The FCA seems to have woken up. It only took eleven years. Eleven years of laziness, torpor, disinterest and deliberately ignoring the problem. But, completely out of the blue, the FCA has suddenly got bored with crapping on bathroom floors and has decided to do a spot of rather belated regulating.

The object of this sudden fit of uncharacteristic activity, is the Ark pension scam. This was operated between 2010 and 2011 by a team of scammers. This team included so-called financial advisers, introducers, a pensions lawyer and an accountant. The principal architect of the six Ark schemes, however, was Stephen Ward of Premier Pension Solutions in Spain. His Spanish firm specialised in (pretty much what it said on the tin) pensions. In particular pension transfers.

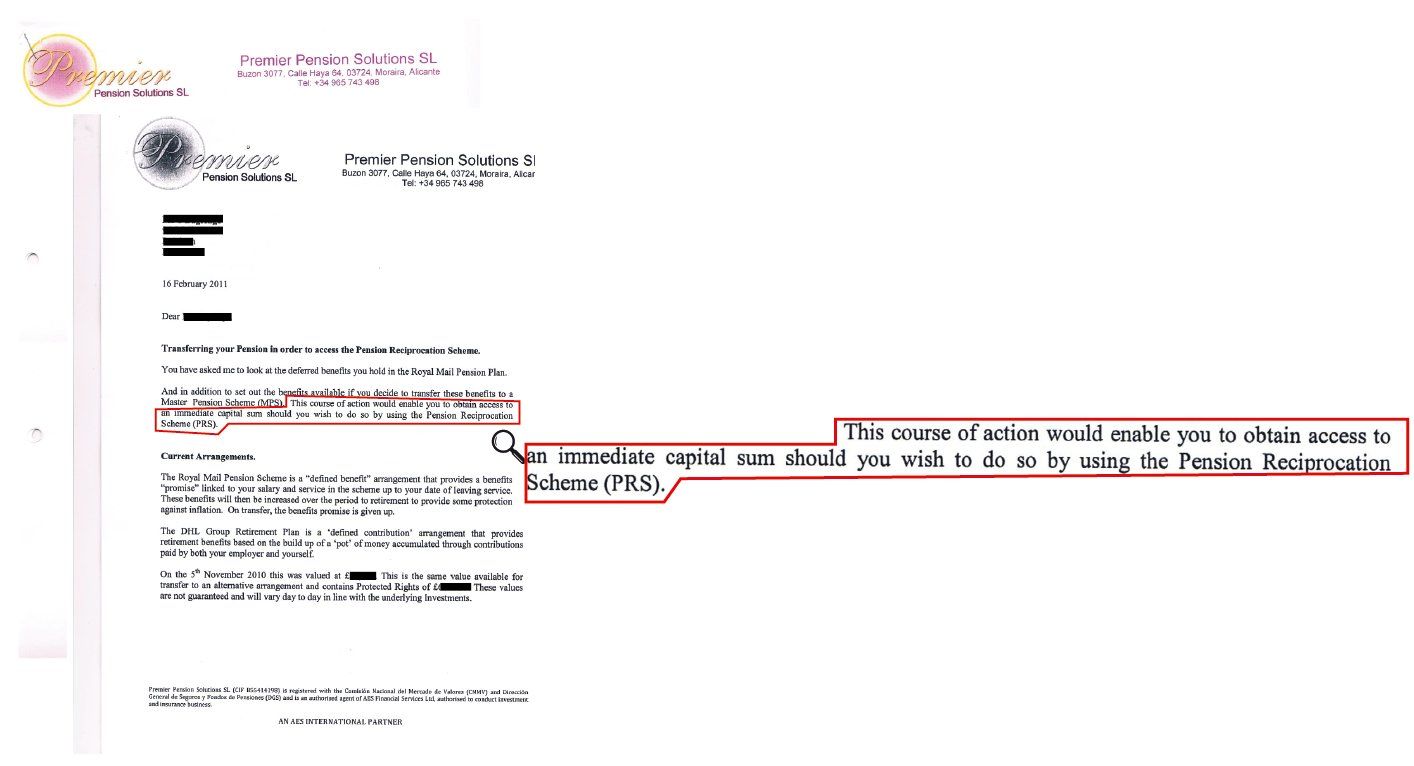

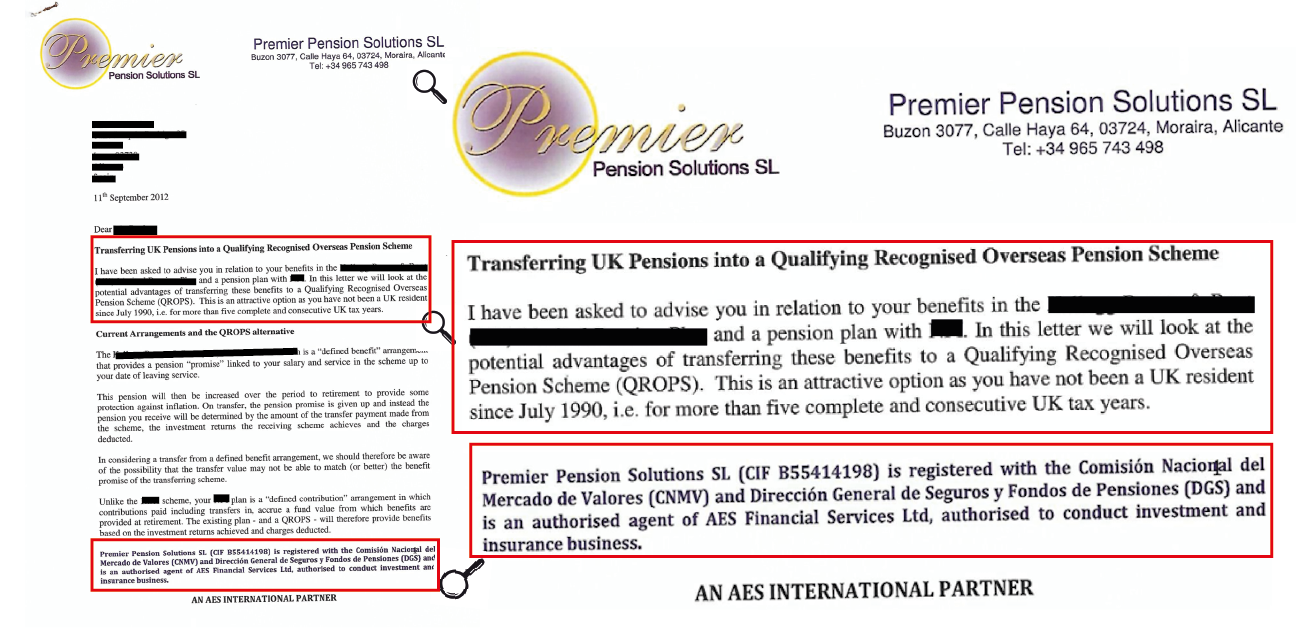

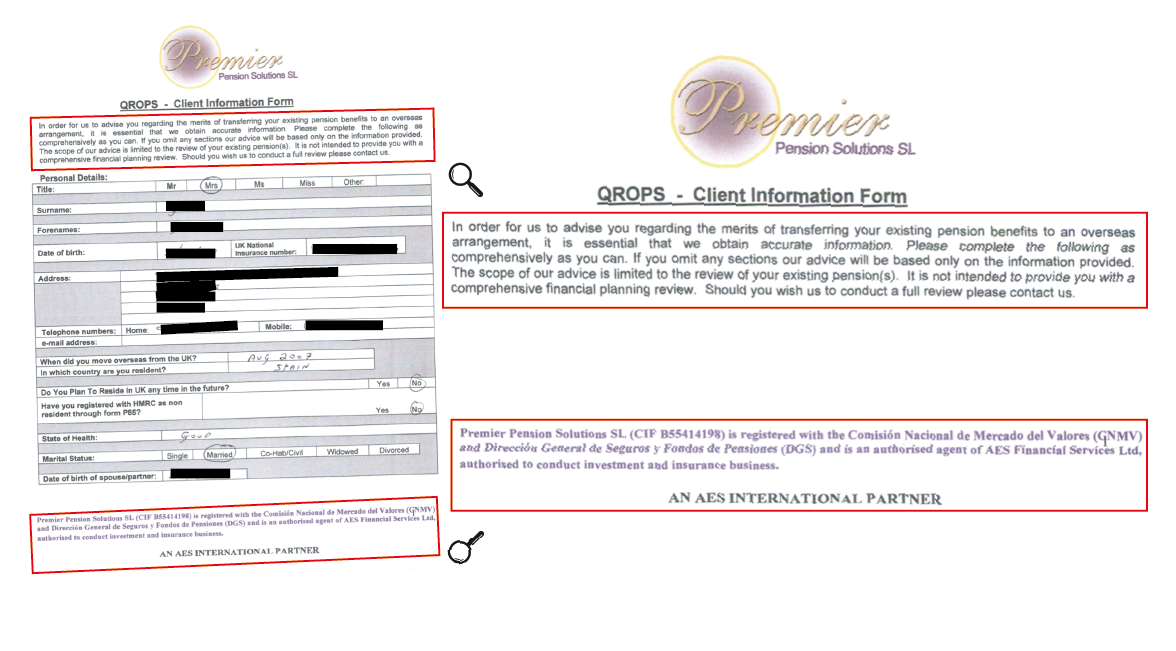

From August 2010, Ward’s company Premier Pension Solutions (PPS) was run as an agent of AES Financial Services – which was regulated by the FSA (now the FCA). Before this, Ward’s company was in the Inter-Alliance network in Cyprus. Coincidentally, the “sister” firm Continental Wealth Management (CWM) was also a member of the Inter-Alliance network. PPS and CWM worked together in close collaboration. CWM often did the cold calling and warm up act for Ward’s various pension scams – including the New Zealand Evergreen liberation scam.

