The Justice Morgan Disaster was a real setback for justice for victims of pension scams and emasculated the pensions ombudsman. Shame on the High Court.

Judgement in the matter of Donna-Marie Hughes and Royal London Mutual Insurance Society

Case Number CH/2015/0377 on 19th February 2016

In the High Court of Justice, Chancery Division

Letters to:

- Justice Morgan

- Steve Webb, Royal London (former pensions minister)

- Pensions Ombudsman

- Ms. Hughes

- Bespoke Pension Solutions

- HMRC

Background: This is the introduction to letters to parties responsible for, involved in and affected by this matter.

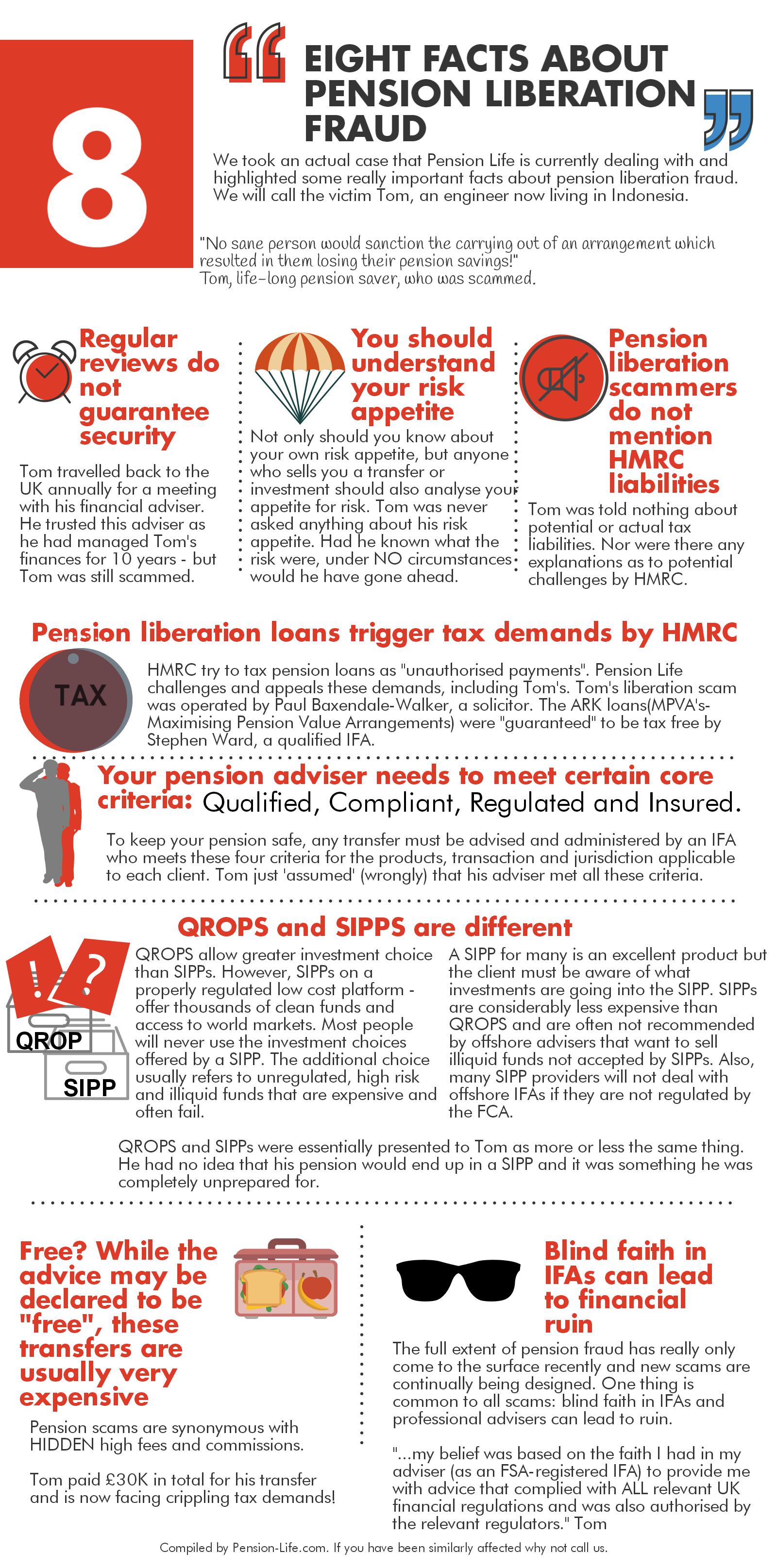

THE EFFECTS OF PENSION SCAMS

Pension scams since at least 2010 have caused serious loss and damage to thousands of victims. There have been suicides, nervous breakdowns, life-threatening illnesses and broken marriages as a result of the stress, despair and horror of pension frauds. The Royal London vs Hughes judgement has put at risk thousands of existing victims and has now potentially opened the flood gates to thousands more. The vast majority of the existing victims fear above all losing their homes and facing poverty in retirement – despite having worked hard all their lives to save diligently for their retirement. Providers and advisers are utterly horrified and disgusted at this judgement because it further compromises confidence in the pensions industry and the principal of saving for retirement.

I would draw attention to Clause 53 in Justice Bean’s Ark ruling where he makes it clear that legislation wording must be interpreted intelligently – and not blindly. Judges can (and should) use their common sense and make ‘purposive’ judgements where necessary. In other words they can decide, where the wording of a clause is poor, weak or ambiguous, on the basis of the obvious purpose or intention of the legislation. Clearly, Justice Morgan failed to do this and relied on the exact wording in the legislation and ignored the obvious intention of the wording.

A substantial number of victims have been appalled by this ruling. The saying “the law is an ass” has been used repeatedly – and with some considerable disgust. I have always found this to be an anomalous saying since a donkey is a dependable, reliable, strong, faithful and obedient creature. And these are all the attributes the law is supposed to have. Legislation is supposed to protect the rights of citizens, but in this matter Justice Morgan’s ruling has had the opposite effect.

