destructive investments.People have lost their life savings and pensions,they have ruined their victims lives,who now face a bleak retirement with decimated pensions.Myself being one of them.

To add salt to the wounds they have paid themselves 87 million !!! HAVE YOU NO SHAME LEONTEQ.

If those involved have one ounce of humanity,they should perhaps spare a thought for their clients,rather than their own bank balances and huge profits.

Leonteq. A name much used and accused by the scammers ex of CWM. Yet another collection of people with no conscience and no shame. One bad lot using and blaming another bad lot all the way down the chains that link them.

Scamming, defrauding, forgery and, probably, many other crimes went into making those chains. Leonteq is just the tip of the iceberg and 17 million pounds is a small part of what is owed to the victims of CWM. Pay up Leonteq. Start the ball rolling and then perhaps the financial industry will get the message and clear out all of nests of rats that live and prosper under its roof.

I have read the above comments and absolutely agree with them, not much more I can add. My husband and I lost money with leonteq and their recovery note which also failed. It is a pity there are so many greedy, selfish people who run companies and don’t even check if the firm is licensed, they just want the money.

While entry/check of a third piece of information might help with cases of mistyped sort code/account numbers I don”t see how its going to help with the main aim here bank transfer scams. The scammer has already managed to persuade me to enter their sort code and account number so they”ll just tell me the account name to use/expect and nothing will have changed apart from more work for me, for every payment I want to make quickly and efficiently. I would suggest a better method would be similar to when credit card companies helpfully or unhelpfully stop transactions awaiting additional verification but on the scammer accounts so that no more money can be transferred in to it until verified. e.g. there are going to be patterns lots of money going in/coming out during the day, small/zero balance at end of day but a high daily/hourly balance or volume of transactions.