An agency agreement was in place between Ward’s firm PPS and Sam Instone’s firm AES. But the agreement specifically excluded pension transfers. Which was pretty odd, bearing in mind pension transfers were PPS’ main activity. This resulted in Ward’s firm giving victims the false impression that the pension advice he provided was regulated. Which, of course, it wasn’t. The exclusion in the agency agreement between PPS and AES was, naturally, hidden from clients and victims.

Complaints directed at Ward about the various pension scams he had been operating over the years were always firmly rebutted. Ward always claimed that his own activities were the responsibility of AES as the regulated party – and that it was up to Instone to decide what PPS could and couldn’t do.

Kirsten Hastings from International Adviser has published some excerpts from the FCA’s questionnaire about Ark, PPS and AES:

- A questionnaire has been sent by the FCA to customers of AES Financial Services (which also traded as International Pension Transfer Specialists (IPTS), Premier Pension Solutions (PPS) and Premier Pension Transfers (PPT).

- These clients invested or transferred pensions into schemes managed by Ark Business Consulting and/or the Ark pension schemes.

- The questionnaire was sent to consumers to gather more information about their dealings with these firms.

- They have until 17 October to respond.

- Director of AES Sam Instone told IA: “We are absolutely certain AES Financial Services Ltd has never provided any advice at all in relation to Ark schemes, so it seems like a strange questionnaire.”

Sam Instone seems to have forgotten that AES Spain was run by rogue “adviser” Paul Clarke for some years – after leaving unlicensed firm CWM in 2010. Clarke advised several victims to transfer into Ark. And good old Sam himself advised his own Dad to transfer into Ark. I guess three destroyed pensions – with accompanying tax penalties – can be easy to forget?

Kirsten Hastings goes on to talk about the history of Stephen Ward’s Ark scam:

- In May 2011, Dalriada Trustees was appointed by The Pensions Regulator (TPR) to take over schemes marketed by Ark Business Consulting.

- TPR took action following concerns that the Ark schemes were being used for pension liberation.

- According to Dalriada, such schemes generally have high charges and invest money in risky and esoteric vehicles.

- They also put members at risk of having to pay large sums of tax.

- The latest Dalriada update to members states it is “not able to place a value on any members’ benefits at the time and are therefore unable to make payments to members”.