OCCUPATIONAL PENSION SCHEME/LIBERATION SCAMS

Let us look at the facts regarding occupational pension schemes/liberation scams to date which have cost victims somewhere between £1 billion and £55 billion (depending upon which quoted authority’s figures are used):

- All the known pension liberation scams have to date used occupational schemes

- Not a single one of the sponsors of these “occupational” schemes had ever traded

- It was never intended that any of the sponsors of these “occupational” schemes would ever trade

- Not a single one of the sponsors of these “occupational” schemes had ever employed anybody

- It was never intended that any of the sponsors of these “occupational” schemes would ever employ anybody

- Some of the sponsors of the “occupational” schemes didn’t even exist

- The companies (whether they existed or not) were set up purely for the purpose of running a pension scam

The legislation does in fact state that a member of an occupational pension scheme should have some sort of earnings/employment – but falls short of saying that the earnings/employment should be with the sponsor of the occupational scheme (to which a member is intending or attempting to transfer). The Pensions Ombudsman spotted this omission and made it clear that a person should indeed have earnings/employment with the sponsor of the scheme otherwise it would be a “very strange result”. In other words, he interpreted the wording of the legislation intelligently – he looked behind the weakness in the wording of the legislation and applied the clear intention of the condition.

The Pensions Regulator’s Scorpion campaign specifically warns against the dangers of the way “occupational” schemes are set up for fraudulent purposes in the case of pension scams:

- A recently set up small self-administered scheme – SSAS, where the member is a trustee sponsored by a newly registered employer

- A scheme sponsored by a dormant employer

- A scheme sponsored by an employer that is geographically distant from the member

- A scheme sponsored by an employer that doesn’t employ the member

- A scheme connected to an unregulated investment company

WHAT ACTUALLY HAPPENED IN THE HUGHES CASE?

Ms. Hughes’ proposed transfer from the Royal London scheme ticked these warning boxes. But now Justice Morgan’s ruling has disarmed and emasculated the Pensions Regulator, the Pensions Ombudsman and the ceding pension trustee.

