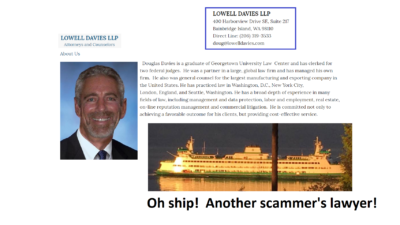

David Vilka of Square Mile International Financial Services has exactly the sort of lawyer one would expect: a scammer’s lawyer. Unsurprisingly, this dope can’t even spell Vilka’s victim’s name and has referred to him as “Mr Sexton” as opposed to “Mr Sefton”. But, again, this is no surprise.

David Vilka of Square Mile International Financial Services has exactly the sort of lawyer one would expect: a scammer’s lawyer. Unsurprisingly, this dope can’t even spell Vilka’s victim’s name and has referred to him as “Mr Sexton” as opposed to “Mr Sefton”. But, again, this is no surprise.

What I must challenge, however, is the fact that Mr. Sefton has referred to this clown as a “two-bit lawyer”. I really don’t think this is true – as he is a one-bit lawyer at best. He has a couple of glowing client testimonials going back to 2016 and 2015 on his amateurish website, and displays no evidence of experience or expertise in the arena of British pensions (and why would he? – he’s purportedly practising US law in the US).

One might forgive Mr. Davies for not understanding anything about UK pensions in general and pension scammers like David Vilka in particular, but to immediately jump into a firm conclusion that there has been defamation against his client shows that he hasn’t even made a one-bit attempt to understand what his client has been up to – or how many lives (like Mr Sefton’s) Vilka has ruined.

I must admit I am used to dealing with a much better class of scammers’ lawyer. Take DWF, for example: this large firm carelessly lost a team of 20 lawyers to rival Trowers and Hamlins a couple of years ago. This wasn’t long after they were caught representing both sides in a case: the Insolvency Service in the winding up of Capita Oak, and Stephen Ward who handled the transfer administration in the same scheme. But at least they dealt with the embarrassment of acting for both the poacher and the gamekeeper with a degree of dignity and elegance – a class act indeed. DWF comes into the same league as my other legal chums – including Carter Ruck and Mishcon de Reya. So, you can see I am more used to dealing with professional firms rather than twerps like this Mr Davies.

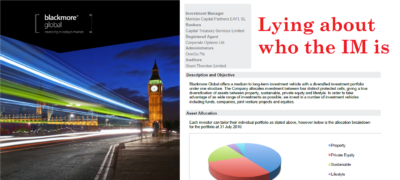

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Mr. Davies is referring to the UCIS investment scam, Blackmore Global, which was illegally promoted to retail investors – and which is a fraud from start to finish.

Anyway, I have answered his absurd email below with my usual comments in bold.

————————————————————————————————-

LOWELL DAVIES LLP

July 14, 2018

Ms. Angela Brooks, Director of Pension Life

Re: Defamation of Mr. David Vilka and Square Mile International

Dear Ms. Brooks:

I am an attorney You may well be, but you are clearly a US attorney – and that does not qualify you to deal with a matter which involves UK pensions

and represent Mr. David Vilka Bad luck

with respect to the defamatory article I never write defamatory articles – I only write the truth

published on your on-line site. Specifically, this complaint relates to the misstatements and misrepresentations made on

the following site:

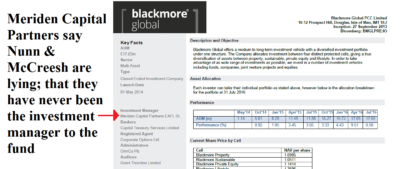

If I might sum up, each and every defamatory allegation with regard to Mr. Vilka and Square Mile International you assert are sourced to one disgruntled individual, Stephen Sexton, none of which allegations are supported by any evidence whatsoever. Wrong. Mr. Sefton is one of a number of victims of Vilka’s scams – many of which were invested in the same toxic, illegal UCIS fund as Mr. Sefton – Blackmore Global – and others were invested in other similar investment scams. Blackmore Global is run by another scammer, Phillip Nunn, who – along with his partner in crime Patrick McCreesh – ran the cold calling and lead generation services for the Capita Oak and Henley pension scams, now under investigation by the Serious Fraud Office.

Mr. Sexton was an unsolicited client of Mr. Vilka and Square Mile who had a substantial pension and for personal reasons of his own wanted to switch his pension and draw down sums for his personal use. When he says “unsolicited” he means not cold called, as was usually the case with Vilka. Vilka lied about being regulated to provide pension and investment advice, and the rest is history: Mr Sefton’s life savings were invested in two UCIS funds which were habitually promoted by Vilka: Blackmore Global and Symphony.