Kirsten also mentions some further points in the FCA questionnaire:

- Did the client (Ark victim) approach the firm or vice versa?

- Where was the client based when these services were provided?

- Would clients be willing to sign a witness statement?

- What regulatory protections was the client told there were?

All Ark victims would certainly be more than happy to sign a witness statement to evidence what Stephen Ward, PPS and AES did, wrote, promised, assured and persuaded.

The regulatory protection, of course, for anyone advised by Stephen Ward’s Premier Pension Solutions (which was most of them) in the Ark scam, was Sam Instone’s AES Financial Services – according to all the documentation.

Ward promoted the Ark £27 million scam during 2010 and 2011 – cases being documented on PPS headed paper announcing that the firm was a “Partner” of AES and regulated through AES. Ward would have earned at least £1 million through the Ark scam – all of which would have been paid through AES.

When Ark went tits up, Ward launched his next pension liberation scam: Evergreen Retirement Benefits QROPS in New Zealand – with his accompanying 50% Marazion “loans”. Again, all advice was given on PPS headed paper announcing that the firm was an AES partner and regulated through AES. This meant another 300 victims lost more than £10 million worth of pensions. It also meant that PPS and AES between them earned at least £1 million from the scam (10% of transfer values). These fees were paid direct to AES.

When Evergreen collapsed (as all PPS pension scams eventually did) in 2012, Ward set up the Capita Oak scam. Another 300 people lost over £10 million – all invested in Store First store pods. Again, all pension transfers were done by Ward. Alongside Capita Oak, Ward carried out all the transfers for Henley (another 250 victims losing £8 million in Store First) and Westminster (another 79 victims losing £3.3 million in other toxic, high-commission investments). All these schemes are currently under investigation by the Serious Fraud Office.

Throughout this era – during which all business done by PPS went through AES – Ward ran multiple, multi-£million pension scams – mostly involving liberation fraud:

- Bollington Wood

- Capita Oak

- Dorrixo Alliance

- Endeavour QROPS

- Evergreen QROPS

- Feldspar

- Halkin

- Hammerley

- Headforte

- Henley Retirement Benefits

- London Quantum

- Southlands

- Randwick

- Randwick Estates

- Southern Star QROPS

- Superlife QROPS

The above list comprises QROPS which were used abusively, and bogus occupational schemes.

All these PPS scams resulted in many hundreds more victims losing millions of pounds’ worth of pensions. Many of these unfortunate people were also persuaded by Ward to liberate their pensions, and so they would have faced crippling tax penalties as well.

Ward’s final triumph in his long-running pension scam campaign was London Quantum. He proudly announced this scheme saying that “Ark is history” and that he was now going straight. Still trading as an AES partner and agent, Ward conned 100 victims into the London Quantum scheme. This was invested in the usual high-risk, high-commission and entirely inappropriate assets (including Dolphin Trust loans and car parking spaces at Park First Glasgow). London Quantum ended up being classified by Dalriada Trustees as being “probably worthless”.

In the Ark Pensions scam, it is clear why so many victims thought PPS was a properly-regulated firm – AS AN AGENT AND “PARTNER” OF AES:

“Premier Pension Solutions SL …..is an authorised agent of AES Financial Services Ltd authorised to conduct investment and insurance business. AN AES INTERNATIONAL PARTNER.“

In the subsequent £100 million Continental Wealth Management pension and investment scam, Ward continued to “advise” hundreds of victims to transfer their precious pensions into the hands of known scammers – in the full knowledge that their pensions would be invested in high-risk, high-commission rubbish funds and structured notes:

But Stephen Ward was a bit more than just an “agent” and “partner” of AES. He was also an integral part of the AES management team – and boasted that he was Director of International Pensions. When all the pension scams finally collapsed, leaving thousands destitute and desperate – as well as hounded by HMRC – Ward and Instone set up IPTS: International Pension Transfer Specialists. This new venture was run from Ward’s office in Moraira – although they tried to hide this by using a PO Box at nearby LettersRUs. And so the misery continued…..

Leave a Reply