The simple fact is that, leaving all legal jargon aside, trustees could now be under a legal duty to effect a transfer to a scheme, even when there is reasonable (or even compelling) suspicion that the transfer is to a bogus scheme. It may now be the case that when all the warning signs clearly outlined by the Pensions Regulator should be ignored even when, as in Ms. Hughes’ case, every single warning bell is sounding loudly and clearly.

It is my obligation to refer you to the fact that the industry, regulators, law enforcement agencies, courts, ombudsmen and victims (existing and future) desperately need the legislation to be tightened – not relaxed (or, as in this case, made completely impotent). This judgement has effectively given the green light for hundreds of scammers to scam thousands of innocent victims out of their hard-earned pensions.

HISTORY OF HOW PENSION SCAMS ARE SET UP

History, since 2011, shows that various pension liberation scams including Ark, Capita Oak, Westminster, Evergreen, Salmon Enterprises, Eric’s Yard, Pennines, London Quantum, Headforte, Southlands etc., all shared a collection of common traits:

- They were set up, administered and promoted by an unregulated firm

- The firm obscured the identity of the team

- The address of the firm was a virtual office

- The assets of the scams being peddled included high risk, illiquid, speculative investments entirely unsuitable for pensions

- Bogus “occupational” schemes were registered with HMRC and tPR (who did nothing to check that the sponsoring employers actually traded or employed anybody – or indeed even existed at all)

- Pensions were liberated using a variety of “loan” structures which victims were assured were legitimate “loopholes”

- Transfer and loan fees were extortionately high

- Victims were promised unrealistic gains such as “guaranteed 8% return per annum”

- The schemes’ assets often included huge “kickbacks” for the introducers (up to 60%)

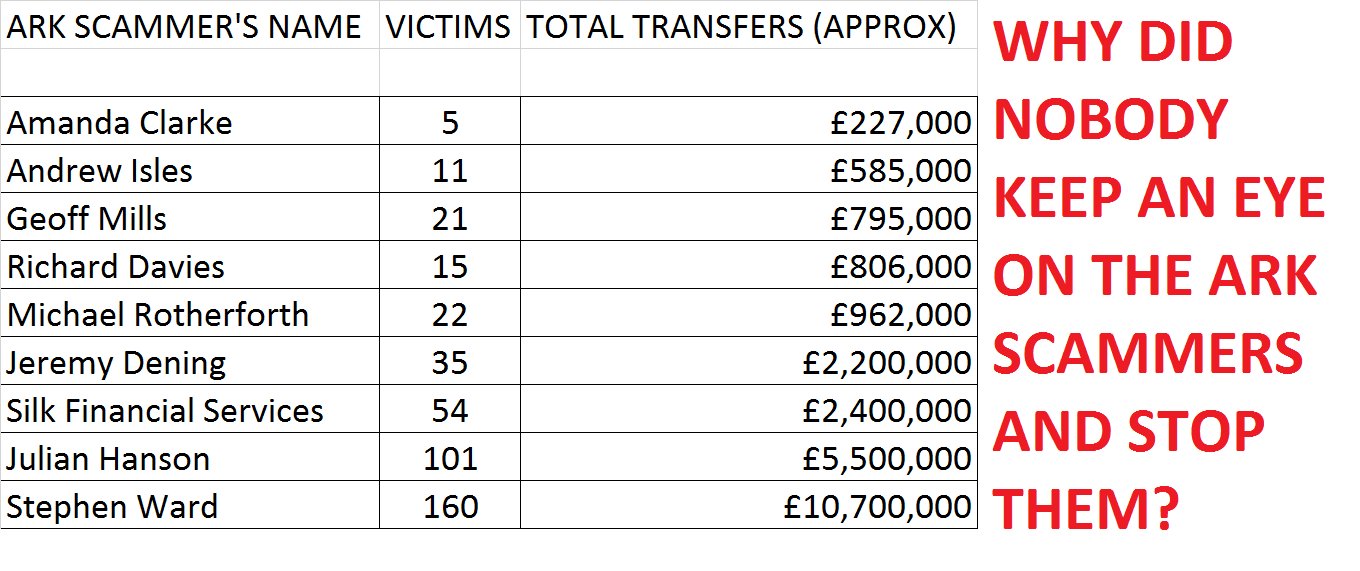

The firms and individuals offering, promoting, and running these schemes included:

