20% Black Hole in Blackmore Global

It is no secret that we have little confidence in the Blackmore Global Group run by Phillip Nunn and Patrick McCreesh – two of the scammers who promoted Capita Oak and earned nearly £1 million from providing “leads” for the cold callers. Capita Oak is now under investigation by the Serious Fraud Office, and Nunn McCreesh’s nefarious activities were investigated and reported on by the Insolvency Service.

To confirm our suspicions that Nunn and McCreesh’s Blackmore Global Fund and Bond are not just high-risk and illiquid crap (and – of course – totally unsuitable for pensions or anyone with less money than sense), they have announced that 20% of your money could go towards paying for the “costs of the investment”. To put that into plain English, any of the unregulated scammers who promote and distribute the Blackmore investments are earning 20% in commission.

This new-found “transparency” by Blackmore is neither a courtesy to their customers, nor evidence of voluntary honesty. Rather, it is a reaction to the FCA´s new rules for being “clear, fair and not misleading” .

“Capital Protection” and “Income Certainty”. Immediately below these phrases, in letters half the size, were the words:

“Capital at risk | Please read our risk section. Illiquid and non-transferable. Not FSCS”

This change is in connection with Nunn and McCreesh’s Blackmore Global Bond. Their Blackmore Global Fund has already featured heavily in the press with criticisms about its costs and unsuitability for pensions. BBC 4 You and Yours did a feature on the fund back in January 2018, finding that an unregulated adviser – David Vilka of Square Mile International Financial Services – invested many of his QROPS clients into this unsuitable fund – which undoubtedly will have paid him fat commissions.

THE BLACKMORE GLOBAL FUND IS A UCIS (UNREGULATED, COLLECTIVE, INVESTMENT SCHEME) WHICH IS ILLEGAL TO PROMOTE TO UK RESIDENTS. Yet, David Vilka – who had no investment license – promoted it and Nunn and McCreesh accepted the many investments into it from him.

What is similar in both the Blackmore Global Fund and Bond, is the lack of transparency from the start. With the fund, there was also a ten-year lock-in, which was in the small print and not mentioned to the pension investors at the time of signing over their pensions to the scammers. Some of the members were nearly 60, meaning that they were unable to access their money when they retired.

The Bond, up until now, has had no transparency on its charges – and the risk factors were most definitely hidden.

The confirmation of a 20% commission charge (to the scammers who promote and distribute this risky, expensive, opaque investment) comes as a welcome dribble of transparency. However, it is still unclear as to how – after this huge payment – Blackmore investors will ever be able to recoup the initial costs and then start to make some headway on their investment.

Bond Review explains this well:

“In slightly simplified terms, if Blackmore raises £10,000 from an investor in its 3 year bonds paying 7.9% per year, and pays out 20% in commission, it now needs to turn £8,000 into £12,370 to repay the investor in full, representing a 55% return over 3 years – or 15.6% per year.

For its 5 year bonds paying 9.9%, the return required to turn £8,000 into £14,950 is 87% over 5 years, or 13.3% a year.

Any investment targeting a return of 15.6% or 13.3% a year will inevitably be extremely high risk – and while Blackmore can diversify over many such projects, some of its projects will fail, which will lower the overall return.”

This is not an investment to enter into lightly (or at all). Blackmore Global showed net liabilities of £7 million on assets of £18 million in its last accounts – December 2017. Finances and accounts can dramatically shift in the short space of one year: a well-run, professional and ethical company could turn things around. But with Blackmore Global failing for three years to even produce audited accounts on their fund, and lying about who their Investment Manager is, this hardly inspires any confidence at all.

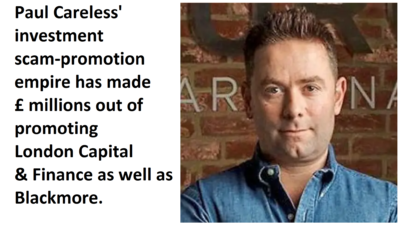

Another worrying thing about Blackmore Global is that they use Surge Financial to promote their toxic wares – and has paid this firm £5.1 million in one year for “marketing services”. Surge Financial is run by Paul Careless, and was promoting the failed London Capital & Finance fund, which paid out an eye-watering 25% to the scammers who promoted and distributed their toxic wares. Having conned thousands of victims into investing £236,000,000 into London Capital and Finance, the whole lot is now probably lost as the company has gone into liquidation. But Surge Financial pocketed £60,000,000 in marketing this toxic fund – and is still promoting Blackmore Global. The FCA declared that the marketing blurb was misleading, unfair and unclear – and it is obvious that the lies told in the glossy brochures duped thousands of people into losing their life savings.

Another worrying thing about Blackmore Global is that they use Surge Financial to promote their toxic wares – and has paid this firm £5.1 million in one year for “marketing services”. Surge Financial is run by Paul Careless, and was promoting the failed London Capital & Finance fund, which paid out an eye-watering 25% to the scammers who promoted and distributed their toxic wares. Having conned thousands of victims into investing £236,000,000 into London Capital and Finance, the whole lot is now probably lost as the company has gone into liquidation. But Surge Financial pocketed £60,000,000 in marketing this toxic fund – and is still promoting Blackmore Global. The FCA declared that the marketing blurb was misleading, unfair and unclear – and it is obvious that the lies told in the glossy brochures duped thousands of people into losing their life savings.

So, with Blackmore Global also using Surge Financial to source victims, and succeeding at the rate of £1.5m a month, it is a serious worry that there will be thousands more victims when the Blackmore Global shit hits the fan.

Bond Review is quoted as saying:

“That Blackmore Bond paid out up to 20% in commission is already known from Blackmore’s December 2017 accounts, which disclosed that £25.4m had been raised in the period (July 2016 to December 2017) and that £5.1m had been paid to Surge Financial for “sourcing investors loans and front and back office operations” (almost exactly 20%).

Could Blackmore Global go the same way as London Capital Finance? We already know that the Blackmore Global fund has been used to scam hundreds of UK-resident victims out of their pensions using QROPS. We also know that few of these victims have had their money back – and that there is zero disclosure as to where the money has gone.

Unfortunately the blog is riddled with inaccuracies. Firstly Blackmore Bond plc and Blackmore Global are two totally separate legal entities in two different jurisdictions but have been randomly interchanged in this blog – some facts relate to one but there is no evidence they apply to the other etc. This is probably due to Kim being new-ish at Pension-Life, hasn’t got the history and not done enough homework. Something that is common to many of her blogs – and she gets paid for this! It is very disappointing.

Also there is a plan (which I have seen) to “sell” Blackmore Global and this blog makes no mention of this nor gives an opinion on how this might affect those investors who, like me, were [mis-]advised by David Vilka of Square Mile International Financial, often making fraudulent misrepresentations in the sales process – https://write.as/scam-victim/the-whole-story – fyi for anyone interested.

Not sure why I wasn’t asked to review/correct the piece before publication, but there you go such is life. It does undermine the credibility of the site however.

Stephen – are you volunteering to be proof-reader/editor?

Ive been 8 months chasing where i thpught my pension was HARBOUR PENSIONS now found out im in a 10 yr lock in ….

Havent signed a thing …. with Blackmores

Now got financial ombudsman on board looking into it all