The switch in pension plans resulted in what Mr. Sexton felt were unreasonable fees (None of which went to Mr. Vilka or Square Mile). I wonder if this idiot would like to explain why Mr Sefton was put into a QROPS when he was a UK resident?

And despite the fact that Mr. Vilka was able to personally intervene and get Mr. Sexton’s monies returned less a nominal fee, Mr. Sexton continued to complain and when Square Mile attempted to make up even this nominal fee on its own part, Mr. Sexton continued to complain because he refused to sign a boilerplate settlement agreement containing a standard confidentiality agreement. It is true that Mr Sefton did, eventually, get around 85% of his original investment back – but only after a dogged fight which was backed up by the pension trustees Integrated Capabilities. There was no intervention by Vilka.

In your post on the Blackmore Fund you have the temerity to cast defamatory aspersions on Mr. Vilka and Square Mile based on your “strong suspicion” and you go on to assert they must have a “strong vested interest in promoting this black hole of a fund.” Why else would scammers such as Vilka promote such a fund? It is a UCIS, with no independent audit to verify whether the purported assets even exist.

Really? What proof of that would you have? Vilka must have had a very strong reason to promote the Blackmore Global investment fraud – why else would he have invested a further 64 victims’ pensions in this UCIS? This was a bunch of people he scammed into transferring their pensions to a Hong Kong QROPS.

And since you have none, we demand you remove this article and/or any reference to Mr. Vilka or Square Mile. I have plenty of evidence thank you.

Let me advise you that Mr. Vilka and Square Mile, contrary to your specious aspersions, are heavily regulated as is the industry. “Heavily”? What you actually mean is that neither Vilka nor Square Mile is regulated for pension or investment advice – only insurance mediation.

The Sexton matter was thoroughly investigated at the time by the appropriate regulators who found no irregularities. You don’t know that.

Mr. Sexton is not nor was he a perplexed victim of Mr. Vilka or Square Mile. He most certainly was – as Vilka and his accomplice John Ferguson know full well.

His pension is worth well over half a million pounds. No it isn’t. Did you do maths at school?

He read and signed multiple acknowledgements before he switched pensions showing very clearly that he knew what he was investing in and the inherent risks involved. No he didn’t. It was never disclosed that the scammers were going to invest his pension in a UCIS fund which is illegal to be promoted to retail UK investors.

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

And again, significantly, he was not cold-called. He sought out Mr. Vilka and Square Mile. Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts via an electronic data box. Are you talking about the accounts which haven’t been updated since 2014?

In sum, there is no bases whatsoever for the specious and actionable statements you make in your referenced post with regard to Mr. Vilka and Square Mile International. I think you mean basis – and yes, there is a solid basis for all the statements I made in my post and not a single one of them is “specious” (although I am amazed you have even heard of the word).

Your comments have caused Mr. Vilka and Square Mile reputational damage, among others, and you are hereby instructed to delete the post immediately. I sincerely hope that the impact of my blog has caused Vilka and his accomplice Ferguson to turn over a new leaf and arrange to pay compensation for Mr. Sefton and all their other victims who have lost part or all of their pensions to the Square Mile scams.

Your failure to do so will result in further damages to Mr. Vilka and Square Mile International, the accrual of further legal fees and costs, and the likelihood of litigation, all of which damages and costs we will recover from you. Good luck with that.

If you have any questions or concerns or require further information, please don’t hesitate to contact me directly at (206) 319-3533. I look forward to confirmation of the removal of the identified defamatory materials. Thank you in advance for resolving this matter expeditiously. I have no questions, other than to enquire as to when your client intends to pay redress for the losses caused by his fraud.

Best regards,

LOWELL DAVIES LLP

LOWELL DAVIES LLP

Douglas Davies Attorney at Law

8497 Hemlock Drive

Bainbridge Island, WA 98110

Direct Line: (206) 319-3533

doug@lowelldavies.com

I recall my father once telling me “If you don’t buck up your ideas at school, you will end up working on the bins or as a lawyer”

Nothing changes!

I like that!

Lawyers will be the first against the wall when the revolution comes!

I like this comment!

Lawyers will be the first against the wall when the revolution comes!!