- Gary Collin of Asset Harbour https://register.fca.org.uk/s/firm?id=001b000000bOu6zAAC

- Premier Pension Solutions in Spain (run by Tolleys Pensions Taxation author Stephen Ward – available on Amazon if you need a copy)

- Premier Pension Transfers Ltd (31 Memorial Road, Worsley)

- Fraser Collins, Villa Financial

- Julian Hanson

- Gerard Associates http://www.gerardassociates.co.uk/

- Frost Financial

- Continental Wealth Management, Spain

- P. Sterling

- Viva Costa International

- Windsor Pensions

- Blu Debt Management

- Wealth Masters

- Paul Baxendale Walker

- James Lau

- Silk Financial Solutions, Alexander Johnson – now James Alexander Enterprises

- Hudson Clarke

- Jackson Francis

- Jeremy Denning

- Tony Jimenez (Newcastle United and Charlton Athletic FC)

- Wightman, Fletcher McCabe

- Spain Wealth Management

- Mark Ainsworth

- Ralph Noel and Sons

Thousands of victims have lost £ billions worth of hard-earned pension funds and gained £ millions in tax liabilities in the past six years. The assets of these schemes have included offshore property, store pods, car parking spaces, unregulated collective investments, eucalyptus forests, hedge funds, forex, Cape Verde property etc.

THE EFFECT OF THIS RULING

I am not saying that Bespoke Pension Services are scammers but on the back of their victory in the case of Ms. Hughes, there are a further 160 blocked pension transfers sitting with the Pensions Ombudsman. We have no way of knowing whether they will all be pension transfers invested in Cape Verde assets, but we do know the Hughes case must have been very important to Bespoke Pension Services’ business.

Interestingly, Bespoke Pension Services are unregulated and their address is a virtual office. According to their latest published accounts the firm was insolvent in 2014. The two directors/shareholders – Mark Anthony Miserotti and Clive John Howells – have between them an impressive portfolio of investment, consultancy, property development, investment and financial planning companies – one of which is called “Fortaleza Investments” which suggests something Brazilian.

On the back of Justice Morgan’s judgement in respect of Royal London, there will be a serious problem for all the pension providers who performed so appallingly in Ark, Capita Oak, Westminster, Evergreen et al: the worst of which being Standard Life, Prudential, Scottish Widows, Aviva and Legal and General. Having handed over £ millions worth of pension funds since 2010 – in a lazy, negligent, box-ticking fashion – there is evidence that they are trying to mend their ways. Or at least there had been, until the judgement in the Hughes/Royal London/Bespoke Pension Services case.

It is essential to read Clause 53 in Justice Bean’s 2011 Ark ruling where he makes it clear that legislation wording must be interpreted intelligently – and not blindly. He is obviously trying to make the point that it is essential to avoid an anomalous or unjust result from failing to look behind the intended meaning of wording in legislation. Indeed, the Pensions Ombudsman had already done that when looking at the wording when he said that he found that a transferee did indeed need to be employed by the sponsor of an occupational scheme in order to avoid a “strange result”. Justice Morgan’s judgement has now put at risk thousands of victims’ pensions. There have already been suicides, nervous breakdowns, life-threatening illnesses, broken marriages and families. There will be widespread poverty in retirement and many people will lose their homes. A strange result indeed – which does rather beg the question of how victims will get any protection or justice now?

PENSION LIFE WOULD LIKE ANSWERS URGENTLY

Hopefully, the recipients of the following letters will provide some answers:

Dear Justice Morgan

Hopefully, you can clear up a few questions which are puzzling me and many other disgusted parties: why did you ignore the Pensions Regulator’s clear warnings re pension scams?; why did you ignore the Pensions Ombudsman’s intelligent interpretation of the poorly-worded legislation?; why did you ignore Justice Bean’s warnings re avoiding anomalous or unjust results in the Ark case?; how many victims will now lose their pensions as a result of your judgement?; how many of these victims will lose their homes and even their lives?; what research did you do into how pension scams have worked this past six years before making your judgement?; what steps are you now taking to highlight the urgency of reforming and re-writing pension legislation to correct the weakness in the wording relating to genuine employment by a sponsor of an occupational pension scheme?; what remorse do you now feel for the fact that you have put £ billions worth of pensions at risk?

Dear Steve Webb, Royal London

Hopefully, as former Pensions Minister, you can give some clarity to how Royal London feels this appalling judgement can be appealed, or its effects mitigated. It is obviously completely unacceptable that pension trustees may now be forced to allow transfers even when it is strongly suspected that the receiving scheme is a scam. However, an even more serious concern is that this may now compromise claims against negligent ceding providers. Dozens of negligent firms handed over £ millions worth of personal and occupational pensions to scammers from 2010 onwards. These firms asked no questions either before tPR’s Scorpion campaign or after and simply used a lazy, negligent, box-ticking approach. Obviously, these firms need to compensate their victims and restore faith and confidence in the industry. According to my own records, the worst offender overall by a generous margin was Standard Life. Other firms that performed especially badly included Prudential, Scottish Widows, Legal and General, Aviva, Phoenix Life and Aegon. My evidence suggests that Royal London was not among those who negligence was as extensive as Standard Life et al, but I do have one case that it would be useful for you to address. Your firm’s victim – whose pension was handed over to one of the Ark schemes: Portman – is currently fighting ISIS in the Middle East and is playing a significant role in defending our country from terrorism. I am sure you will be particularly keen to ensure he is compensated for the loss of his pension and the exposure to crippling tax penalties. What will definitely help to rescue the public’s and the industry’s disgust at the widespread negligence of firms such as Standard Life will be if Royal London sets a shining example and pays out the required compensation voluntarily rather than waiting for the victims to have to drag these matters through the courts.

Dear Pensions Ombudsman

Hopefully, you will have some valuable thoughts and suggestions on the effects of Justice Morgan’s ruling in the Royal London case. As I am sure you can imagine, the scammers will be absolutely delighted and will now be setting out to ruin even more victims’ lives on an even greater scale. It is obvious that pension scams are very lucrative for the scammers and their success can be measured by the impressive houses and cars they own. Perhaps you could let me have your thoughts as to what pension trustees should now be doing to protect their members? You must also be aware that targeted victims are often carefully “coached” by the scammers as to how to overcome resistance to transfer requests. In the case of the London Quantum scam (the trustee of which was Stephen Ward of Dorrixo Alliance at 31 Memorial Road, Worsley), for example, one adviser reported that he had several clients desperately trying to get out of the scheme and several more trying equally desperately to get into the scheme. Now that London Quantum is in the hands of tPR-appointed Dalriada Trustees, the assets have been disclosed as being the usual toxic, illiquid, high-risk investments such as car parking spaces, forex trading, derelict German buildings and Cape Verde properties.

Dear Ms. Hughes

Hopefully, you yourself can shed some light on why you were so desperate to transfer your Royal London £8,000 fund into a SSAS. You are registered as the sole director and shareholder of Babbacombe Road 1973 Ltd. However, there is no evidence that this company has ever traded or employed anybody since 2014. Also, it would be interesting to know what your connection to Bespoke Pension Solutions is and how this firm initially made contact with you. Your High Court proceedings must have involved some considerable time, effort and expense; did you pay your legal costs yourself? Were you aware that this firm had a further 160 pension transfer attempts hingeing on the outcome of your case? I am also curious as to why you have three different director IDs at different addresses? 905529548 at 49 Wakedean Gardens, Yatton, Bristol BS49 4BN; 918824265 at First Floor Flat, 269 Babbacombe Road, Torquay TQ1 3SZ, 912378590 at Brynteg Llangenny, Crickhowell, Powys NP8 1HE. Finally, why are you using a firm with no evidence of a premises, regulation, qualifications or team members?