One quote from above: “Nor did Mr. Vilka or Square Mile receive any payment from the Blackmore fund or its partner firms regarding Mr. Sexton’s transaction as confirmed by the Czech National Bank which has direct access to Square Mile’s company bank accounts…”

You won’t see payments from Blackmore to Vilka or Square Mile probably because payments from Blackmore & partner firms went to Lillywhite as explained quite clearly (https://pension-life.com/not-so-square-mile-and-far-from-lilly-white/ ) by the other reprobate in the picture above, Director of Lillywhite, who was also a co-director of Square Mile until Nov 2017. The CNB would most likely have seen Blackmore payments to Lillywhite (described as “distribution fees) and subsequent payments from Lillywhite to Square Mile (aka Aktiva Wealth Management) and/or Vilka.

If the Czech National bank hasn’t the intelligence to spot obfuscation when they see it then that’s why these unpleasant people chose that jurisdiction to operate their business of advising people to transfer their pensions into “introducer’s funds” regardless of a person’s best interest, as admitted in the link referenced above. If that isn’t describing a “strong vested interest” then what does?

Moreover this was NEVER disclosed by Vilka, nor their introducers and “back office service providers”, Aspinal Chase, who by the way also OWNED Blackmore Global! Even a two-bit lawyer and Mickey Mouse Regulators should be able to see what the game is here! It isn’t rocket science – well maybe it is to them. So, if all the CNB did was look at one Bank Account then they are pretty stupid indeed!

And for the record I didn’t “SEEK Vilka out” which makes it sound like I purposely went looking for him and him alone – it is more accurate to say I went looking for an IFA, came across Aktiva Wealth Management’s website (owned by Vilka) and through an innocent enquiry was then DUPED by Vilka into believing he was a regulated IFA, permitted to give investment advice and transfer pensions – but later told by the FCA, in writing, he wasn’t, and neither Vilka nor his lawyer(s) has ever provided one shred of evidence to the contrary despite numerous requests to do so by me, Angie and the BBC – https://www.bbc.co.uk/news/business-42776709 – he just turns and hightails it to another lawyer!

So if Vilka wants to compare notes on fraudulent misrepresentation then he should first tell his lawyer the truth and start coming up with some hard evidence – I have a shed load – Vilka has to date, in over two years now, produced NONE – Not one iota!

It is fair to say, Vilka is the architect of his own reputation – damaged or otherwise. I truly dislike the person and what he stands for and the distress he caused me and the dozens of others, still trapped in the UCIS’s he recommended, with no redress.

Good luck following the introducer payments on this one, the firm has an office registered here in Gibraltar but the ownership seems to be in Dominca.

http://www.checkcompany.co.uk/director/991630/LILLYWHITE-HOLDINGS-LLC

I don’t intend to follow the introducer payments. The BBC tried to do this earlier in the year and gave up. The journo didn’t have the time to join the dots and his management put him onto other assignments. It wasn’t important enough to spend the time.

The Blackmore Group Offer Document says on page 13 of 18: “The Board has appointed BG Finance Holdings Ltd as a consultant to carry out various tasks …” It also says on the same page a “management fee is applied to each cell equal to 2.5% per annum of assets under management…” and on page 19 it says: “A subscription fee of 3% of the value of each cell share will be charged and deducted from the subscription received by the Company. The fee can be paid to any introducing Agent or broker introducing investors to the Company …” My guess this “subscription fee” is the commission or as the Lillywhite email linked above calls it the “distribution fee”.

BG Finance Holdings Ltd. can be found here https://offshoreleaks.icij.org/nodes/10158565 and is a shareholder of Blackmore Global Finance Ltd, registered in the Virgin Islands.

You can see the obfuscation going on and how money is likely to be paid to offshore “BGFH” for “consultancy services” and then no doubt diverted to Lillywhite via its Dominican Office. Not a penny of it being easily traceable to either Vilka or Square Mile. It isn’t something “ordinary” people like me have the resources to follow but “agencies” could if they had the will.

Clearly the CNB doesn’t have the will, nor Action Fraud in the UK. The BBC no doubt could have done it but didn’t feel it newsworthy enough to put the effort in – not a big enough story I guess. Blackmore and Square Mile are bottom feeders and not important enough to make headline News – not like British Steel or BHS!

Just have to live with not being able to follow the trail.

We operate a financial claims company and now have over 30 claims that all would appear to be against Mr Vilka. An almost identical structure and investment proposition and declarations to scheme trustees that are farcical! Please get in touch if you are interested in discussing the situation with me or indeed have any ideas as to how claims can be made against Mr Vilka personally. It is our intention to try and assist people who have lost money as it is utterly disgraceful and amongst the worst cases or apparent fraudulent activity I have seen in 26 years within financial services.