Dear Bespoke Pension Solutions

Hopefully, you could explain a couple of issues that I am struggling to understand. Why do you use a virtual office rather than a physical address? Officefront Why are the members of your team not disclosed on your website? What qualifications do your team have for pensions and investment advice? Why was your firm still trading while, according to Companies House records, the company was insolvent in 2014? Did your firm pay off the £101k owed to creditors in 2014? What regulation does your firm have for pensions and investments in the UK? Which lead generation service do you use? Which cold-calling sales service do you use? What investment introduction commission relationships do you currently have? (e.g. Store First, Quantum, Cape Verde, Dubai Car Parks, Dolphin etc). Do you have professional indemnity insurance? Did you pay Ms. Hughes’ legal fees? What connection does your firm have to First Review Pensions? http://whocallsme.com/Phone-Number.aspx/01332426342/2

Dear HMRC

Hopefully, you can now – finally – provide answers to crucial questions relating to your role in pension scams. Since 2010, HMRC have been registering schemes without checking the credentials of the trustees, the sponsoring employer or the purpose behind the scheme (i.e. to provide income in retirement, to operate pension liberation or to earn huge commissions on investment introductions). Of even greater concern is the burning question as to why HMRC did not de-register schemes as soon as there were concerns in order to prevent victims from losing their pensions and gaining crippling tax liabilities. If you remember, HMRC had a meeting with Stephen Ward of Premier Pension Solutions to discuss the Ark schemes in February 2011. At this time, there was about £7m in Ark, but HMRC did not suspend the registration and nothing was done to close the scheme down until three months later by which time there was £30 million in Ark. Hence, HMRC was directly responsible for hundreds of victims’ financial ruin and is currently pursuing these people for tax which was entirely preventable had HMRC suspended the schemes. Subsequently, having known that Stephen Ward was heavily involved in pension liberation, HMRC then went on to accept numerous pension scheme registrations from him and his company Dorrixo Alliance at 31 Memorial Road, Worsley. These included Southlands, Headforte and London Quantum – among many others. HMRC was handed evidence of these various schemes in May 2014, and yet took no action to suspend any of the schemes. Then in August 2014 a serving police officer lost his police pension to London Quantum. In 2010/2011, HMRC, the Crown Prosecution Service and the Pensions Regulator were all investigating the fraud being perpetrated by pension trustees Tudor Capital Management. But although there were a total of 25 different schemes involved – one of which was Salmon Enterprises (yet another bogus “occupational” scheme) – HMRC did nothing to suspend the schemes and prevent victims from losing their pensions and being exposed to tax liabilities. HMRC is currently pursuing thousands pension scam victims for tax on transactions which could – and should – have been prevented had HMRC acted diligently. Therefore, kindly confirm what proposals is HMRC currently working on for compensating these victims for the damage and loss caused by HMRC’s negligence?

From Angela Brooks, ACA Pension Life

www.pension-life.com

I will, of course, be more than happy to help Deloittes see the whole picture – rather than just what the Fraudsters want them to see. I will happily buy a whole shed full of spades as well as several boxes of latex gloves and surgical masks. However, the most important way in which I can assist them is to give them details of the various scams which the Fraudsters have operated and facilitated.

I will, of course, be more than happy to help Deloittes see the whole picture – rather than just what the Fraudsters want them to see. I will happily buy a whole shed full of spades as well as several boxes of latex gloves and surgical masks. However, the most important way in which I can assist them is to give them details of the various scams which the Fraudsters have operated and facilitated. Deloittes will need to concentrate on at least three main areas: Trafalgar Multi-Asset Fund; Cornerstone Friendly Society and Blackmore Global. They will also need to liaise closely with the Serious Fraud Office which is investigating the Trafalgar fund scam and the West Yorkshire and Humber Police which is investigating the Cornerstone scam.

Deloittes will need to concentrate on at least three main areas: Trafalgar Multi-Asset Fund; Cornerstone Friendly Society and Blackmore Global. They will also need to liaise closely with the Serious Fraud Office which is investigating the Trafalgar fund scam and the West Yorkshire and Humber Police which is investigating the Cornerstone scam.

TPR had appointed Dalriada Trustees to the case, and with this ruling, they will be able to attempt to recoup the stolen money from the four scammers. Unfortunately it is unclear how much money is actually left to recoup as scammers are notoriously clever at hiding their ill-gotten gains offshore and presenting themselves as “men of straw”.

TPR had appointed Dalriada Trustees to the case, and with this ruling, they will be able to attempt to recoup the stolen money from the four scammers. Unfortunately it is unclear how much money is actually left to recoup as scammers are notoriously clever at hiding their ill-gotten gains offshore and presenting themselves as “men of straw”. One of the victims, Colin, from South Wales, had become the full-time carer for his partner when he was approached via text message. Promised investments in the now bust St Lucia Developments, a lump sum which he planned to spend on a holiday. Having heard about the pension scams, he tried to contact the scammers with no success.

One of the victims, Colin, from South Wales, had become the full-time carer for his partner when he was approached via text message. Promised investments in the now bust St Lucia Developments, a lump sum which he planned to spend on a holiday. Having heard about the pension scams, he tried to contact the scammers with no success. A couple, John and Samantha, both fell victim to this scam despite being advised by their pension provider that it could be a scam. They received their lump sum and were told their pension was invested in truffle trees. After reporting the case to the police, they were later informed that their lump sum was from their own funds and HMRC promptly served them with a large tax bill.

A couple, John and Samantha, both fell victim to this scam despite being advised by their pension provider that it could be a scam. They received their lump sum and were told their pension was invested in truffle trees. After reporting the case to the police, they were later informed that their lump sum was from their own funds and HMRC promptly served them with a large tax bill. Why has cold calling not been banned by the government?

Why has cold calling not been banned by the government?

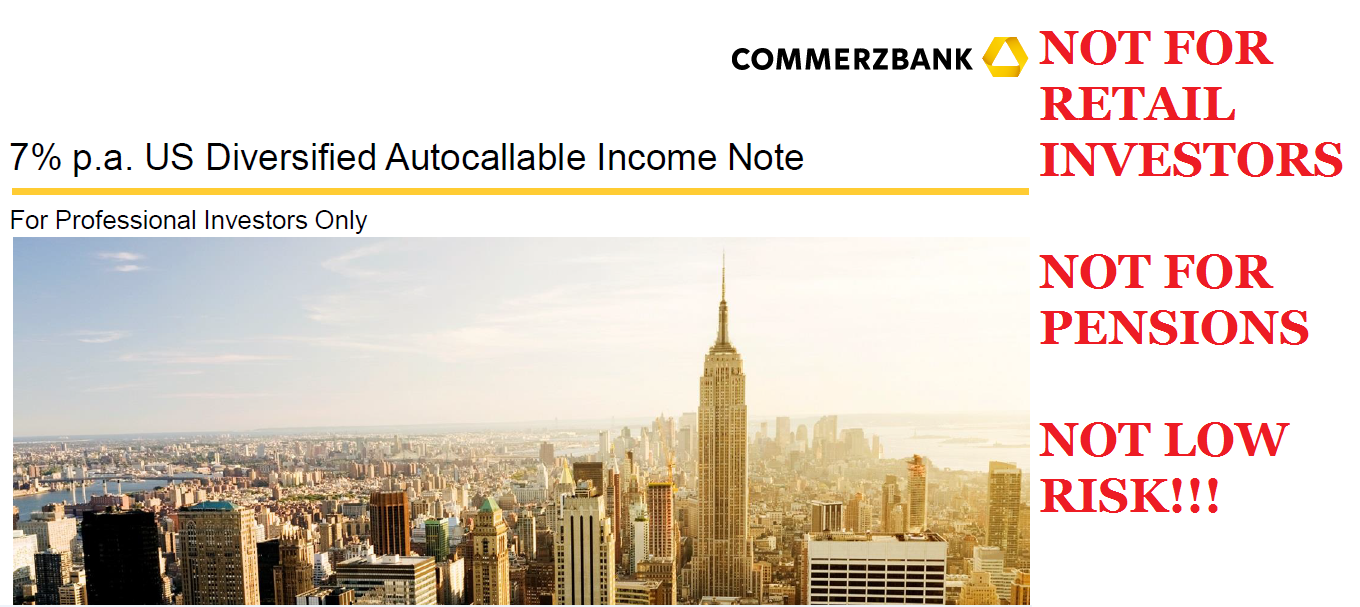

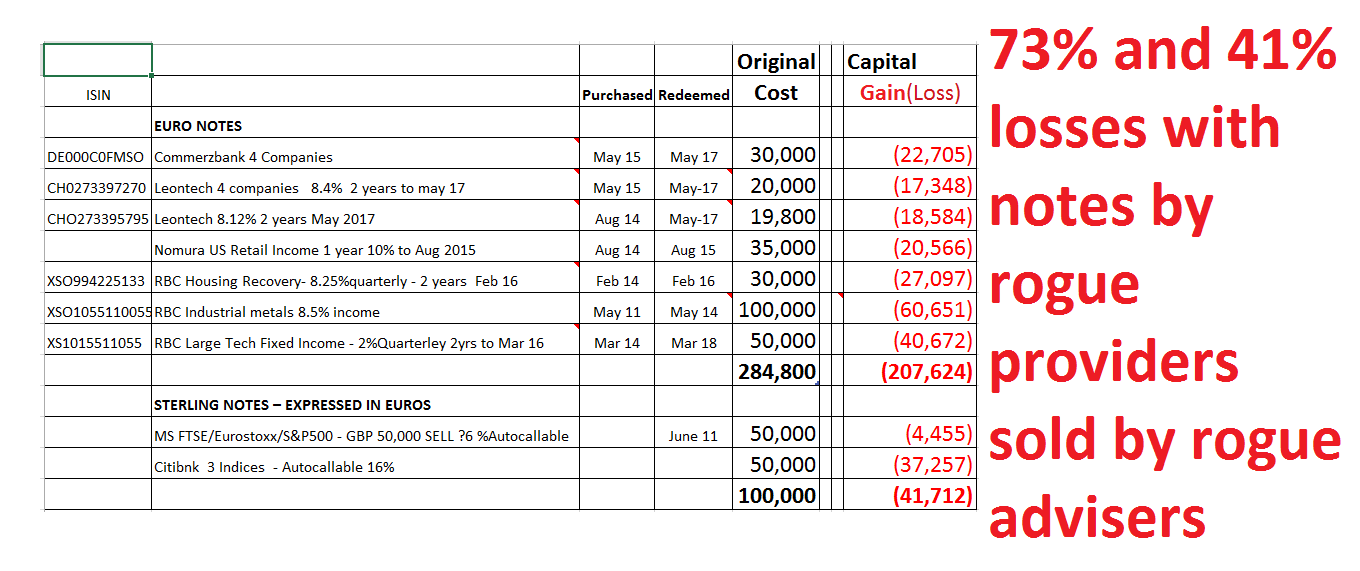

Structured notes – say NO to them if an adviser wants to invest your pension in them. They are high-risk investments which are for professional investors

Structured notes – say NO to them if an adviser wants to invest your pension in them. They are high-risk investments which are for professional investors  As in the above example, it is a disgrace that structured note providers such as Commerzbank, Nomura, RBC and Leonteq have allowed their toxic products to be used for retail pension savers. Even when these rotten products have nosedived repeatedly, these dishonest and dishonourable providers keep on flogging them to destroy victims’ retirement savings.

As in the above example, it is a disgrace that structured note providers such as Commerzbank, Nomura, RBC and Leonteq have allowed their toxic products to be used for retail pension savers. Even when these rotten products have nosedived repeatedly, these dishonest and dishonourable providers keep on flogging them to destroy victims’ retirement savings.